Index rollover in the March series was notably lower than the three-month average, suggesting potentially weaker market breadth.

Strong short covering is observed, particularly in the 22,000 and 22,200 strike calls. It is advisable to keep an eye on two-wheeler stocks, as monthly data is anticipated to be robust. Additionally, the technology sector may see a positive performance today, possibly driven by a bounce back trade influenced by global cues, brokerage upgrades, and the expected continuation of the positive trajectory in private banks.

Overall, market sentiment appears to maintain a small positive bias, with trends indicating that the anticipated positive momentum in private banks is likely to persist.

As the Indian markets ended the last day of the financial year in green, analysts expect the auto and financial sectors to be the top picks for the new fiscal starting next week.

"We are heading towards an all-time high trajectory. Also, looking at the broad-based bank action in the large-cap and mid-cap space, that clearly shows that these momentums can extend further," said Rajesh Palviya, senior vice president of technical and derivatives research at Axis Securities Ltd.

On the first day of April, there is going to be a new all-time high trajectory for Nifty and this rally could extend to the 22,700–22,800 level, he said.

FII And DII Activity

Overseas investors stayed net buyers on Thursday for the third consecutive day. Foreign portfolio investors bought stocks worth Rs 188.31 crore and domestic institutional investors remained net buyers for the seventh day and mopped up equities worth Rs 2,691.52 crore, the NSE data showed.

Markets On Thursday

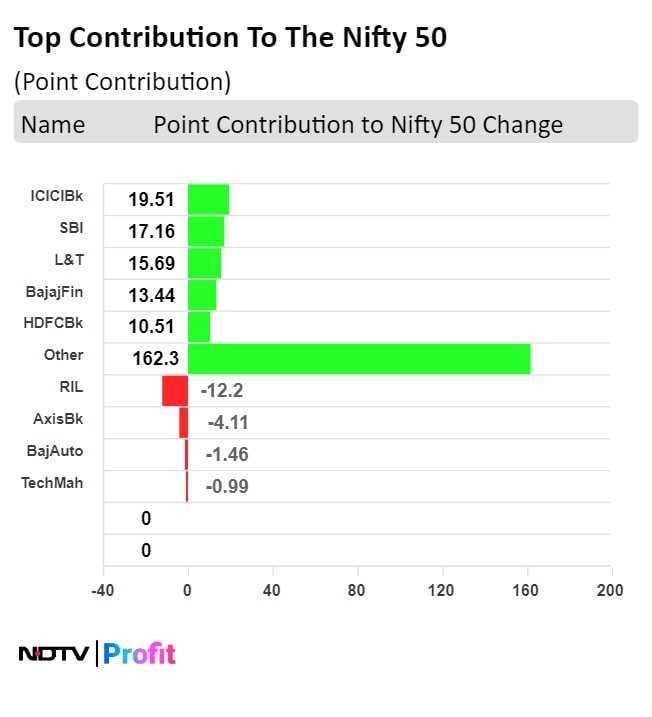

Benchmark equity indices pared some gains in the last hour of Thursday's session but still managed to close the last week of the financial year over 1% higher.

The NSE Nifty 50 ended 219.85 points, or 0.99%, higher at 22,343.50, while the S&P BSE Sensex gained 639.16 points, or 0.88%, to end at 73,635.48.

In FY24, the Nifty gained 28.61% and the Sensex ended 24.85% higher.

"To sustain a continued rally, it (Nifty 50) must surpass the 22,525 level decisively. On the downside, 22,200 could serve as short-term support," said Rupak De, senior technical analyst at LKP Securities Ltd.

On a weekly basis, Nifty ended higher for the second week, rising 1.04%. The Sensex rose 1.13%.

