Good morning!

The GIFT Nifty traded 0.73% higher at 25,261 as of 6:15 am, signalling a positive start to Indian equities.

US stock-index futures were little changed while, the futures indicted decline in Hong Kong and Europe.

Watch NDTV Profit Live

Markets On The Home Turf

The benchmark equity indices closed with gains on Wednesday, led by share prices of Titan Co. and Grasim Industries Ltd.

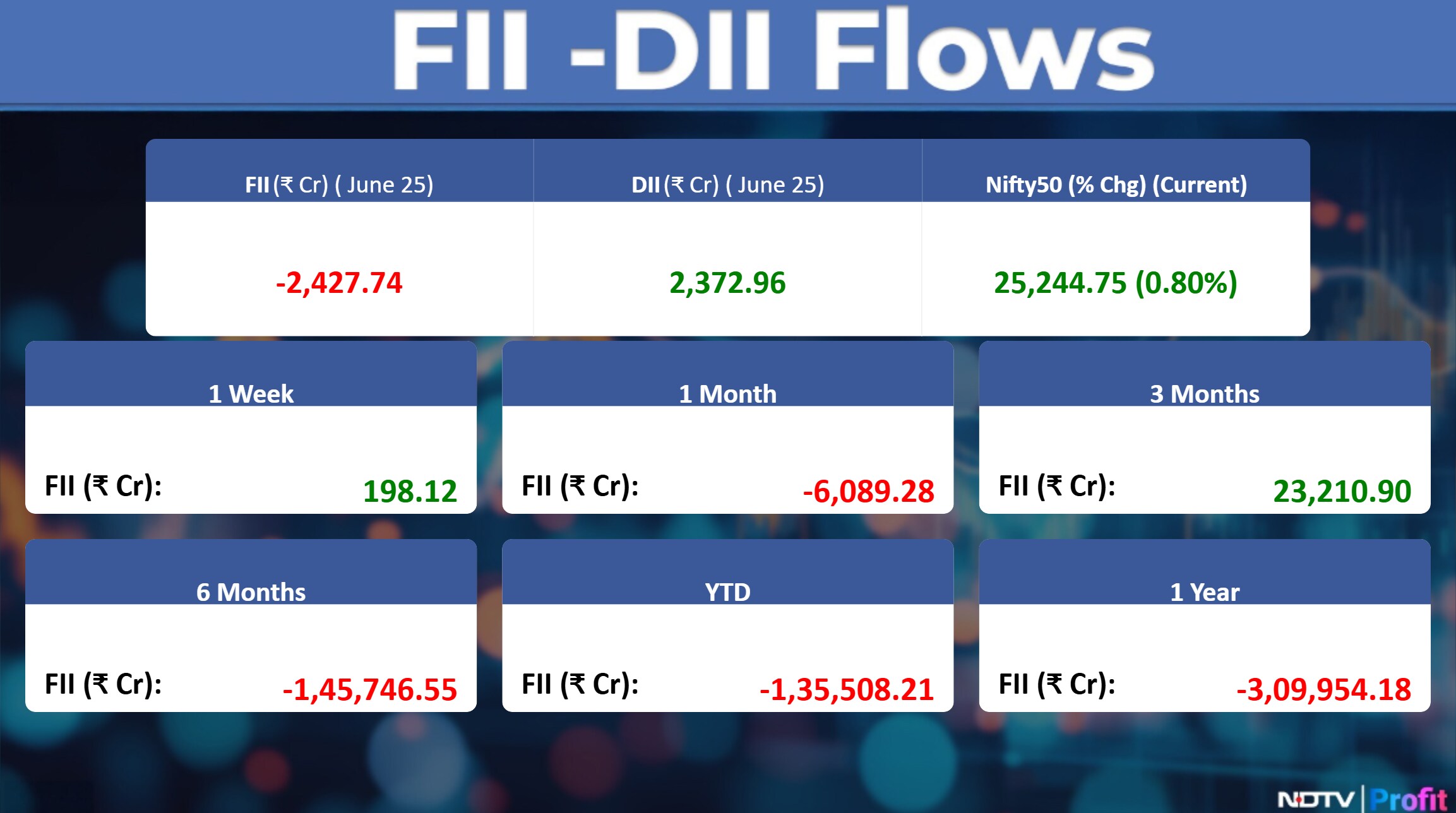

The NSE Nifty 50 ended 200.40 points, or 0.80% higher at 25,244.75, while the BSE Sensex closed 700.40 points, or 0.85% up at 82,755.51. During the day, the Nifty rose 0.89% to trade at 25,266.80 and the Sensex rose 0.93% to 82,815.91.

Commodity Check

Oil rose higher on Thursday after US President Donald Trump said that his maximum pressure campaign on Iranian oil will continue. Additionally, a report by the US government has shown a sharp decline in American crud stockpile.

