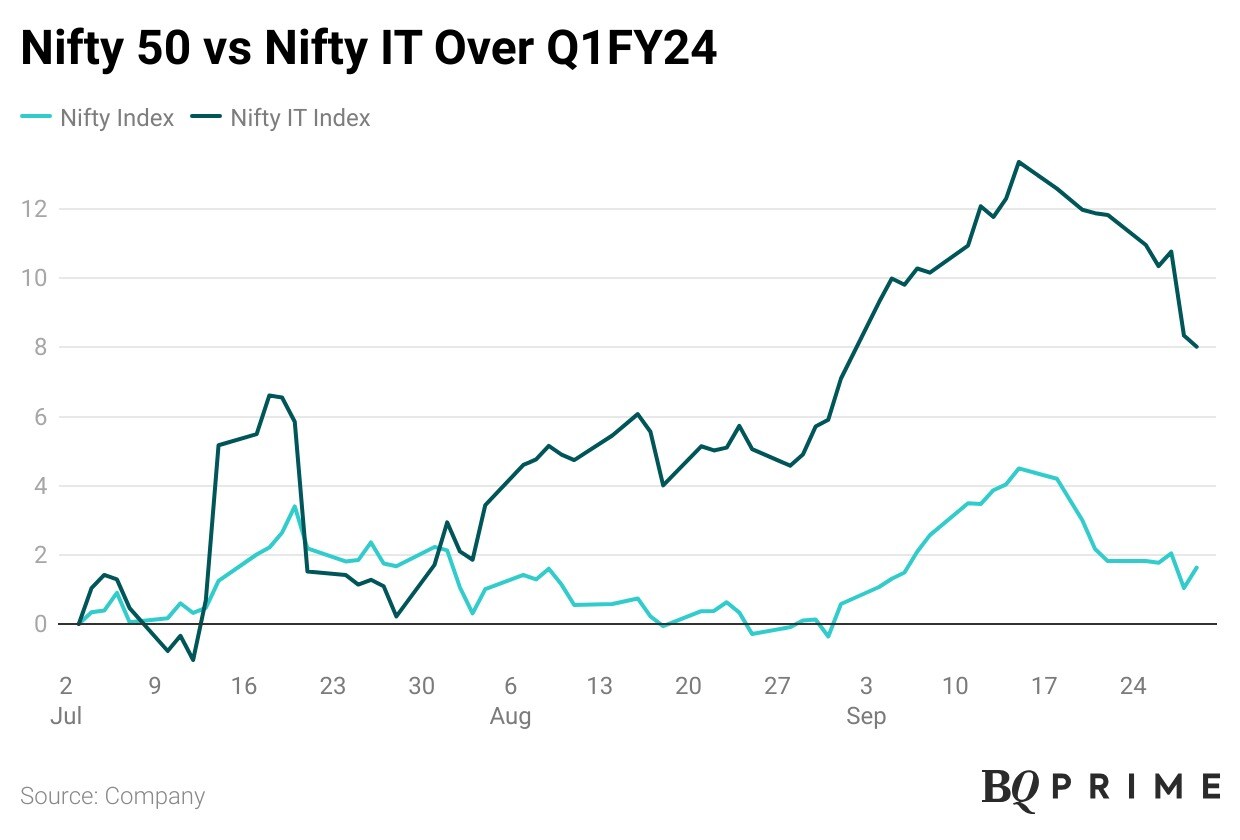

A gauge of information-technology stocks beat the benchmark in July–September. That outperformance is in no way an indicator of how India's top-tier IT firms performed over the same time.

