This month on Startup Street, the word was economical.

Cars24 founder says he is trying to fix “leakages” to curb inefficiencies, as well as acknowledged that he doesn't think he's ready go to public yet. An edtech unicorn, too, is cutting non-essential spending in an effort to build frugality into its core.

Separately, an NGO report recommends creation of focused funds for climate tech firms.

Here's what went on in July...

IPO Still A Concept, Profitability by 2023: Cars24 Founder

Cars24 Founder Vikram Chopra said the company's IPO is still at a “concept stage”.

The confirmation comes nearly a year after Business Insider and Bloomberg, among others, reported that India's biggest online marketplace for used automobiles was aiming to hit the markets in 18-24 months. According to the Bloomberg report, the company was also in talks to raise $350 million from SoftBank and others.

The company has more than half a billion dollars in the bank, Chopra told BQ Prime. The layoffs, that were reported at the company, of around 600 people, were “genuinely performance-linked exits that happen every year”.

Still, Chopra said, the environment has made him realise that over time, a number of inefficiencies have crept in to the company. “I always thought I'm running the ship very tightly. When I step back and the slowdown forced me to look, I saw many inefficiencies.”

For instance, Chopra said, when somebody buys a car using their platform, they were allowing credit card checkout. “For something like a car, that's worth Rs 6 lakh, that's a Rs 6,000-10,000 payment charges that we were just paying. That's a big amount! We were letting that leakage through our system.”

Chopra detailed a few more such “leakages” he was forced to detect and fix amid a time that's being acknowledged as a “funding winter”.

“We also used to do the title transfer and charge one flat fee. That fee, however, is a function of specific requirements. For example if you're taking a loan on the car, then you're not just getting the title transferred, you're also getting the RC hypothecated. That's an extra charge we were ignoring.”

He also spoke about lowering stringent air-conditioning cooling standards for used cars and shutting down extra studios that did comprehensive photo shoots for cars.

“There were many freebies that we were just doling out where the consumer doesn't mind paying either.”

Chopra said he remains positive on the long-term picture of the used cars market, but said the short-term bothers him as well. “As an entrepreneur, you have to learn to not get too bogged down by that.”

He said the core business, which was selling wholesale to dealers from sellers, was almost profitable at Ebitda level pre-Covid. That business, which makes up around 60% of revenue for the company, is nearing profitability again.

The remaining business is also on track to be profitable by 2023. “We have a clear path to build this business profitably. It will take one and half year but we have enough capital till then.”

But “if the market offers capital, you would take that opportunistically and accelerate growth further.”

With rivals like CarTrade Ltd. already listed and Droom's DRHP having been filed, Chopra said he doesn't think he's ready go to public yet.

“I want to behave like a public company internally. I don't want to jump into markets without having practice. We want to do an IPO for sure, the timeline we don't know, but what is in our control is to practice behaving like a public company. Which means to have corporate governance of the highest order, to have the right board, to have the right policies and most importantly, to predict the business,” he said.

“When you're public, you need to give guidance for every quarter. Do I even have that ability and confidence to say that? Those all have to be learnt.”

Two Sides Of The Unicorns Tale

While India saw blockchain tech startup 5ire and fintech OneCard turn unicorn, one from the $1-billion valuation club talked about building frugality into its core.

Metal credit card company OneCard and 5ire both raised large, $100-million (Rs 798 crore) rounds, making them the 104th and 105th unicorns, respectively.

1/3#5ire is now one of the world's fastest #unicorn, valued at $1.5B after a $100M funding from UK-based @srammram group!@pratikgauri @prateek_fire @cryptoideas pic.twitter.com/9exGAWNT0d

The funding in OneCard came amid a Reserve Bank of India notification that hit buy-now-pay-later startups. The new guidelines no longer allow loading of wallets or cards using credit lines.

On the flipside, edtech unicorn Unacademy is trying to cut non-essential spending in its business, amid increasing pressure from investors and plans for an initial public offering on the horizon.

“Until now we have never had frugality as one of our core values,” Unacademy Founder Gaurav Munjal said in an internal memo to employees on July 10. BQ Prime has reviewed a copy.

“Honestly, since we were focused on growth and the fact that we had raised millions of dollars of capital it wasn't a priority.” But now, he said, the goal has changed. “We have to do an IPO in the next two years. And we have to turn cash flow positive. For that we must embrace frugality as a core value.”

