- Trump threatened a probe on the EU after its €2.95 billion fine on Google for abuse of ad tech dominance

- The EU ordered Google to stop favouring its own advertising technology services over rivals

- Google plans to appeal the fine, calling it unjustified and harmful to European businesses

US President Donald Trump threatened a probe on the European Union that could prompt fresh tariffs, in response to the bloc's fining of Alphabet Inc.'s Google over findings the company exploited its advantage over rivals.

Trump made his warning in a social media post Friday after the EU announced it was fining Google almost €3 billion ($3.5 billion) and as it ordered the search giant to stop favoring its own advertising technology services.

“This is on top of the many other Fines and Taxes that have been issued against Google and other American Tech Companies, in particular,” Trump posted on Truth Social. “Very unfair, and the American Taxpayer will not stand for it! As I have said before, my Administration will NOT allow these discriminatory actions to stand.”

Trump has previously used so-called 301 probes to target imports from Brazil over its prosecution of former President Jair Bolsonaro. He's long criticized Europe for its fines against US technology firms, and earlier this month warned he would impose “substantial” tariffs on countries that imposed digital taxes, rules, or regulations that hit American companies.

The US president said the topic of digital taxes and fines came up at a Thursday night dinner at the White House with top tech executives, including Alphabet's Sundar Pichai, Meta Platforms Inc.'s Mark Zuckerberg and Apple Inc.'s Tim Cook.

“They weren't complaining about, in that regard, to China. They weren't complaining about other places. It's the European Union,” Trump told reporters Friday. “We can't let that happen.”

Exploited Advantage

The European Commission said Friday that Google had abused its dominance by giving its own ad exchanges a competitive advantage and must bring the practices to an end.

“When markets fail, public institutions must act to prevent dominant players from abusing their power,” EU antitrust Commissioner Teresa Ribera said in a statement. “True freedom means a level playing field, where everyone competes on equal terms and citizens have a genuine right to choose.”

The company immediately vowed to appeal. Lee-Anne Mulholland, vice president for regulatory affairs at Google, said the move “imposes an unjustified fine and requires changes that will hurt thousands of European businesses by making it harder for them to make money.”

