LG Electronics India began its first year on Dalal Street at a time when discretionary demand was low, and demand was witnessing a structural shift towards premiumisation. Its quarterly result was poor, with revenue growth and margins reflecting the temporary pause in purchases triggered by the anticipated GST rate cut.

Beyond these numbers, LG's position in the premium category, its improving market share, capacity expansion, and Make in India strategy point to a business preparing for the next phase of demand. Recent tax cuts are expected to support discretionary spending, and LG, as a market leader across multiple categories, stands to benefit as demand stabilises. This provides the context for the company's long-term roadmap and its plans to improve scale and profitability.

A Strategy Built Around India's Changing Consumer

LG's long-term strategy, called "Future Vision", is built on three key principles: Make for India, Make in India, and Make India Global. Under Make in India, localisation efforts (which stood at 55.8% in Q2 FY26) are targeted to increase by 2-3% annually over the next three to four years, eventually reaching around 70%. This localisation is also expected to lift margins upwards.

LG is adopting a two-pronged strategy to expand its price range. This includes focusing on the premium segment while leveraging the LG Essential series to penetrate the volume segment and target first-time buyers. The company is strengthening its premium portfolio with new front-door refrigerators and AI-enabled front-load washing machines.

Diversification Beyond B2C

Beyond the premiumisation shift, the company is also diversifying into the high-margin B2B business. This segment currently contributes roughly 6% of total sales but delivers margins higher than those of the B2C segment. As a result, LG plans to scale its presence in B2B markets, particularly in high-margin, fast-growing areas such as heating, ventilation, and air conditioning and information display panels.

LG is also using its market leadership in cooling to expand into the data center cooling market. Alongside these product introductions, the company is steadily growing its non-hardware recurring businesses, such as Annual Maintenance Contracts. AMC offers higher margins, helping LG build a recurring revenue stream and retain customers more effectively.

LG is also setting up its third factory with a capital expenditure of Rs 5,000 crore over the next four to five years, funded through internal accruals. The project is expected to double capacity by FY29, although that timeline remains distant. However, in the short run, the first product line for room air conditioners is expected to come onstream by October 2026, followed by the aircon compressor line in the fourth quarter of FY27.

The facility will also be used to export premium products to larger markets, making LG a global production hub. Exports contributed approximately 7% to net sales in the first half of FY26, up from 6% in FY25. A gradual ramp-up of this capacity will aid revenue growth, provided demand remains firm.

Appliances Demand Cools as Consumers Wait for GST Revision

While the long-term plan appears strong, short-term weakness persisted in the second quarter of FY26, due to the GST cut, which temporarily hampered demand.

