(Bloomberg) -- Stocks added to one of their biggest November rallies on record amid bets the Federal Reserve will pull off a soft landing as the economy remains fairly strong and inflation shows signs of cooling.

The S&P 500 came off session highs after Fed Bank of Richmond President Thomas Barkin argued the central bank should keep the option to hike interest rates on the table in case inflation proves stubborn. Megacaps were mixed, with Nvidia Corp. leading gains in chipmakers, Tesla Inc. climbing in the run-up to its Cybertruck delivery event and Microsoft Corp. pushing lower. The Russell 2000 index of small caps climbed 1.5%. Treasury two-year yields dropped seven basis points to 4.66%.

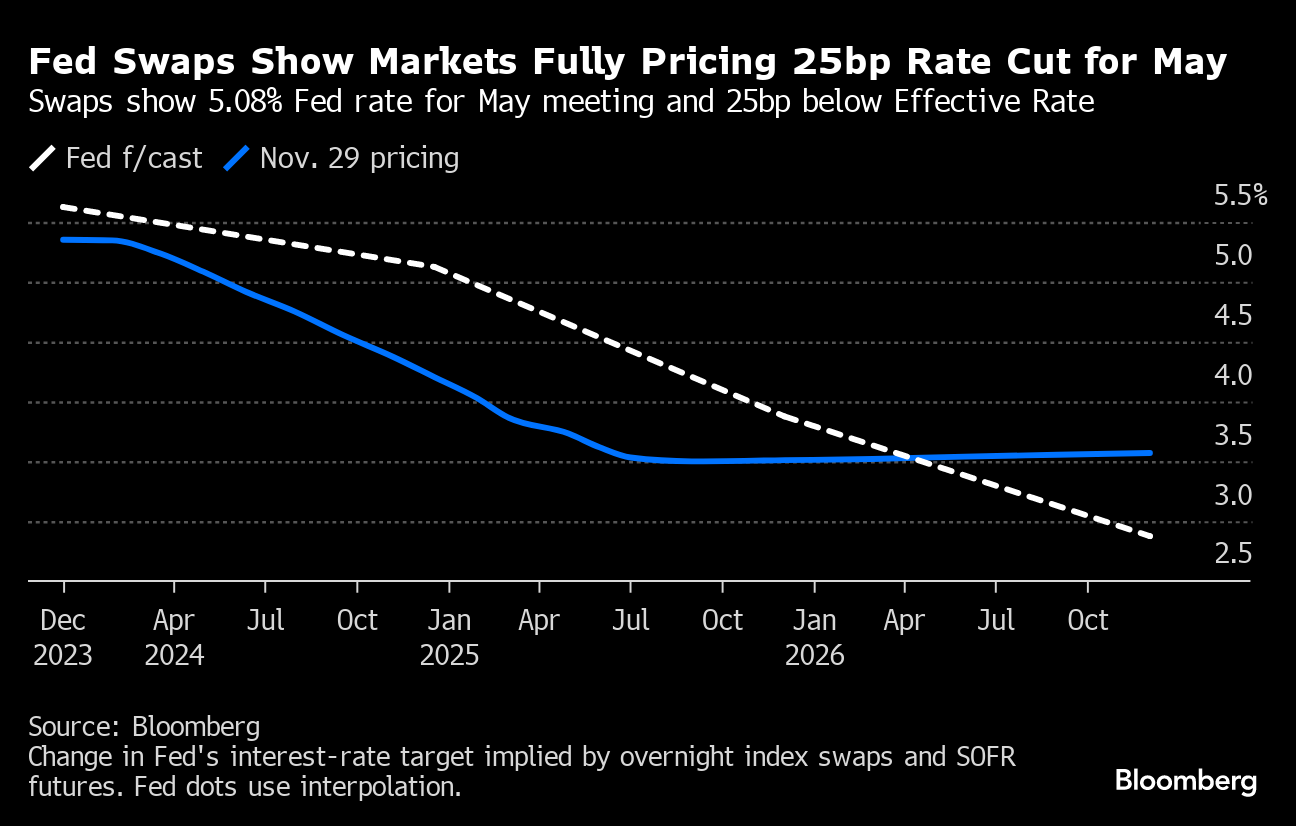

Fed swaps fully priced in a quarter-point rate cut by May.

