India's benchmark stock indices erased most of their early gains through midday on Thursday to trade near intraday lows, led by losses in financial services stocks.

As of 12:09 p.m., the Nifty 50 was 30.50 points, or 0.14%, higher at 21,689.10, while the Sensex rose 85.42 points, or 0.12%, to 71,932.99.

"Nifty witnessed a U-turn with a gap-up opening and went on to rise gradually as the day progressed to end on a positive note, improving the bias and sentiment once again," said Prabhudas Lilladher in a note. "The support is seen around 21,550, while the resistance is seen at 21,800 level."

Shares of Infosys Ltd., Tata Consultancy Services Ltd., Reliance Industries Ltd., Adani Ports and Special Economic Zone Ltd., and Axis Bank contributed to the Nifty 50.

While those of HDFC Bank Ltd., ITC Ltd., Sun Pharmaceutical Industries Ltd., Kotak Mahindra Bank Ltd., and Nestle India Ltd., weighed on the index.

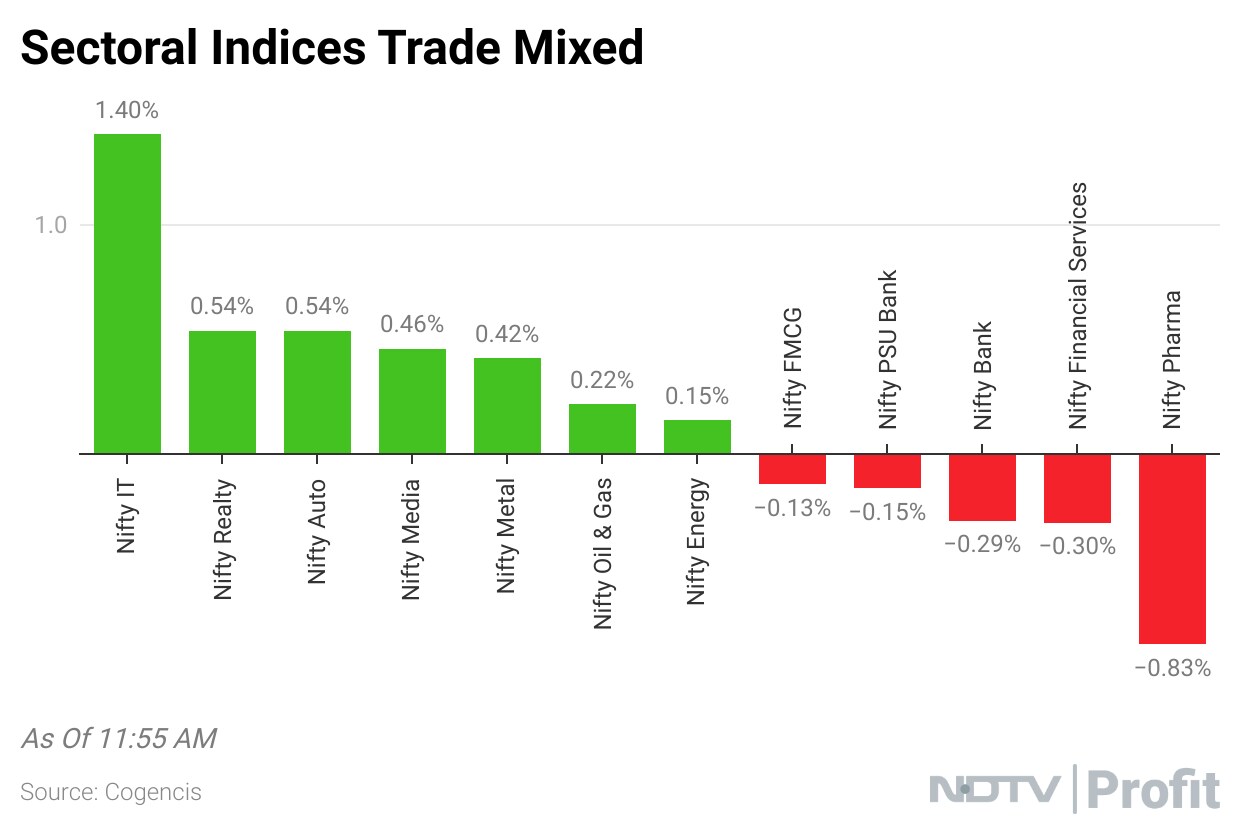

Sectoral indices were mixed. Nifty IT rose the most by over 1% while Nifty Pharma lost 0.8%

However, broader markets outperformed with the BSE Midcap rising 0.42% and the Smallcap gaining 0.6% through midday on Thursday.

Seventeen out of the 20 sectors compiled by BSE Ltd. advanced, while three declined. Information technology and telecommunication indices rose the most.

The market breadth was skewed in favour of the buyers. About 2,283 stocks rose, 1,484 declined, and 124 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.