HDFC Bank Ltd., which stayed away from large corporate loans in the previous investment cycle starting 2009, sees room to increase lending to corporations as a new public-sector led investment cycle starts to kick-in.

The bank, which has among the lowest proportion of bad loans across the industry, sees an opportunity to lend to state-owned companies which are being pushed to increase investments in the absence of large private sector spending. At the same time, an increase in foreign direct investment from multinational firms could create opportunities for local lending, K Balasubramanian of HDFC Bank told BloombergQuint last week. Balasubramanian joined HDFC Bank as Group Head – Corporate Banking in April this year after a 20-year stint with Citibank.

Both sets of companies would typically have strong credit ratings and, hence, a lower risk of default.

“This time around the next level of big bang capex will come first from the public sector and then the private sector. This will create opportunities to lend,” Balasubramanian said.

Public sector spending should pick up in the next 12 months or so. The government has asked these firms to look at long-term projects for capacity creation. We are seeing movement in the refinery, petrochemical and fertiliser segments.K Balasubramanian, Group Head - Corporate Banking, HDFC Bank

Projects are also being structured in a more viable manner now which makes them “bankable,” he added.

Other sectors where lending opportunities may emerge include the roads sector where the government has set a target of building 25,000 kilometres in highways in fiscal 2017. Banks are “dying” to lend to road projects where contractors and lenders have been ring-fenced from risks such as delays in land acquisitions, said Balasubramanian.

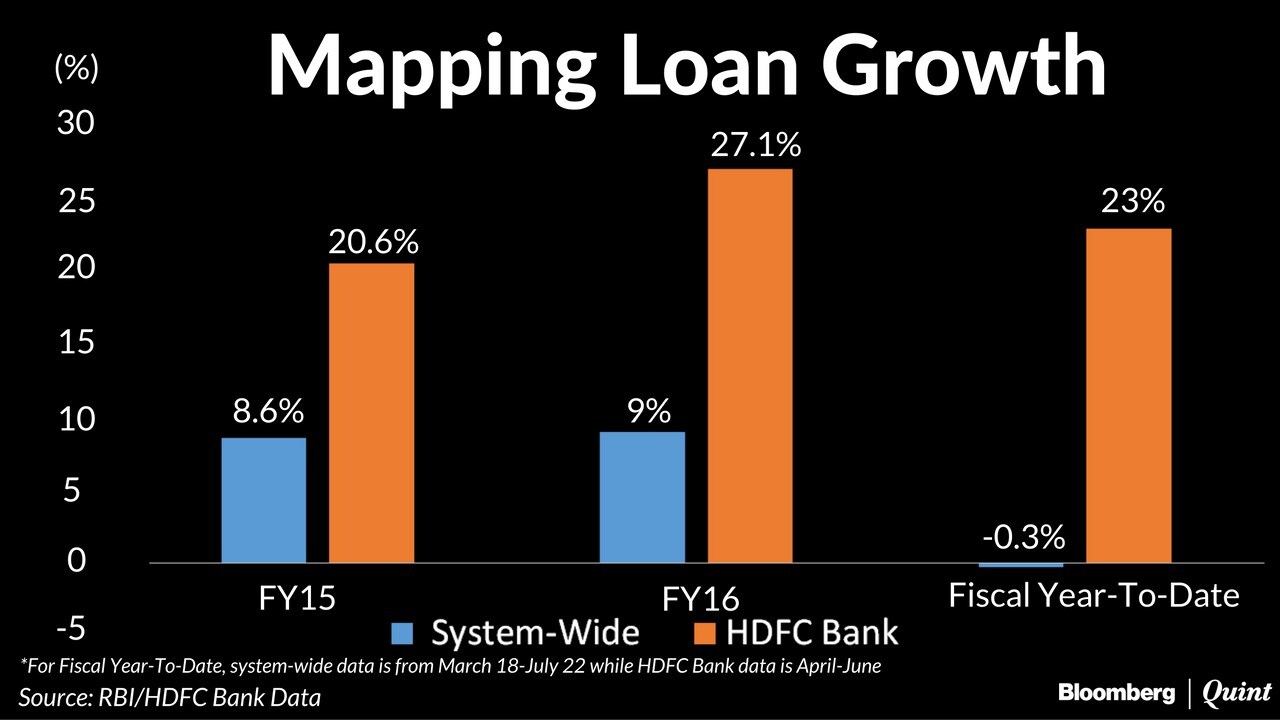

Bank credit growth has remained tepid for the last two fiscal years as leveraged firms stayed away from fresh investments and lenders remained reluctant to lend.

