Shares of Jindal Steel & Power Ltd. gained as most analysts retained their 'buy' calls after the third quarter, citing a recovery in sales volume, higher realisations, and deleveraging efforts.

The steelmaker saw its revenue fall 8% sequentially to Rs 12,524.86 crore in the three months ended December, according to an exchange filing on Tuesday. That compares with the Rs 11,975-crore consensus estimate of analysts tracked by Bloomberg.

JSPL Q3 FY22: Key Highlights (Consolidated, QoQ)

Net profit down 37% at Rs 1,621.68 crore, against an estimate of Rs 1,792 crore.

Total costs up 2% at Rs 10,299.85 crore.

Ebitda at Rs 3,310 crore versus a forecast of Rs 3,595 crore.

Other income at Rs 10.49 crore.

JSPL's Managing Director VR Sharma, in an interview to BloombergQuint, said the steelmaker intended to cut the share of long products such as rebar to wire rods from existing 70% to 50% of the portfolio. It instead will focus on hot-rolled coils, colour-coated and galvanised steel.

Sharma expects coking coal prices to remain higher in the next couple of weeks, thereby impacting the ongoing quarter.

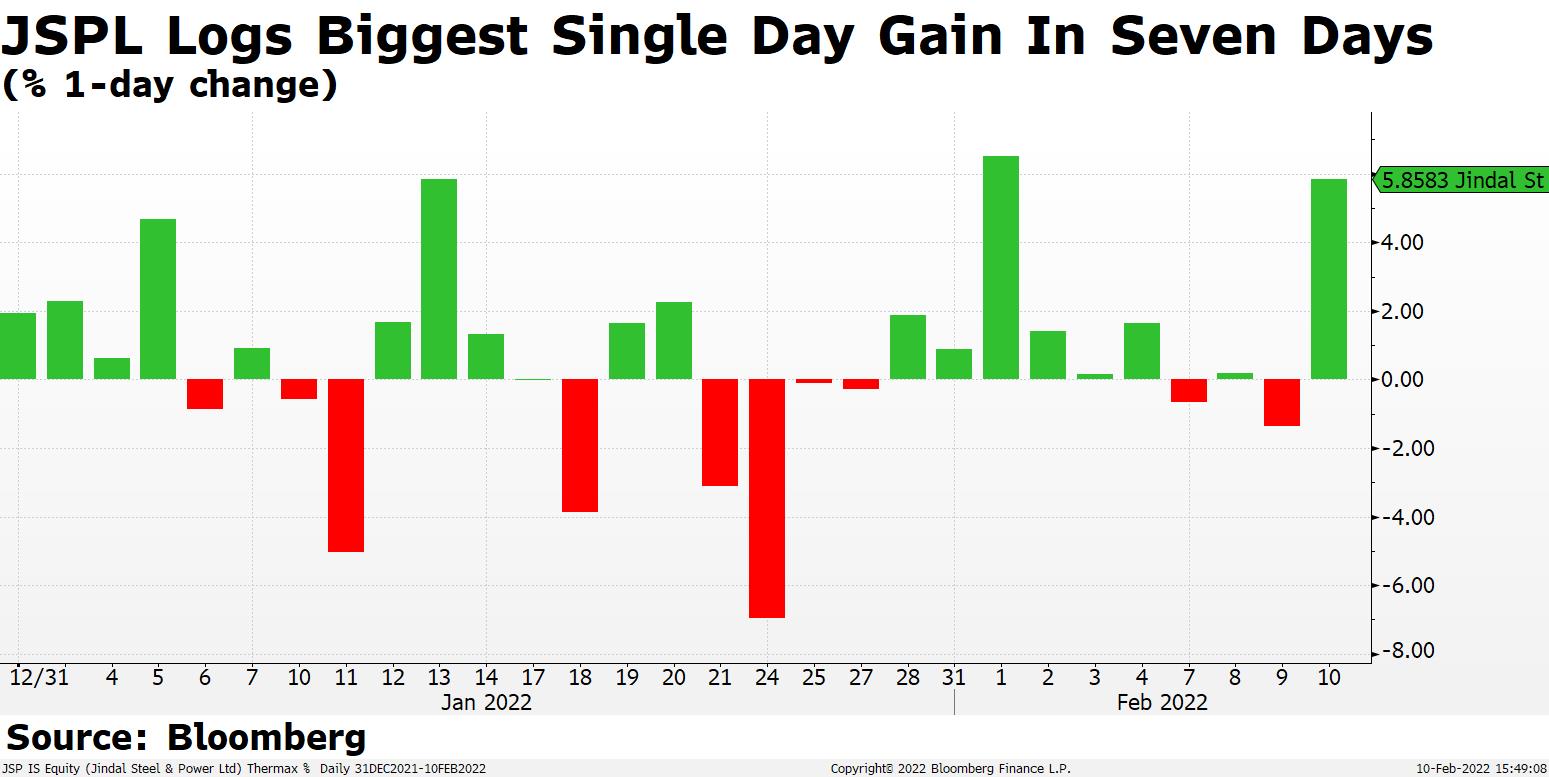

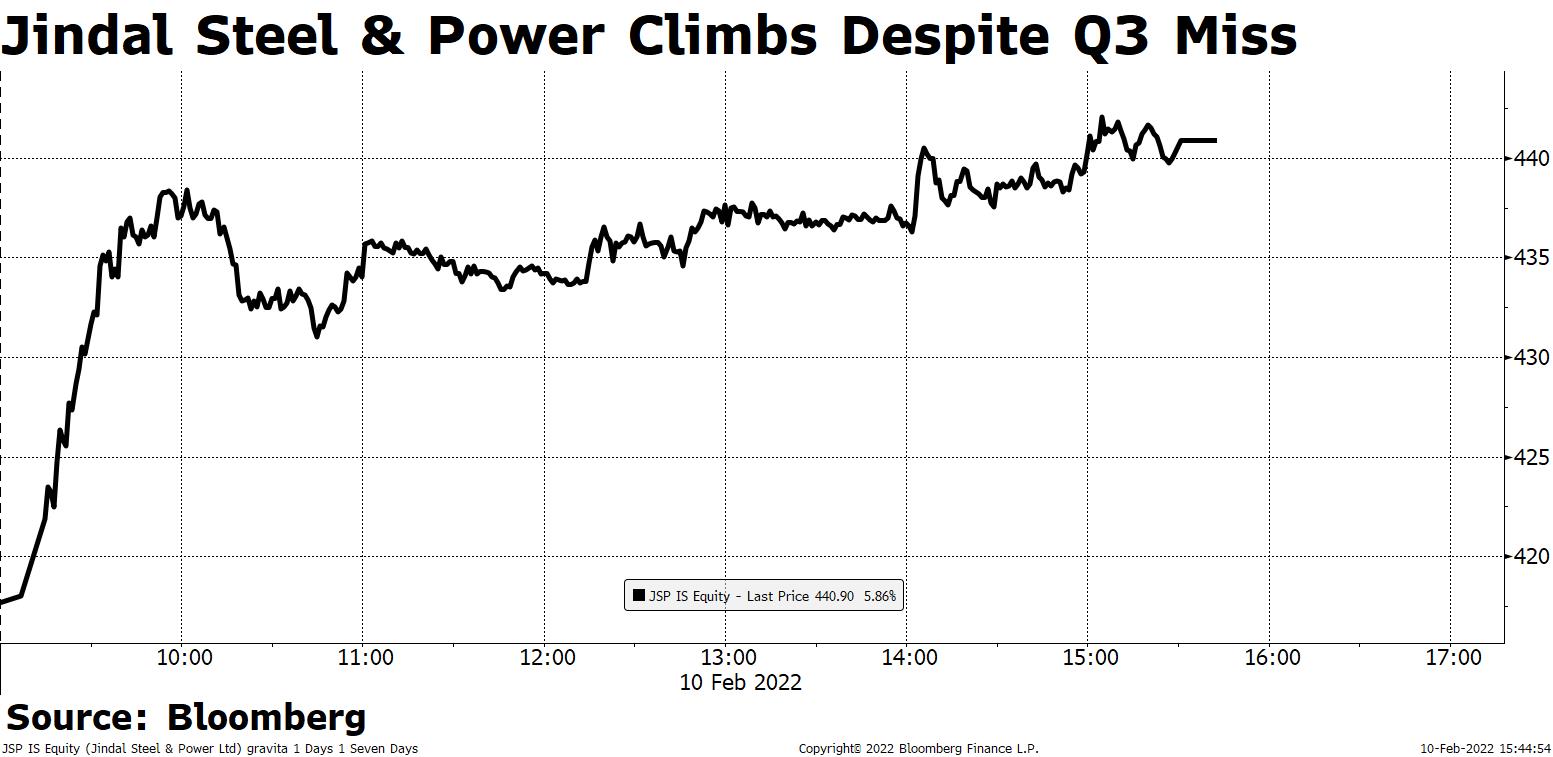

Shares of JSPL rose as much as 6.15%, the biggest intraday gain in seven sessions. The stock closed 5.86% higher.

The stock's trading volume was nearly 2.7 times the 30-day average volume at markets close..

Of the 27 analysts tracking the company, 24 rate a 'buy', two suggest a 'hold' and one recommends a 'sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 31.3%.

Here's what the brokerages have to say about JSPL's Q3 FY22 results...

Motilal Oswal

Maintains 'buy' and raises target price to Rs 533 from Rs 478 earlier, an implied return of 22.77%.

Sales volumes declined due to extended monsoon in north India, construction ban in NCR region, Omicron variant and unseasonal rains in south India.

