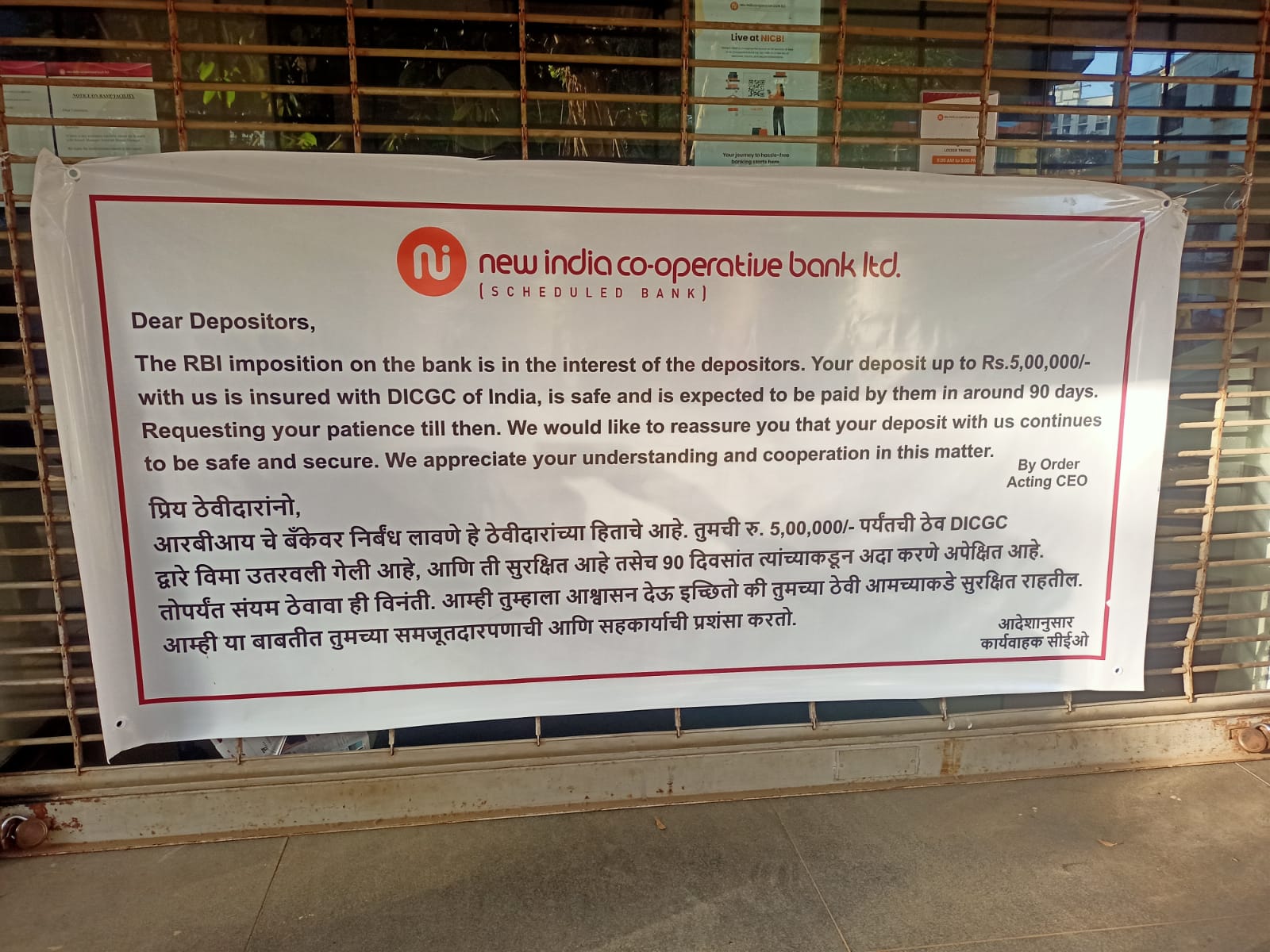

The Reserve Bank of India imposed several restrictions on New India Co-Operative Bank on Friday, including grant or renewal of any loans and advances, making any investment, incurring any liability, including borrowing of funds and acceptance of fresh deposits, or disbursement of any payment.

Customers of the bank were seen lined up outside its offices in Kandivali, Andheri and Mira Road, after the ban.

The move by the RBI came due to New India Co-operative's present liquidity position. "The bank has been directed not to allow withdrawal of any amount from savings bank or current accounts, or any other account of a depositor, but is allowed to set off loans against deposits,” the RBI said in its statement on Thursday.

Mumbai: Customers queue outside New India Cooperative Bank in Mahavir Nagar, Kandivali West as RBI issues notice to hold all financial operations.

For the latest news and updates, visit: https://t.co/by4FF5oyu4 pic.twitter.com/p42qtTQdwn"These directions are necessitated due to supervisory concerns emanating from the recent material developments in the bank, and to protect the interest of depositors of the bank," the central bank added.

The lender, however, is allowed to set off loans against deposits, subject to the conditions stated in the above RBI Directions.

These directions shall remain in force for a period of six months from the close of business on Feb. 13, 2025, and are subject to review.

Signage outside New India Co-operative Bank (Source: NDTV Profit)

While the customers are confused about when they will get their money, eligible depositors will receive deposit insurance claim amount of their deposits, up to a monetary ceiling of Rs 5 lakh, from the Deposit Insurance and Credit Guarantee Corporation.

This was after the Parliament in 2021 passed the Deposit Insurance and Credit Guarantee Corporation Amendment Bill, paving the way for quicker payout to depositors of stressed banks in India.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.