Non-food bank credit grew 9 percent in fiscal year 2016 after a growth of 8.6 percent in fiscal year 2015, according to data from the Reserve Bank of India. Credit to industry grew at just 2.7 percent in fiscal 2016 compared to 5.6 percent in the previous year. The picture this year seems similar. Between March 18 and July 22, non-food bank credit has contracted by 0.3 percent while credit to industry has fallen 3.4 percent.

HDFC Bank has grown faster than the system. In the June quarter, the bank's loan book grew 23 percent while its wholesale lending book grew 24.5 percent. The bank reports its consolidated wholesale lending loan book which includes working capital loans. It does not separately disclose the size of its term lending portfolio.

Apart from lending to public sector firms, HDFC Bank also sees an opportunity in lending to local operations of multinational firms.

Multinationals is another segment where we are seeing lots of action. FDI flows have picked up and along with the FDI flows there is need for working capital and term financing, which we are participating in. There are lots of discussions happening on the multinational side on trying to provide structured financing and that is something we have been participating in.K Balasubramanian, Group Head - Corporate Banking, HDFC Bank

Analysts who track the bank said that while the bank may opportunistically increase lending to some corporates, the mix between retail and wholesale lending may not shift significantly. They also expect the bank to pick and choose clients in a manner that doesn't compromise lending margins.

“Lending to public sector enterprises and multinationals is perceived to be much safer, so it's not a big risk if they are increasing their exposure,”said Siddharth Purohit, an analyst at Angel Broking. “At the same time, if you pick only the high rated corporates, then yield may not be too high. So they will have to pick and choose carefully.