Reduction in Ebitda was due to a sharp rise in net raw material/conversion costs.

Raises FY22E/FY23E Ebitda estimate by 13.3%/14.5% to reflect higher steel sales volumes and better realisations as prices have improved since February 2022.

Expects improvement in domestic demand as Covid curbs gradually ease.

The company's focus to achieve zero net debt by the end of FY23 augurs well for the growth prospects.

Prabhudas Lilladher

Maintains 'buy' with a target price at Rs 555, an implied return of 27.95%.

Strong volume growth, conservative margins, attractive valuations are key positive factors.

Higher realisations in Q3 were offset by higher-than-expected increase in costs.

Q3 earnings marginally missed estimates. The company remains well placed for long-term growth.

ICICI Securities

Maintains 'hold' with a target price of Rs 433, an implied downside of 0.15%.

Decline in Q3 Ebitda was mainly due to high raw material costs.

With the divestment of Jindal Power, the company is likely to achieve its aim of turning net debt free by FY23E

Margin pressures due to a sharp rise in coking coal prices are likely to continue.

More spending on infrastructure projects, as announced in union budget, will give a boost to the industry.

IDBI Capital

Maintains 'buy' but cuts target price to Rs 536 from Rs 540, still an implied return of 28.69%.

Production has commenced from the recently acquired Kasia mine in Odisha, which has 278 million tonnes of iron ore of average Fe (iron) grade of 62.5%.

Production in Kasia mine will further facilitate the company growth ambitions.

The company will continue to deleverage balance sheet as it benefits from a strong steel cycle.

The stock is likely to be a rerating candidate over a couple of years as the company completes sale of power business, reduces debt, expands steel capacities and sells non-core overseas assets.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.