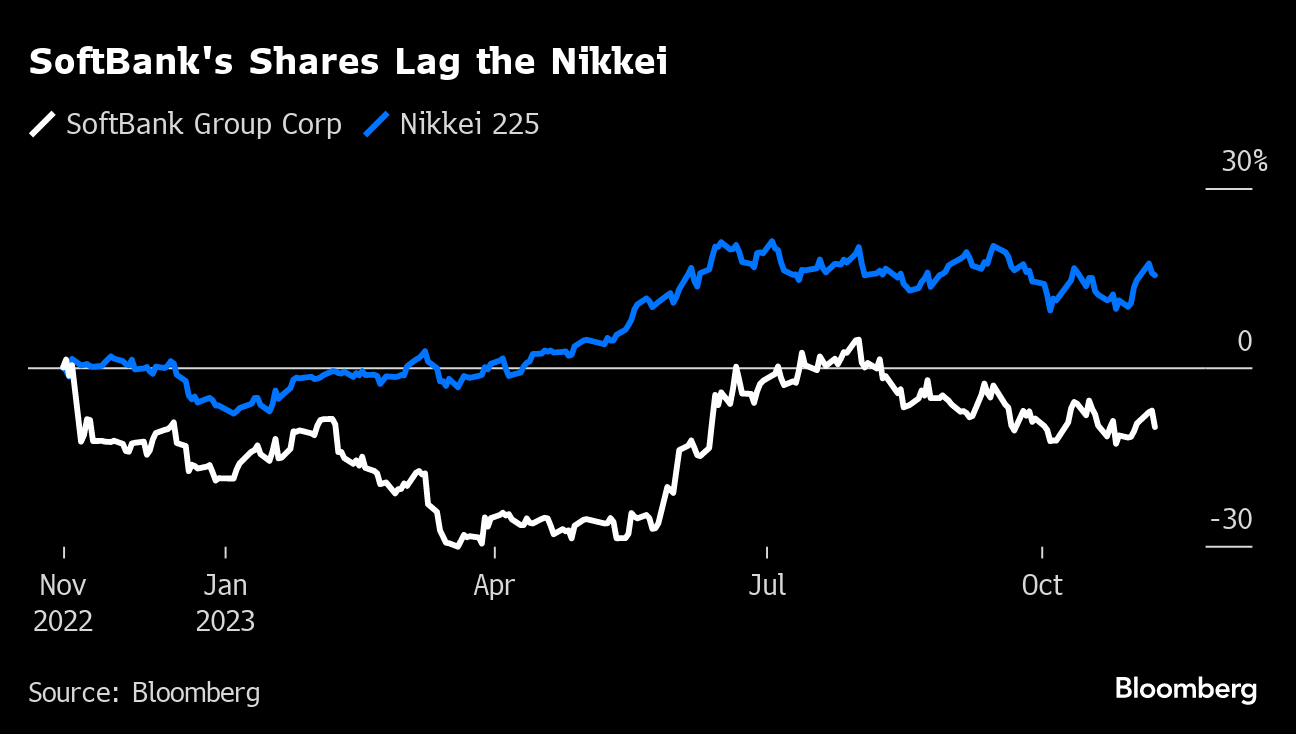

(Bloomberg) -- SoftBank Group Corp.'s flagship Vision Fund reported another loss with the drop in valuations at WeWork Inc. and other portfolio companies, on top of foreign exchange losses that could hurt Masayoshi Son's pursuit of new startup deals.

The Vision Fund segment lost ¥258.9 billion ($1.7 billion) through the end of September, including declines in the value of holdings such as SenseTime Group Inc., AutoStore Holdings Ltd. and Symbotic. It also wrote down the value of WeWork and disclosed its cumulative losses from backing the office-sharing startup were $14.2 billion through September, though that figure may rise with WeWork's bankruptcy filing this week.

The persistent red ink cast doubt over SoftBank's claims that the worst is over for the Vision Fund, which funneled more than $140 billion into hundreds of money-losing startups worldwide. There's little visibility into the performance of the majority of the Vision Fund's unlisted portfolio companies.

“It's hard to be optimistic, as there's a bit of uncertainty over how things will develop in the near term,” said Tomoaki Kawasaki, a senior analyst at Iwai Cosmo Securities Co. “But attention is now on how and whether SoftBank's investments in AI-related firms will boost shareholder value and net asset value.”

SoftBank Group as a whole had a net loss of of ¥931.1 billion, compared with a ¥3 trillion profit last year when the Japanese company cashed in on its stake in Alibaba Group Holding Ltd. SoftBank took a ¥183 billion hit from the weaker yen, largely because of its US dollar-denominated liabilities. Analysts on average had estimated a group net income of ¥203.4 billion.

SoftBank is trying to regain its footing after its Vision Fund unit lost $53 billion in the last two years on startup missteps. The $4.9 billion initial public offering of chip unit Arm Holdings Plc has given SoftBank some capital to pursue deals.

Chief Financial Officer Yoshimitsu Goto, who has taken over the earnings call duties from Son, leaned into the positives from the quarter. He said the value of Arm is now about three-fold its investment, from ¥3.3 trillion to ¥8.5 trillion.

He also said there is more than $29 billion of assets in its portfolio that SoftBank may be able to cash in soon, calling out TikTok parent ByteDance Ltd., Fanatics Inc. and PayPay Corp.

“SoftBank is now in investment mode,” Goto said during a briefing in Tokyo after results. “We're investing two to three times more than we did on a quarterly basis, compared with the same period a year ago.”

SoftBank said it invested $1.5 billion in the September quarter and $1.8 billion a quarter earlier. That's far below the tens of billions of dollars it invested quarterly in its heyday.

Goto also pointed out, by certain metrics, the Vision Fund made money on investments in the latest quarter, a figure it lists as ¥33.8 billion. That doesn't count a host of expenses at the Vision Fund, including changes in third-party interests, SG&A and an unspecified category of “other loss.”

Analysts were skeptical, especially because SoftBank hasn't committed to buy back its own shares.

“This was a disappointing quarter,” Astris Advisory analyst Kirk Boodry said in a note to investors, citing poor investment returns and management's hesitancy to repurchase shares.

Founder Son has made a series of bets this year on autonomous technologies, particularly in transportation and logistics. They include investments in autonomous trucking startup Stack AV, an AI-using warehousing joint venture with Symbotic Inc. and a follow-on investment in Vision Fund portfolio firm and navigation software maker Mapbox Inc.

As SoftBank invested billions of dollars in unprofitable startups beginning in 2017, it inflated valuations worldwide before they were punctured by China's tech crackdown from 2020 and the US Federal Reserve's rate hikes last year. The company spent months writing down losses while limiting new investments.

SoftBank appears to be directly investing in recent deals, bypassing the Vision Fund. The second Vision Fund, although wholly-funded by SoftBank, requires approval from an additional investment committee.

At the end of September, SoftBank Group had approximately 110 portfolio companies, including Alibaba, T-Mobile US Inc. and Deutsche Telekom AG.

Prior to SoftBank's results, chip unit Arm gave a disappointing sales forecast on a prolonged smartphone slump and uncertainty regarding license agreements, sending the stock down in late trading to below its September IPO price of $51 per share.

--With assistance from Vlad Savov, Beth Thomas, Jane Lanhee Lee, Subramaniam Sharma and Gearoid Reidy.

(Updates with executive comment from earnings briefing)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.