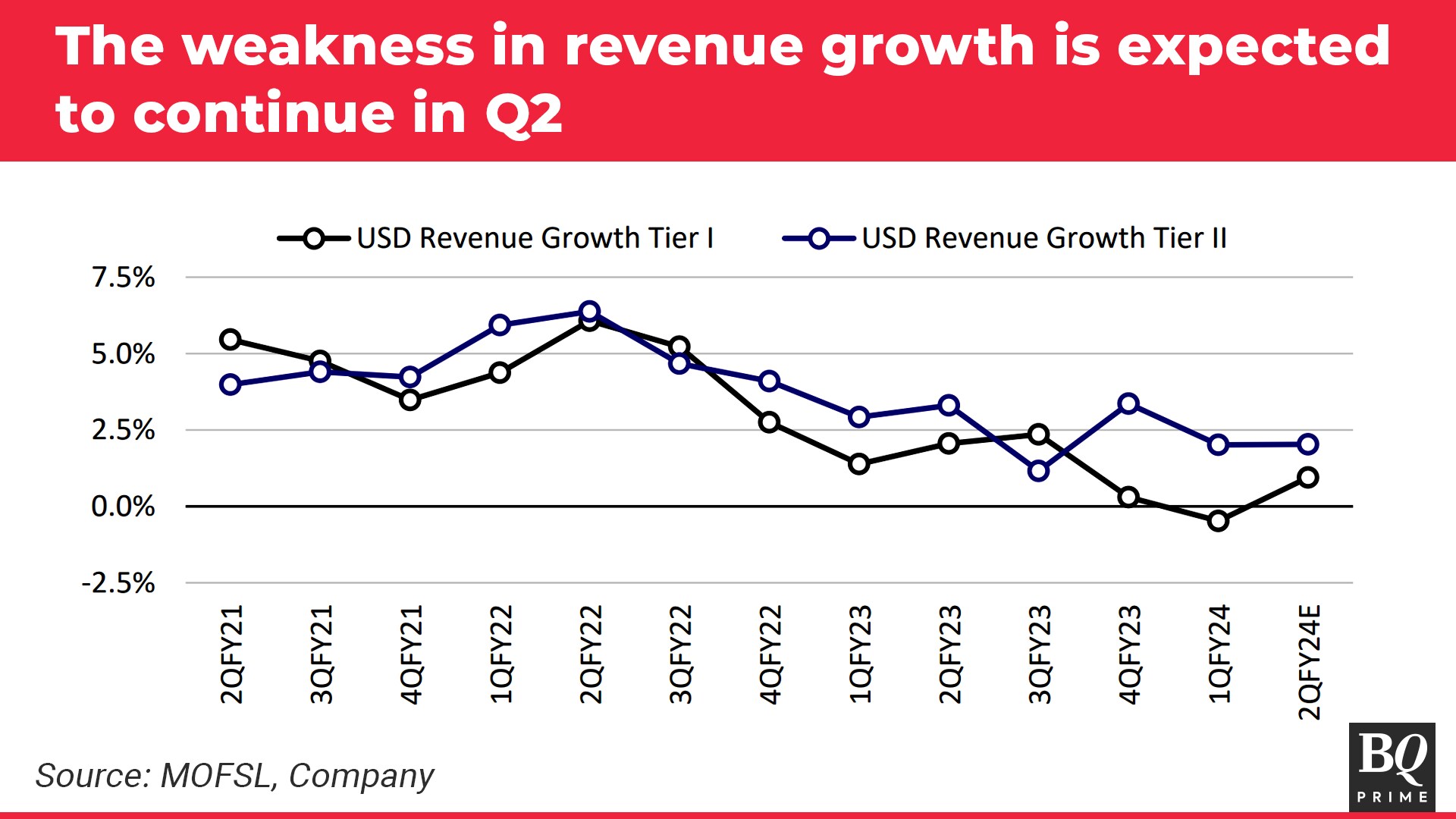

Growth in India's $250 billion IT services industry likely remained weak in the three months ended Sept. 30, as macroeconomic headwinds in their biggest market continued to weigh on discretionary spending, according to analysts. Granted, there were several large deals signed during the quarter, but they were spread over several years. Snap returns from short-term projects are still hard to come by.

