The acquisitions of two homegrown brands in deals worth Rs 7,000 crore will help Tata Consumer Products Ltd. in many ways but won't immediately boost earnings of the food and beverages arm of the $103-billion Tata Group.

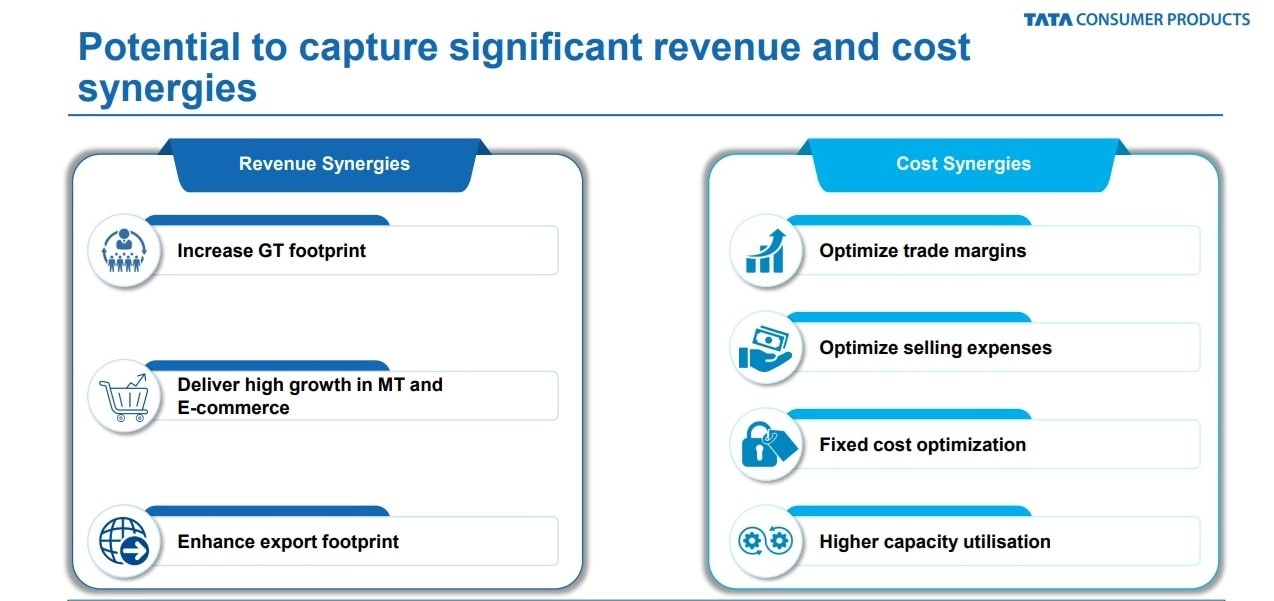

The buyouts have the potential to capture significant revenue and cost synergies to boost the company's growth and enhance operating margin, Tata Consumer Products said in an investor presentation filed with exchanges. However, it said, the earnings per share will break even only in second year of operations, and will then turn accretive.

The takeovers would add as much as Rs 1,140 crore to Tata Consumer's revenue in FY24.

Tata Consumer has two steady-base businesses—salt and tea—with market leaderships and potential for sustainably high single-digit to low double-digit growth in revenue, Nuvama had said prior to the announcement. Still, its other new businesses—Soulful and NourishCo—contribute more to the top line, it had said.

Earlier, Nuvama Institutional Equities, based on reports about potential deals, had raised the price-to-earnings multiple for Tata Consumer's India business to 65 times from 55 times, bringing it on a par with peers like Hindustan Unilever Ltd. and Nestle Ltd. The brokerage attributed the proposed acquisitions as one of the key triggers for the upgrade.

The Latest Buyouts

The Ching's deal is the biggest brand buyout by Tata Consumer.

The Tata Group company will buy 75% of Ching's sauces and noodles maker Capital Foods Pvt. from existing investors — Invus Group, a European family office and investment arm with a 40% stake and U.S. private equity group General Atlantic that owns 35% — valuing the firm at Rs 5,100 crore. That translates to a stake value at Rs 3,825 crore. It expects to acquire the balance 25% in Capital Foods within three years.

