The origins of the Shriram Group date back to 1974 when R Thyagarajan and a few of his friends started a chit fund business based out of Chennai. That business grew beyond chit funds very quickly and in the span of five years, they had launched a transport finance business. Since then, the Shriram Group has expanded into virtually every corner of the financial services business, with the exception of banking.

Last Saturday, Thyagarajan shared a podium with industrialist Ajay Piramal, a shareholder in three Shriram Group companies, and banker Rajiv Lall, who heads IDFC Bank, to announce exclusive merger talks between the Shriram Group and the IDFC Group.

Not everyone is convinced the deal is a good idea. For the Shriram business and the Shriram shareholders. Thyagarajan, however, believes that the proposed merger will allow the group to offer its customers an even wider portfolio, which in turn will benefit shareholders, he told BloombergQuint in an interview on Wednesday.

We believe that if we extend the range of services that we provide for our customers, it will benefit them and in turn the company providing these services will also benefit...With banking products also coming into our fold, we will be able to offer the whole range of financial services to our customers. We believe it is going to benefit them. And because it is going to benefit them, we believe we will be able to earn some more money for our shareholders.R Thyagarajan, Founder, Shriram Group

The merger, if closed, will be a complex one.

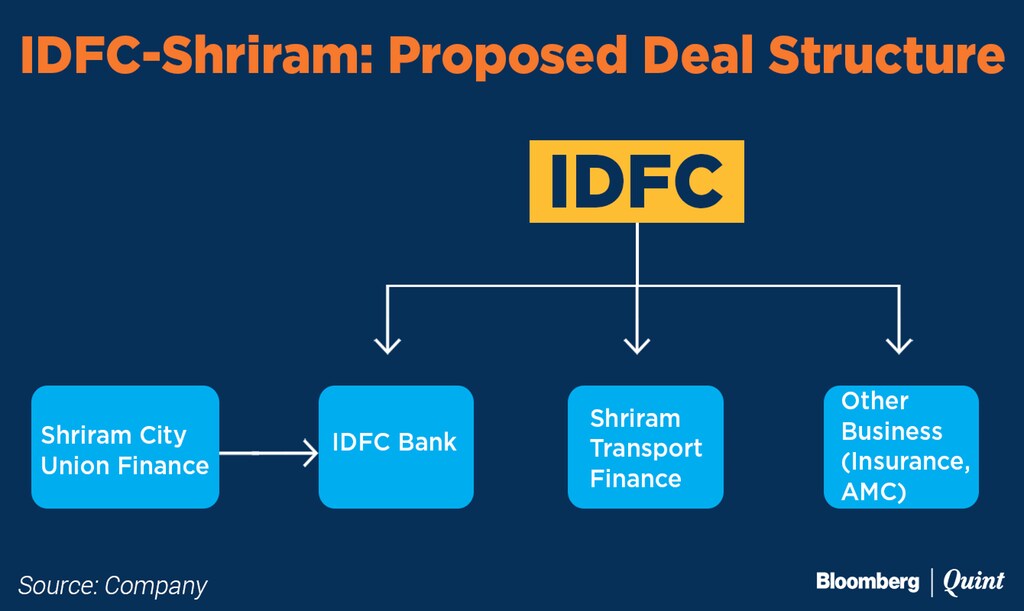

The proposal suggests that Shriram City Union Finance will be merged into IDFC Bank, which in turn is held by IDFC Ltd. Shriram Transport Finance, however, will be merged with IDFC Ltd. This structure is intended to overcome a number of regulatory hurdles which the deal may hit upon. One of these is the requirement that IDFC's shareholding in IDFC Bank cannot fall below 40 percent before October 2018. The other regulatory hurdle may emerge from the shareholding of Piramal Enterprises in the Shriram Group companies. Piramal Enterprises holds 20 percent in Shriram Capital and 10 percent each in Shriram City Union Finance and Shriram Transport Finance.

Also Read: IDFC-Shriram Deal Is A Lose-Lose For All Shareholders, Says Anil Singhvi

Restricting Piramal's holding in the bank at 10 percent, in keeping with RBI's current regulations, could mean that the swap ratios will go against Shriram shareholders, analysts have warned.

Thyagarajan says this will not be the case.

When we complete the details of the merger, it will emerge that every shareholder of every one of our businesses will be benefited significantly from the merger. The benefits that the shareholder gets under the merger scheme than the pre-merger scheme.R Thyagarajan, Founder, Shriram Group

Also Read: IDFC Bank: A Bank In A Hurry

Thyagarajan goes on to explain that in the case of the Shriram Transport Finance, shareholders will benefit from the income stream from businesses like insurance which will also be merged into IDFC along with the transport finance finance.

“Whatever we do, we will have to ensure that it benefits the shareholders. If it doesn't, how will we get their approval,” asked Thyagarajan while adding that he expects the merger to increase shareholder value.

When asked whether shareholders, particularly the Shriram Employees Trust, which holds 45 percent in Shriram Capital, are in favour of the deal, Thyagarajan said that most support the transaction. Large institutional shareholders, such as private equity firm TPG, have also not raised any concern, he added.

The preliminary discussions we have had with some of them (members of the Shriram Trust) suggest that they are quite enthusiastic and happy...The key people are on board, so the rest will be as well. They know that we will take care of them the way we have taken care all these years.R Thyagarajan, Founder, Shriram Group

Also Read: IDFC-Shriram Merger: Everything You Need To Know

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.