Gold has for long been a preferred choice of financial safety, especially for investors with low-risk appetite. Demand for gold in India - the second largest consumer of gold after China - has been rising steadily for the past many years. Every year, new gold investors look out for the best way to start investing in the precious metal. Financial advisors are often asked: Is it physical gold, gold ETF (exchange-traded funds) or gold bonds? With the age-old characteristic of gold being safety, financial experts recommend small allocation towards gold as a hedge against volatility and inflation.

Experts say that investors looking to invest in gold in any form - jewellery, coins, biscuits or demat accounts - for any purpose have three basic options: physical gold, gold ETFs and sovereign bonds. "Although there are many avenues to invest in gold through purchase of physical gold or jewellery, the most convenient way is to invest in gold through dedicated gold mutual funds or gold ETFs and to invest through sovereign gold bonds. Primarily, the resale value of gold jewellery is comparatively lower than(that of) gold biscuits," Dinesh Rohira, founder and CEO, 5nance.com, told NDTV.

Physical gold is the gold you purchase in physical form. Gold ETFs are like mutual funds, where the money collected from a pool of investors goes into gold. In other words, gold ETFs track the physical gold price. Sovereign gold bonds or SGBs not only track the price of gold but also pay an interest, which is payable every six months.

When to buy gold in physical form

According to experts, funds should be parked in gold in demat form unless the investor may need physical gold for some foreseeable event, such as marriage. Among other benefits, investment in gold in demat or dematerialised form provides safety against theft.

"To invest in gold, we have multiple options available with us - physical gold, buying gold in futures and options, investing in gold through gold ETFs, or buying gold through a monthly scheme...Gold future contracts can be bought to hedge existing physical gold position, whereas buying physical gold is good for people who have some need of gold jewellery down the line," Rahul Agarwal, director, Wealth Discovery/EZ Wealth, told NDTV.

"If you invest through Gold ETFs, the value is stored electronically, which also provides safety. Further, it can be invested partially with as low as Rs. 1,000 a month... For long-term investors looking at an avenue of eight years, sovereign gold bonds provide a better yield by allowing an incremental return of 2.5 per cent as interest, payable semi-annually," Mr Rohira explained.

When to avoid physical gold

Gold ETFs ensure good returns that are comparable with those of physical gold, says Mr Agarwal. "Investing in gold through ETFs is advisable because they are traded on the exchanges and are highly liquid and the investment can be cashed out at any time. Physical gold, on the other hand, carries transactional expenses, which often can be on the higher side and could defeat the entire purpose of investing in gold," according to Mr Agarwal.

Gold bonds vs gold ETFs

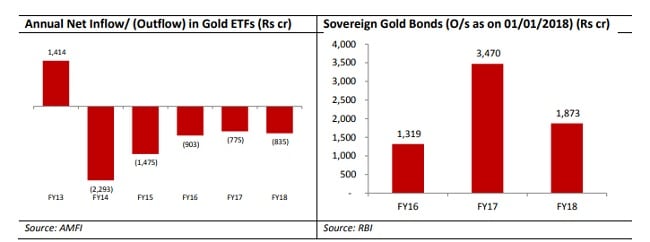

Credit ratings agency CARE Ratings has cited introduction of sovereign gold bonds as one of the reasons behind decreasing attraction of gold ETFs in the country. "SGBs are more attractive as compared to gold ETFs as these bonds pay interest as well as protect the quantity of gold invested," CARE Ratings said. Gold ETFs suffer from tracking errors, which reduce returns and do not pay any interest unlike sovereign gold bonds, it noted.

"For a long-term objective and time frame, it is advisable to invest into sovereign gold bonds while formedium-term, gold ETFs provide a better option," according to Mr Rohira of 5nance.com.

How much to invest in gold

Financial advisors always suggest a mix of equity and gold in portfolio.

"A large-size portfolio should have at least 10-15 per cent allocation towards gold, and lower allocation if the portfolio is smaller. It is imperative for investors to consider gold investment as a part of equity in term of volatility, and debt asset in terms of returns expectation," says Mr Rohira.

"Gold should definitely be a part of an investor's portfolio...Ideally gold or precious commodity should be between 5 to 10 per cent of one's investment portfolio. However, it can vary depending on one's risk appetite and financial situation," Mr Agarwal adds.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.