The oil-procurement patterns of India's Reliance Industries Ltd. are coming under scrutiny after the European Union announced new restrictions on diesel made from Russian crude.

Reliance bought Abu Dhabi's Murban crude in a rare purchase late last week, traders said, adding that it picked up the cargo soon after Friday's sanction package. The private refiner isn't a regular buyer of the UAE grade, a premium crude that tends to be costlier than its regular appetite of Russian Urals and heavier Middle Eastern varieties.

Separately, people familiar with Reliance's import plans said the company has begun seeking to diversify its crude purchases away from Russia, its single-biggest source of oil so far this year. The people asked not to be identified as they aren't authorized to speak publicly.

A company spokesman wasn't immediately available to comment on the matter when contacted during regular working hours.

Reliance, a mega refiner owned by billionaire Mukesh Ambani, and other Indian processors have been among the world's top beneficiaries of Moscow's war in Ukraine. Europe shunned Russian crudes soon after the 2022 invasion, leading to deep cargo discounts that enticed Indian refiners to crank up opportunistic buying for production of fuels such as diesel, which it resold to western customers.

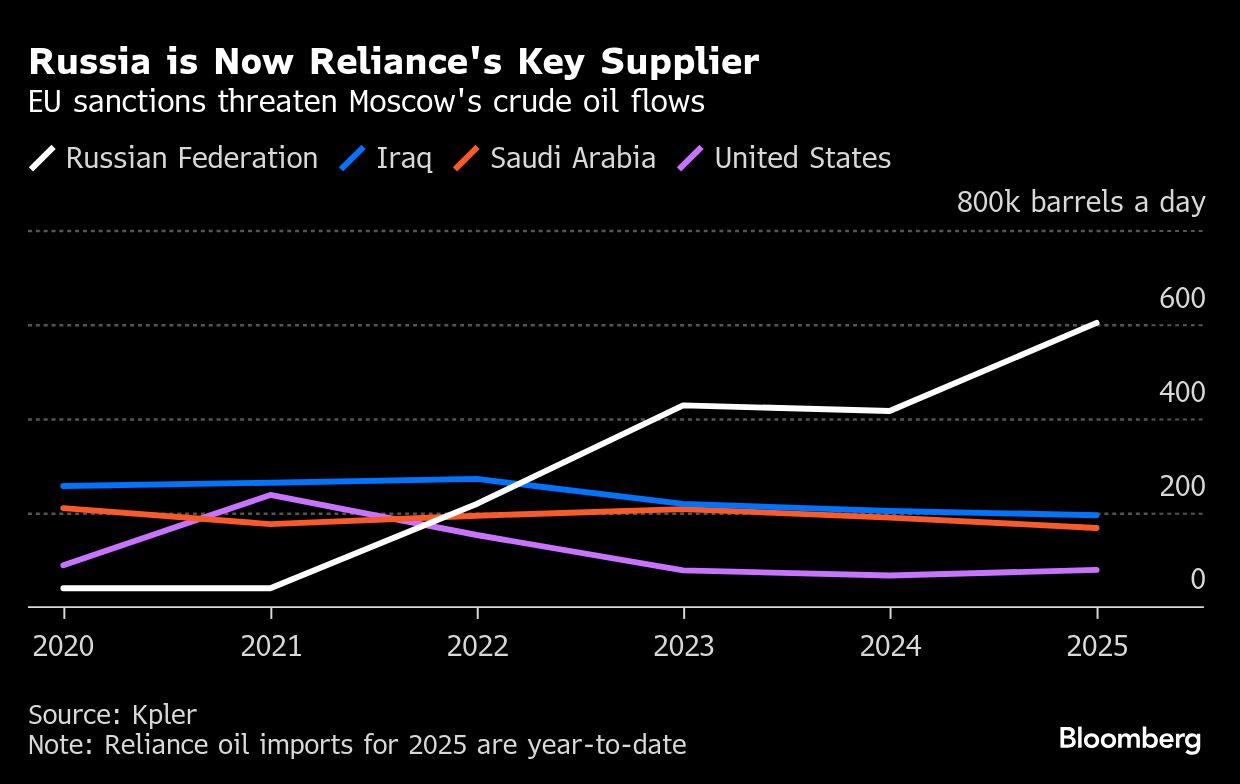

According to ship-tracking data compiled by Kpler, Russia has supplied almost half of Reliance's crude imports so far this year. In turn, around one-fifth of the processor's total product exports were sold to Europe. The process of refining Russian crude into diesel for sales into Europe has put Reliance in the line of fire of EU's latest pressure on Moscow, with the ban set to take effect Jan. 21 next year.

While it's too early to tell if Reliance will pivot dramatically away from Russia, traders say there are some initial signs of the company seeking alternatives from places such as the Middle East. Still, it's unclear how the mega refiner will source close to 600,000 barrels a day of crude from other producers, and at what cost, they added.

So far, the South Asian nation has been critical of latest EU sanctions, with India's Foreign Secretary Vikram Misri on Tuesday saying that there was a need for “balance” when secondary sanctions are imposed on the purchase of Russian oil and gas.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.