Olectra Greentech, a player in India's electric bus manufacturing segment, has raised eyebrows over its business as its sales guidance stands in significant contrast to the operational realities.

The company witnessed cancellations in orders one after the other, hitting it with a significant revenue loss.

According to the data compiled by NDTV Profit, the order cancellations from the state governments—Maharashtra and Telangana—earlier added up to a revenue loss of approximately Rs 9,070 crore for Olectra Greentech. Though, the Maharashtra government recently reinstated its contract with a revised schedule.

An order for 50 intercity buses by the Telangana government, originally placed on March 6, 2023, and expected to begin delivery by July 2024, was drastically cut. Out of the initial 50 buses, only 10 were delivered, leading the Telangana government to reduce the order to this minimal quantity. This reduction represents a revenue loss of approximately Rs 70 crore for Olectra Greentech, based on an estimated cost of Rs 1.75 crore per bus, as mentioned by the company.

On the other hand, the Maharashtra government that previously terminated a massive Rs 9,000 crore contract for 5,150 e-buses due to persistent delays has now reinstated it.

The decision came after Olectra Greentech officials met with the Maharashtra Transport Minister on Friday, May 30, 2025. A new delivery schedule has been proposed, outlining the delivery of 620 buses in 2025, 2,100 in the next year, and the remaining 2,210 in 2027.

The Gap Between Guidance And Delivery

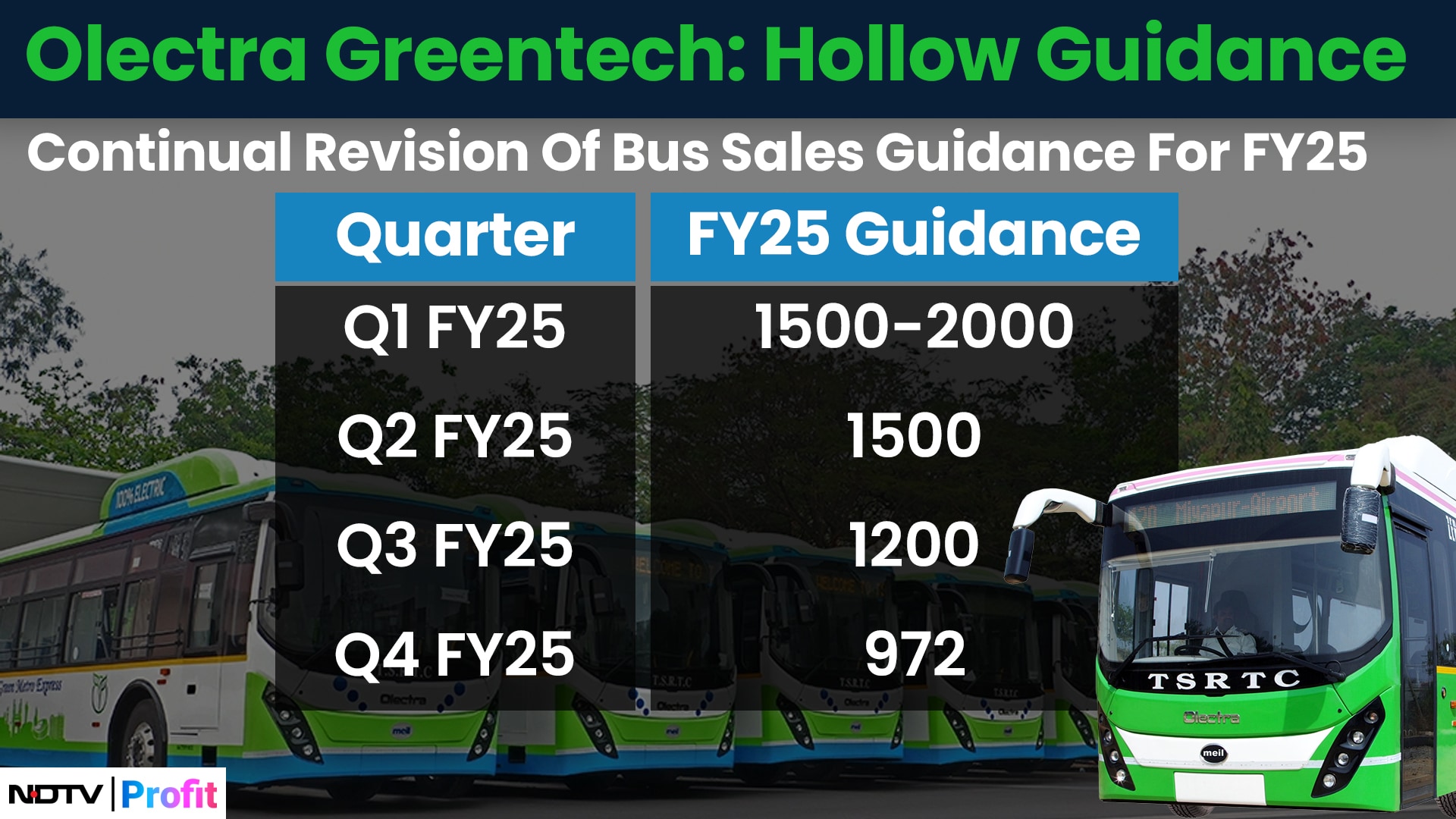

Beyond individual contracts, Olectra Greentech's internal sales guidance has also seen continual downward revisions for financial year 2025.