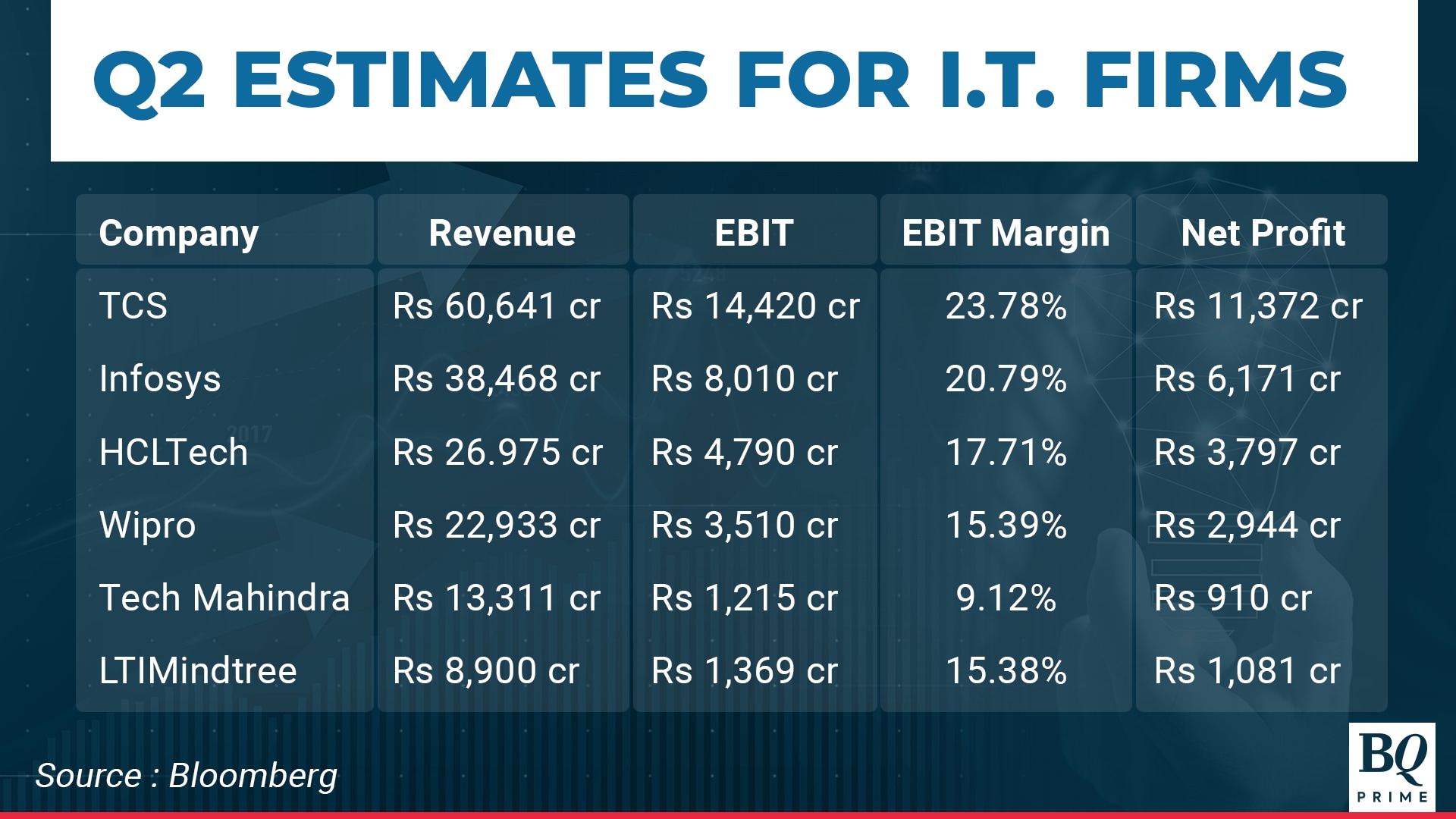

“While the industry has witnessed an uptick in order inflow over the past two months with a focus on cost efficiency, the slowdown in project-based business is expected to hamper overall industry growth, even though Q2 is traditionally a robust season for the sector,” Mukul Garg, research analyst at Motilal Oswal Financial Services Ltd., said in a research report. “Our IT coverage universe should report a median revenue growth of 1.5% QoQ in Q2 FY24. This growth rate is among the slowest observed over the last decade, despite a marginal impact from forex fluctuations.”

Nirmal Bang, another Mumbai-based brokerage, agreed with the assessment.

“The market believes that after two successive quarters of weak results, demand has likely stabilised and we could see modest growth in Q2 FY24 and Q3 FY24,” the brokerage said in an Oct. 2 research report. “We are building in (-)1-2% growth on a QoQ basis for Tier-I and 2-3% growth for Tier-II companies in Q2, which is seasonally a strong quarter.”

