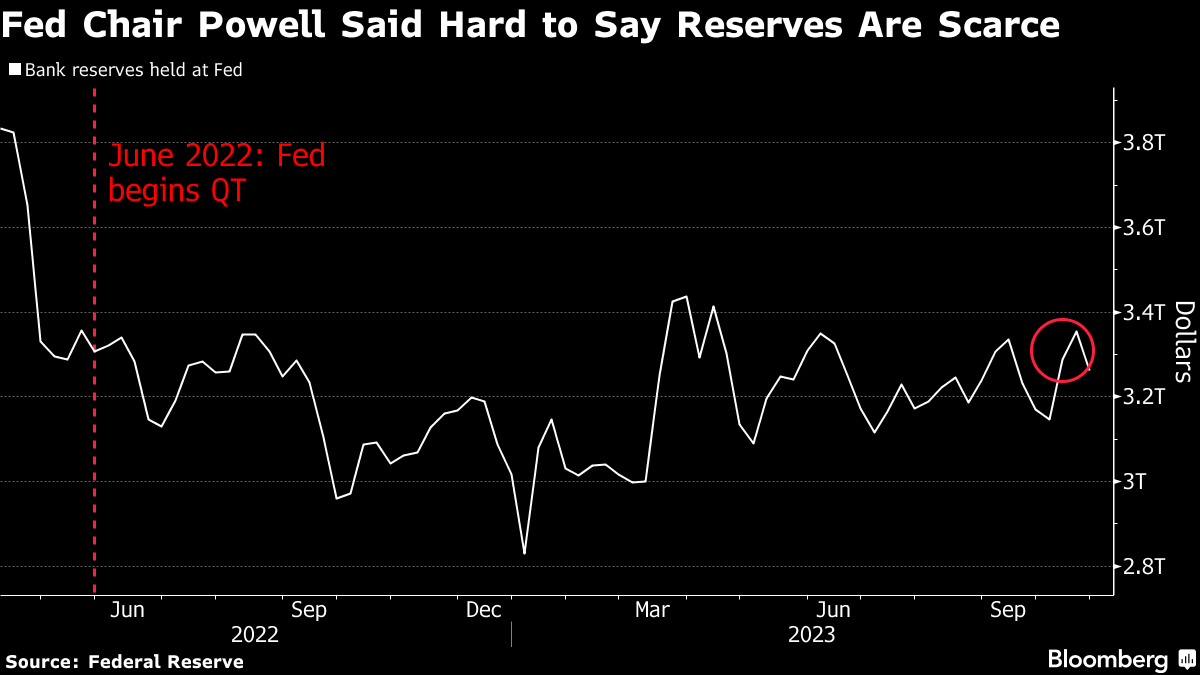

(Bloomberg) -- The Federal Reserve and some market participants are out of sync on whether reserves in the banking system — a key determinant for the central bank to continue its quantitative tightening — have already reached the appropriate level of scarcity.

Bank reserves totaled $3.26 trillion in the week through Oct. 25, Fed data show.

“At $3.3 trillion of reserves, I think it's hard to make a case that reserves are scarce at this point,” Fed Chairman Jerome Powell said during a press conference Wednesday after the bank announced its decision to hold rates steady.

Yet right before Powell spoke, Matthew Hornbach, global head of macro strategy at Morgan Stanley & Co., said on Bloomberg Television that reserves may have already reached the minimum level that banks need to conduct their business.

Theoretically, a drop in reserves to the level of scarcity would push the Fed to consider halting its sale of assets from its balance sheet, a part of so-called QT that it's used to combat inflation.

Scarcity has caused problems in the past, most notably in September 2019, when the Treasury increased borrowing and the Fed stopped buying as many Treasuries for its balance sheet. Balances dropped by nearly $166 billion to $3.14 trillion in the week through Sept. 20 in 2019, Fed data show.

Wall Street strategists have estimated the banking system's aggregate lowest comfortable level of reserves is somewhere around $2.5 trillion.

But lenders are still jittery following the failures of Silicon Valley Bank and Signature Bank earlier this year.

The Fed's August survey of financial officers showed that roughly 79% of respondents said their institutions preferred to hold additional reserves above the lowest comfortable level. Almost half of those respondents also reported increased borrowing from Federal Home Loan Banks as the result of the industry turmoil in March.

In the 18 months since the central bank started hiking interest rates, cash has been flowing out of the banking system in search of higher-yielding alternatives. The Fed has pledged to keep interest rates at current levels for longer than the market earlier anticipated, and deposits are continuing to leave, raising the risk that bank reserves will be siphoned off.

Fed policymakers have said the banking system's lowest comfortable level of reserves is roughly 8% of gross domestic product, which includes a small buffer above the level in September 2019.

However, strategists including Bank of America's Mark Cabana and Katie Craig have said recent bank liquidity preferences may imply scarcity closer to when reserves are about 10% of GDP — which means QT might end once balances at the overnight reverse repo facility, or RRP, reach zero near the end of 2024.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.