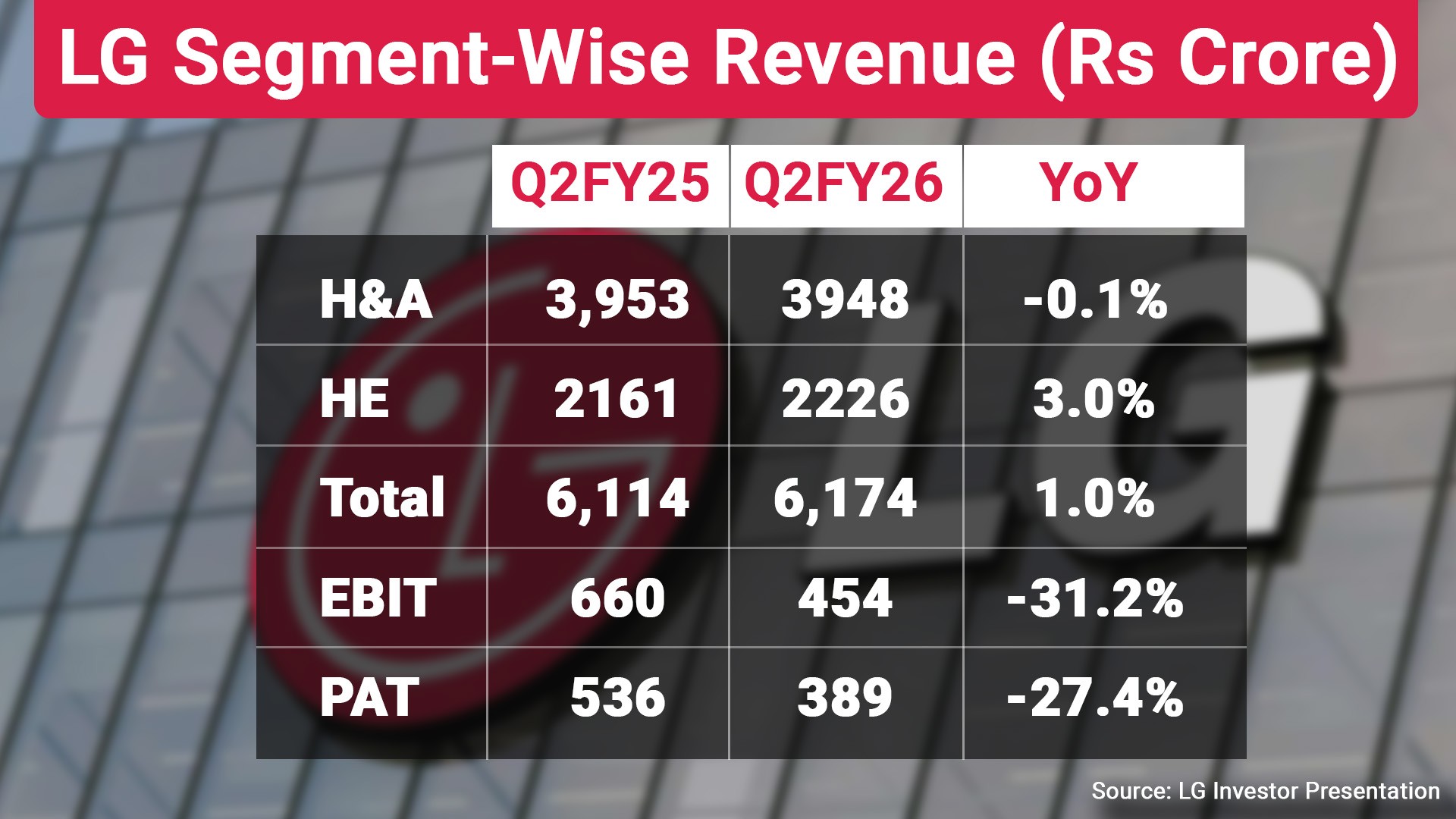

As a result, revenue inched up by only 1% year-on-year to Rs 6,174 crore, weighed down largely by the weak performance of the Home Appliance and Air Solution segment. LG operates through two segments: Home Entertainment, which includes televisions and soundbars, and Home Appliance and Air Solution, which covers refrigerators, air conditioners, and washing machines.

HE delivered a 3% rise in revenue to Rs 2,226 crore, supported by stronger festive-season demand for televisions. That growth, however, was tempered by US tariff-related pressures and broader geopolitical disruptions that constrained momentum.

Even with those challenges, LG managed to consolidate its leadership in the premium TV category. The company improved its offline market position, with its OLED market share rising to 62.6% (+4.2%) and TV market share to 27.5% (+1.4%).