While Brent crude was up 0.10%, West Texas Intermediate crude oil rose 0.25%.

London Metal Exchange

Copper extends advance to rise 0.15%.

Aluminium rose after a fall in the previous session, up 0.12%.

Nickel was flat for the second session.

Zinc was also flat.

Lead extended decline for the second session with a 0.02% decline.

Asian Markets Update

S&P 500 futures remained largely flat.

Euro Stoxx 50 futures fell 0.8%.

Futures for Hong Kong's Hang Seng Index fell by 0.6%.

Japan's Topix index rose 0.2%.

Australia's S&P/ASX 200 declined by 0.2%.

US Market Updates

The US stocks rally lost some steam on Wednesday with S&P 500 index, that was few points away from its all-time high ended the session flat. This was after US Federal Reserve Chair Jerome Powell said that the officials were struggling to determine the toll of tariffs on inflation.

“The question is, who's going to pay for the tariffs?” Powell said in response to a question during his testimony before the Senate Banking Committee. “How much of it does show up in inflation. And honestly, it's very hard to predict that in advance.”

On the other hand, technology heavy Nasdaq 100 index rose 0.2% and posted its all-time closing high after Nvidia Corp. hit a record high and Micron Technology Inc. gave an upbeat forecast. The Dow Jones Industrial Average was down 0.2%.

Stocks In News

Wheels India: The company approved the acquisition of 7.64 lakh shares of Axles India from forge 2000 for Rs 22.68 crore.

Balaji Amines: The company received consent to operate the manufacture of ISOPROPYLAMINE. Trial runs will start and commencement of commercial Production will take effect shortly.

Union Bank of India: The company approved raising funds up to Rs 6,000 crore via debt and equity.

SMS Pharma: U.S FDA concluded inspection at Telangana facility with Zero form 483 observations. The inspection was conducted from June 23-25.

Dilip Buildcon: The company provisionally completed the construction of four lane Bengaluru-Chennai Expressway in Andhra Pradesh.

Jio Financial Services: The company will invest Rs 190 crore in the arm Jio Payments Bank.

Timex Group: Promoter Timex Group Luxury Watches will exercise oversubscription option in OFS. B V to sell up to 15% stake via offer for sale on June 25 and 26.

Vodafone Idea: The telecom said to seek $2.9 billion in loans to Bolster Network.

ASK Automotive: The company entered a 49:51 JV agreement with TD holding GMBH. The agreement to manufacture, market and sell sunroof control, helix cables for passenger vehicles.

Ceat: The company approved raising up to Rs 500 crore via NCDs and approved to infuse capital up to Rs 400 crore in arm Ceat Oht Lanka.

RCF Chemicals: Department of Fertilizers denies request for EPMC or spot gas recognition procured for urea operations for 2021-23. The non-recognition is expected to have a financial impact of nearly Rs 204 crore.

Federal Bank: The board to consider fundraising via debt, equity in its board meeting on June 30.

Tata Steel: The company acquired 179 crore shares aggregating to Rs 1,563 crore in T Steel Holdings.

Garware Technical Fibres: The company in an agreement to sell all its assets and liabilities in its Norway branch to arm.

Godrej Properties: The company executed a share purchase agreement for stake sales in arms for Rs 54 crore.

Tejas Networks: The company in an agreement with Rakuten Symphony to drive global expansion through interoperable 5G solutions.

JSW Energy: The company signed a power purchase agreement with NHPC for 300 MW solar-wind hybrid capacity. The project is expected to be commissioned in the next 24 months.

Manappuram Finance: The company executed an agreement to issue a warrant worth Rs 2,192 crore to BC Asia Investments XIV at Rs 236 per warrant. Each warrant carries the right to subscribe to 1 share.

OM Infra: The company received Rs 199 crore order for 2880 MW Dibang project from NHPC in Arunachal Pradesh.

AU Small Finance Bank: The company to consider an annual fundraise plan in its board meeting on June 28.

Signature Global: The company approved raising up to Rs 875 crore via NCDs.

BSE: SEBI imposed penalty of Rs 25 lakh for violation of regulation. The penalty has no material impact on financial, operation or other activities.

Tata Steel: The company received show cause notice relating to irregular availing of Input Tax Credit of Rs 890 crore during FY19.

Mahindra and Mahindra: The company sells its entire stake in Mahindra Defence Systems to Mahindra Advanced Tech.

Panorama Studios: Arm in an agreement with Arha Media and Broadcasting to grant exclusive licence of airborne rights of four Telugu Films.

Prime Focus: Step-Down arm Brahma AI Holdings incorporated wholly owned arm Brahma AI services USA.

