Smita Gaikwad, 45, spends her evenings watching English movies and news on television. For that, she pays Tata Sky Rs 8,000 a year. She also binges on series and movies on Netflix and Amazon Prime, paying around 11,000 a year. The Mumbai-based media and marketing professional is unaware that from Dec. 29, she is allowed to create her own pay TV packages that can help lighten her Rs 19,000 yearly bill.

The DTH operator is yet to inform her about it, Gaikwad said. “I want only certain channels but invariably pay for the entire bundle I am offered,” she said. “Also, HD channels are expensive.”

She is not alone. Consumers BloombergQuint spoke to in four cities shared the view. They watch only a few of the channels offered by cable TV and DTH operators as part of bouquets but end up paying for all. With cheap data fuelling online consumption of content, they also gorge on soaps, movies, stand-up comedy and more on Netflix, Amazon Prime, Hotstar, AltBalaji, SunNxt and Zee5 to name a few. On an average, they spend Rs 1,000 a month on video-streaming apps.

The Telecom Regulatory Authority of India's latest changes in tariff structure are aimed at helping such consumers lower costs. These require broadcasters to publish channel rates and ask cable operators and DTH service providers to offer all channels a la carte at a maximum monthly price of Rs 19 each.

According to the TRAI's order:

- A consumer will have to pay a fixed fee of Rs 130 a month for 100 free-to-air standard-definition channels.

- By paying Rs 20 more, a consumer will get additional 25 SD channels.

- Broadcasters can't bundle pay channels with those offered free.

- High-definition channels can't be bundled with SD content.

The new tariff order essentially means there would be as many bouquets as TV households, said Punit Misra, chief executive officer, domestic broadcasting business at Zee Entertainment Enterprise Ltd. That's because each household can create its own bouquet under the new guidelines, he said.

But like Gaikwad, Sankalp Sharma from Bhopal, Madhya Pradesh doesn't know that he can save money. He spends about Rs 1,100 on services from Airtel DTH and video-streaming platforms. “I have two connections under one ID and both have most of the channels,” he said. “I haven't been informed by the service provider that there has been a change in the tariff regime.”

Others said they will now pay for only what they consume.

Shaheen Sharma pays Rs 1,100 a month for an Airtel DTH connection, and additionally subscribes to Netflix and Amazon Prime. She has decided to ditch some of the content. “I won't opt for channels that I don't watch.”

Bratin Roy from Bengaluru too plans to choose his own channels. He pays Airtel DTH Rs 400 for a regular plan and has an add-on sports HD bouquet and one regional channel. He spends an additional Rs 800 on a Netflix subscription. “Since my daughter watches cartoon channels on TV, I have a DTH connection,” he said. “But if the new tariff order does bring down my bill, I will opt to pay only for channels I watch.”

Broadcasters Find A Way Around

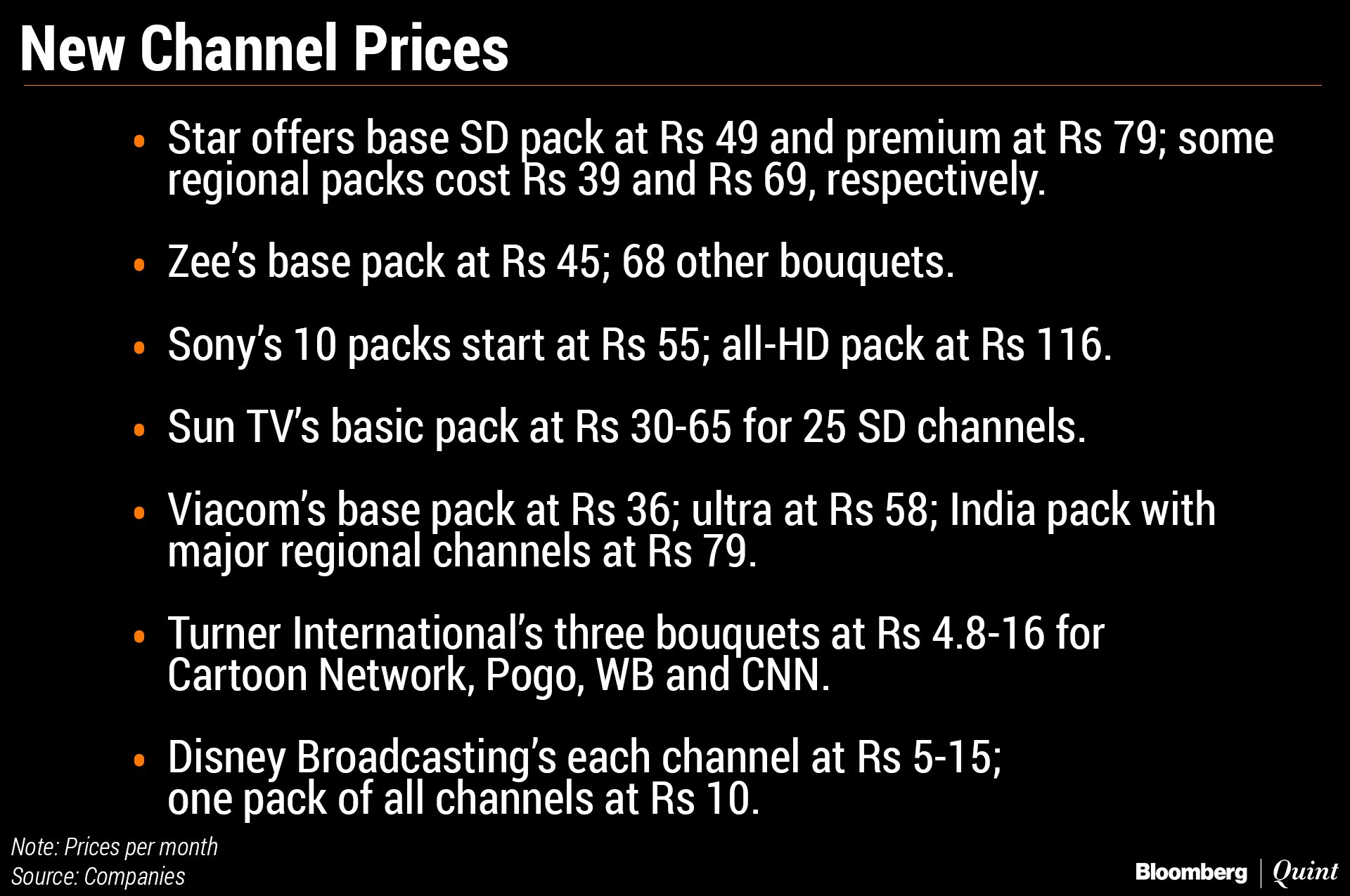

Broadcasters responded to the new tariff structure by making all free-to-air channels paid. They now charge as little as 50 paise and then offer them in a bundle.

So, if a consumer still subscribes to 250 channels from any broadcaster, monthly bill will remain at Rs 350-450.

Moreover, broadcasters are betting on discounting to keep them hooked. “The amount of discounting is the choice of the broadcaster and that is something which is in sync with the consumer-led pricing mechanism,” Zee's Misra said. “It's an open market operation. You have the power of choice and you have the power of discount.”

CLSA, in a report, agreed that channel bouquets will prevail. The brokerage's analysis of pricing of top broadcasters showed that they offer a 20-65 percent discount.

Yet, according to TRAI, consumers stand to gain if they subscribe only to the channels they need. In its order citing data by the Broadcast Audience Research Council, the regulator said more than 90 percent of families view or flip 50 channels or less.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.