The upcoming week is expected to be filled with significant news, with global markets facing pressure amid a second round of reciprocal tariff set to be introduced by US President Donald Trump on April 2.

The upcoming week will also witness the start of the new financial year 2026. Prime Minister Narendra Modi is set to visit Thailand and Sri Lanka where he will attend the Bimstec Summit between April 4 and April 6.

Key economic data releases include India Nikkei Services PMI for March. In India, the initial-public-offering market is likely to be quiet, with only small SME offerings scheduled.

The week will culminate with the Australia's Reserve Bank taking a decision on the rate, a crucial indicator for the global market performance.

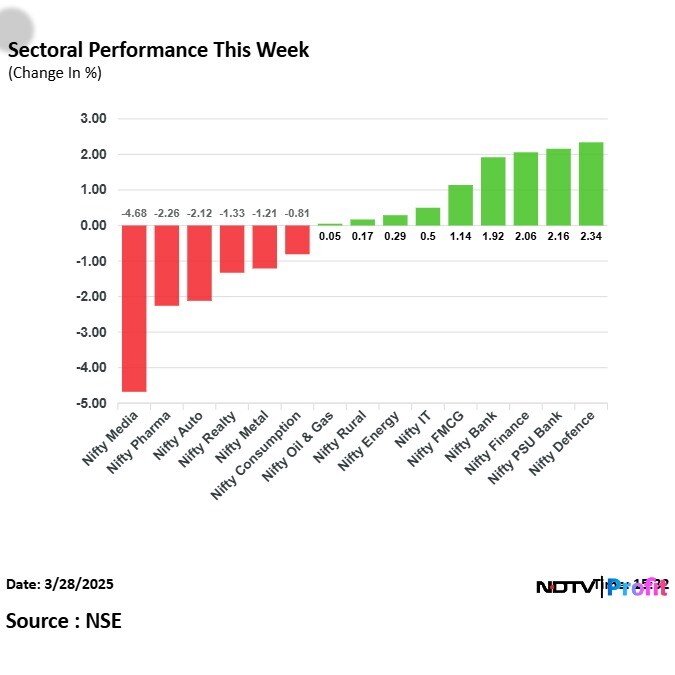

Markets Last Week

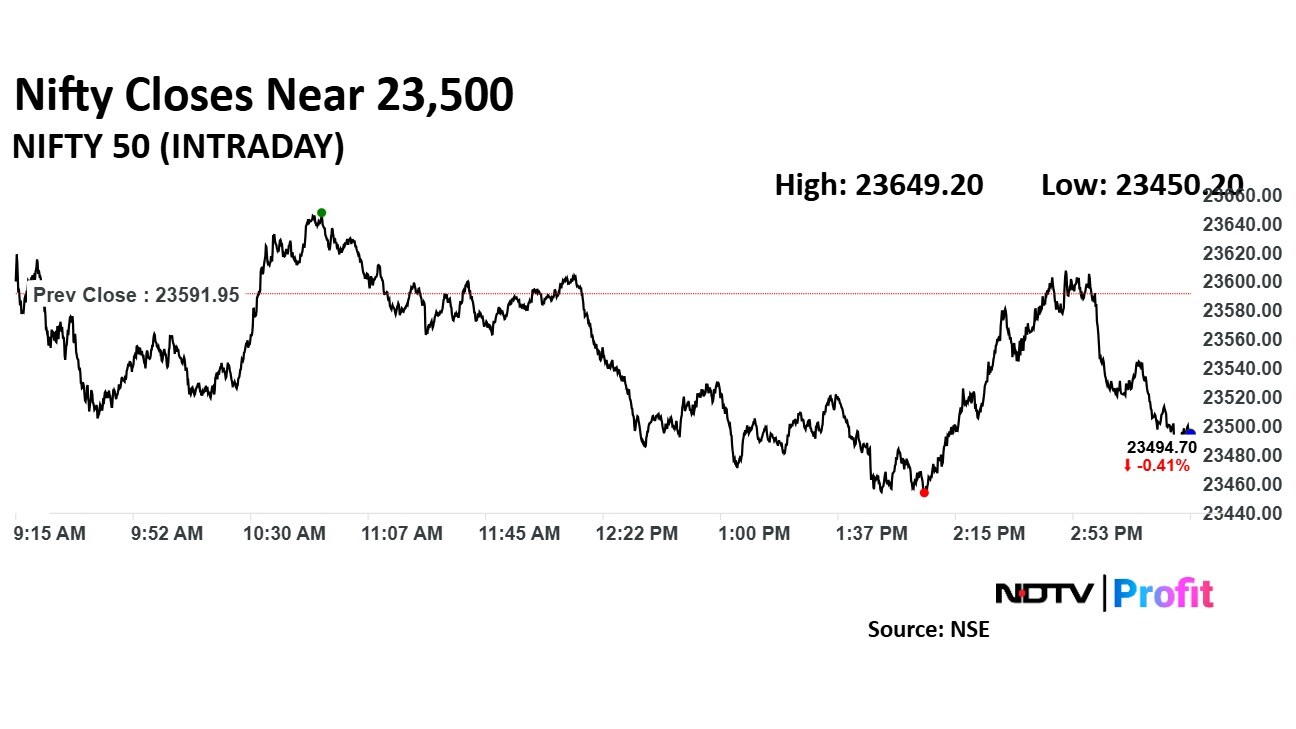

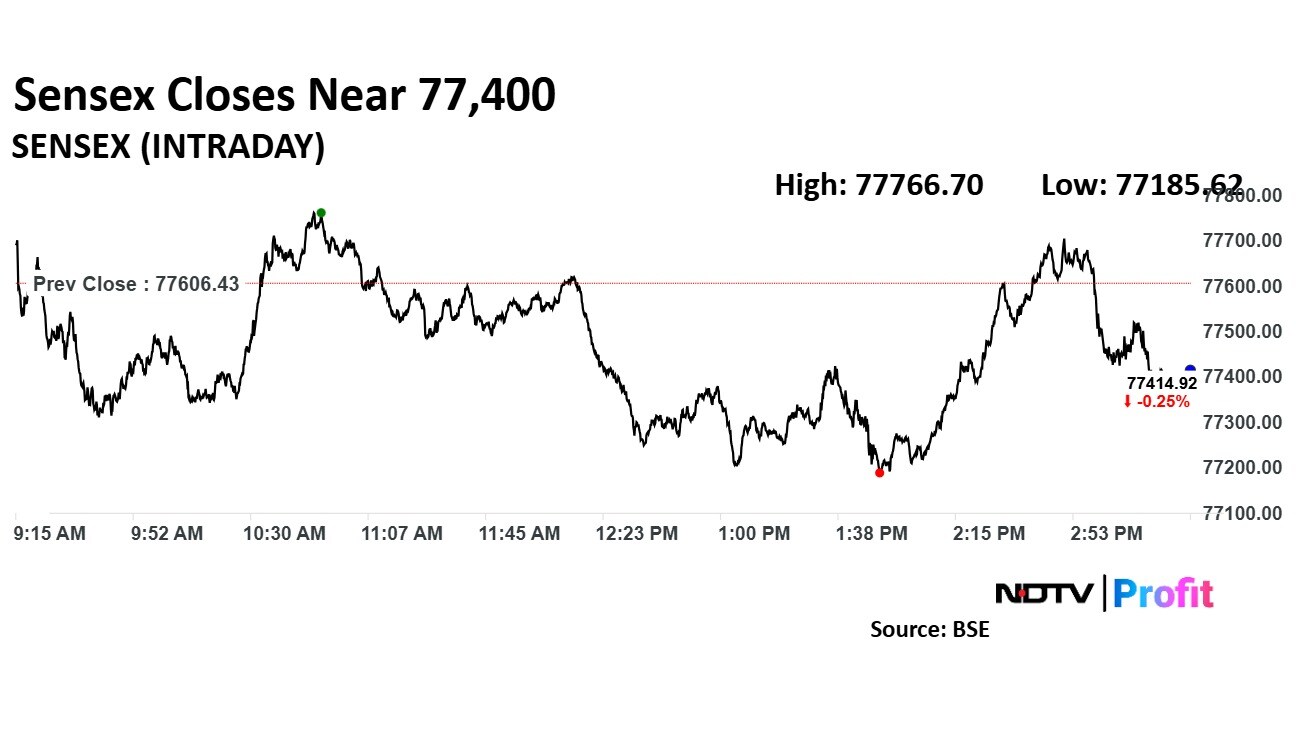

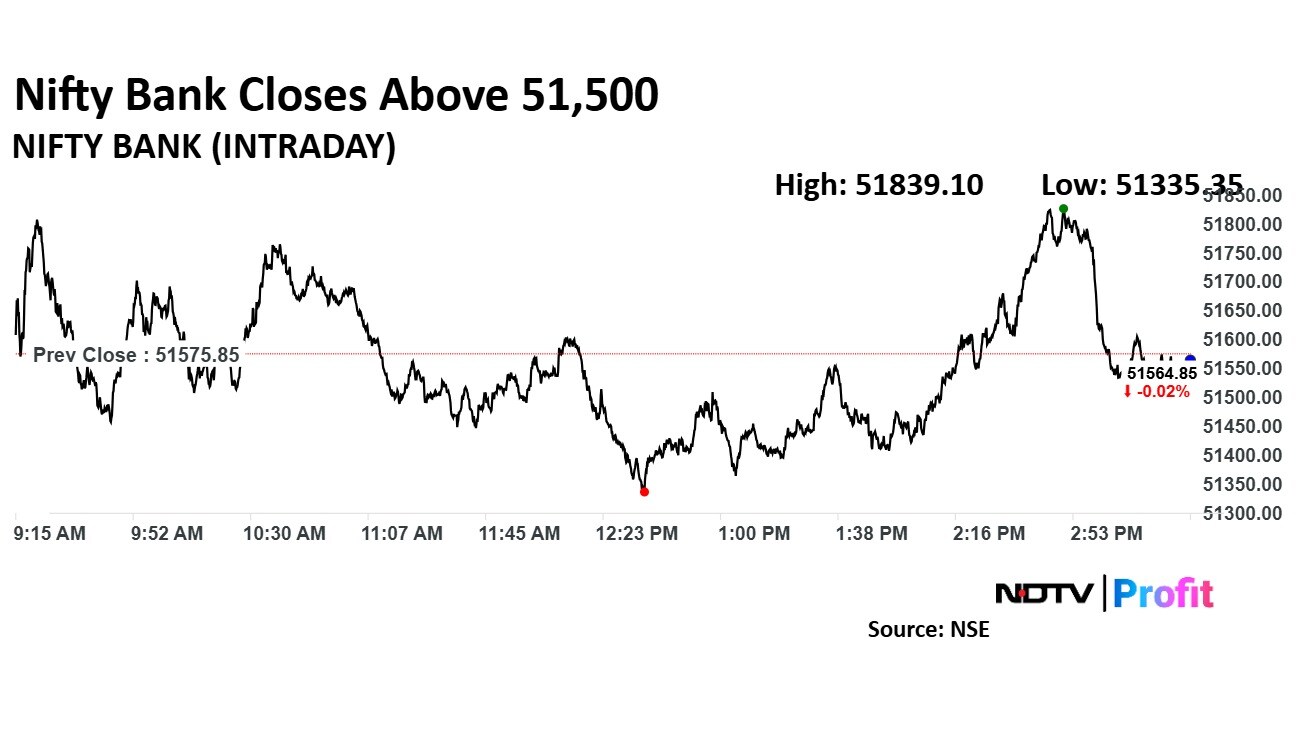

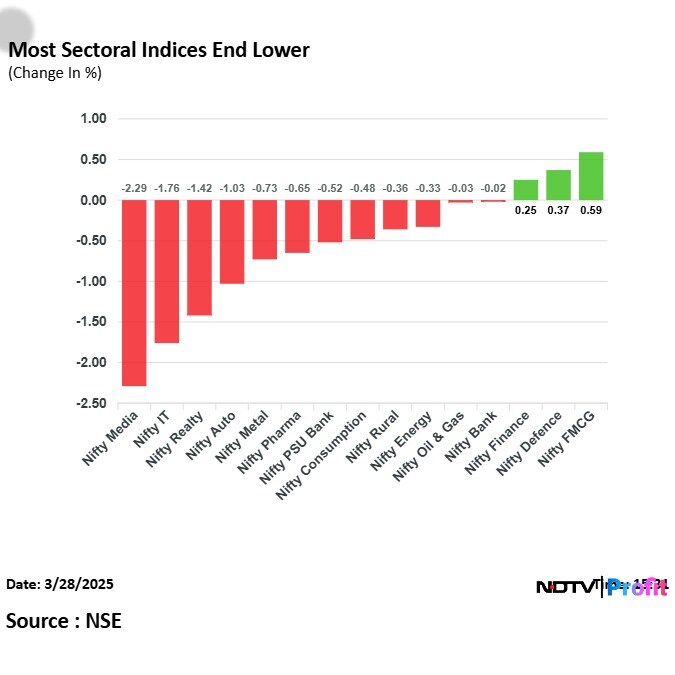

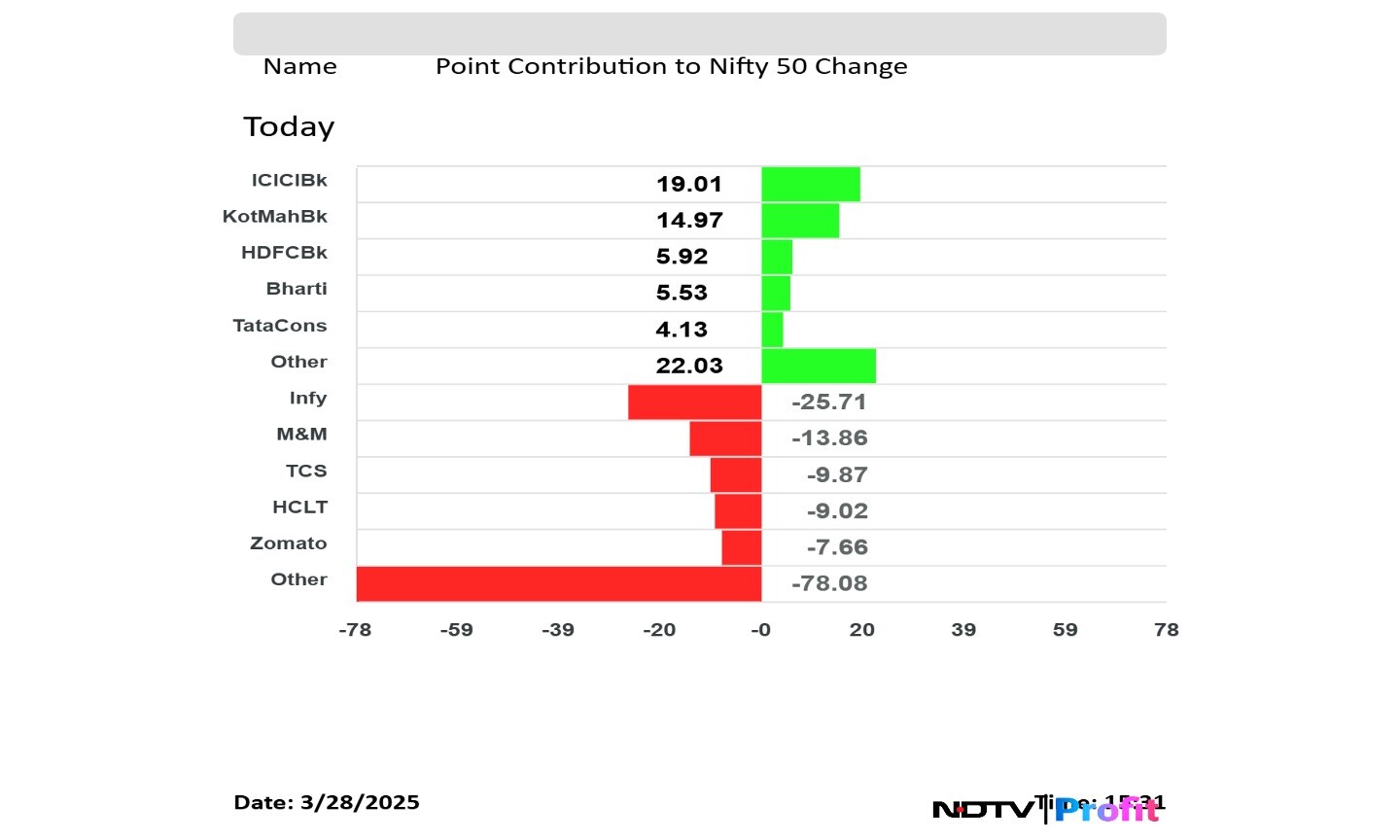

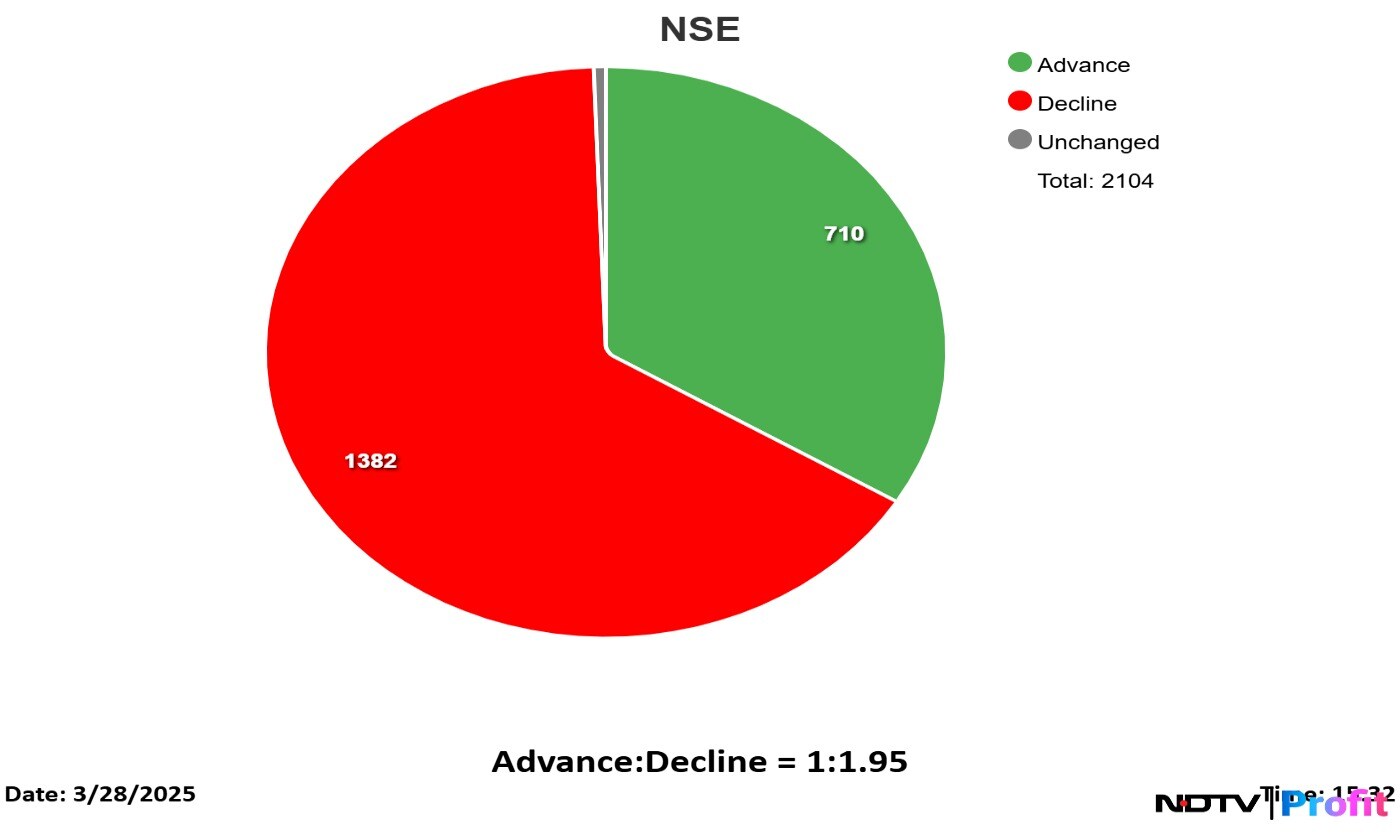

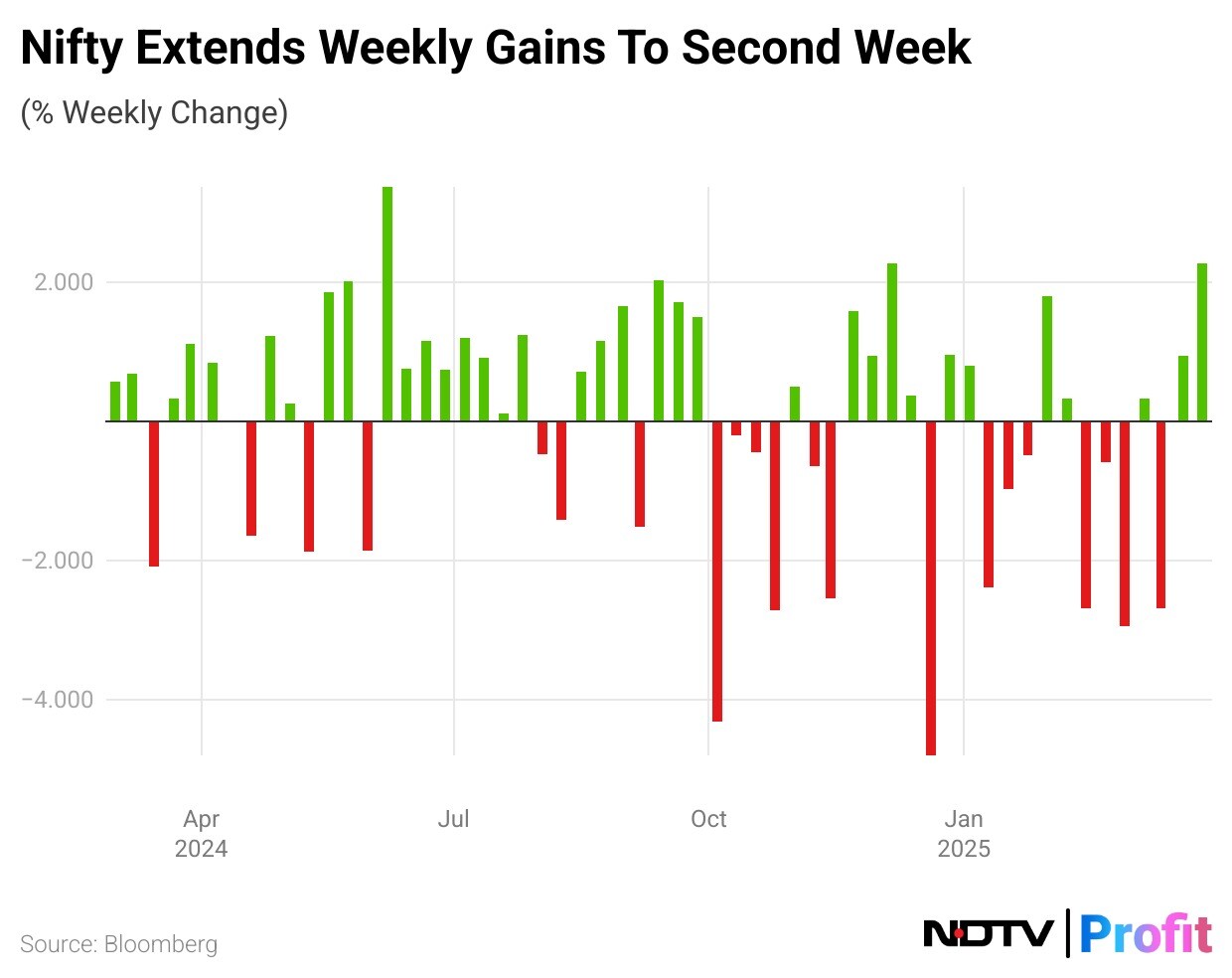

A quick recap first. The Nifty snapped its five-month losing streak and the Sensex paused its three-month declining spree even as the benchmark equity indices ended with losses on Friday. The