Nestle India Ltd.'s shares traded lower on Wednesday after the release of third-quarter earnings on concerns of inflation and urban slowdown.

Nuvama cut the target price, citing urban slowdown and inflation, while maintaining a 'buy' rating on the stock. Anand Rathi maintained 'hold', and Macquarie maintained its 'neutral' rating. The brokerages are expecting e-commerce growth and expansion across segments to support growth.

Nuvama On Nestle

As the urban slowdown starts to reverse, Nestlé's position is expected to benefit strongly in urban India, where the majority of salaried class resides. Nestlé is now number one in coffee as it maintains a stable market share in noodles, up to 60% and is a leader in baby food, it highlighted.

The company has also logged growth in wafer-based chocolates and is the number two player in single-serve breakfast cereals. Further, the brokerage also cites that the company has taken up to 2% price hikes in the coffee segment due to inflation in coffee while other categories such as chocolates and prepared dishes have not seen sharp hikes till now.

The e-commerce segment of the company also posted high double-digit growth, contributing 9.1% to domestic sales. The brokerage also expects the appointment of Manish Tiwary to build this channel given his prior experience in Unilever and Amazon.

Nestlé has made significant investments in India, including its tenth factory in Odisha. Capex as a percentage of revenue rose from 1.8% in 2015 to 7.7% in financial year 2024. The revised target price for Nestle India is Rs 2,845 which was earlier higher at Rs 2,870.

Macquarie on Nestle

Macquarie maintains a 'Neutral' rating with a target price of Rs 2,250. The brokerage sees an opportunity at the premium end and is hopeful of recovery from current lows.

The company has managed to expand its reach through rural-urban and digital tools. The firm also notes that inflation has hurt milk and nutrition sales. Nestle's out-of-home offers brand-building opportunity has also been expanding. Commodities like coffee, cocoa and wheat inputs could see further inflation, according to Macquarie.

Citi On Nestle

Key growth drivers, according to the brokerage, are distribution expansion, increasing household penetration, digital focus across business functions and premiumisation. Further, there could also be expansion into catering to rising health consciousness of consumers and also the out of home consumption.

Given these strategic initiatives, the brokerage believes, that Nestle India is well placed to return to its strong growth trajectory once the demand environment improves.

Premium products are outpacing the overall category growth and Nestle India, with its portfolio of brands, looks well placed to benefit.

The joint venture with Dr. Reddy's is also aimed to address the need in medical nutrition and general wellness category. Commodity inflation is impacting near-term growth, according to Citi. The management has stated that select food commodities continue to witness high inflation, resulting in material pressure on consumption demand.

Nestle India's key initiatives include buying efficiencies, manufacturing and conversion cost correction with distribution cost reduction.

Anand Rathi On Nestle

Anand Rathi has given Nestle a target price of Rs 2,700 after the company posted its third quarter results. The company's revenue showed a 3.9% increase compared to the previous quarter. While EBITDA remained stable, profit after tax saw a 4.9% increase.

The brokerage notes the company's E-commerce channel is maintaining its strong momentum, achieving high double-digit growth and accounting for 9.1% of domestic sales.

Products introduced since 2015 now contribute approximately 7% to total sales and the growth was driven by rapid commerce, consumer acquisition, festive promotions, and premiumisation. The uptick is lead by Kitkat, Nescafe, and Maggi, according to the brokerage.

The company has achieved robust growth in key international markets, driven by nutrition, instant tea, and confectionery. Coffee exports maintained strong double-digit growth. Maggi remained focused on expanding its Spicy and Korean range, while MAGGI Atta Noodles extended its reach to the Urban market.

The pet-care business achieved double-digit growth, driven by Felix and Friskies from the cat food portfolio. Further, Milkmaid experienced growth, driven by the festive season. Munch remained focused on regional markets, delivering strong growth and Kitkat continued expanding its premium portfolio.

The company had a decent quarter in challenging environment with 3 out of 4 product groups delivering healthy growth led by a combination of pricing and volume, according to the brokerage.