Gross domestic product rose at an upwardly revised 5.2% annualized pace in the third quarter, the fastest in nearly two years. Consumer spending advanced at a less-robust 3.6% rate. The Fed's preferred inflation metric — the personal consumption expenditures price index — was revised down.

To John Leiper at Titan Asset Management, while GDP highlighted the strength of the economy, the drop in the core PCE price index will be interpreted by Fed officials as a sign their strategy remains on track and they may achieve a soft landing scenario. “The Goldilocks narrative continues for now,” he said.

“The Fed could find themselves in a ‘sweet spot',” said Jeffrey Roach at LPL Financial. “Inflation is trending lower, the consumer is still spending — but at a slower pace — and the Fed could end its rate hiking campaign without much pain inflicted on the economy.”

The economy continues to frustrate all of the naysayers, according to Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

“Given the positive economic backdrop, we believe the market will rally until the end of the year and we should have a good start to 2024 – the exact opposite of what many believed as recently as this summer,” he noted.

Solita Marcelli at UBS Global Wealth Management says she agrees with the market's assessment that US growth, inflation, and rates will all head lower next year. However, her view on the timing and size of US rate cuts differs to the market, with potential for uncertainty and volatility. S

“We believe investors should focus on quality.” she noted. “In fixed income, quality bonds offer attractive yields and should deliver capital appreciation if interest rate expectations decline as we expect. In equities, quality companies with strong balance sheets and high profitability, including those in the technology sector, should be best positioned to generate earnings in an environment of weaker growth.”

Jamie Cox at Harris Financial Group, says that even as the headline GDP numbers were revised higher and look rosy, it is concerning that consumer spending is starting to roll over.

“The increasing costs of higher interest rates are now at the consumer's doorstep. We'll see if this is one off or the beginning of a trend, the latter of which would put recession back on the table.”

From here, investors will be watching the response in risk assets as well as the Fed Beige Book due later Wednesday — although neither are likely to provide a material challenge to the bond bullish tone, according to Ian Lyngen at BMO Capital Markets.