For Fabindia-backed Organic India, TCPL will pay Rs 1,900 crore.

For Capital Foods, the transaction translates to 6.8 times the estimated FY24 net sales, while for Organic India its 5.2 times, according to the investor presentation.

This move is in line with the Tata Group company's intent to expand its product portfolio and its target addressable market in fast-growing and high-margin categories.

The acquisitions have the potential to capture significant revenue and cost synergies.

TCPL said it will finance the deal through a combination of cash reserves available, as well as debt and equity issuance through rights issue, subject to board approval on Jan. 19.

As of Sept. 30, 2023, it had cash reserves (net of borrowings) of Rs 2,526 crore.

The company also has a comfortable debt-equity level, which allows it to borrow from the market. As much as Rs 3,000 crore in short-term debt is likely to be raised and converted to equity thereafter.

Capital Foods

Capital foods has been the first to identify and label the "desi Chinese" cuisine, which is native to India and loved across the U.S., Canada, Australia, the U.K., and Singapore. Some of Capital Foods' marquee products are Ching's Secret schezwan chutney, instant soups, Chinese masalas, Chinese sauces, hakka noodles, flavoured noodles and Smith & Jones ketchup, pasta, paneer masala, and ginger-garlic paste.

According to Tata Consumer's investor presentation, Ching's is the market leader across categories such as Schezwan chutneys, blended masala (desi Chinese), sauces and ginger garlic paste, with a share of 87%, 55%, 27% and 12%, respectively.

The total addressable market for categories in which Capital Foods is present in is pegged at Rs 21,400 crore. Tata Consumer management estimates the market to grow at 13% CAGR till 2027, indicating strong consumer preference. The structural growth drivers include rising incomes, addition of global cuisines in in-home cooking and convenience. TCPL also estimates the “in-home” desi-Chinese segment to grow 24% CAGR.

Capital Foods' Ebitda margin is estimated at 20% for FY24.

The acquisition will help Tata Consumer strengthen its pantry platform.

