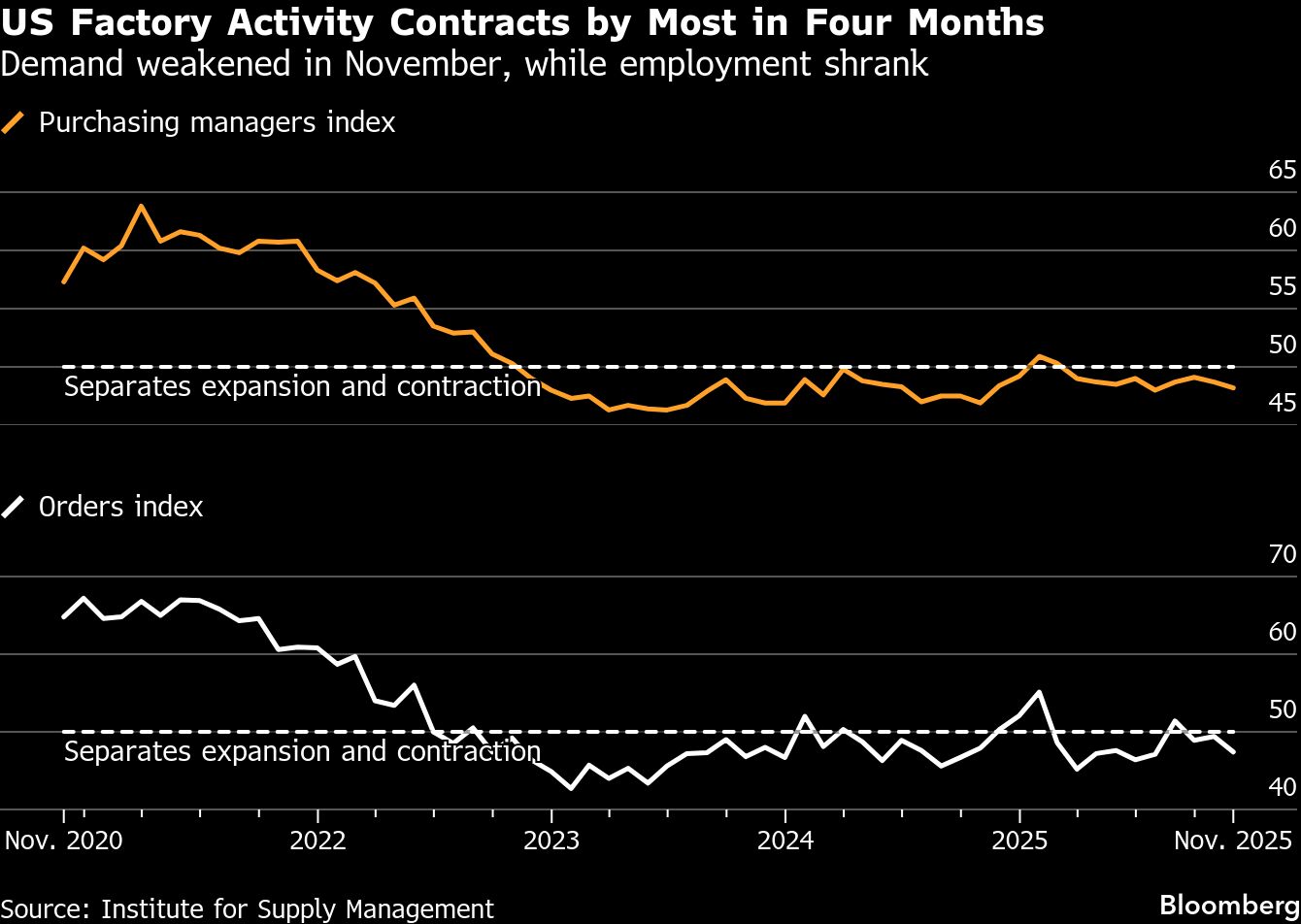

US factory activity shrank in November by the most in four months as orders weakened, indicating manufacturers are struggling to break free from an extended period of malaise.

The Institute for Supply Management's manufacturing index eased 0.5 point to 48.2, according to data released Monday. The measure has been below 50, which indicates contraction, for nine straight months.

The survey suggests the nation's manufacturing base remains bogged down by trade policy uncertainty and elevated production costs. The ISM index of prices paid for materials picked up for the first time in five months and is about 8 points higher than a year ago.

Customer demand has largely been uninspiring as well. Orders contracted in November at the fastest pace since July, while backlogs shrank by the most in seven months.

Susan Spence, chair of the ISM Manufacturing Business Survey Committee, said uncertainty about tariffs is driving the pullback because customers are holding off on orders until there's more clarity on the cost of goods.

“We do not see anything on the horizon that's going to turn the ship until there is more certainty,” Spence said on a call with reporters.

The soft demand conditions help explain a steeper contraction in factory employment last month. Roughly 25% of respondents reported lower employment, the largest share since mid-2020.

Meanwhile, the group's production index rebounded in November, expanding at the fastest clip in four months. Despite the advance, output this year has been uneven.

Eleven manufacturing industries contracted in November, led by apparel, wood and paper products and textiles. Four industries, including computer and electronic products, reported growth — the fewest in a year.

Select ISM Industry Comments

“New order entries are within the forecast. We have increased requests from customers to get their orders sooner. Transit time on imports seems to be longer.” — Machinery“We are starting to institute more permanent changes due to the tariff environment. This includes reduction of staff, new guidance to shareholders, and development of additional offshore manufacturing that would have otherwise been for US export.” — Transportation Equipment“Tariffs and economic uncertainty continue to weigh on demand for adhesives and sealants, which are primarily used in building construction.” — Chemical Products“The unstable market has made pricing fluctuate in a very volatile way; I have had to reduce suppliers for raw materials to maintain a better direct cost structure. Reducing my suppliers has reduced the availability of some items and created longer lead times.” — Fabricated Metal Products“Business continues to be a struggle regarding long-term sourcing decisions based on tariffs and landing costs. External (or international) sourcing remains the lowest-cost solution compared to US production/manufacturing.” — Computer & Electronic Products“Trade confusion. At any given point, trade with our international partners is clouded and difficult. Suppliers are finding more and more errors when attempting to export to the U.S. — before I even have the opportunity to import.” — Electrical Equipment, Appliances & Components“Domestic and export business have been lackluster. Our customers are taking prompt orders only and still don't have confidence to build inventory, much less make expansion plans.” — Wood Products

The survey also showed that supplier delivery times of materials for manufacturers quickened for the first time in four months.

Producers' and customers' inventories continued to shrink, although at slower paces than a month earlier.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.