A Shifting Market

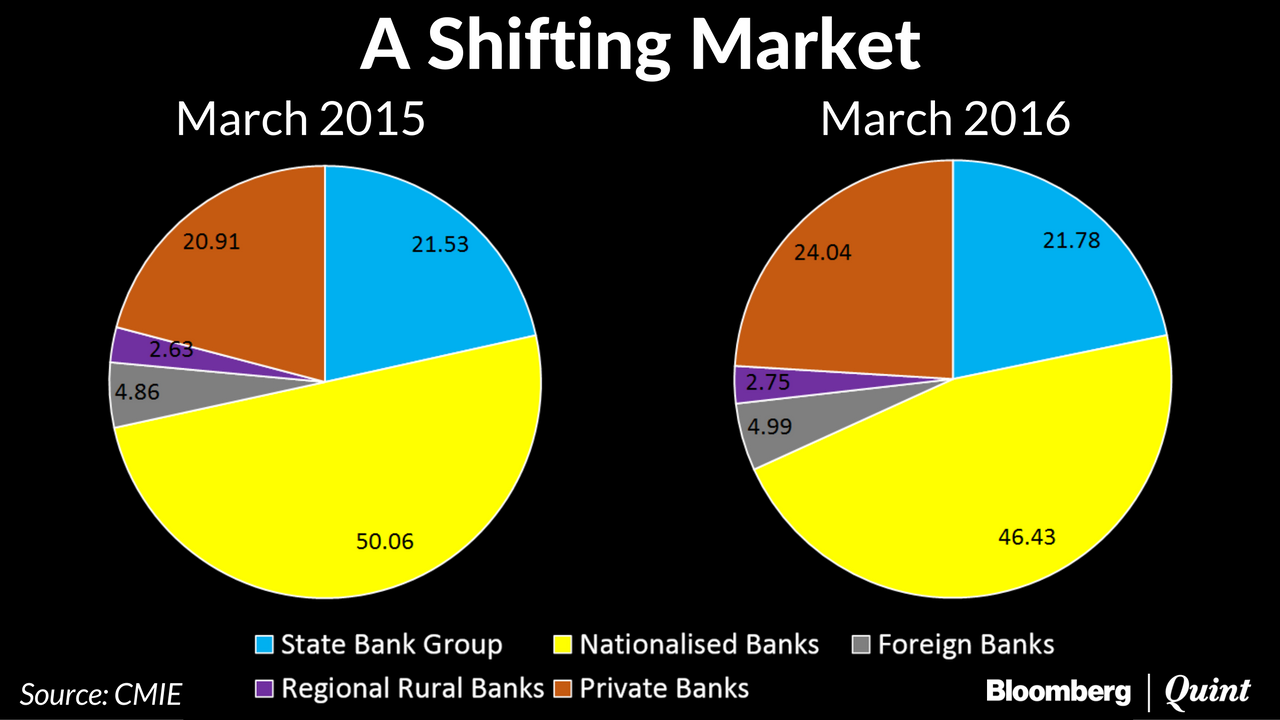

What is allowing HDFC Bank to expand its corporate loan book is the shift taking place in the banking market where a number of banks are saddled with a large proportion of bad loans. This, in turn, is limiting their capacity to lend.

Total stressed assets across the banking sector stood at 11.5 percent of total loans as on March 2016. For public sector banks, this proportion was higher at 14.5 percent. With many of these banks also strapped for capital, growth has taken a back seat.

Nationalised banks, excluding State Bank of India and its associate banks, have lost nearly four percentage points in market share in the past year alone, data from the Center for Monitoring India Economy (CMIE) shows.

At the same time, foreign banks, particularly European lenders, have restricted growth due to increased regulatory capital requirements in their home markets. This leaves room for well-capitalised lenders like HDFC Bank to come in and grab market share.

Both public sector banks and multinational banks have their own problems. Public sector banks have huge bad loans and the international banks are scaling back due to global compulsions. That leaves us a nice space into which we can expand.K Balasubramanian, Group Head - Corporate Banking, HDFC Bank

Bagging The No. 1 Spot

HDFC Bank's counter-cylical growth comes at a time when rival ICICI Bank Ltd. has turned cautious on corporate lending even though it continues to see strong growth in retail loans.

ICICI Bank's domestic advances grew 17 percent during the quarter ended June 30, 2016 compared to the 23 percent growth reported by HDFC Bank. For the two lenders, which were running neck-to-neck in terms of asset size, this has meant a change in the pecking order.

For the first time in the June quarter, HDFC Bank overtook ICICI Bank in terms of total assets. HDFC Bank had total assets of Rs 7.55 lakh crore at the end of June compared to the Rs 7.27 lakh crore reported by ICICI Bank. For a like-to-like comparison, ICICI Bank's standalone asset base is being considered.

Analysts, however, said this may be temporary as ICICI Bank has strong relationships in place to ramp up corporate lending if the private sector investment cycle picks up.

“ICICI Bank has a strong project funding background. They can choose to grow aggressively once they have made the necessary adjustments on their corporate loan book,” said Purohit while adding that markets are more focussed on HDFC Bank's return on equity rather than the size of its asset base.

Bond Markets Vs Banks

Over the medium term, what may hurt ICICI Bank and HDFC Bank alike is the attempt to move large corporate borrowings towards the bond markets and away from banks. In August, the Reserve Bank of India released new norms which will push large borrowers to source at least half their incremental debt needs from the bond markets.

Starting April 1, 2017, anyone with bank loans of more than Rs 25,000 crore will fall in this category of large borrowers. If these companies continue to borrow from banks, banks will have to provision more and assign a higher risk weight to such borrowings, which will add to the cost.

This may reduce the corporate loan demand being directed to banks. Banks have already ceded market share to the debt markets over the past two years. According to a January report from research house Ambit Capital, Indian banks have lost nearly 5 percentage points in market share to the bond market over the past two years as bond markets have transmitted lower interest rates much quicker than banks.

Balasubramanian acknowledged that this will have some impact on bank credit growth.

“This will bring down the risk that the banking system carrier. The deadline, however, may be challenging unless you develop the investor base alongside,” he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.