What started as a guidance of 1,500 to 2,000 buses in the first quarter of the year dropped to 1,500 in the second quarter, 1,200 in the third and settled at 972 in the fourth quarter.

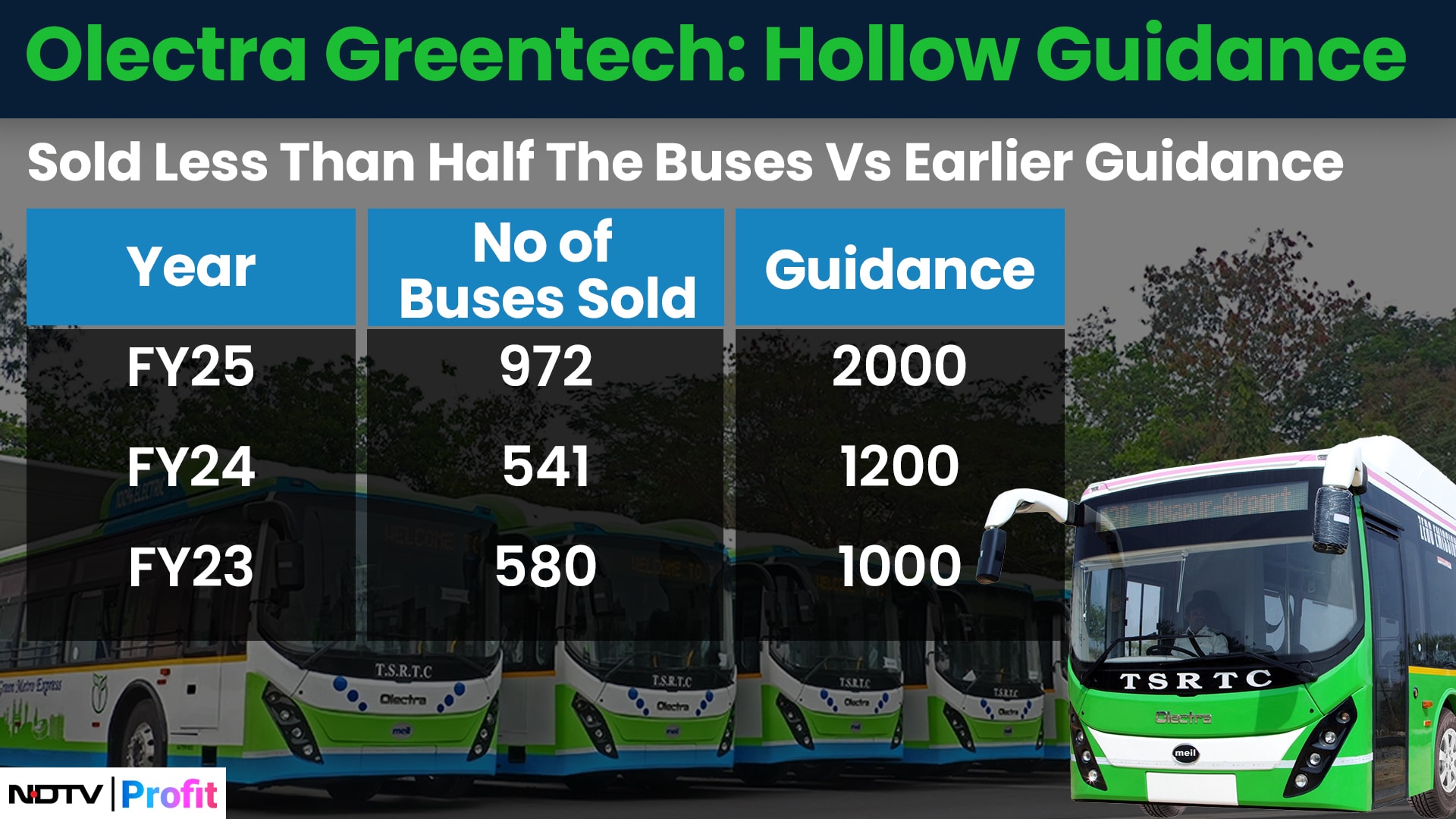

The constant reduction in guidance highlights the company's inability to meet its own projected sales figures. Data backs the pattern as well because Olectra sold only 972 buses in financial 2025, against a guidance of 2,000.

The company sold 541 buses in the previous year compared to a guidance of 1,200. These numbers show the wide gap between the company's promises and actual deliveries.

A Capacity And Supply Problem

A core issue contributing to the delays seems to be Olectra's manufacturing capacity and supply chain constraints. With a current annual capacity of only 1,200 units, fulfilling its large order book of 10,224 buses would realistically take 8 to 9 years.

The company has cited supply constraints for critical components, including batteries, which it procures from BYD. While it earlier aimed to increase the capacity to 5,000 buses by the fourth quarter of financial year 2025, this target has now been pushed to the second quarter of 2026.

This raises crucial questions about how Olectra plans to meet its financial year 2026 guidance and whether its capacity expansion plans are on track.

The market has already reacted to these concerns, with Olectra's stock down 31% in the past year. Adding to the uncertainty, the company currently has no analyst coverage, and its stock is trading 74 times its financial year 2025 price–earnings ratio, pointing to potential stretched valuation concerns as well.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.