Moreover, Accenture Plc's latest guidance paints a murkier picture for Indian IT. The world's largest IT firm expects its revenue to grow at 2-5% in the fiscal ending Sept. 30, 2024, as opposed to a previously estimated 4.6%, pointing to a “slower for longer” demand.

Effectively, the weakness seen in the April-June quarter is likely to persist across the board with no meaningful signs of recovery or deterioration.

Margin Outlook

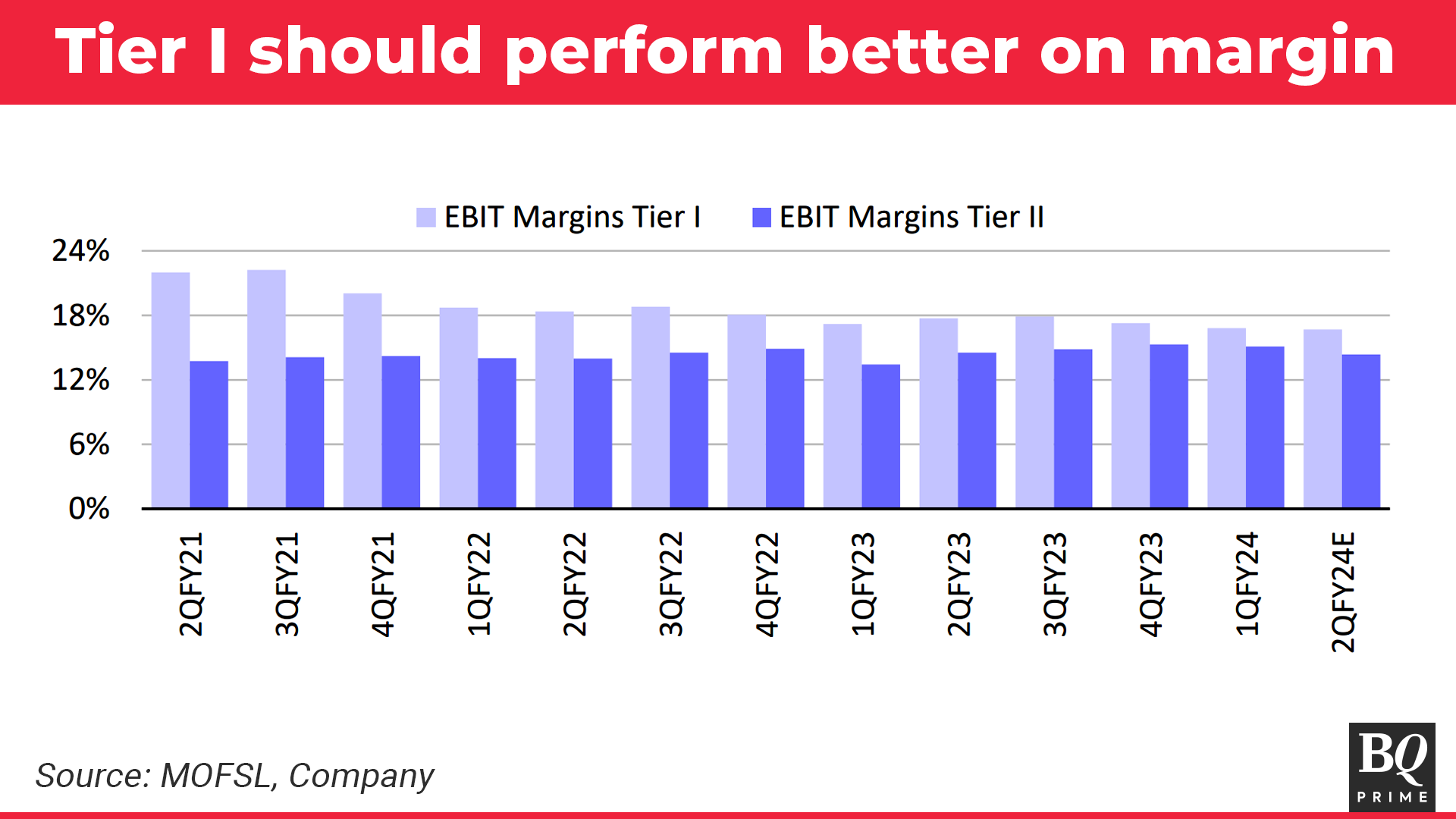

While growth continues to be a challenge, Indian IT firms likely delivered on operational profitability in July–September, given the singular focus on cost control.

