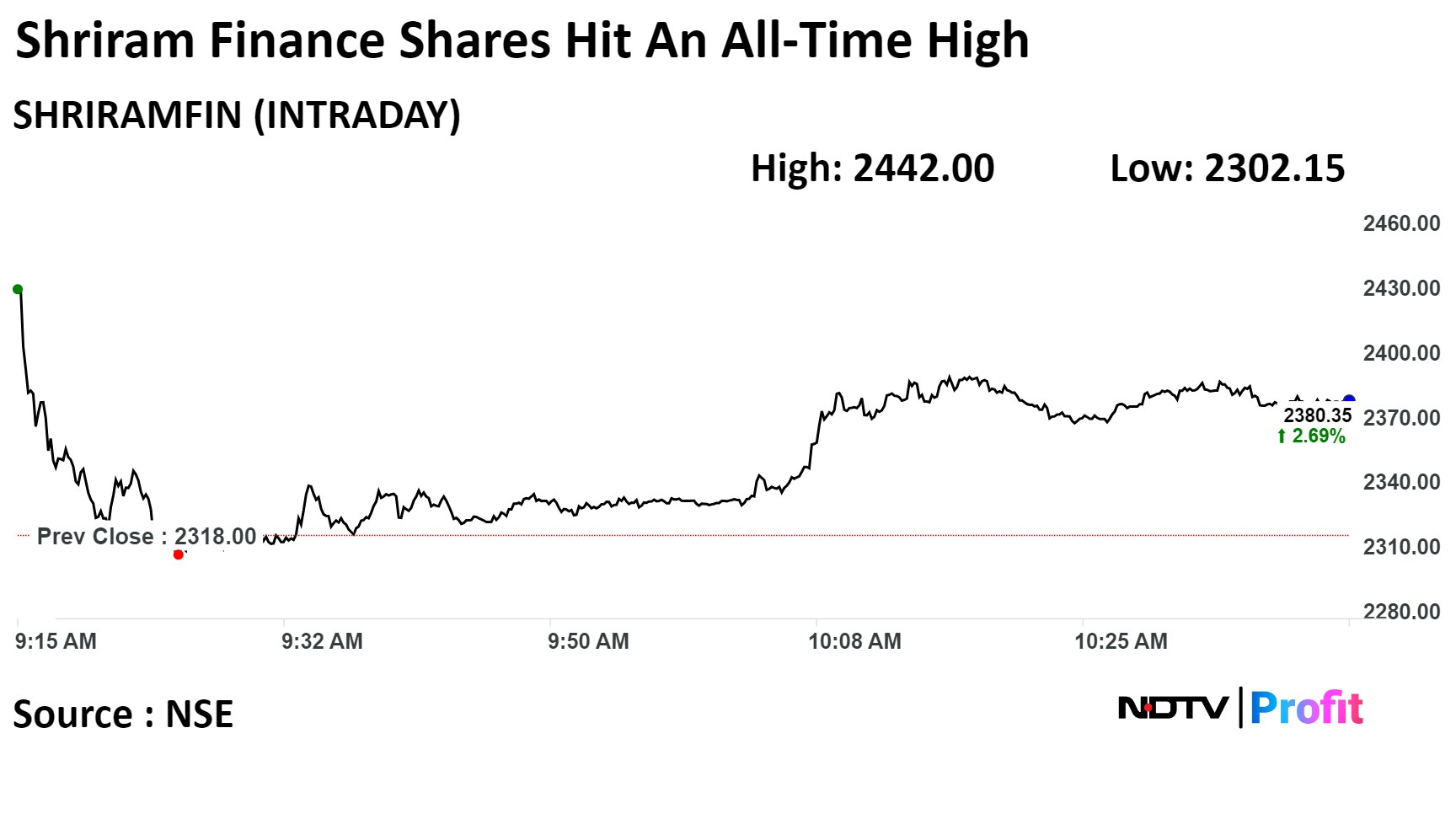

Shriram Finance Ltd.'s shares hit an all-time high on Monday after its third-quarter net profit rose, meeting analyst estimates.

The company's net profit rose 2.3% year-on-year to Rs 1,818.3 crore in the quarter ended December, according to an exchange earnings. This compares to the Bloomberg estimate of Rs 1,894 crore.

The non-banking financial company reported an operationally healthy quarter, with healthy AUM growth across all its products and an expansion in NIM, according to Motilal Oswal Financial Services Ltd.

