Nifty In Technical Charts: More Of The Same

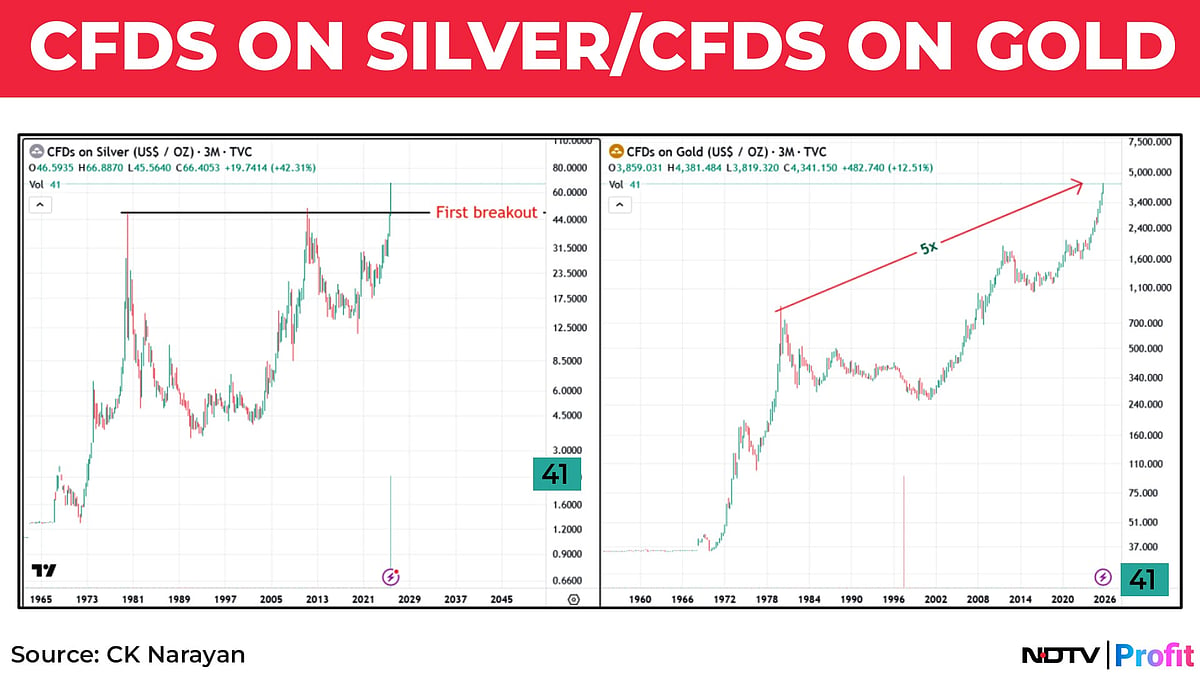

For those who play commodities, they can participate in the silver and gold rally directly through futures.

If you remained a buyer on dips, as has been suggested in a recent set of letters, you got a chance to get in at lower levels on the Nifty as the market pulled up from lower levels of the week (25,801) to finish marginally better (26,036). Chart 1 shows the kinds of analyses that you would have to apply in order to have been a buyer at dips though.

Possible? Yes. Will people do it? Very doubtful. Most people want idealised situations of a clean pattern with a clean move out of it that lasts for multiple sessions so that they can all get in and out without much difficulty and therefore make money easily.

If only market were so obliging!

Chances are more like, you bought the 38% retracement, got a rally, made some money, so you bought the 62% retracement and got slammed, and then completely missed the double bottom signal, were afraid to take the higher bottom gap breakout and ended the week in frustration of having missed out on the few chances to trade the index during the week.