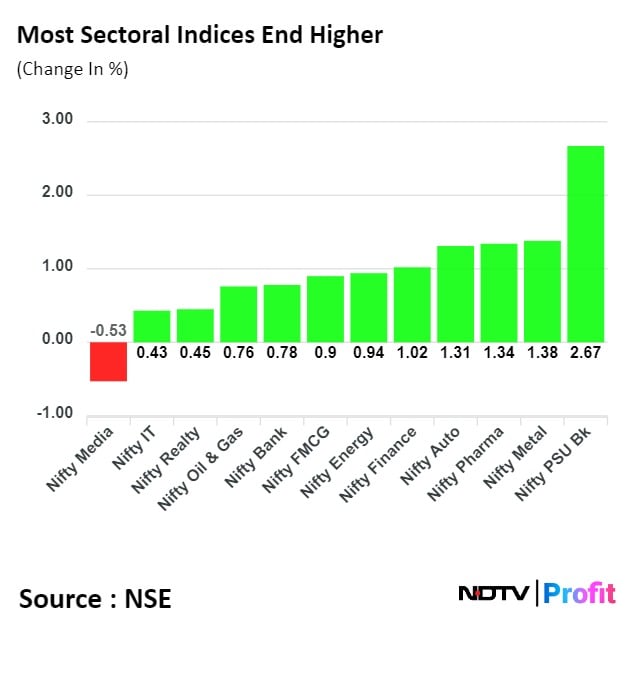

Nifty Realty was the top sectoral performer this week, while Nifty Media fell the most.

Major Stocks In News

HDFC Bank: The lender plans to sell its 100% stake in HDFC Education and Development Services through the Swiss Challenge method. After the Swiss challenge process is over, the bank will decide on the purchaser.

Bank stocks: The RBI authorised 11 banks to import both gold and silver in FY25, starting April 1. Axis Bank, HDFC Bank, SBI, and Karur Vysya Bank are among the eligible buyers for gold and silver, and Indian Overseas Bank, PNB and Union Bank of India can buy only gold.

Infosys: The IT major expects a refund of Rs 6,329 crore from the Income Tax Department. It also informed the stock exchanges about tax demand to the tune of Rs 2,763 crore.

NTPC: The company has discontinued operations at the 2x110 MW Barauni Thermal Power Station Stage-I permanently.

Top Brokerage Call

Jefferies On GAIL

The brokerage has maintained an 'underperform' rating with a target price of Rs 150 per share.

The Petroleum and Natural Gas Regulatory Board's newly notified unified tariffs remain unchanged at $81.13 per metric million British thermal unit.

New tariffs, effective June, will include newly commissioned pipelines.

The brokerage's estimates remain unchanged, and it projects muted earnings growth over FY24–26.

Risk reward remains unfavourable.

Citi On Ambuja Cement

Citi has maintained a 'buy' on the cement manufacturer with a target price of Rs 645 apiece.

About 44% of promoter warrants converted inspire confidence.

The brokerages allow the company to benefit from cost efficiencies.

It expects a favourable swap ratio for Ambuja should there be a merger with ACC.

Global Cues

Markets in Asia were trading higher in early trade on Monday as risk sentiment improved after data showed industrial activity in China rebounded from a five-month decline.

The Nikkei 225 was trading 0.15%, higher at 40,428.48, and the KOSPI was trading 0.27% higher at 2,753.95 as of 06:35 a.m.

The S&P 500 index rose by 0.11% and the Nasdaq Composite fell 0.12% as of 6:37 a.m. The Dow Jones Industrial Average rose by 0.12%.

Brent crude was trading 0.19% lower at $86.81 a barrel. Gold was up by 1.21% at $2,256.77 an ounce.

The GIFT Nifty was trading 15.5 points, or 0.07%, higher at 22,539.50 as of 6:50 a.m.

Rupee Update

The Indian rupee closed weaker against the U.S. dollar on Thursday, the last trading day of fiscal 2024.

The local currency depreciated two paise to close at Rs 83.40 against the U.S. dollar. It had closed at Rs 83.38 a dollar on Wednesday, according to Bloomberg data.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.