(Bloomberg) -- Stocks, bonds and the dollar saw small moves after the Federal Reserve reiterated its cautious approach on rates, with traders also awaiting Nvidia Corp.'s results.

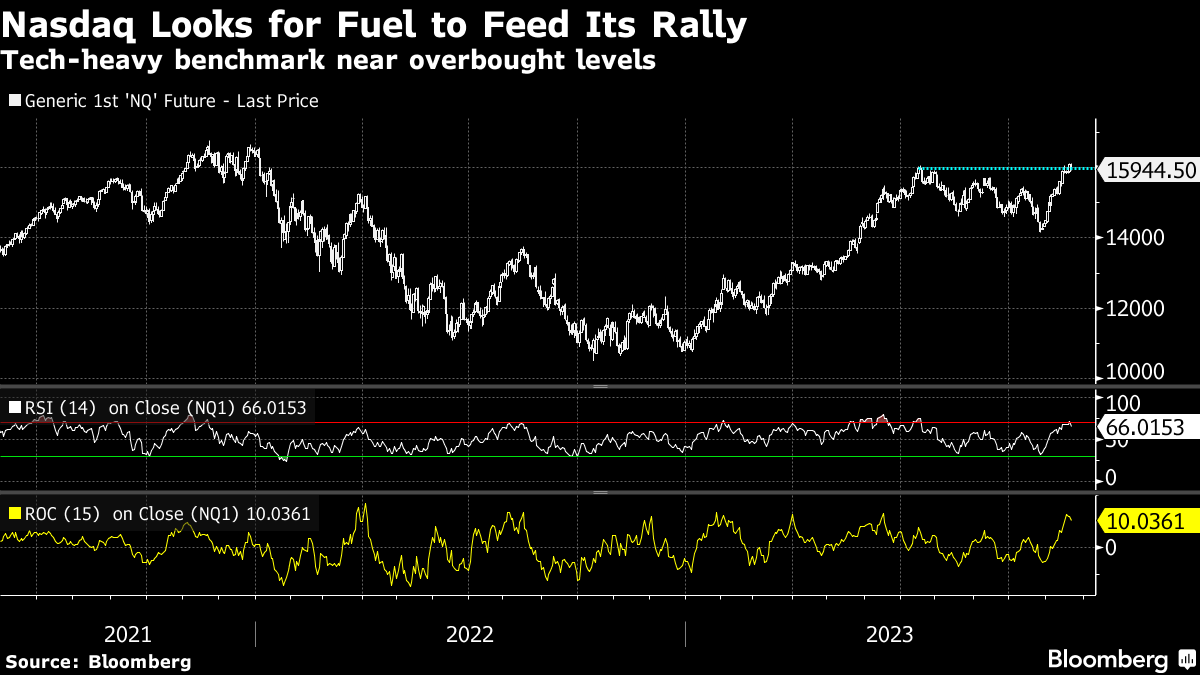

The S&P 500 dropped from “overbought” levels and the Nasdaq 100 underperformed. As the earnings season winds down, questions on the sustainability of the advance led by the “Big Seven” group of megacaps have resurfaced, with Nvidia declining from a record. The bar was set high for the world's most-valuable chipmaker, whose shares have more than tripled this year — leaving little room for error.

Read: Key Takeaways From Minutes of Fed's Oct. 31-Nov. 1 Meeting

Some $6 trillion in market capitalization has been added to the US equity benchmark in 2023 in a rally fueled by the artificial intelligence boom, Corporate America's resilience and bets the Fed will pivot to rate cuts next year. The gains left the index about 5% away from reclaiming its all-time high.

“The stock market is once again priced for perfection,” said Matt Maley, chief market strategist at Miller Tabak + Co. “Maybe Nvidia's earnings will be ‘perfect' enough to push things even higher. However, since the stock market is more ‘overbought' right now — than it was ‘oversold' three weeks ago — investors will need to remain very nimble as we move through the end of November and into December.”

