Jeep Is The Rare Car Brand That’s Cutting Prices Right Now

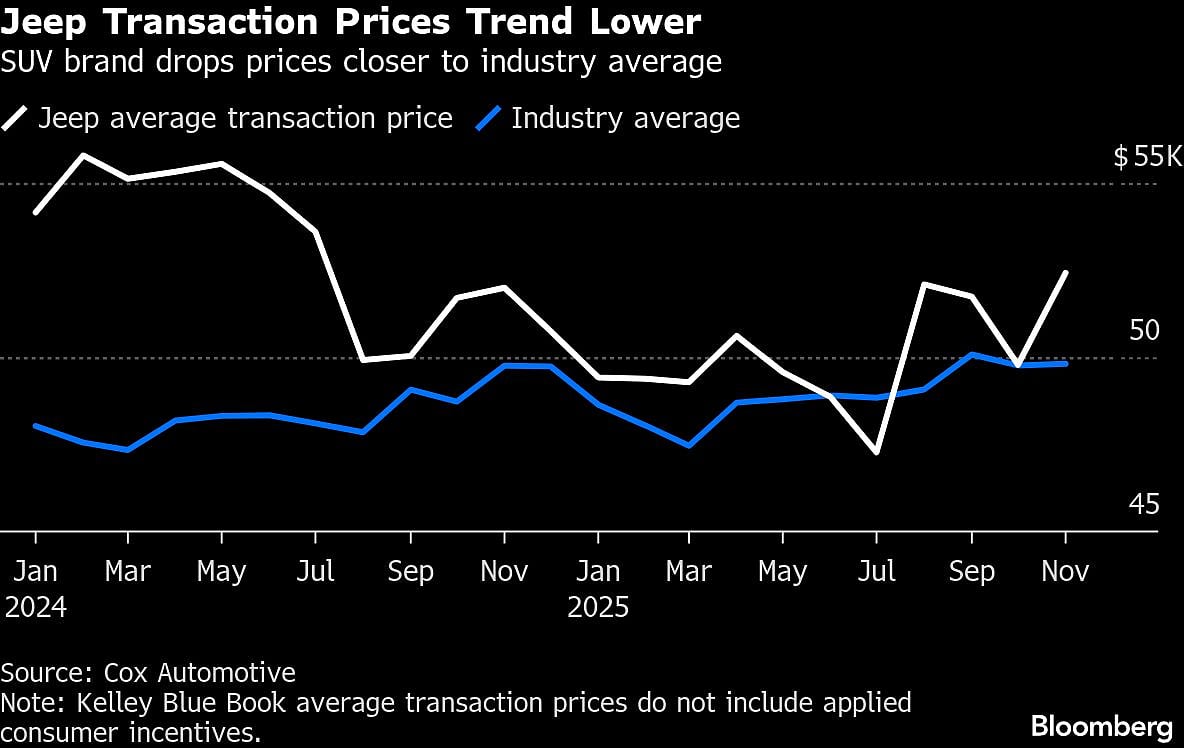

Thus far at least, Jeep is a rare case, with few auto brands lowering sticker prices. Manufacturers keep charging more in part because the Trump administration’s tariffs have raised costs.

Stellantis NV’s Jeep brand is mounting a turnaround bid by cutting prices, an unusual strategy in an increasingly exorbitant US car market.

The quintessential SUV brand has simplified its lineup, offering fewer model iterations and reducing up-charges. Take the Wrangler, for example — Jeep has both trimmed base prices and slashed the cost of configuring its halo vehicle with extra options.

A Wrangler Sport S now starts at $42,495, down $1,350 from the prior model year. Opting for a version with LED lights, all-terrain tires, and a heated steering wheel and seats now sets a customer back roughly another $5,000, instead of almost $9,400 previously.

(Image: Bloomberg)

“We did this on every car,” Bob Broderdorf, Jeep’s chief executive officer, said in an interview. “This is us giving back to the customer the things that make Jeep Jeep.”

While the initial response has been tepid — Jeep’s US sales rose just 1% last year — stabilizing the brand has been a top priority for Stellantis CEO Antonio Filosa. The dramatic decline his predecessor Carlos Tavares presided over was one of the biggest black marks on his record and contributed to his sudden exit just over a year ago.

Thus far at least, Jeep is a rare case, with few auto brands lowering sticker prices. Manufacturers keep charging more in part because the Trump administration’s tariffs have raised costs. But with the average new vehicle hovering near $50,000 — up from around $35,000 only a decade ago — more carmakers will be tempted to relent as industry sales slow.

“Stellantis found out pretty quickly, if we cut costs, cut content and jack up prices for the typical consumer, we lose,” said Erin Keating, an executive analyst at market researcher Cox Automotive. “They have had to do a structural reset simply because the rest of the market was humming along and they were tanking.”