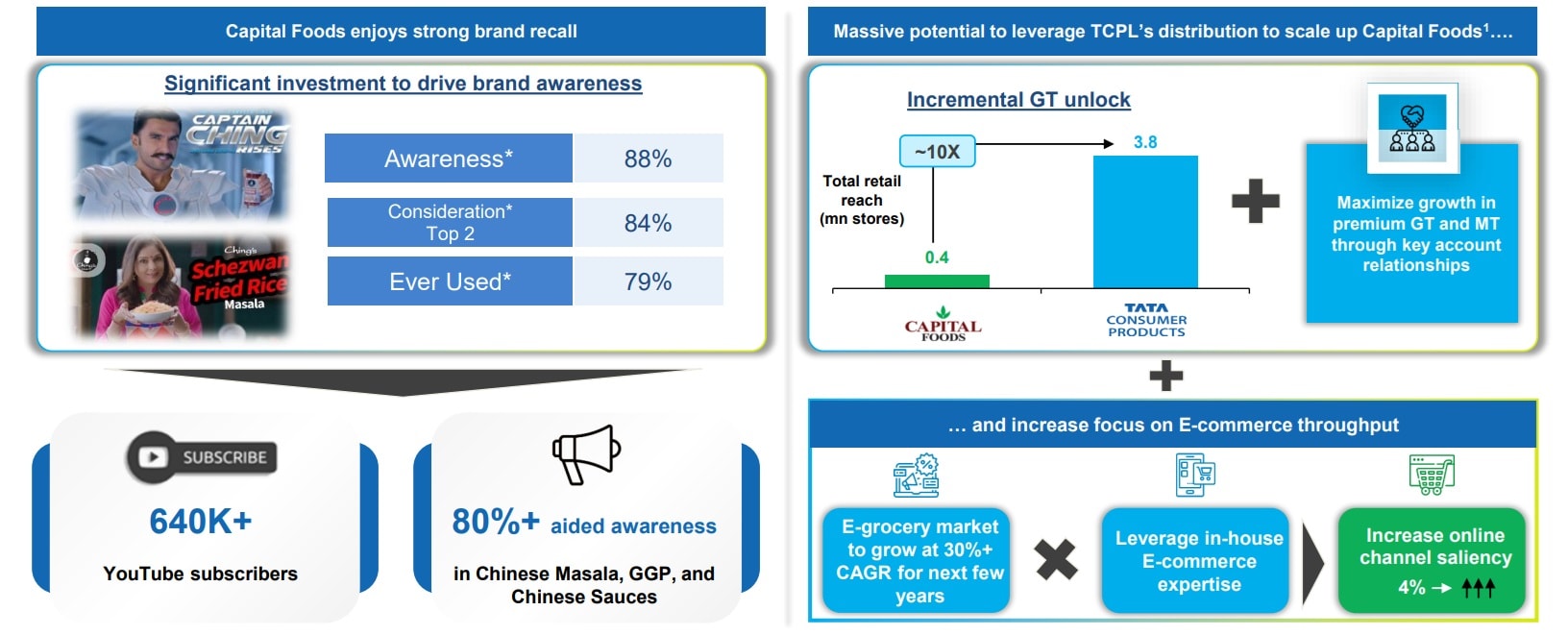

There are also significant synergy benefits with the existing businesses of Tata Consumer in areas spanning distribution, logistics, exports and overheads.

Capital Foods has the potential to drive strong double-digit revenue growth significantly higher than Tata Consumer's current trajectory, the company said.

Capital Foods has a projected top line of Rs 750-770 crore for FY24.

According to Nuvama, Capital Foods can make Tata Consumer's food play much stronger. The deal is expected pit it directly against Nestle's Maggi, which leads the Rs 5,000-crore branded instant noodles market with a 60% share.

The overall size of the instant noodles market is Rs 11,600 crore. By 2035, according to Sharekhan, the market is likely to grow four times its current size.

"This [deal] could be mildly negative for Nestle India as it was also likely one the bidders for Capital Foods...We expect competition in noodles and cooking aids to increase as TCPL scales up the business," said Abneesh Roy, executive director, Nuvama Institutional Equities. Other players in the category include ITC Ltd.'s YiPPee!, Top Ramen, Wai Wai and Patanjali.

"The portfolio of Capital Foods will particularly benefit from the heft of Tata Consumer's distribution network and marketing muscle," according to Roy.

Capital Foods also has well-established co-manufacturers and its own manufacturing plants in Vapi, Nashik, and Gandhidham.

The cooking paste and condiments categories are largely unorganised and Capital Foods competes with the likes of Mother's Recipe, Dabur Ltd. and ITC Ltd. in the branded segment.

Organic India

The total addressable market for categories such as tea and infusions, herbal supplements and other packaged food like ghee, honey and jaggery powder, is projected at Rs 7,000 crore in India and Rs 75,000 crore in international markets where Tata Consumer has a strong presence.

Organic India has a portfolio of over 100 products in the health and wellness space. The 25-year-old premium brand has gross margin of 55%. The unprofitable company has a projected top line of Rs 360-370 crore for FY24.

The company has four manufacturing plants with low utilisation in Uttar Pradesh, Rajasthan, Madhya Pradesh and Uttarakhand.

According to Tata Consumer presentation, Organic India's addressable market is estimated to grow at a CAGR of 11% in the domestic market and 8% CAGR overseas. The structural growth drivers include higher demand for health and wellness products, growing consumer awareness around wellness and changing consumer preferences, amid rising lifestyle ailments and obesity, it said.