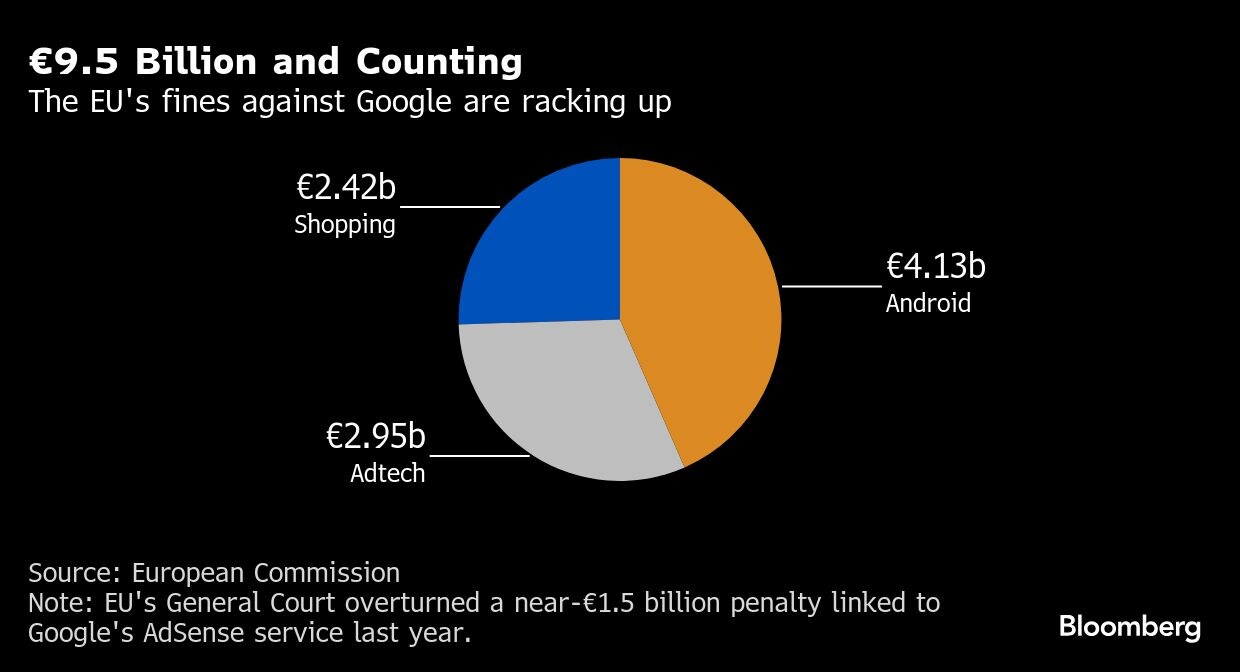

The fine, which totaled €2.95 billion, ranks among Brussels' toughest sanctions and is the second-highest by the EU against Google for alleged abuses of dominance. It follows a €4.125 billion Android penalty and a €2.42 billion fine for crushing shopping search rivals. A €1.49 billion AdSense levy was annulled last year.

The decisions push Google's EU liabilities to just shy of €10 billion — far higher than fines against Apple, Meta and Microsoft Corp.

The Mountain View, California-based company is No. 1 in the $757.5 billion global digital ad market, according to 2025 estimates by research firm EMarketer. In total, worldwide, Google is expected to pull in $205.04 billion in digital ad revenue in 2025. Most of that — $171.72 billion — comes from Google's global search advertising business. The remaining $33.33 billion is from display ads.

Google runs an ad-buying service for marketers and an ad-selling one for publishers, as well as a trading exchange where both sides complete transactions in lightning-fast auctions.

The European Publishers Council, which brought the complaint to the European Commission, said “a fine will not fix Europe's broken adtech market.”

“Without strong and decisive enforcement, Google will simply write this off as a cost of business while consolidating its dominance in the AI era,” said Angela Mills Wade, the council's executive director. “Europe risks undermining its own rules and weakening the news media and publishing sector.”

Movement for an Open Web, an advocacy group campaigning against tech platforms' dominance of the web, joined the EU complaint.

Google's adtech operations remain under threat in the US, according to a filing late Friday from the Department of Justice's antitrust division, which outlined its final version of proposed remedies ahead of a Sept. 22 hearing. The government said Google should be ordered to immediately sell off its advertising exchange, AdX, as well as make its technology interact with rivals.

In the filing, the DOJ softened its stance on whether Google must sell off another piece of its ad tech business, the service that helps websites sell display advertising, known as a publisher ad server.

The original proposal was a phased process that would have included open-sourcing of the technology followed by a full divestiture. Now the DOJ is proposing waiting between two to four years to determine if the latter is necessary.

Google has rejected the proposed breakup, saying that remedy is too extreme and shouldn't be used in this case. Instead, the company has offered to make its advertising exchange work seamlessly with rival technology and has agreed to install a monitor to ensure compliance for the next three years.

“The last thing a court should do is intervene to reshape an industry that is already in the midst of being reshaped by market forces,” the company said.

Tense Moment

The EU punishment comes at a tense moment for EU–US trade relations, with Trump repeatedly deriding the bloc's efforts to rein in Silicon Valley giants. Google won some relief this week when a US judge ruled that it wouldn't need to sell off its Chrome browser to address the harms alleged by the DOJ.

Earlier, the EU's Ribera pointed to the potential for a US ruling that would force Google to break up its ad tech platform.

“At this stage, it appears that the only way for Google to end its conflict of interest effectively is with a structural remedy, such as selling some part of its Adtech business,” she said in her statement.

The EU warned Google in 2023 that it had abused its dominance in advertising technology to harm online publishers. At the time, the Brussels-based commission said Google had favored its own ad exchange program over its rivals and bolstered the company's central role in the ad tech supply chain.

Ribera's predecessor, Margrethe Vestager, said then that only a “mandatory divestment” of part of its business would solve the issues. The Dane had spent a decade in Brussels, where she hit Google with fines of more than €8 billion across three different cases, although one penalty was annulled and another cut by EU judges.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.