A margin recovery is anticipated across the board following the completion of wage hikes in the April-June quarter, according to Motilal Oswal. Additionally, a few top-tier companies have postponed their wage hike cycles, which should buoy margins in the near term. Lower net employee additions is yet another positive—companies currently possess sufficient talent to sustain incremental growth. Their focus has now shifted towards optimising bench strength to enhance efficiency.

“Tier-I companies should report margin change to the tune of -100 basis points to +90 bps QoQ in Q2. Similarly, the Tier-II pack should see margin change in a wider band of -260 bps to +180 bps QoQ,” Motilal Oswal said.

DAM Capital concurred.

“We anticipate aggregate margins for our coverage to inch up 30 bps sequentially. This should be led by deferment of wage hikes by a few companies, higher utilisation levels, and operating efficiencies,” DAM Capital analysts Anmol Garg and Vivek Doshi said in an Oct. 3 report. “We also anticipate a reduction in the street's FY24 margin estimates as deal ramp-ups and the impact of wage hikes could have strong headwinds in Q3 FY24.”

Nirmal Bang was more circumspect with its margin call.

“Margin improvement QoQ may be constrained due to a lack of operating leverage,” stated the brokerage. “Some negative surprises are likely in store and another consensus earnings downgrade is on the cards after two successive quarters. We believe the market has not priced that in or is looking beyond the near-term pain.”

Deal Dynamics

Large deals, the likes of TCS-NEST UK and HCLTech-Verizon struck during the September quarter, aren't that big a deal. Such multibillion-dollar wins are unlikely to meaningfully show in the topline, as they will unravel over several years. What Indian IT firms badly need are shorter projects that'll convert into revenue faster.

That's still not happening.

While digital transformation services—a rising tide that lifted all Indian IT companies during the pandemic—will continue to remain a key theme over the medium term, spending by enterprise clients in the US remains curtailed by macroeconomic headwinds stemming from interest rate hikes and sticky inflation. Sectors such as banking and financial services, retail, hi-tech, and communication continue to show signs of softness.

“The growth for BFSI and retail has joined a negative territory with a 1.2% and 0.4% decline in Q1. We expect these two verticals to remain weak in Q2,” Motilal Oswal said. “Additionally, manufacturing joined the weaker growth trajectory with 1.0% QoQ median growth in Q1, affecting specific companies within the sector.”

Moreover, there are no signs of demand recovery in the key geographies of the US and Europe. The majority of clients are maintaining caution and pausing contracts that are non-critical to them. The adverse macro environment is blurring the near-term visibility of recovery and the resumption of discretionary spending.

Worse still, DAM Capital sees deferment of previously signed discretionary projects.

“It is expected that Q2 FY24 would present challenges for most companies, following an already subdued Q1,” the brokerage stated in its report. “(But) despite the overall muted growth performance, deal wins have remained robust, with these new wins translating into revenue generation.”

Slower For Longer

The threat of a shallow recession in the US, as well as Accenture's disappointing guidance, indicate that the pains for India's IT sector will persist well into the next fiscal.

“Accelerated normalisation of monetary policy in the US raises probabilities of a shallow recession and, consequently, high probability of negative surprises on the fundamental side over the next 12 months,” Nirmal Bang said in its research report. “We believe consensus is underestimating growth and margin risks in FY25, as it did in FY24.”

Even if one were to ignore the risks over the next 12–18 months and take a five-year view, Nirmal Bang believes that the valuations are expensive and can at best deliver mid- to high single-digit returns.

“We believe that dollar revenue growth over a five-year period (FY23–28) for the Tier-I set will at best be at par with the FY15–20 period at about 7%,” Nirmal Bang stated. “We also expect margins for most companies to remain in a narrow band at around FY24 levels and not see a material expansion.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.