- Varun Beverages plans to enter the alcoholic beverage segment, including RTDs and spirits

- African subsidiaries will test the beer market via exclusive Carlsberg distribution deals

- Q3 profit rose 19.5% to Rs 741 crore while revenue grew modestly by 2% to Rs 4,897 crore

Varun Beverages Ltd. has decided to foray into the fast-growing alcohol segment. The board on Wednesday approved plans to add an alcoholic beverage business to the main objects of the Memorandum of Association of the company.

"In response to the growing popularity of Ready To Drink (RTD) and variety of Alcoholic Beverages, VBL sees an opportunity for expansion into the business of RTD & Alcoholic Beverages of any type or description, including beer, wine, liquor, brandy, whisky, gin, rum, vodka in India & abroad," a statement said.

Certain African subsidiaries of VBL will now test the beer market in their territories. They have entered into an exclusive distribution agreement with Denmark's Carlsberg Breweries A/S for their popular brand 'Carlsberg'.

Varun Beverages is one of the largest franchisees of PepsiCo. It distributes a wide range of carbonated soft drinks, as well as a large selection of non-carbonated beverages, including packaged drinking water in India.

The company's plan to diversify comes amid strong competition from the Reliance Retail Ventures Ltd.-owned Campa Cola brand, which has triggered a pricing war in the segment.

Consolidated sales volumes rose by a paltry 2.4% in the September quarter. While domestic volumes remained subdued due to prolonged rainfall across India, international operations grew by 9%.

The Indian alcoholic beverage industry is expected to witness a revenue growth of 8-10% in the current financial year, reaching Rs 5.3 lakh crore, according to a research report from Crisil. This growth continues the momentum seen over the past three years, with a CAGR of 13%. The market size is projected to hit $300 billion by 2035.

Premiumisation has caught up in India in the last few years, where rising disposable income has given consumers a chance to elevate their preferences in everything from cars to soaps.

Varun Beverages Q3 Highlights (Consolidated, YoY)

Revenue up 2% to Rs 4,897 crore versus Rs 4,805 crore.

Ebitda down 0.3% to Rs 1,147 crore versus Rs 1,151 crore.

Margin at 23.4% versus 24%.

Net profit up 19.5% to Rs 741 crore versus Rs 620 crore.

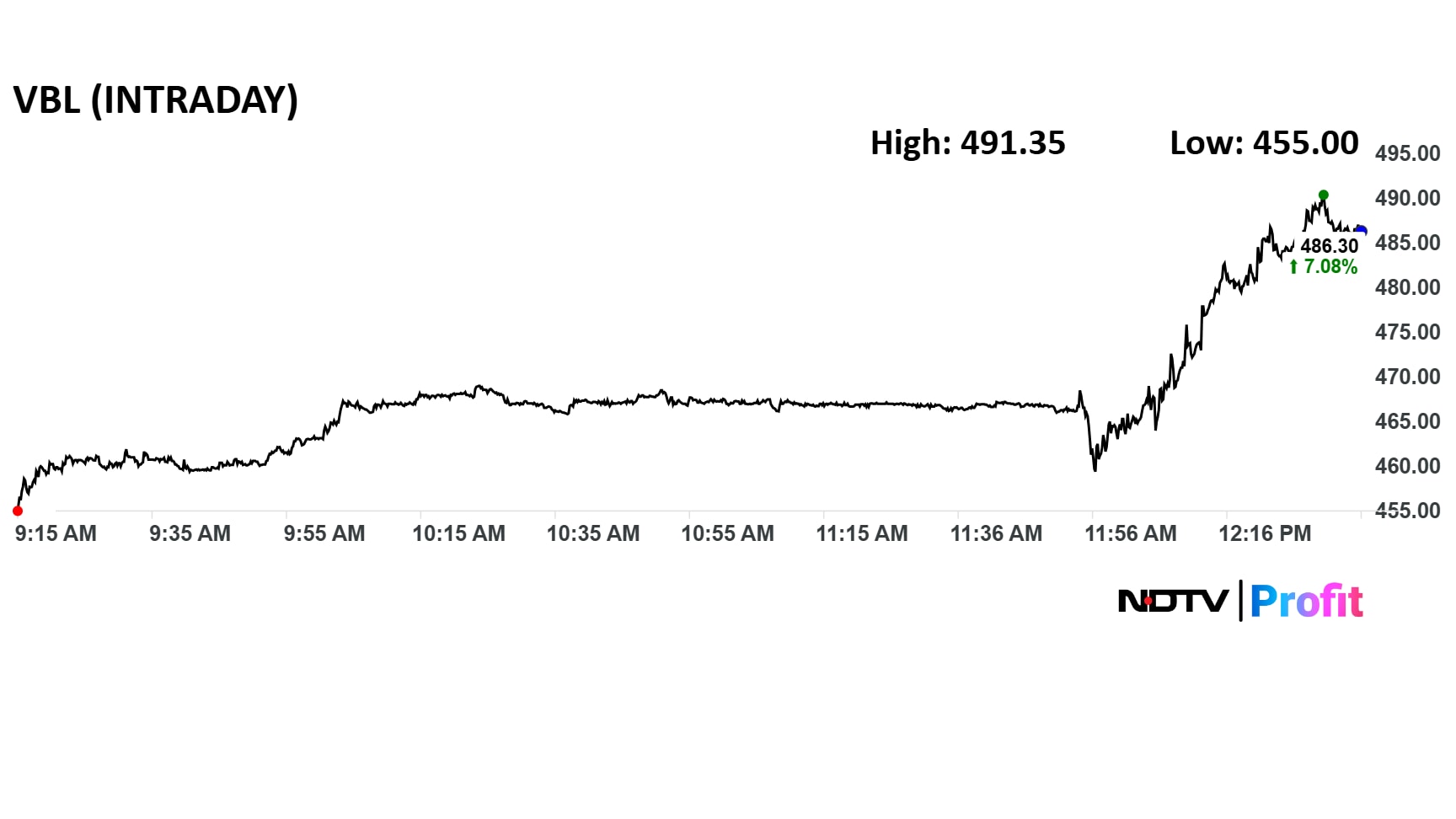

VBL Shares Jump

Varun Beverages' share price jumped 7.5% to Rs 491.35 apiece.

Varun Beverages' share price jumped 7.5% to Rs 491.35 apiece on the NSE after the announcement, compared to a 0.5% advance in the benchmark Nifty 50.

The total traded volume stood at nearly four times the 30-day average, with a turnover of Rs 870 crore.

The stock is down 20% on a 12-month basis and 23% year-to-date.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.