Jamie Dimon Can't Wriggle Out of WeWork So Easily

Jamie Dimon Can't Wriggle Out of WeWork So Easily

(Bloomberg Opinion) -- Until recently, things were looking bright for JPMorgan Chase & Co. The lender emerged as a big winner from the global financial crisis; and under the leadership of Jamie Dimon, had managed to notch fast growth in retail deposits. The company’s share price has gained more than 200% since 2008, compared with 27% at Goldman Sachs Group Inc. and Morgan Stanley’s flat performance.

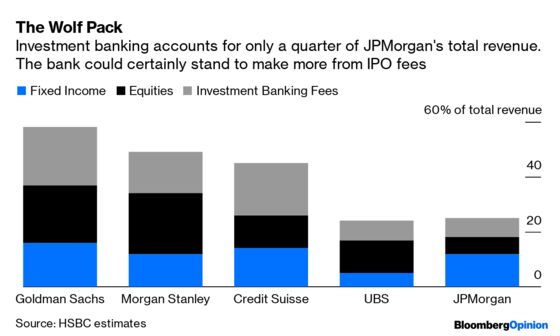

That shareholder support, as well as a strong balance sheet, has given JPMorgan space to expand its investment-banking operation, which still only accounts for about a quarter of its total revenue. JPMorgan’s IPO underwriting business in the U.S. trails Goldman and Morgan Stanley’s; so being named the lead bank for the blockbuster IPO of a $47 billion unicorn looked like a major coup.

It turns out moving up the league table isn’t that easy. WeWork’s much anticipated listing has been put on hold now that Adam Neumann, its charismatic yet troublesome founder, has stepped down as CEO. JPMorgan is now seeing millions in fees slipping out of its hands. And to make matters worse, the bank can’t just walk away – JPMorgan isn’t just WeWork’s lead IPO banker, but also a main commercial lender.

In recent years, Dimon has made a considerable effort to win deals by pitching JPMorgan as a soup-to-nuts bank. Once its technology dealmakers hunt down promising entrepreneurs, an “army” of commercial and private bankers will follow on their heels, offering startups credit lines and even personal mortgage loans to founders, the Wall Street Journal reported. WeWork seemed like the perfect candidate.

The bank arranged a $650 million credit line for Neumann’s company in November 2015, followed by an additional $500 million two years later – a strong show of faith for a cash-bleeding startup. Last year, WeWork’s Ebitda margin was -75%; in other words, for every dollar WeWork made, it spent $1.75. As of June, WeWork had $1 billion of stand-by letters of credit outstanding, which won’t terminate until November 2020.

Meanwhile, in the offering memorandum for the company’s $669 million bond due in 2025 – shown to investors in April 2018 – WeWork listed JPMorgan, along with Neumann, SoftBank Group Corp., and Benchmark Capital, among its investors. In 2014, the bank participated in a funding round that valued WeWork at $5 billion. So it isn’t unreasonable for creditors to expect JPMorgan would step in and help fix the mess WeWork now finds itself in.

Such a burden would be a significant setback for the bank, just when it had been making inroads in key markets around the world. The company has been spending big in the tech arms race afoot among its rivals, and is expanding its business offerings. JPMorgan is now looking to challenge Citigroup Inc.’s lock on the cash-management business and is diving into China to compete head-on with UBS AG in the last market on earth where money managers can still earn fees.

As the WeWork drama unfolds, Dimon is learning that chasing the shiny object can run you smack into a wall. Now he has no choice but to get his hands dirty and plug WeWork’s cash drain. Bankers in the cloistered halls of Morgan Stanley must be feeling giddy right now.

To contact the editor responsible for this story: Rachel Rosenthal at rrosenthal21@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Shuli Ren is a Bloomberg Opinion columnist covering Asian markets. She previously wrote on markets for Barron's, following a career as an investment banker, and is a CFA charterholder.

©2019 Bloomberg L.P.