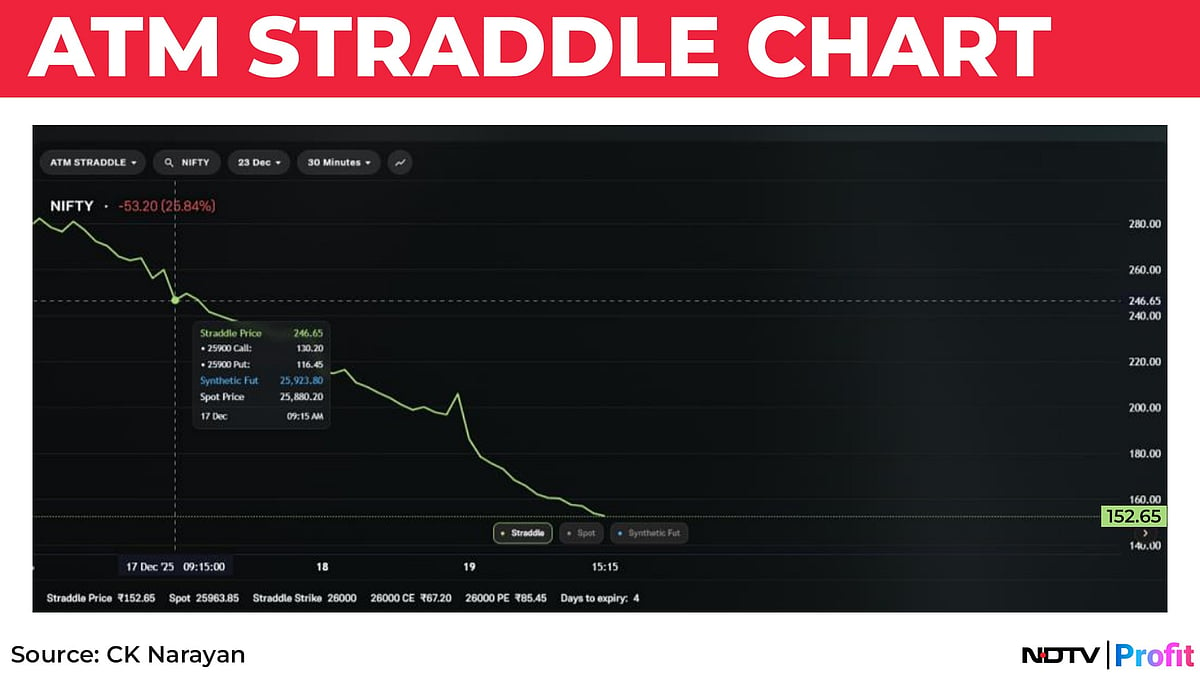

So who's making money? Some of the option guys perhaps. Chart 2 is an ATM Straddle chart of the weekly options. From Wednesday through Friday, the value dropped from 245 to around 157. So, that is perhaps one area that may be making money. Not surprising, considering that we are in a ranged market and such trades will work.

But it is to be noted that the IV has also fallen under 10 and however profitable the above chart may look, it is in grave danger of an IV and Gamma spike if some unexpected news comes in. Stoplosses may not work as prices, at such times, jump through the stops and you are left hanging with an unfavorable-and fast eroding-position.

So, this is possible but those indulging in it know what I am talking about. Typical story of a small, capitalised option seller is — collect gains for an expiry or two, and then get slammed thereafter. Since he doesn’t know better, he is destined to repeat this action, providing nice fodder for the professional option traders.

Is there a solution? Well, there is. It is to become very efficient in your trading process, execute quickly, grab smaller profits when seen, quickly move on to what is showing an opportunity (whether index or stocks). Not everyone’s cup of tea, though. But a solution, all the same.

