US President Donald Trump has announced plans to significantly reduce prescription drug prices in the country, stating on social media that prices would be cut by over 59%. While the details of the executive order are still awaited, Sun Pharmaceutical Industries Ltd.'s US exposure makes it a key company to watch.

At the heart of this proposal is the revival of the 'Most Favored Nation' pricing model, which could have implications for companies like Sun Pharmaceutical.

The MFN model, originally proposed in 2020, aimed to link Medicare Part B drug reimbursements to the lowest prices paid by OECD countries. While the earlier version was struck down in federal courts and eventually withdrawn by the Biden administration, Trump's comments suggest a renewed attempt to implement it.

The move aims to align American drug costs with those paid in other developed nations and echoes previous efforts during his first term.

Macquarie notes that a return to MFN pricing could affect companies selling branded medications within the US, particularly those with exposure to Medicare Part B. For example, Sun Pharma's product Ilumya is sold under this programme and could face downward pricing pressure. However, the impact on generic drugmakers is expected to be minimal, as generics are significantly cheaper and primarily sold under Medicare Part D, which wasn't targeted in the original MFN model.

However, according to analysts at Citi, current proposal may be less aggressive than it appears. The executive order reportedly encourages a direct-to-consumer market and asks pharmaceutical firms to negotiate pricing with the Department of Health and Human Services. If no agreement is reached within 180 days, MFN pricing may then be enforced. This indirect approach could soften the immediate impact on companies like Sun Pharma.

Citi also points out that high US drug prices stem largely from structural issues within the insurance and distribution systems, particularly the role of pharmacy benefit managers. These middlemen often favour large pharmaceutical firms offering rebates, limiting access for smaller players. Should future reforms reduce PBM influence, companies such as Sun Pharma and Biocon could benefit, especially in the specialty and biosimilars segments.

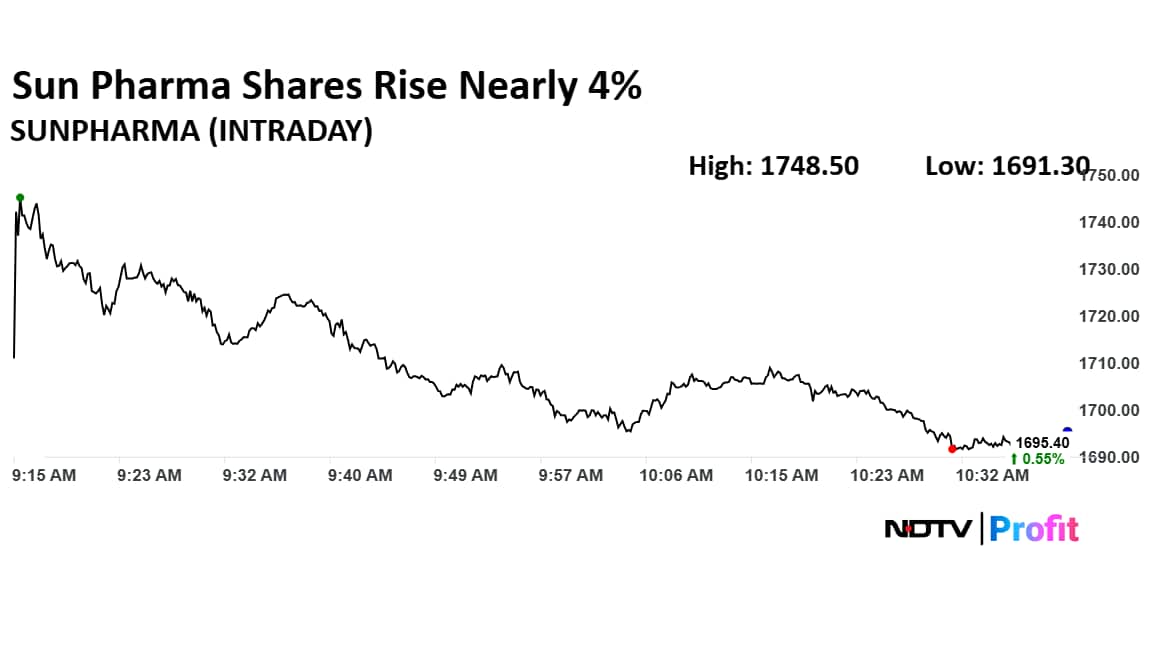

Sun Pharma Share Price Rises

The shares of Sun Pharma rose as much as 3.69% to Rs 1,748.50 apiece, the highest level since May 9. It pared gains to trade 0.42% higher at Rs 1,693.20 apiece, as of 10:36 a.m. This compares to a 1.02% decline in the NSE Nifty 50 Index.

It has risen 11.03% in the last 12 months and fallen 10.23% year-to-date. Total traded volume so far in the day stood at 3.3 times its 30-day average. The relative strength index was at 48.80.

Out of 42 analysts tracking the company, 34 maintain a 'buy' rating, five recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.