“Even though we have Rs 2,800 crore in the bank, we are not efficient at all. We spend crores on travel for employees and educators. Sometimes it is needed, sometimes it is not,” the memo said. “There are a lot of unnecessary expenses that we do. We must cut all these expenses. We have a strong core business. We must turn profitable asap.”

The startup would implement the following changes:

Meals and snacks will not be complimentary across offices.

Strong guidelines for travel/no business class travel for anyone including CXOs and founders/employees and educators can pay from their own pocket if they want an upgrade.

Certain privileges like dedicated drivers for CXOs will be removed.

Founders and management will take a salary cut.

Shutting down certain businesses that have failed to find product market fit like Global Test Prep.

“Do I have your support to turn Unacademy Group profitable?” asked Munjal of his employees.

The older crop of startups are seeing a wave of actions to jet their way to profitability. After a large round of layoffs across startups, from Zomato to Meesho, cost-cutting measures are commonplace.

No IPL from next year.

Climate Finance: Green Shoots

The Indian startup ecosystem neither produces a large number of climate startups, nor do all states achieve funding to the same extent.

But both are necessary to accelerate India's transition toward a net-zero economy and to achieve its climate targets, especially given the decentralised and heterogeneous nature of the country, according to a report.

Titled ‘Climate Finance For Startups in India', the report by Bengaluru-based NGO Climate Dot Foundation recommends creation of focused funds for climate tech firms.

It also estimates climate tech investments at around $20 billion (Rs 1.58 lakh crore) in 2021, a fourfold jump from 2020.