Read: PGIM Warns Against Risk Rally as Demand Woes Mount: Surveillance

Short-term charts on the S&P 500 are currently sporting a negative divergence between price action (approaching recent 2023 highs) and momentum (lower highs), according to Dan Wantrobski, at Janney Montgomery Scott.

“This is a sign that buying power is weakening even as the S&P looks to test into the low-4600 zone,” Wantrobski noted. “Markets are now vulnerable to profit taking/consolidation over the near-term. We also believe they are still vulnerable to elevated volatility/correction within the first half of 2024.”

Hedge funds are holding their most-concentrated wagers on US equities than anytime in the past 22 years, according to data from Goldman Sachs Group Inc. The most popular bets remain in megacap tech, with Microsoft Corp., Amazon.com Inc. and Meta Platforms Inc. in Goldman's list of “Hedge Fund VIPs” this quarter.

Read: Wall Street Rally Boosts Everything From Microsoft to Small Caps

To Savita Subramanian at Bank of America Corp., the S&P 500 is set for a fresh high in 2024 because US companies have adapted to higher rates and weathered macroeconomic jolts. She sees the gauge at a record 5,000 by the end of 2024, which is 10% higher than Monday's close. Next year will be “a stock picker's paradise,” they said.

US stocks have “much more upside potential” as they approach decisive bullish breakouts, wrote BofA's technical strategist Stephen Suttmeier. If the S&P 500 could surpass the low 4,600s, it would confirm a “bullish cup and handle” pattern from early 2022 — triggering more gains, he added.

“Our base case is for further modest equity gains in 2024, with the S&P 500 Index ending the year around 4,700,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management. As inflation continues to fall and growth moderates, we are even more positive on quality fixed income. But an unusually wide range of risks could still spoil the outlook.”

In economic news, sales of previously owned US homes fell by the most in nearly a year in October, highlighting the toll elevated mortgage rates and still-high prices continue to take on the resale market.

