One97 Communications Ltd., Life Insurance Corp., and Tata Power Co. will be among the major stocks to watch on Monday.

The Reserve Bank of India has confirmed that Paytm's QR, soundbox, and card machine will continue to work as always even beyond March 15. The Paytm operator also said that it shifted its nodal account to Axis Bank Ltd. to continue seamless merchant settlements as before.

LIC received an income tax refund worth Rs 21,740 crore for the assessment years 2012-13 to 2019-20. Tata Power received a Letter of Intent from REC Power Development and Consultancy to acquire Jalpura Khurja Power Transmission for Rs 838 crore.

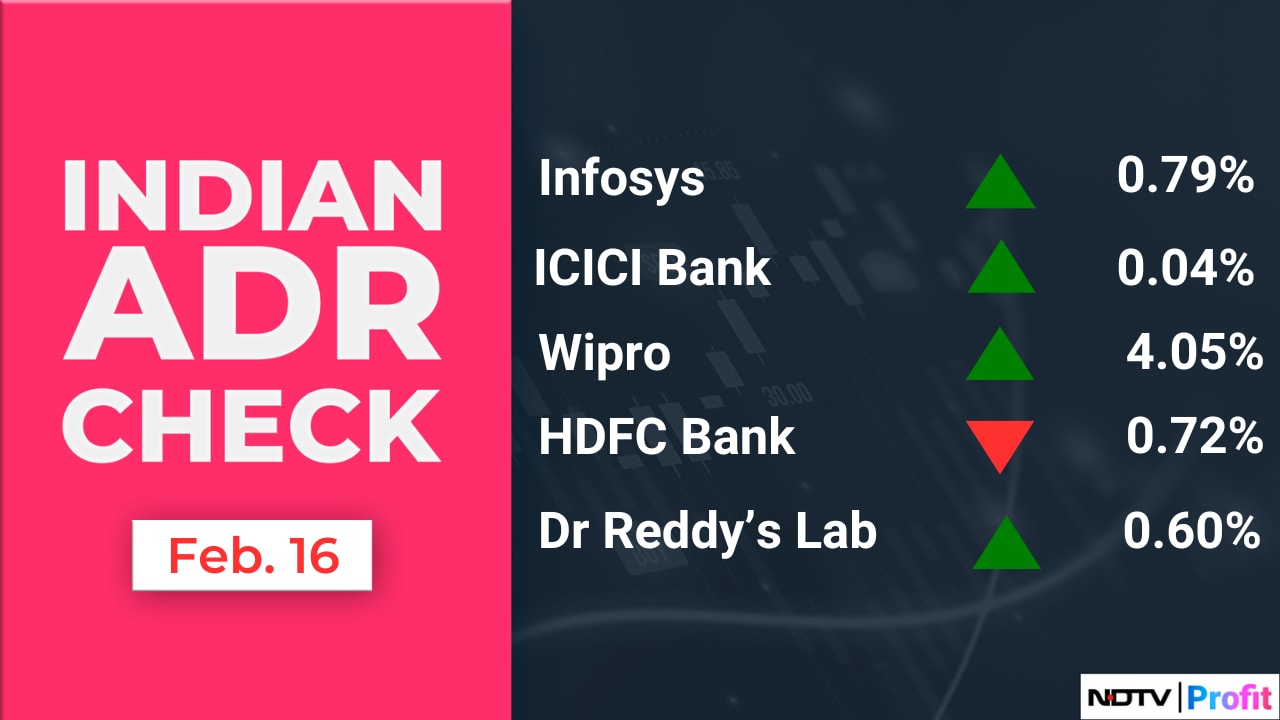

India's benchmark equity indices gained more than 1% this week, with shares of Mahindra and Mahindra Ltd. and Wipro Ltd. adding around 11%.

The indices closed higher in the fourth consecutive session on Friday, with shares of Larsen and Toubro Ltd., Infosys Ltd. and M&M contributing the most to gains.

The NSE Nifty 50 closed 121.85 points up, or 0.56%, at 22,032.60 and the S&P BSE Sensex gained 365.84 points, or 0.51%, to end at 72,416.22.