Bondada Engineering: The company incorporated subsidiary GreenBond RE Park Private.

Macrotech Developers: Raunika Malhotra ceases to be whole-time director of the company.

Texmaco Rail: The company received Rs 535 crore order to manufacture and supply 560 open-top wagons from Camalco SA.

HG Infra: The company incorporated an arm to set up standalone battery energy storage systems in Gujarat.

Can Fin Homes: The company approved to raise up to Rs 10,000 crore via debt and 1,000 crores via QIP.

JSW Steel: The company filed a review petition in the Supreme Court regarding its earlier judgment related to Bhushan Power and Steel Ltd.'s resolution plan.

PB Fintech: The co-founders Yashish Dahiya and Alok Bansal are set to sell 5.05 million shares or 1.1% stake at Rs 1,800 apiece, which is 2.2% discount to current market price. The transaction is valued at Rs 912 crore.

Western Carriers: The company received a Rs 558-crore order for Slab, Coil & Sheet Plate dispatches to DSO Containers from Jindal Stainless.

JSW Energy: Subsidiaries filed a written petition against Andhra Pradesh Southern Power Distribution before Andhra Pradesh HC as Andhra Pradesh Southern Power Distribution Company denied payment of dues amounting Rs 507 crore.

HUL: Magnum HoldCo to buy 61.9% stake Of Kwality Wall's India from Unilever.

IPO Offering

Globe Civil Projects: The public issue was subscribed to 15.27 times on day 2. The bids were led by Qualified institutional investors or 8.15 times, non-institutional investors or 21.32 times, retail investors or 16.74 times.

Ellenbarrie Industrial Gases: The public issue was subscribed to 0.31 times on day 2. There were no bids by Qualified institutional investors, non-institutional investors or 0.58 times, retail investors or 0.37 times.

Kalpataru: The public issue was subscribed 0.17 times on day 2. The bids were led by Qualified institutional investors or 0.17 times, non-institutional investors or 0.45 times, retail investors or 0.73 times and reserved for employees or 0.38 times.

Sambhv Steel Tubes: The public issue was subscribed 0.6 times on day 1. The bids were led by Qualified institutional investors or 0.60 times, non-institutional investors or 0.68 times, retail investors or 0.57 times and reserved for employees or 0.59 times.

HDB Financial Services: The public issue was subscribed to 0.37 times on day 1. The bids were led by Qualified institutional investors or 0.01 times, non-institutional investors or 0.76 times, retail investors or 0.30 times and reserved for employees or 1.77 times, reserved for shareholders or 0.7 times.

Bulk Deals

Awfis Space Solutions: VBAP Holdings sold 10 lakh shares or 1.41% at Rs 650 apiece.

Star Health and allied Insurance: WF Asian Smaller Companies Fund Limited sold 166.85 lakh shares or 2.85% at Rs 420.03 apiece, SBI Mutual Fund bought 164.22 lakh shares or 2.8% at Rs 420 apiece.

JTEKT India: Nippon India Mutual Fund A/C Nippon India Small Cap Fund bought 19.98 lakh shares or 0.78% at Rs 138.84 apiece.

Insider Trading

GHCL: Promoter Neelabh Dalmia bought 1,800 shares.

Ultramarine & Pigments: Promoter Narayan S sold 1,000 shares.

Jindal Steel & Power: Promoter Jindal Power bought 5.99 lakh shares.

Valor Estate: Promoter Vinod K. Goenka bought 3 lakh shares.

Wardwizard Innovations & Mobility: Promoter Yatin Sanjay Gupte created a pledge for 1.93 crore shares.

Quick Heal Technologies: Promoter Kailash Katkar created a pledge for 27.25 lakh shares.

Salasar Techno Engineering: Promoter Base Engineering LLP sold 4.93 lakh shares.

Transindia Real Estate: Promoter Shashikiran Shetty bought 45,934 shares.

Trading Tweaks

List of securities to be excluded from ST-ASM Framework: Carysil, Nelco.

List of securities to be excluded from ASM Framework: Dredging Corporation of India, Zenith Steel Pipes & Industries.

Ex-Dividend: Prime Securities

Shares to Exit Anchor Lock-In: Ventive Hospitality (5%), Carraro India (49%), Sanathan Textiles (2%), Mamta Machinery (50%)

F&O Cues

Nifty June Futures up by 0.71% to 25,250 at a premium of 6 points.

Nifty June futures open interest down by 25.8%.

Nifty Options June 26 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,200.

Securities in ban period: Titagarh, Birlasoft and MCX.

Currency/Bond Update

The Indian rupee closed 11 paise weaker at 86.09 against the US dollar on Wednesday.

The yield on the benchmark 10-year government bond ended 5 bps lower at 6.325%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.