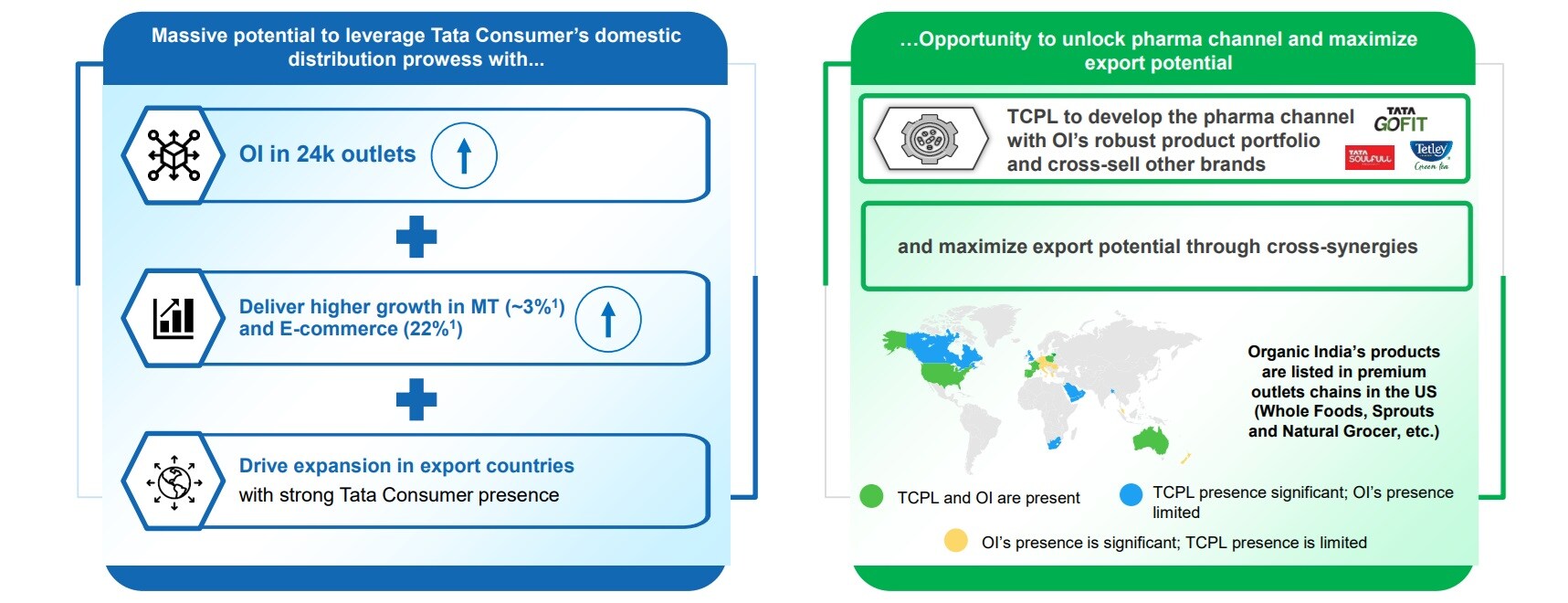

The buyout will provide synergies in distribution, logistics and overheads apart from driving portfolio premiumisation and unlocking additional channels like pharma, maximising exports and entering new local markets, according to the Tata Group company.

The acquisition will also enable Tata Consumer's entry into key organic products categories globally, such as quinoa and pulses. There is also potential to add products in allied categories like protein and child nutrition.

A Proven Track Record Of Inorganic Growth

Tata Consumer Products' Chief Executive Officer Sunil D'Souza had always maintained that inorganic expansion would be key growth driver for the food and beverage arm of the $103-billion Indian conglomerate.

The company has a proven track record in successfully scaling up its past acquisitions. Since its formation in 2020, as Tata streamlined its 156-year-old sprawling business empire, Tata Consumer Products bought stakes in NourishCo Beverages Ltd. and cereal brand Soulfull.

NourishCo started as a joint venture between Tata Consumer and PepsiCo in 2010. Tata Consumer acquired PepsiCo's stake in 2022 for Rs 13 crore. According to Motilal Oswal, NourishCo's revenue rose at a CAGR of 32% over FY12-20 (joint venture period). Since its acquisition in FY21, that pace has gone up to 38%, despite the impact of the pandemic. Also, NourishCo turned Ebit positive, with margins rising annually from 3% in FY21 to 6% in FY22, aided by synergies.

Since acquisition, Tata Consumer introduced multiple non-carbonated and ready-to-drink beverages with innovation-to-sales contribution reaching 10% in FY22. In FY23, NourishCo's revenue rose 80% year-on-year to Rs 620 crore. D'souza expects NourishCo to report four-digit sales in FY24.

Tata Soulfull's revenue more than doubled year-on-year. Its profitability improved, driven by initiatives aimed at reducing manufacturing and freight costs, according to Motilal Oswal. Soulfull's reach has increased to over 0.4 million outlets from 15,000 outlets at the time of its acquisition.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.