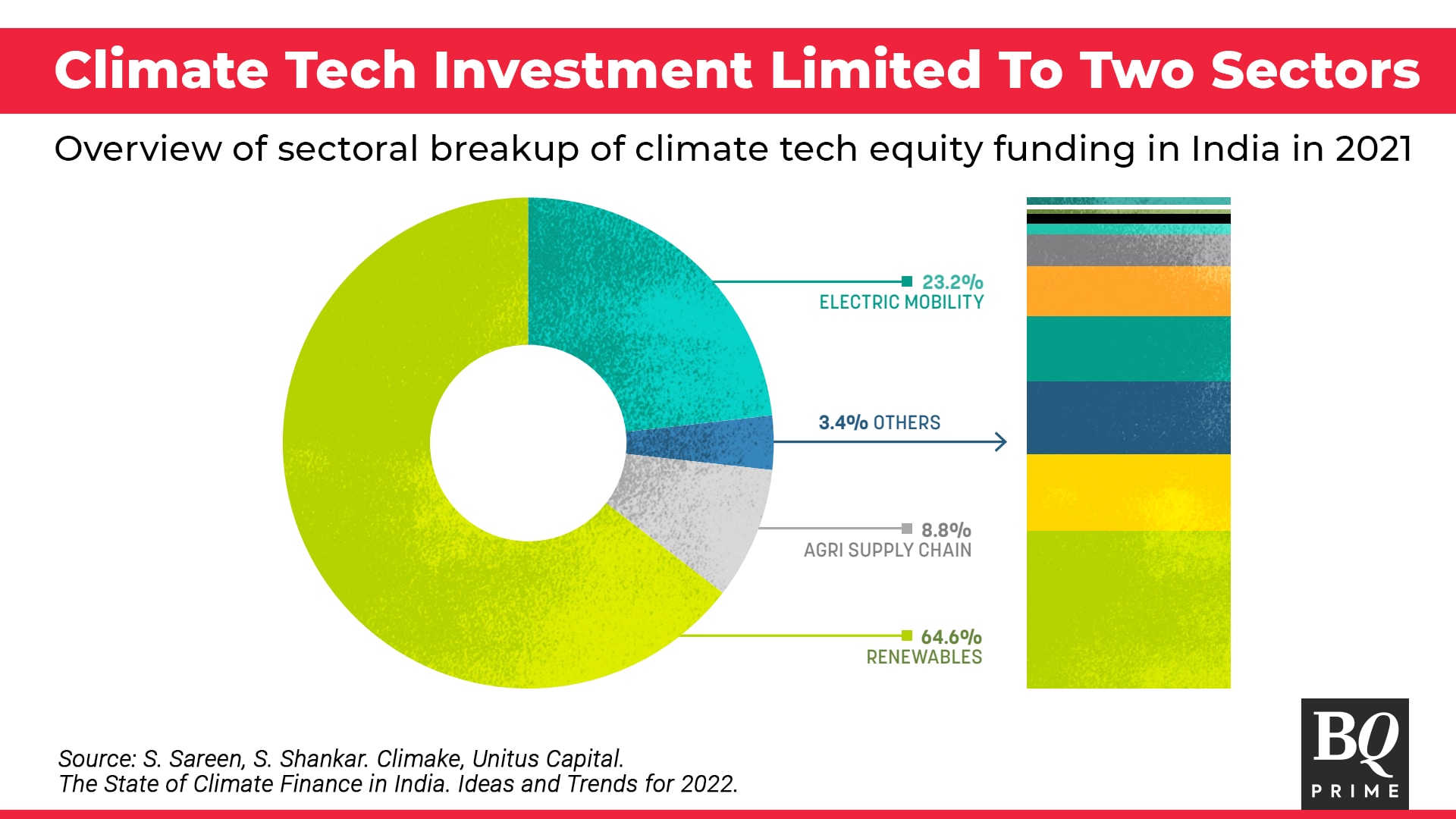

“The funding, however, has largely been limited to two sectors, renewable energy and electric vehicles, suggesting the policy priorities of the country and reflecting market adoption,” it said. “Another relevant point is that most of this funding goes into established business models for renewable energy and not necessarily to funding innovative ideas for startups.”