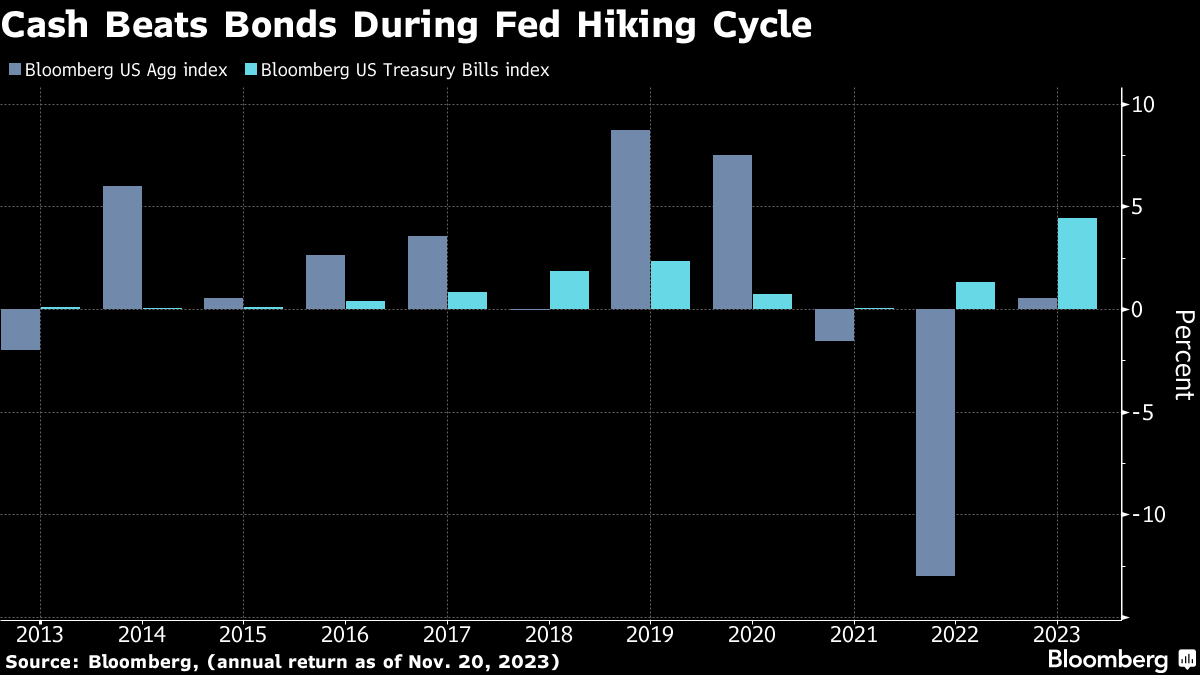

For investors stashing record sums in cash, US bond managers overseeing a combined $2.5 trillion have a bit of advice: It's time to put that money to work. That's the message from Capital Group, DoubleLine Capital, Pacific Investment Management Co. and TCW Group.

Signs of ebbing inflation and softer growth have fueled a 3.6% surge in the Bloomberg US Aggregate Index in November, leaving it with a return of about 0.7% for 2023. That's still well short of what cash has earned this year. But it shows what a real turning point could deliver after a year marked by head fakes over price pressures and Fed policy.

“If people are moving into cash because of 5% rates, we could see that money start trickling back into markets soon. Inflation is coming under control, and the bond market is now preparing for the Fed to start cutting rates in March,” said Callie Cox at eToro.

Corporate Highlights:

- Lowe's Cos. cut its forecast, underscoring the shift away from big home-renovation projects after the pandemic boom.

- Best Buy Co.'s same-store sales fell by more than expected in the third quarter after what the retailer called “uneven consumer demand.”

- Kohl's Corp. reported a seventh-straight drop in comparable sales, pointing to an ongoing decline in foot traffic and a broader shift away from consumer spending on discretionary goods like apparel.

- Abercrombie & Fitch Co. boosted its forecast on the back of stronger-than-expected third-quarter sales as the retro brand's comeback continues to resonate with teens and young millennials.

- Dick's Sporting Goods Inc. raised its profit forecast as strong demand for sports gear overcame concerns of a slowdown in spending ahead of the holiday season.

- Broadcom Inc.'s deal with software maker VMware Inc. has received a list of conditions it must meet to get approval from Chinese regulators, the final hurdle for the companies' $61 billion merger.

- Zoom Video Communications Inc. reported better-than-expected revenue on strong enterprise sales.

- Ford Motor Co. is reducing capacity and hiring plans at a battery plant it's building in Michigan because it sees weaker demand for electric vehicles.

Key events this week:

- Eurozone consumer confidence, Wednesday

- US initial jobless claims, University of Michigan consumer sentiment, durable goods, Wednesday

- Bank of Canada Governor Tiff Macklem speaks, Wednesday

- Eurozone S&P Global Manufacturing & Services PMI, Thursday

- Thanksgiving holiday — US markets closed — Thursday

- ECB publishes account of October policy meeting, Thursday

- Germany IFO business climate, Friday

- US S&P Global Manufacturing PMI, Friday

- Black Friday, traditional kick-off for the US holiday shopping season

- ECB's Christine Lagarde speaks, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.2% as of 2:01 p.m. New York time

- The Nasdaq 100 fell 0.7%

- The Dow Jones Industrial Average fell 0.2%

- The MSCI World index fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.3% to $1.0909

- The British pound rose 0.2% to $1.2526

- The Japanese yen was little changed at 148.34 per dollar

Cryptocurrencies

- Bitcoin fell 1.4% to $36,896.5

- Ether fell 2.6% to $1,974.14

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.43%

- Germany's 10-year yield declined four basis points to 2.57%

- Britain's 10-year yield declined two basis points to 4.10%

Commodities

- West Texas Intermediate crude fell 0.1% to $77.73 a barrel

- Spot gold rose 1% to $1,998.13 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Jason Scott, Tassia Sipahutar, Pearl Liu, Thyagaraju Adinarayan, Robert Brand, Michael Mackenzie and Elena Popina.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.