Morgan Stanley suggests investors to opt for a ‘barbell strategy' of buying high- and low-risk stocks amid market volatility.

Indian stocks have held up remarkably well despite the rise in oil prices, possibly due to a combination of a change in macro funding mix to foreign direct investment, falling oil intensity in GDP, high real relative policy rates and a strong domestic bid on stocks, the financial services provider said in a March 9 note. “That said, the length of the military action in Ukraine could determine its impact on earnings and multiples. The Sensex is now in a bear market in oil terms.”

A rise in domestic policy rates may bring another bout of volatility beyond geopolitics, said the note co-authored by equity strategists Ridham Desai and Nayant Parekh and equity analyst Sheela Rathi.

Morgan Stanley's new Sensex target for December is 62,000, which is 11% lower than earlier and suggests 16% upside from current levels. At the portfolio level, it recommends a shift to a barbell strategy—using both growth-oriented and more conservative investments—with wider sector positions.

The research house also cut FY23 earnings estimates for the Sensex constituents by 8% to reflect lower GDP growth forecasts. It expects earnings to compound at 22% annually over the coming two years, down from its earlier estimate of 24%.

Sector Pick

Within cyclical and rate-sensitive stocks, Morgan Stanley is overweight on financials, consumer discretionary and industrials and underweight on utilities, energy and materials.

“In defensives, we double upgrade technology (from underweight to overweight) and go underweight on consumer staples (from equal weight) and stay underweight on healthcare,” the report said.

“Given the broad market correction, we are size agnostic versus our previous preference for large caps.”

Infosys Ltd. and Tech Mahindra Ltd. have been added into Morgan Stanley's focus list, thanks to resilient margin, deal wins and expectations of broad-based revenue growth.

Biggest Macro Challenge

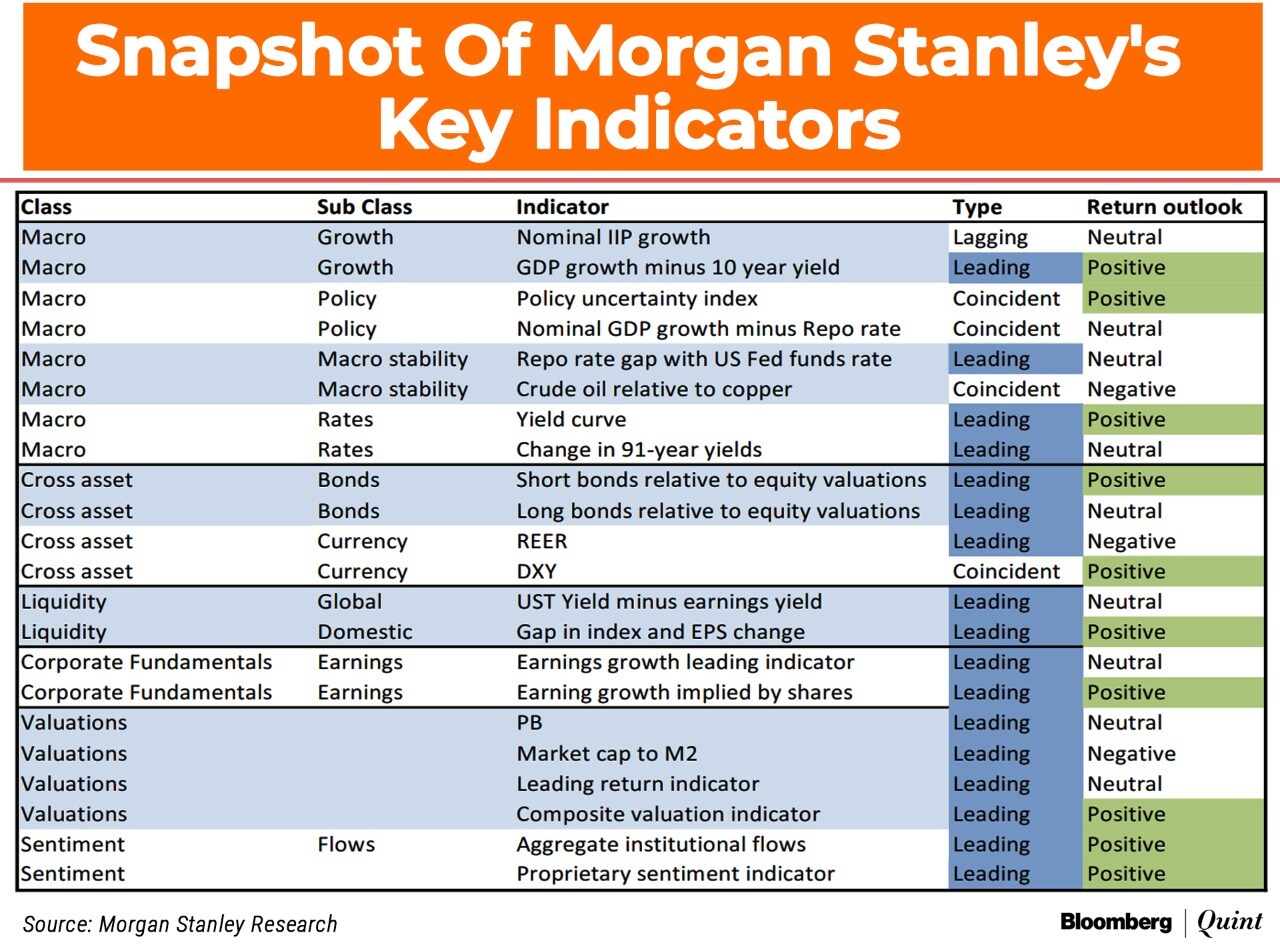

A rise in crude prices is a major issue for India, one of the biggest oil importers, as it's the single most important ingredient in terms of trade and macro stability. “The market's relative performance responds to supply-led changes in oil prices (oil prices relative to copper). This is a coincident indicator and is looking very challenging for India.”

Still, Morgan Stanley said the ongoing bull market compares well with history. “If this bull market is reminiscent of that in 2003-08, as we think (given a likely fresh earnings cycle), it has more legs to it.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.