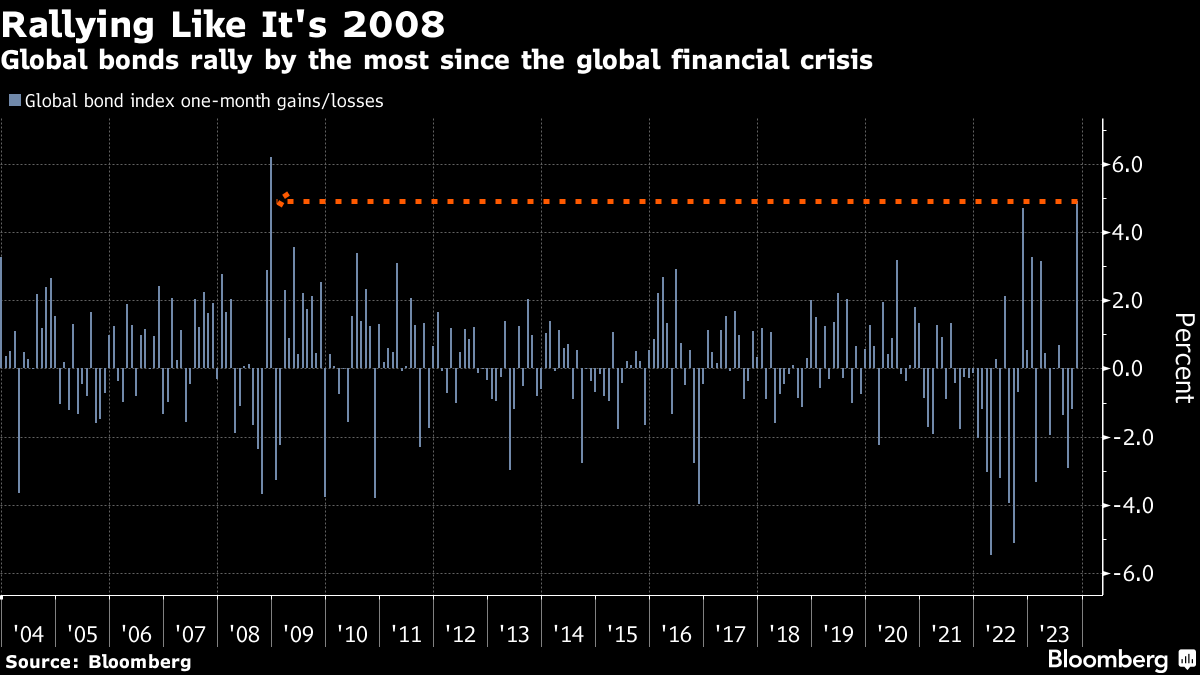

Global bonds are soaring at the fastest pace since the 2008 financial crisis. November's rally is being driven by increasing speculation the Fed and its global peers have largely finished hiking interest rates and will start cutting next year.

“If more start to believe the Fed is done and focus on the next rate moves, which will be cuts, then there is plenty of firepower to bring rates lower in yield. However, we have moved a lot in a short period of time,” said Andrew Brenner at NatAlliance Securities.

The world's advanced economies are heading into a deepening slowdown as markedly higher interest rates take a hefty toll on activity that could still become more acute, the OECD warned. The Fed and the European Central Bank will need to keep interest rates high for longer than investors expect to ensure inflation is weeded out of their economies, OECD Chief Economist Clare Lombardelli told Bloomberg Television.

Corporate Highlights:

- General Motors Co. will boost its dividend by 33% and repurchase $10 billion of shares — its biggest-ever buyback plan — sparking renewed interest among investors in a stock that has slumped this year as the company's technology investments have faltered.

- UnitedHealth Group Inc. forecast membership in its important Medicare segment that missed Wall Street estimates, a sign of slowing growth in a business that has powered insurers' earnings for years.

- Foot Locker Inc. raised its full-year forecast, citing strong results over Thanksgiving week and progress on its strategic growth plan.

- CrowdStrike Holdings Inc., a security software company, reported third-quarter results that beat expectations and the company raised its full-year revenue forecast.

- Rover Group Inc., an online marketplace in the fast-growing market for pet-care services, agreed to be acquired by Blackstone Inc. in a $2.3 billion all-cash deal, the companies said Wednesday.

- SoFi Technologies Inc., the fast growing one-stop shop for financial-services products, is exiting crypto even with token prices surging because of increased scrutiny of the sector by banking regulators.

- Miriam Adelson, the widow of casino magnate Sheldon Adelson, is selling $2 billion of stock in Las Vegas Sands Corp. so the family can acquire a majority stake in the Dallas Mavericks NBA franchise from Mark Cuban.

- NetApp Inc., a data storage company, boosted its full-year adjusted earnings per share forecast above analyst expectations.

- Activist Investor Elliott Investment Management has built a $1 billion stake in Phillips 66 and plans to push for two board seats.

Key events this week:

- China non-manufacturing PMI, manufacturing PMI, Thursday

- OPEC+ meeting, Thursday

- Eurozone CPI, unemployment, Thursday

- US personal income, PCE deflator, initial jobless claims, pending home sales, Thursday

- China Caixin Manufacturing PMI, Friday

- Eurozone S&P Global Manufacturing PMI, Friday

- US construction spending, ISM Manufacturing, Friday

- Fed Chair Jerome Powell to participate in “fireside chat” in Atlanta, Friday

- Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.3% as of 10:31 a.m. New York time

- The Nasdaq 100 rose 0.4%

- The Dow Jones Industrial Average was little changed

- The Stoxx Europe 600 rose 0.4%

- The MSCI World index rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro fell 0.2% to $1.0966

- The British pound fell 0.1% to $1.2675

- The Japanese yen was little changed at 147.56 per dollar

Cryptocurrencies

- Bitcoin fell 0.6% to $37,745.57

- Ether fell 1.4% to $2,026.48

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.29%

- Germany's 10-year yield declined six basis points to 2.44%

- Britain's 10-year yield declined eight basis points to 4.09%

Commodities

- West Texas Intermediate crude fell 0.6% to $75.98 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Robert Brand, Garfield Reynolds and Elizabeth Stanton.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.