"It is yet to fully exploit its distribution network for products like MSME and gold loans. As it does this over the next one year, AUM growth in MSME, PL and gold loans will continue to remain stronger than other segments," the brokerage said in a Jan. 27 note.

Shriram Finance Q3 Results Highlights (Standalone)

Revenue from operations up 17.26% at Rs 8.922.4 crore (YoY).

Net profit up 2.3% at Rs 1,818.3 crore (YoY).

Gross NPA at 5.66% vs 5.79% (QoQ).

Net NPA at 2.72% vs 2.80% (QoQ).

Here is what brokerages have to say.

Morgan Stanley

Morgan Stanley maintained an 'overweight' rating on the stock with a target price of Rs 2,700 apiece, implying an upside return potential of 17%.

It raised FY24 AUM growth assumptions to 20% from 18% previously. The FY25/26 AUM growth estimates remain unchanged at 15% each.

Morgan Stanley also raised the FY24–26 average NIM by 5 basis points, to 9.66%. This is offset by higher operating and credit costs. Higher credit cost assumptions are largely going towards further strengthening coverage.

"We build higher stage 3 formation (net) and write-offs in F25 and F26 versus F24, yet total provision coverage on stage 3 assets improves to 115% in F25/26 from 110% in 3QF24," the brokerage said in a Jan. 26 note.

Morgan Stanley raised FY24, FY25, and FY26 earnings estimates by 1.3%, 1.9%, and 1.2%, respectively, mainly reflecting higher revenues (NII + other income) and lower credit costs, which are offset by higher operating costs.

"We make marginal tweaks to our loan growth assumptions," it said.

HSBC

HSBC maintained a 'buy' rating with a target price of Rs 2,720 apiece, implying an upside of 17.2%.

It changed its earnings per share estimates by -2.1%, +3.4% and +2.1% for FY24e, FY25e and FY26e, respectively.

"We have increased credit cost estimates to 220-230 basis points for FY24-26e. We have built some margin resilience as the cost of funds abates in FY25e–26e," it said in the Jan. 26 note.

HSBC is factoring in a 17% AUM CAGR (unchanged) for the company over FY24e-26e. Increasing penetration of non-vehicle consumer businesses into vehicle finance branches is likely to be a key AUM growth driver.

Shriram Finance's ability to borrow from multiple sources (domestic, foreign, banks, retail NCDs, CPs, co-lending) would help it at a time when bank funding might become scarce, costly or both, it said.

HSBC has an EPS CAGR of 18% over FY24e–26e factors in credit costs of 220 basis points (higher than the management estimate of 200 basis points) to account for the increased risk factors in consumer credit.

"We estimate Shriram Finance can deliver a 3.3–3.5% ROA and 15.5–16.5% ROE over FY24e-26e," it said.

The downside risks include pressure on NIM from an inability to improve yields, a persistent increase in the cost of funds, and higher-than-expected credit costs.

Nomura

Maintained a 'buy' rating while revising the target price to Rs 2,700 apiece.

Nomura increased the earnings per share estimates by 2%/4% for FY25/26F and expects AUM/EPS CAGRs of 16%/19% over FY24-26F and an average ROA/ROE of 3.3%/16.4% for FY24-26F.

Credit cost increased 12 basis points sequentially to 2.4% due to elevated write-offs and additional provisions of Rs 5.25 billion on Stage 1 assets.

The company is confident of maintaining FY24 credit costs at 2.0%.

The risks that may impede the achievement of the target price are slower than expected loan growth and asset quality issues from riskier segments like personal loans, 2W and MSME.

Motilal Oswal Financial Services

Motilal Oswal has reiterated a 'buy' rating on the stock with a target price of Rs 2,700 apiece.

With an expanded geographical presence and a larger workforce, SHFL can leverage cross-selling opportunities to reach new customers and introduce new products, leading to improved operating metrics and a solid foundation for sustained growth.

Shares of Shriram Finance rose as much as 5.84%, the highest since Jan. 11, before paring gains to trade 3.37% higher at 10:35 a.m. This compares to a 0.62% advance in the NSE Nifty 50.

The stock has risen 94.82% in 12 months. Total traded volume so far in the day stood at 3.6 times its 30-day average. The relative strength index was at 72, implying the stock is overbought.

Of the 37 analysts tracking the company, 35 maintain a 'buy', one recommends a 'hold,' and one suggests a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 11.5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.