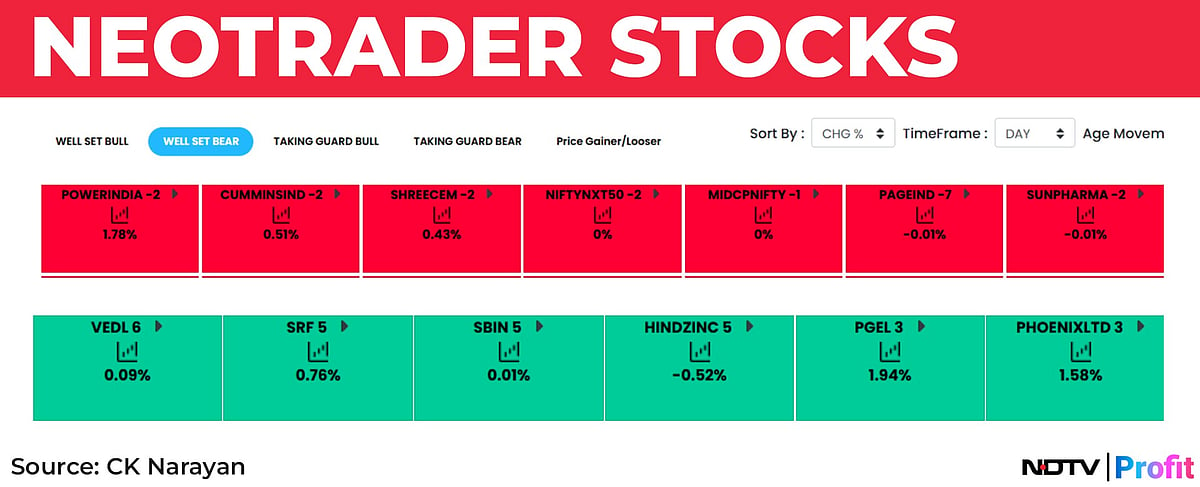

These are times when softwares like Neotrader come in very handy. It pinpointed the opportunities that emerge every day. Whether bullish or bearish, both conditions and the right stocks are identified and flashed. All you got to do is trade them in that direction.

In the two rows of stocks shown, note that the signals have been shown across the week. VEDL has been on the bullish signal list for six sessions, while SRF has been there for five sessions. Across six sessions, VEDL rose around 1 % while SRF rose 3.5% in five sessions. Similarly, PowerIndia lost 8.5% in a couple of sessions, while Cummins lost 3.8% over a couple of sessions.

Point here is that if you use the right tool set and have the right kind of approach, there is still a lot of money to be made in the market. Softwares like Neotrader are designed to identify such opportunities in the market and once you develop the trust and faith that yes, such identification is possible, then markets will pose us no problems.

I must confess to a good week because VEDL and PowerIndia are stocks that I traded (among others) during the week and those turned out rather nice. At the end of the week, I still remain long in SRF, given that its chart is now an improved one.

The problem is that most people think that the chart is the ultimate implementation tool for trading. It is not. You need proper alerts of certain actions to be taken in certain scrips (from the entire list) and then guidance on how they are to be traded. Once we get that information in time, then we can take a look at the chart to see what the potential can be.

Understand therefore, that charts are actually addendums to a super scanning software. And, it is not as though scanners will do the trick, for every charting package has some kind of scanners built in. Those do just some 10% of the job of a listing. The real deal lies in the ability to take the output of a scan, run it through some AI enabled engines to come up with a Master List. That is what Neotrader does.

I created Neotrader for my own use, first, and now make it available to the general public. If it interests you, give my office a shout.

Why did I bring this up this week? Because there is this feeling among a lot of people that shorting straddles and strangles is a route to consistent profit making. Furthest from the truth, if you ask me. Most traders who attempt this are uneducated in the art of trading options (especially short) and lap up a lot of bilge served out of YouTube and build their castles.

With short options, it requires good expertise to control the risks. With Neotrader, your risk is always under control because it is well defined in advance. Charts are great aids in helping one track an executed trade but very difficult to use as a primary generator of trade ideas.

OK, now after all that marketing plug, back to analysis.

The event of the week-much anticipated though was the Bank of Japan raising rates. Chart 3 is Japan's 10-year yield. The era of free money from Japan is truly over now, it appears. For the past three decades, the world has fed on cheap Yen, creating the famous "carry trades" on almost everything!

Will these get unwound? In what way? Only the future can tell. But a tumult it shall cause, that is for sure. Since inflation remains high in Japan, there is no clarity as to what shall be the terminal rate in this hiking exercise, as the central bank has indicated a wide band between 1% and 2.5%! So, this Japan matter will continue to dangle as a sword on all carry trade assets for a while.

The other news-making area was the blast off in Silver. Now, a few weeks ago, I had featured some positive comments on both the precious metals (and on Silver in particular in my Charts and Beyond videos on YouTube). While all the precious metals (which includes Platinum and Palladium as well) are on a tear, Silver has had its longest rising streak in its history! But what is even more interesting is shown in Chart 4, which is a multi-decade monthly chart of both Gold and Silver.

It can be noted in this chart, that over the past decades since 1980 top, Gold had gone up 5x. But Silver, for all the noise it is making right now, has just about staged a long-term breakout of the 1980 high! So, I would think that all the noise about Silver having gone up too much is all bunkum and we ain’t seen nothing yet!