NSE Nifty 50 ended 72.60 points or 0.31% lower at 23,519.35, while the BSE Sensex closed 191.51 points or 0.25% down at 77,414.92.

On a monthly basis, the Nifty ended 6.30% higher, while the Sensex closed 5.76% up. The indices also ended the week in positive this week, with Nifty gaining over 0.77% and Sensex rising over 0.60%.

The indices also ended this financial year in positive, with Nifty rising over 6.99% in financial year 2025 and Sensex rising over 6.78%. This is the second consecutive year that Nifty has ended in the positive after seeing an over 10% recovery from its lowest point in fiscal 2025.

Domestic Cues

Several significant events will take place in the domestic market on a truncated week as India will observe a holiday on the occasion of Eid-ul-Fitr.

Key economic data will be released, including balance of payments for the fourth quarter and the current account as a percentage of the GDP for the fourth quarter. Data on infrastructure output for February, trade balance for Q4 and foreign debt for Q4 will be published.

On Wednesday, the Nikkei S&P Global Manufacturing PMI for March will be released, followed by the M3 Money Supply data. On Friday, the Nikkei Services PMI for March and the FX Reserves in USD will be announced.

Global Cues

The key global event is the US' reciprocal tariffs on April 2. Australia's retail sales for February and the Reserve Bank of Australia's interest rate decision and statement will be closely watched.

On Monday, the Chicago PMI for March will be released, followed by data from Japan, including the Tankan All Big Industry CAPEX, Tankan Big Manufacturing Outlook Index, and Tankan Large Manufacturers and Non-Manufacturers Indexes for Q1.

China's Caixin Manufacturing PMI for March will also be released, providing insights into the manufacturing sector's performance. On Tuesday, the US Manufacturing PMI for March, construction spending for February, and ISM Manufacturing data will be announced.

Wednesday will see the release of the ADP Nonfarm Employment Change for March, US factory orders for February, and crude oil inventories. The RBA's Financial Stability Review and Australia's trade balance for February will also be published.

On Thursday, the OPEC meeting, US jobless claims, trade balance and various PMI data will be key highlights. On Friday, the US nonfarm payrolls, unemployment rate, and speeches from Fed officials will be significant events to watch.

Primary Market Action

India's primary market was in a lull in March, with a notable slowdown in initial public offerings, marked by a complete absence of mainboard offerings and listings throughout the month

There are no upcoming SME IPOs in India this week. But three current active SME IPOs are Infonative Solutions Ltd., Spinaroo Commercial Ltd. and Retaggio Industries Ltd.

Corporate Actions Ahead

Shares of RailTel Corp., United Spirits Ltd. and Varun Beverages Ltd. will turn ex-date for the issue of interim dividends. Shares of Ranjeet Mechatronics Ltd. and Sal Automotive Ltd. will turn ex-date for their bonus issue.

The table below shows the full list of corporate actions for the upcoming week.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.