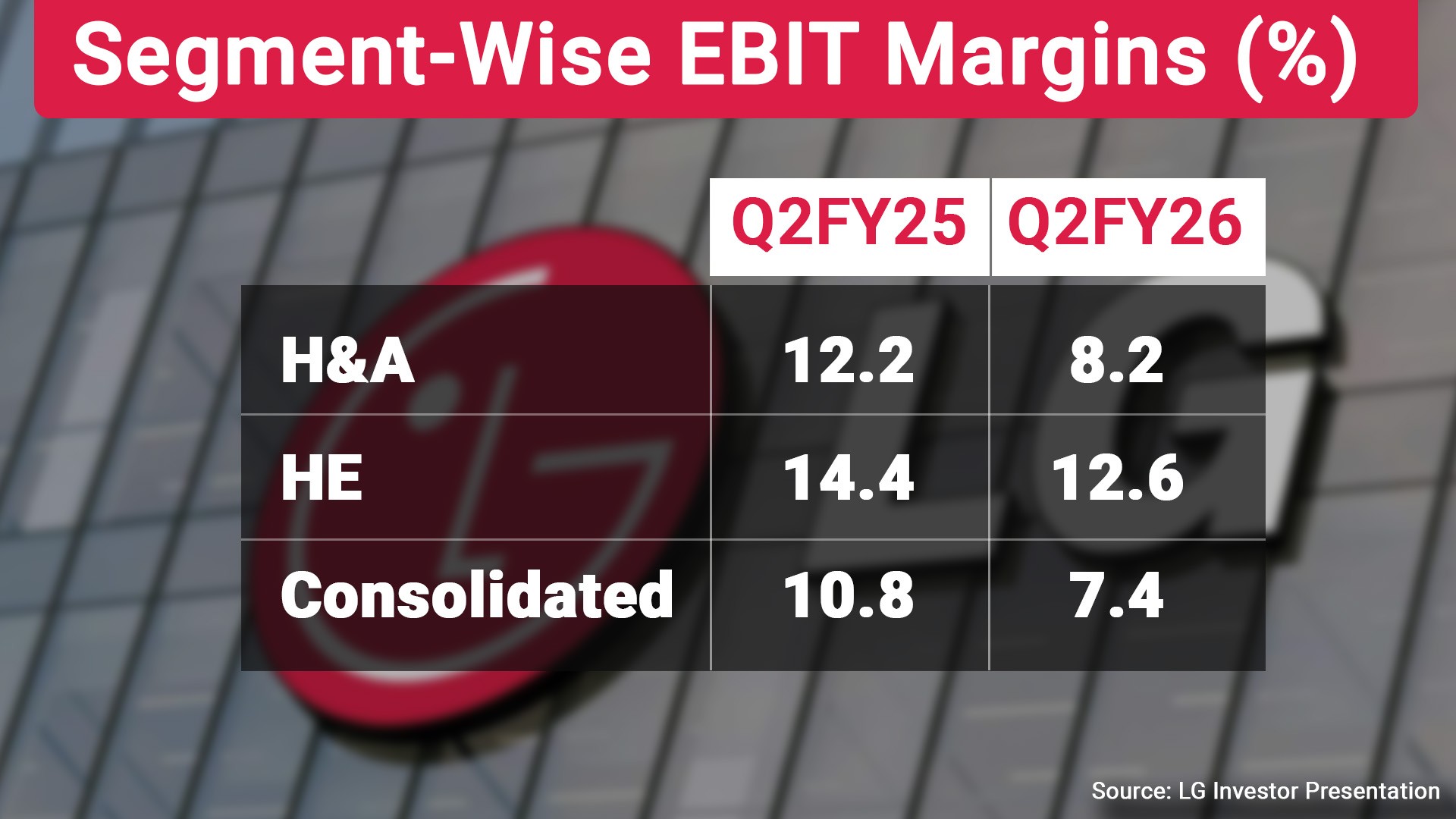

However, EBIT margin fell 180 basis points to 12.6%, from 14.4% in the same quarter last year. The H&A business, which accounts for the larger portion of the top line, remained flat at Rs 3,948 crore, reflecting the slowdown triggered by the tax-rate transition. Margin pressure was severe, with EBIT margin falling 400 bps to 8.2%.

Steady Market-Share Gains Across Key Appliance Categories

Despite this, LG continued to gain traction in its premium categories. The company widened its presence across key product lines, with refrigerator market share rising to 29.9% (+1%), washing machines (33.4%), room AC 17.4% (+0.5%), and the premium side-by-side refrigerator segment 43.2% (+4.5%). These year-to-date September-quarter gains indicate that the brand's premium positioning remains firm, even as overall demand remains subdued.

This weakness fed into overall profitability, dragging consolidated the Ebitda margin down to 8.9%, from 12.4% in Q2 FY25. Net profit consequently declined 27.4% to Rs 389 crore. Margin erosion was driven by rising commodity costs, currency depreciation, and higher compliance-related expenditure.

Higher mandated recycling costs under which companies must pay a minimum of Rs 22 per kg for e-waste recycling also impacted its margins. That said, LG's return ratios are already the best in the segment, with Return on Capital Employed of 43% and Return on Equity of 37% as of FY25.

Premium Valuation Supported by Strong Return Ratios

At Rs 1,566 per share, LG Electronics trades at a P/E of 48.3, which does not appear inexpensive. However, LG trades at a discount to consumer-discretionary peers such as Voltas (80), Havells (60), and Blue Star (66). With return ratios that are more than twice those of its peers, any sustained improvement in operating performance over the coming quarters could provide a floor for the valuation and gradually support the stock.

That said, the risks cannot be overlooked. LG paid about 1.9% of its revenue in royalties to its parent, LG Electronics, and this amount can be increased to up to 5% of turnover without requiring shareholder approval. Any future upward revision could directly weigh on profitability. The company also carries a significant contingent liability burden, which remains a concern for investors evaluating long-term risk.

Disclaimer: The views expressed in this article are solely those of the author and do not necessarily reflect the opinion of NDTV Profit or its affiliates. Readers are advised to conduct their own research or consult a qualified professional before making any investment or business decisions. NDTV Profit does not guarantee the accuracy, completeness, or reliability of the information presented in this article.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.