Brokerages cut Ebitda estimates of FSN E-Commerce Ventures Ltd., the parent of Nykaa, for the current fiscal, citing weaker performance as advertisement income fell, even as fashion and B2B shine.

The online beauty and fashion retailer's third-quarter revenue met analysts' estimates, while profit doubled sequentially but fell short of expectations.

The consolidated net profit of FSN E-Commerce Ventures rose 123% year-on-year to Rs 17.4 crore in the quarter ended December, according to its exchange filing. That compares with the Rs 32.55 crore consensus estimate of analysts tracked by Bloomberg.

The revenue growth was healthy, at 22% year-on-year. Gross margins declined 90 basis points year-on-year, weighed by higher discounting in own brands and lower ad income, according to Jefferies.

"Contribution margin saw a sharper 320 basis point year-on-year decline due to higher marketing spends, given the muted demand environment," the brokerage said in a Feb. 6 note.

Beauty, personal care and e-commerce are the perfect match, according to HSBC Global Research. It expects the segment's market to grow at a 20–30% CAGR over the coming decade, followed by a decade of double-digit growth.

Nykaa Q3 FY24 Results Highlights (Consolidated, QoQ)

Revenue up 18.7% at Rs 1,789 crore. (Bloomberg estimate: Rs 1,790.10 crore).

Ebitda up 22.5% at Rs 98.7 crore. (Bloomberg estimate: Rs 115.90 crore).

Margin at 5.5% vs 5.53% (Bloomberg estimate: 6.5%).

Net profit up 123% at Rs 17.4 crore. (Bloomberg estimate: Rs 32.5 crore).

The company approved investment of up to Rs 150 crore in arm Nykaa Fashion Ltd. via rights issue, to be utilised for repayment of loans.

Here is what analysts have to say about Nykaa's Q3 FY24 results.

HSBC Global Research

Maintains a 'buy' rating but lowers the target price to Rs 240 apiece from Rs 250 apiece, implying an upside of 48.7%.

With its leading scale in BPC, reach, and broad product range, Nykaa looks well positioned for profitability and sustainable exponential growth. It expects revenue to nearly double every two to three years over the next five years.

Nykaa is augmenting the core e-commerce operation with a growing pan-India store network, raising structural barriers for others, edging up its game in the consumer experience, and out-investing rivals in building its aspirational positioning.

Building a portfolio of its own skin and beauty brands and extending its overall proposition for other retailers through its eB2B SuperStore. This should mark Nykaa's long-term evolution as not just a platform owner but as a formidable brand owner.

"We think Nykaa has a distinctive fashion strategy, evident from strong growth in 3QFY24, when industry growth was challenging. It could also potentially surprise in the next five years through profitable growth, which should serve as the key catalyst," it said in a Feb. 7 note.

Valuation is appealing and implies 17% long-term earnings growth, well within the growth opportunity for BPC, it added.

Morgan Stanley

Morgan Stanley has an 'overweight' on the stock with a target price of Rs 192 apiece, implying an upside of 20%.

Stable growth trends across businesses and improving profitability in fashion and eB2B segments are positives.

Incremental negative Ebitda margin impacts from ESOP expenses and international expansion are negative.

Morgan Stanley revised FY24, FY25 and FY26 Ebitda by -10%, +1% and -3%, respectively, to factor in the weaker performance.

The flow-through effects (on a small base) led to 57%, 6% and 12% cuts to our FY24, FY25 and FY26 earnings.

Jefferies

Jefferies retained a 'buy' with a target price of Rs 210 apiece, implying an upside of 30%.

BPC contribution margin compressed to a seven-quarter low. However, fashion surprised positively with growth and profitability.

Product margin was 20–40 basis points lower YoY/QoQ on higher discounts in the own-brand portfolio.

Ad income (percentage of revenue) declined as BPC brands prioritised discounting over marketing spends to push growth.

The brokerage cut FY24–25 Ebitda estimates by 3-8% as it lowered its contribution margin estimates for BPC.

BofA Securities

Maintains a 'neutral' rating with a target price of Rs 178.

Gross profit margin declined on higher eB2B mix and lower marketing income.

On BPC side, higher discounting is likely short-term impact and current discounting cannot sustain.