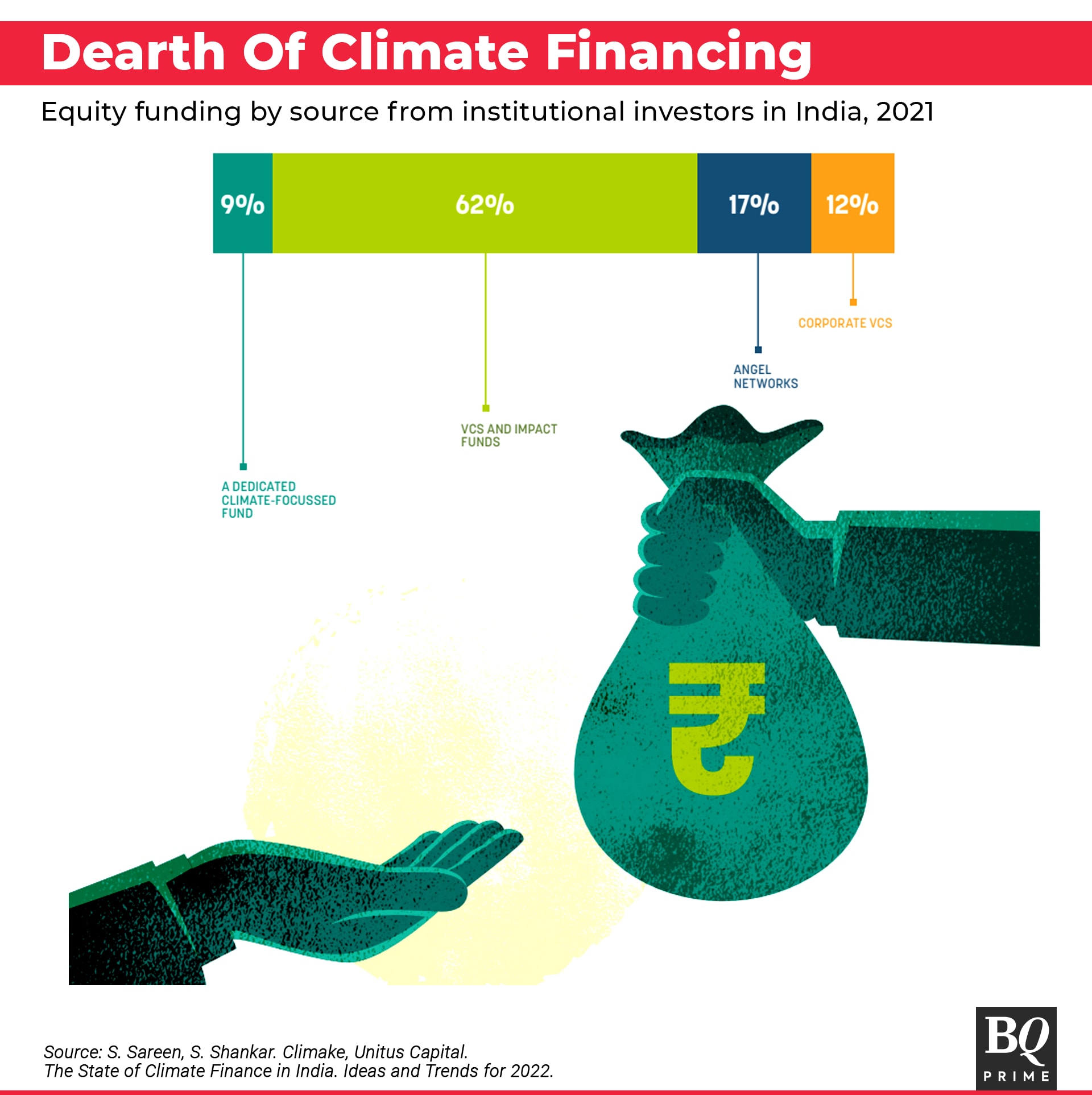

Equity funding in particular for climate startups is beginning to mature, it said. “A large portion of this funding comes from traditional venture capital firms, impact investors and angels. There appears to be very few dedicated climate funds (only 9% of overall funding), which provides an opportunity to grow this segment.”

Top Startup Deals And Developments In July

GrowthX raises $1.5 million (around Rs 11.8 crore), claims for it to be the largest ever community-led seed round with 212 investors.

NBFC-Account Aggregator Finvu AA raises $2.5 million (Rs 19.8 crore) in a seed round led by Varanium Nexgen Fund, IIFL, DMI Sparkle Fund and M2P, among others.

Goldstone Tech acquires app-based logistics aggregator WowTruck for Rs 8 crore.

HDFC Life invests in Z3Partners tech fund.

Prosus Ventures leads $25 million (198 crore) Series B round in Vegrow.

Byju's struggles to close $800 million (Rs 6,336 crore) funding as investors balk.

Medtel plans to raise $10 million (Rs 79.2 crore) in Series A funding.

Lockscreen unicorn app Glance adds 4 crore users in past year.

Fresh produce supply chain startup Wheelocity raises $12 million (Rs 95.04 crore)

Quantum computing startup BosonQ Psi raises $525,000 (Rs 4.15 crore) in pre-seed round.

Space tech startup Agnikul opens India's first rocket engine factory in Chennai.

Detect Technologies raises $28 million (Rs 222 crore).

Google-backed Wysa bags $20 million (Rs 158 crore).

Ola's electric mobility arm, Ola Electric, will invest $500 million to set up a facility for making cells and battery packs for electric vehicles in Bengaluru.

Arvind to sell its tech division ‘Omuni' to Zomato-backed Shiprocket.

Water purifier co Drinkprime raises Rs 60 crore in Series A.

Early Learning Edtech startup Creative Galileo raises $7.5 million (Rs 59 crore) in Series A funding.

Emami acquires 30% stake in a pet-care startup Cannis Lupus Services.

Upgrad acquires Harappa Education for Rs 300 crore. upGrad closed this transaction with present Harappa shareholders, Bodhi Tree Systems, a newly formed platform between James Murdoch and Uday Shankar and co-founders Pramath Raj Sinha and Shreyasi Singh.

YC backed Better Opinions raises $2.5 million (Rs 19.8 crore) from Metaplanet VC and others

PE investor Chryscapital names ex-L&T Infotech chief Sanjay Jalona as Operating Partner.

Actress Nora Fatehi invests in cloud kitchen operator Curefoods.

Spotnana raises $75 million (Rs 595 crore) from Durable Capital, Mubadala, others.

Rural tech startup Jai Kisan scoops up $50 million (Rs 396 crore) in Series B led by existing and new investors in debt and equity.

Swiggy announces permanent work-from-anywhere, moonlighting policy.

PhonePe Pte. Ltd. reaches amicable settlement with Affle Global Pte. Ltd. to acquire OSLabs Pte. Ltd.

Bizongo raises $25 million (Rs 198 crore) from liquidity group.

Fi Raises $45 million (Rs 357 crore) In Series C funding round.

Nas Academy raises $12 million (Rs 95 crore) from investors such as Pitango, BECO Capital, FTX, HOF Capital, Jack Conte, Nikhil Kamath.

Unicorn healthcare startup Pristyn to increase employee headcount by 20%.

(Source: Company Statements)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.