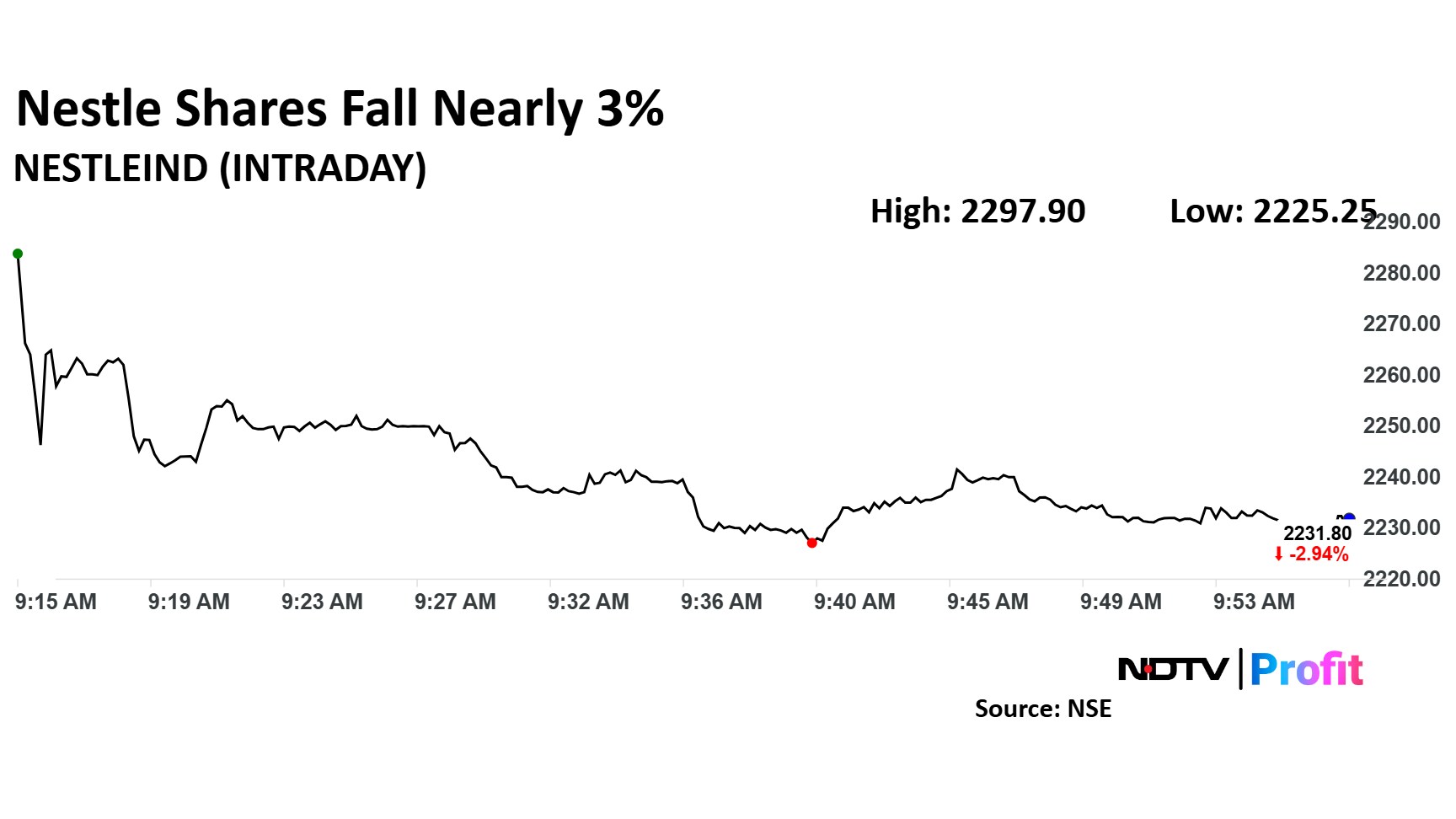

Nestle India Share Price

Nestle India share price fell as much as 3.23% during the day to Rs 2,225.25 apiece on the NSE. It was trading 3.06% lower at Rs 2,229.10 apiece.

It has risen 2.72% in the last 12 months. The total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 68.

Twelve out of the 38 analysts tracking the company have a 'buy' rating on the stock, 19 recommend a 'hold' and seven suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 2,425.35, implying an upside of 8.4%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.