Overseas investors in Indian equities turned net buyers on Friday after two consecutive days of selling. Foreign portfolio investors mopped up stocks worth Rs 253.3 crore, while domestic institutional investors bought stocks worth Rs 1,571 crore, the NSE data showed.

The Indian rupee strengthened by 2 paise to close at Rs 83.02 against the U.S. dollar.

Markets in Asia-Pacific region were trading on a mixed note in early trade on Monday, while investors look forward to the reopening of Chinese markets today after a week-long holiday.

The Nikkei 225 was 0.09% higher at 38,525.25, while the KOSPI was 1.15% up at 2,678.83 as of 6:31 a.m.

Wall Street is ending the week on a bit of a sour note, with bonds down and stocks wavering after economic data continued to fuel speculation the Federal Reserve will be in no rush to cut interest rates, reports Bloomberg.

The S&P 500 index and Nasdaq Composite fell by 0.48% and 0.82%, respectively, as on Friday. The Dow Jones Industrial Average fell by 0.37%.

Brent crude was trading 0.31% lower at $83.23 a barrel. Gold was higher by 0.25% at $2,018.54 an ounce.

Earnings Post Market Hours

Crisil Q3 FY24 (Consolidated, YoY)

Total income up 34.3% at Rs 628.2 crore vs Rs 467.6 crore.

Net profit up 110.4% at Rs 231 crore vs Rs 109.8 crore.

Board recommends final dividend of Rs 28 per share.

Schaeffler India Q3 FY24 (Consolidated, YoY)

Revenue up 4.45% at Rs 1,874.5 crore vs Rs 1,794.6 crore

EBITDA down 6.12% at Rs 324 crore vs Rs 345.2 crore

Margin down 194 bps at 17.28% vs 19.23%.

Net profit down 9.25% at Rs 209.6 crore vs Rs 230.9 crore.

Board recommends dividend at Rs 26 per share.

Stocks To Watch

One97 Communication: Reserve Bank of India has confirmed that the company's QR, soundbox, and card machine will continue to work as always even beyond March 15. The company has shifted its nodal account to Axis Bank to continue seamless merchant settlements as before.

Life Insurance Corp.: The company announced the launch of a new product LIC's Amritbaal for the Domestic market. The company also received an income tax refund worth Rs 21,740 crore for the assessment years 2012-13 to 2019-20.

Tata Power: The company received a letter of intent from REC Power Development and Consultancy to acquire Jalpura Khurja Power Transmission for Rs 838 crore.

Bajaj Auto: The company fixed Feb. 29 as the record date for determining shareholders eligible to participate in share buyback.

NTPC, Nalco: NTPC has inked an initial agreement with NALCO to supply over 1,200 MW of round-the-clock power for the aluminium maker's operations in Odisha.

PB Fintech: The company's unit received IRDAI approval for a license upgrade.

Harsha Engineers: The company signed a Memorandum of Understanding for transferring 25.9% investment in Sunstream Green Energy One to Sunstream Green Energy for Rs 10 per share.

NHPC: The company is laid the foundation stone for the it 300 MW grid-connected solar PV project In Rajasthan.

ITI: The company signed a Memorandum of Understanding with JandK Operations to manufacture and provide BharOS-enabled digital devices and services.

Bajaj Hindustan Sugar: The company agreed to acquire a 15.5% stake in Unique One RNG, for Rs 1.55 crore.

Fineotex Chemicals: The company raised Rs 280 crore from promoters, high net-worth individuals, and foreign institutional investors at a valuation of Rs 346 per share vs the current market price of Rs 438 apiece.

Titagarh Rail Systems: The company received an order worth approximately Rs 170 crore for the manufacture and supply of 250 specialized wagons from the Ministry of Defence.

Kaynes Technology: The company incorporated a wholly owned subsidiary Kaynes Mechatronics Pvt.

Paradeep Phosphates: The company announced the shut down of NPK - a plant located at Goa to carry out the regular annual maintenance activities.

Bharti Airtel: The telecom major received notice of imposing a penalty of Rs 1.31 lakh from the Department of Telecommunications, Maharashtra for an alleged violation of subscriber verification norms.

Ramkrishna Forgings: The company has made an additional investment by way of a rights issue in the equity share capital of Ramkrishna Aeronautics Pvt., a wholly owned subsidiary company, by subscription of 10 lakh equity shares at a face value of Rs 10 each aggregating to Rs 1 crore.