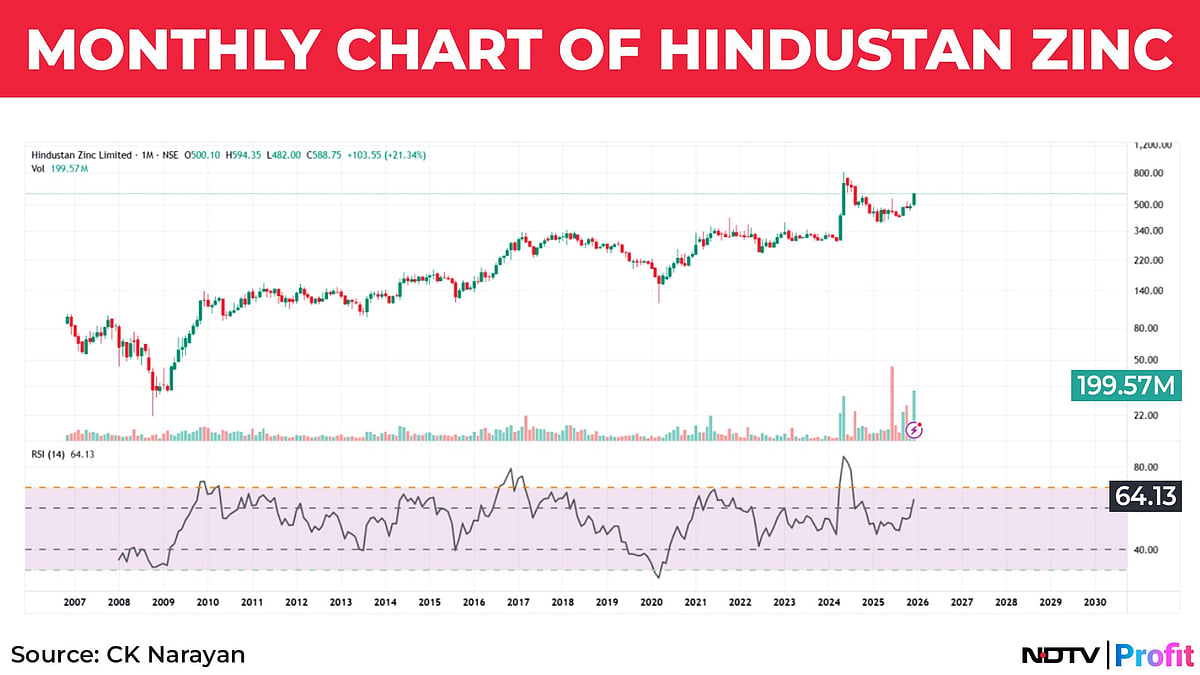

For those who play commodities, they can participate in the silver and gold rally directly through futures. But for equity guys, Hindustan Zinc remains the sole proxy for play Silver. Chart 5 is the monthly chart of Hind Zinc and here too we can note that matters are just warming up. Long term investments should be considered.

The third item in the news was the INR, weakening rapidly to a new low at 91.07 before the RBI came in to crack the whip big time. Chart 6 shows the big changes that occurred with the RBI intervention that pushed the Rupee back to 89.25 late into Friday. Not seen such violent moves in the pair since a long time. It is beyond me to interpret this at a macro level but on the charts, I would say that such large reversals to the downside as seen would imply that the recent low of 91.07 may not be seen for quite some time now.

The FIIs turned buyers over the last 3 sessions, after having been sellers all through the month. There was some crazy activity in Infy ADR on Friday evening on some inexplicable short squeeze. The other ADRs were seemingly unaffected, so, this is an Infy thing. Why? We may not know. Will the sudden intervention by RBI on the INR spook the fledgling rally attempt in IT stocks ahead? Is this all connected in some way to the Japanese carry trade stuff? Who knows?

The whole thing is now out of control of what is going on locally and there are far too many international things flying around and hitting the fan. Maybe that is why the damn market is so ranged.

Since there is very little we can control, except what we shall trade in and how, it is better to continue with the policy that has worked so far — continue to buy the dips. Widen the participation to include stocks and sectors because they are all responding rather well to news and events. Use some aids like Neotrader (mentioned above) to make your job easier. And don’t overthink any event at the moment.

Disclaimer: The views expressed in this article are solely those of the author and do not necessarily reflect the opinion of NDTV Profit or its affiliates. Readers are advised to conduct their own research or consult a qualified professional before making any investment or business decisions. NDTV Profit does not guarantee the accuracy, completeness, or reliability of the information presented in this article.