Netflix, a company that built its business on junk bonds, is looking to borrow heavily again.

The streaming company once known as “Debtflix” before it started generating heavy cash flow is looking to add tens of billions of dollars of debt to finance its planned $72 billion acquisition of most of Warner Bros. Discovery Inc. But Netflix Inc. has a stronger balance sheet than it did before the pandemic, which will probably allow the company to boost the price it pays in any bidding war that emerges, while remaining investment grade.

“Netflix's credit profile really turned around,” said Stephen Flynn, an analyst covering telecom and media debt at Bloomberg Intelligence. “They've come a long way from high yield.”

The company's current agreed acquisition includes $59 billion of temporary debt financing from Wall Street banks. The entertainment giant plans to eventually replace that with as much as $25 billion of bonds, $20 billion of delayed-draw term loans, and a $5 billion revolving credit facility. Some will probably also be paid down with cash flow.

The company's debt load might swell even more now that Paramount Skydance Corp. launched a hostile takeover bid for all of Warner Bros. that values the company at more than $108 billion including debt, around $26 billion more than Netflix's offer.

To a team of Morgan Stanley analysts led by David Hamburger, rising debt levels are a risk for Netflix investors now. The streaming company, graded A by S&P Global Ratings and a notch lower by Moody's Ratings at A3, is vulnerable to a cut to the BBB tier, the analysts wrote in a Monday note. They recommend selling the company's notes due in 2034 and 2054 given the potential for Netflix to issue significant amounts of new debt and see its ratings cut.

There are other risks for the company beyond downgrades: it must execute one of the largest media deals of all time. Regulators could move to block the transaction. And Paramount's hostile takeover bid may win over Netflix, in which case Netflix would be stuck paying a $5.8 billion penalty in the form of a breakup fee, without gaining a new business that would boost its revenue.

Still, many analysts and investors see the risks as manageable. Risk premiums on the company's debt are little changed over the last week. On Monday, Moody's affirmed Netflix's A3 rating, citing the company's strong operating performance and benefits it will gain from acquiring “some of the most highly regarded intellectual property in the media industry,” including Harry Potter, HBO and DC Comics. The ratings agency changed its outlook on the company to “stable” from “positive,” reflecting a slight increase in risk for the company from the acquisition.

According to Bloomberg Intelligence calculations, Netflix would have about $75 billion in debt if the acquisition goes through based on the latest terms, up from about $15 billion now. But even with much higher debt, the new company is expected next year to generate around $20.4 billion of earnings available to pay interest, known as earnings before interest, taxes, depreciation and amortization.

At that level, net debt would equal about 3.7 times Ebitda. Then in 2027, earnings would probably grow and bring the leverage ratio down to about mid-2x range, according to BI, a more typical level for an investment-grade company.

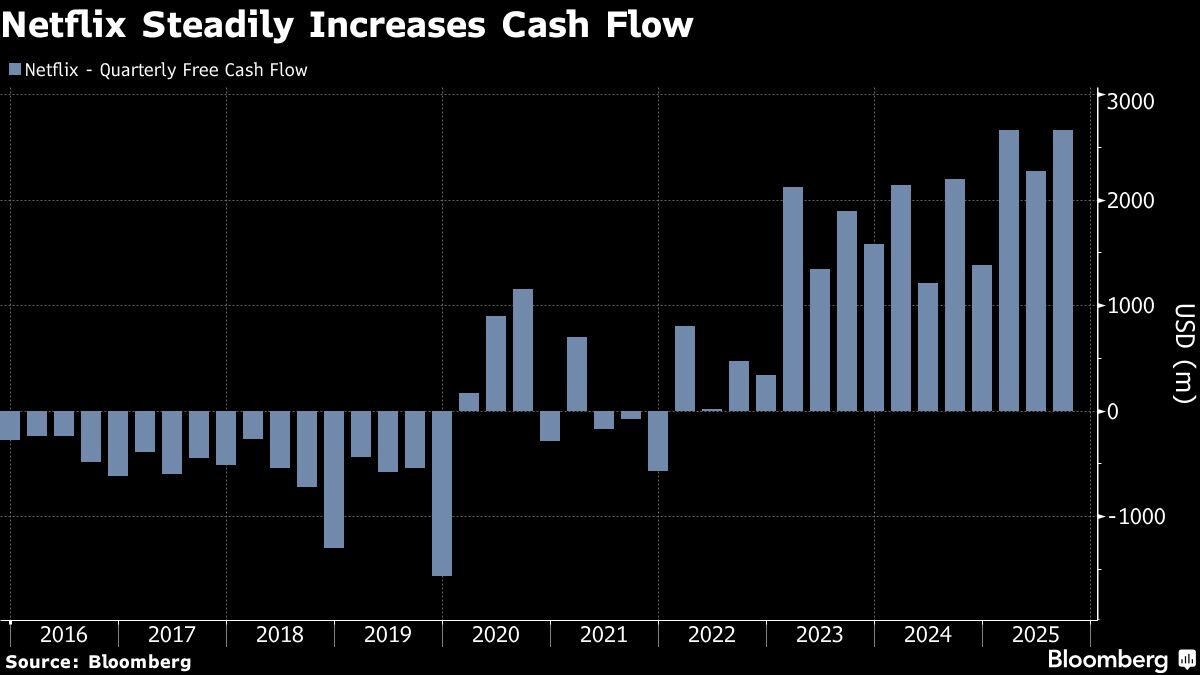

“Overall, Netflix is a very, very strong credit,” BI's Flynn said. “They've got growing revenue, growing Ebitda, and growing free cash flow, so the pro-forma company can de-lever quite quickly.”

Netflix's swelling debt load recalls the company's heavy borrowing before the pandemic, with a key difference: the streaming giant is much stronger now. Netflix first started selling junk bonds in 2009 when it was transitioning from mainly renting DVDs through the mail into a streaming company. Over the following years its debt load climbed to as high as $18.5 billion as it gained more rights to stream movies and television programs, and started producing hits like “House of Cards” and “Stranger Things.”

Some detractors called the company “Debtflix” as it piled on the liabilities. But then its investments came to look prescient. The global pandemic hit in 2020, and vast amounts of cash flowed into its coffers as people worldwide found themselves homebound in lockdown, desperate for entertainment. Netflix had a backlog of series and movies to release that proved even more valuable than the company had expected.

In 2023, the company started generating more than $6.9 billion of free cash flow every year. Bond raters upgraded it to investment grade status, allowing it to finance itself at a cheaper cost at a time when it needed less debt funding.

“Netflix has earned the right to take on an acquisition of this size,” said Jim Fitzpatrick, head of US investment-grade credit research at Allspring Global. “Their balance sheet has plenty of capacity to accommodate something like this, even if they have to up their bid.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.