Dr Reddy's Laboratories: The pharma major declined to comment on market speculations that it is in a race to acquire Novartis AG's stake in Novartis India.

Balrampur Chini Mills: The company will enter new business of polylactic acid manufacturing for bioplastics, with an investment of Rs 2,000 crore, spread over a period of 2.5 years.

Titagarh Rail Systems: The company bagged an order worth Rs 170 crore from Defence Ministry for supply of 250 specialised wagons over three years.

Laurus Labs: The company invested Rs 99 crore in subsidiary Laurus Synthesis by subscribing to rights issue.

Block Deals

Data Patterns: Florintree Capital Partners LLP sold 59.96 lakh shares (10.71%), while, the Government of Singapore bought 31.47 lakh shares (5.62%), Mirae Asset Mutual Fund bought 10.94 lakh shares (1.93%), Mathew Cyriac bought 6.8 lakh shares (1.21%), Kotak Mahindra Mutual Fund bought 5.46 lakh shares (0.97%) at Rs 1,837 apiece.

Bulk Deals

Apollo Micro Systems: Bajaj Finance sold 37.82 lakh shares (1.44%) at Rs 121.48 apiece and Columbia Petro Chem bought 37 lakh shares (1.41%) at Rs 121.5 apiece.

Insider Trades

Advanced Enzyme Technologies: Promoter group Advanced Vital Enzymes sold 72,851 shares between Feb. 14 and 15.

Star Cement: Promoter Suchita Agarwal sold 10,000 shares on Feb. 12.

Pledge Details

Aurobindo Pharma: Promoter RPR Sons Advisors, P.Suneela Rani (jointly holding) created a pledge of Rs 1.34 crore shares on Feb. 14.

Sterling and Wilson Renewable Energy: Promoter Khurshed Yazdi Daruvala created a pledge of 4.5 lakh shares on Feb. 12.

Stove Kraft: Promoter Rajendra Gandhi created a pledge of 2 lakh shares on Feb. 14.

Who's Meeting Whom

Sobha: To meet analysts and investors on Feb. 23.

Greaves Cotton: To meet analysts and investors on Feb. 20.

Landmark Cars: To meet analysts and investors on Feb. 21.

PG Electroplast: To meet analysts and investors on Feb. 22.

Kalyan Jewellers: To meet analysts and investors on Feb. 20.

Bajaj Finserv: To meet analysts and investors on Feb. 21.

Grasim Industries: To meet analysts and investors on Feb. 20.

Kamat Hotels: To meet analysts and investors on Feb. 21.

Vijaya Diagnostic Centre: To meet analysts and investors on Feb. 22

Titan Co: To meet analysts and investors on Feb. 20

Kotle-Patil Developers: To meet analysts and investors on Feb. 20

Finotex Chemicals: To meet analysts and investors on Feb. 19

Vedanta: To meet analysts and investors on Feb. 27

Brigade Enterprises: To meet analysts and investors on Feb. 19

Trading Tweaks

Price band revised from 10% to 20%: Prakash Industries.

Price band revised from 2% to 5%: Kaushalya Infrastructure Development Corp.

Price band revised from 5% to 20%: Om Infra.

Moved into short-term ASM framework: Inox India, Shaily Engineering Plastics.

Moved Out of short-term ASM framework: BF Utilities, EIH, SMC Global Securities.

F&O Cues

Nifty February futures up by 0.38% to 22,097.80 at a premium of 57.1 points.

Nifty February futures open interest up by 1.42%.

Nifty Bank February futures up by 0.18% to 46,503.4 a premium of 118.55 points.

Nifty Bank February futures open interest down by 0.3%.

Nifty Options Feb 22 Expiry: Maximum Call open interest at 23,000 and Maximum Put open interest at 21,000.

Bank Nifty Options Feb 21 Expiry: Maximum Call Open Interest at 47,000 and Maximum Put open interest at 44,000.

Securities in ban period: Aditya Birla Fashion, Ashok Leyland, Balrampur Chini Mills, Bandhan Bank, Canara Bank, Delta Corp, Hindustan Copper, India Cement, Indus Tower, National Aluminium, Sail, Zee Entertainment Enterprise.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.