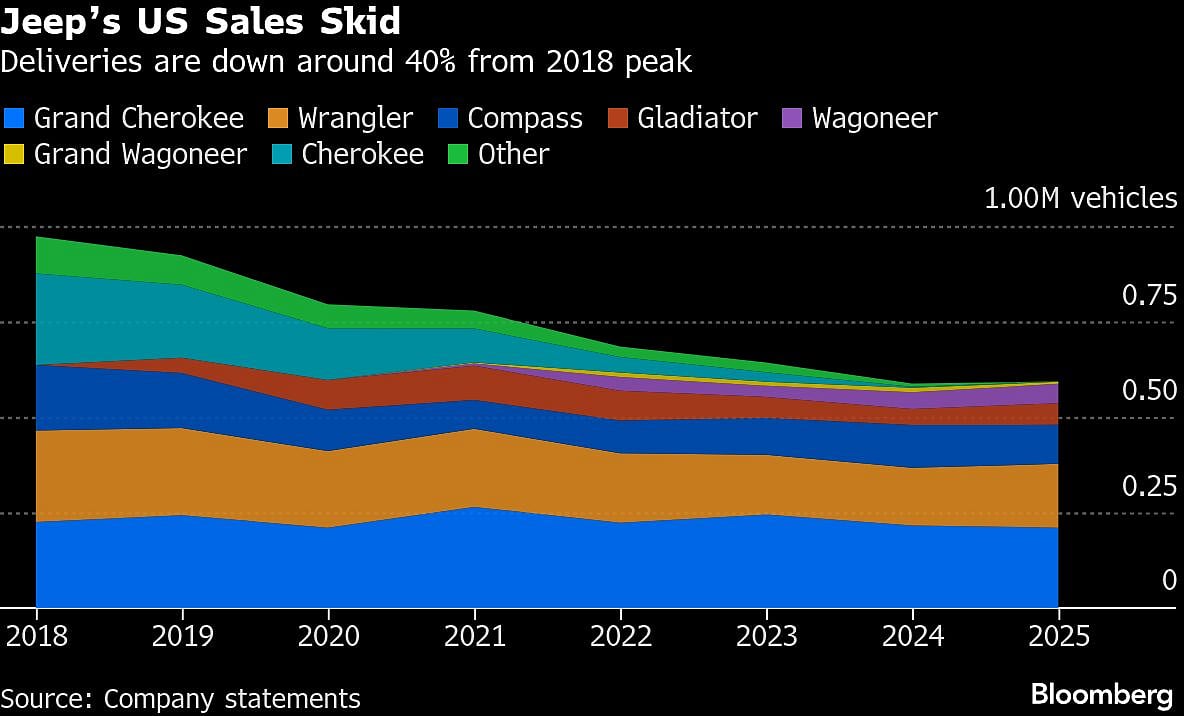

Jeep’s peak in the US coincided with the end of an era for its then-parent, Fiat Chrysler. In 2018, the year longtime Fiat CEO Sergio Marchionne died following complications from surgery, the company sold just shy of 1 million Jeeps in America.

That same year, Ford Motor Co. announced plans to phase out almost all of its passenger car models, tilting its lineup toward sport utility vehicles. The revival of the Bronco and a broader industry influx of higher-margin SUVs steadily chipped away at Jeep’s position.

Questionable product decisions also didn’t help. Jeep discontinued what had been one of its top-sellers, the Cherokee, in 2023. By the following year, Jeep’s US sales had fallen 40%.

(Image: Bloomberg)

Filosa and his team are now racing to undo the damage. Jeep is launching four new or refreshed models over a 12-month stretch, bringing back the Cherokee and popular engines that were scrapped during Tavares’ tenure. A pricing reset that started in 2024 helped dealers clear lots that had been bloated with inventory, and US sales rose each of the last three quarters.

There’s evidence the moves are starting to work. Jeep snapped a six-year losing streak in 2025, with deliveries rising 4% in the fourth quarter, when many other brands were losing momentum.

Carlo Merlo, a Jeep dealer in St. Louis, is jazzed about being able to offer options like Sky Slider, a motorized canvas top for off-roading Wranglers, for much less. This add-on now costs $995, a fifth of what Jeep used to charge.

“These features are the things that excite people,” said Merlo, who’s also vice chair of the Stellantis dealer council. “If it’s too expensive, dealers aren’t gonna order because they know customers just can’t afford them.”

(Image: Bloomberg)

Broderdorf, Jeep’s CEO, is betting the trim-level changes and new configurations can drive both volumes and profits, rather than sacrifice one for the other. Stellantis has little room for error, having forecast a low-single digit adjusted operating income margin for the second half of 2025.

The company also confirmed Friday it’s phasing out plug-in hybrid versions of Jeep and Chrysler models in North America, some of which have been plagued by recalls over fire risks. For the 2026 model year, Stellantis will focus on hybrids and range-extended EVs, or EREVs, which have an on-board gas generator to recharge the battery.

Jeep still has a long way back to its heydays. Its share of the SUV market dropped to 5.6% last year, the lowest since at least 2002 and down from a peak of 13.4% in 2016, according to auto-market researcher Edmunds.

But the changes at Jeep, and new product from Ram — including the return of performance-tuned TRX muscle trucks — has renewed optimism among Stellantis dealers like Kevin Farrish.

“It’s been a tough couple of years,” said Farrish, who owns a Chrysler, Dodge, Jeep and Ram store near Washington, DC. “Comparatively, we’re expecting a much better 2026.”