The Indian postal service, officially known as India Post, doesn't just fulfil the task of providing postal services, but also offers multiple post office saving schemes where people can invest money for risk-free guaranteed returns. One of the options under these savings schemes is the ‘National Savings Time Deposit'.

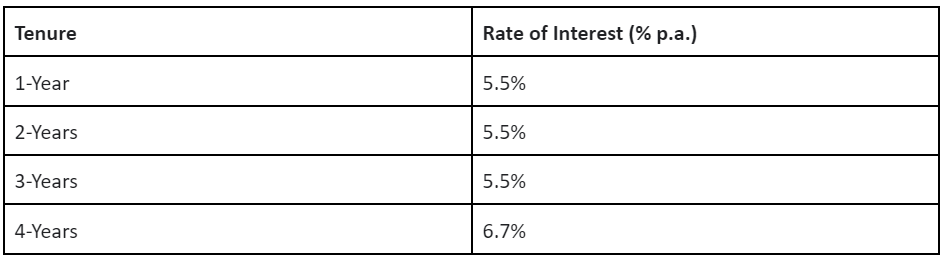

In simple terms, the National Savings Time Deposit is a type of investment savings scheme by the post office that allows investors to invest capital for different tenures, the minimum being 1-year and the maximum being 5-years. Investors can choose to invest among 4 different time deposits, with varying tenures and interest rates, as you can see in the table given below:

Interest Rates For Post Office Time Deposits

There are 4 different tenure periods available under the National Savings Time Deposit, with varying interest rates:

Note: These interest rates have been recorded at the time of writing and are subject to change over time.

Main Features Of The Post Office Time Deposit

The following are the main features of the National Savings Time Deposit:

Individuals above the age of 10 years can open a National Savings Time Deposit account at any post office centre. Moreover, guardians can also open these time-deposit accounts on behalf of minors.

This time-deposit account can also be opened in the form of a joint account that can be held by a total of 3 individuals. Individuals are also free to create more than a one-time deposit account and also have the option to transfer accounts from one post office to another.

Investors have the choice to choose between 4 different tenures- 1-year, 2-years, 3-years, and 5-years. The 5-year time deposit offers the highest rate of interest at 6.7%.

Income tax exemptions are available only for the 5-year time deposit under Section 80C of the Income Tax Act, 1961.

The rates of interest for these time deposits are often revised quarterly by the government. While the interest returns are calculated quarterly, they are released to the investors annually. The interest is either paid out in cash or by cheque. If the interest earnings exceed ₹10,000, then it would only be paid out through cheque.

Investors who do not withdraw their funds after the maturity period will not get any additional interest returns. However, if the post office has a core banking facility, your time deposit will get renewed for the same period with the same rate of interest.

Investors will need to make a minimum deposit of at least ₹1000 when setting up the National Savings Time Deposit. There is no upper limit to how much money can be invested.

In the event that the investors wish to withdraw their money prematurely, they can do so after 6 months of creating the time deposit account

How To Set Up A Post Office Time Deposit Account?

Investors can follow these simple sets of instructions to open their own National Savings Time Deposit account at a post office:

Visit any nearby post office and acquire the relevant application form. You can also choose to download the form online

Fill in the form correctly and provide all the necessary details. Ensure that there is no errors on the form.

Collect and attach all the necessary forms such as the PAN Card, address proof, id proof and other documents.

Submit the application form with all the right documentation at the post office and your National Savings Time Deposit will soon be activated.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.