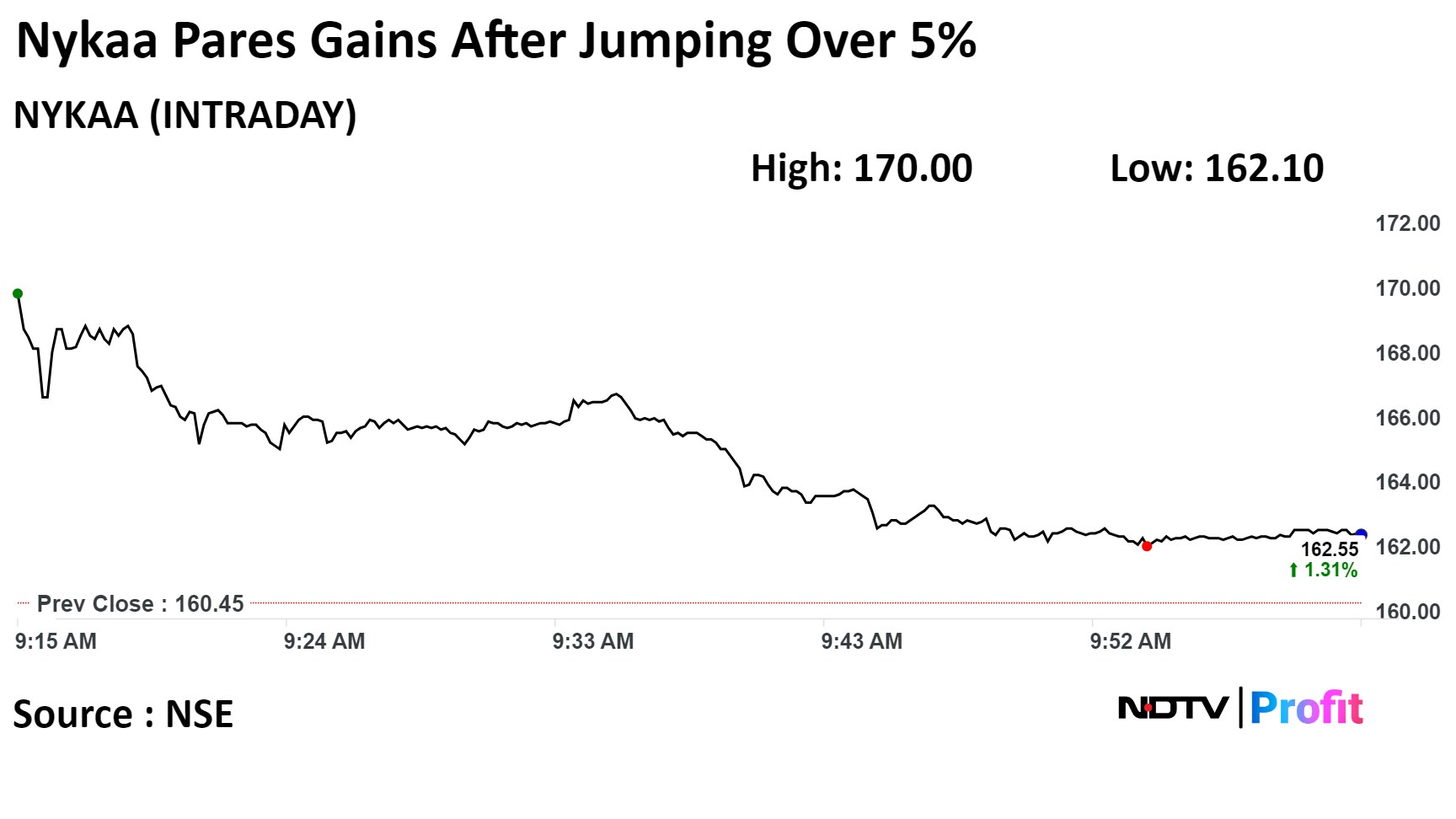

Shares of FSN E-Commerce Ventures Ltd. rose as much as 5.95%, the highest level since Jan. 9, before paring gains to trade 1.25% higher at 9:59 a.m. This compares to a 0.33% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 4.5 times its 30-day average.

Of the 24 analysts tracking the company, 14 maintain a 'buy', five recommends a 'hold,' and five suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 9.7%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.