Analysts cut target prices for Ipca Laboratories Ltd. after the third quarter, citing cost pressures and reduced business in sartans used to treat high blood pressure, prevent heart attack and stroke. That weighed on the investor sentiment.

The drugmaker's net profit missed estimates in the quarter ended December, and margin contracted.

Q3 FY22 Highlights (Consolidated, YoY)

Net profit down 26% at Rs 197 crore, compared with the Bloomberg consensus estimate of Rs 226 crore.

Revenue up 1.4% at Rs 1,430.5 crore, against the Rs 1,458-crore forecast.

Total costs up 7.6% at Rs 1,182.7 crore.

Other income down 16% at Rs 12.9 crore.

Ebitda stood at Rs 311 crore.

Ebitda margin contracted to 21.5% from 26.5%.

The active pharmaceutical ingredient segment contributed Rs 309.4 crore to the total revenue in Q3 FY22, a 12% decline over the year earlier. Domestic formulations business rose 23%, while exports formations rose 4% year-on-year.

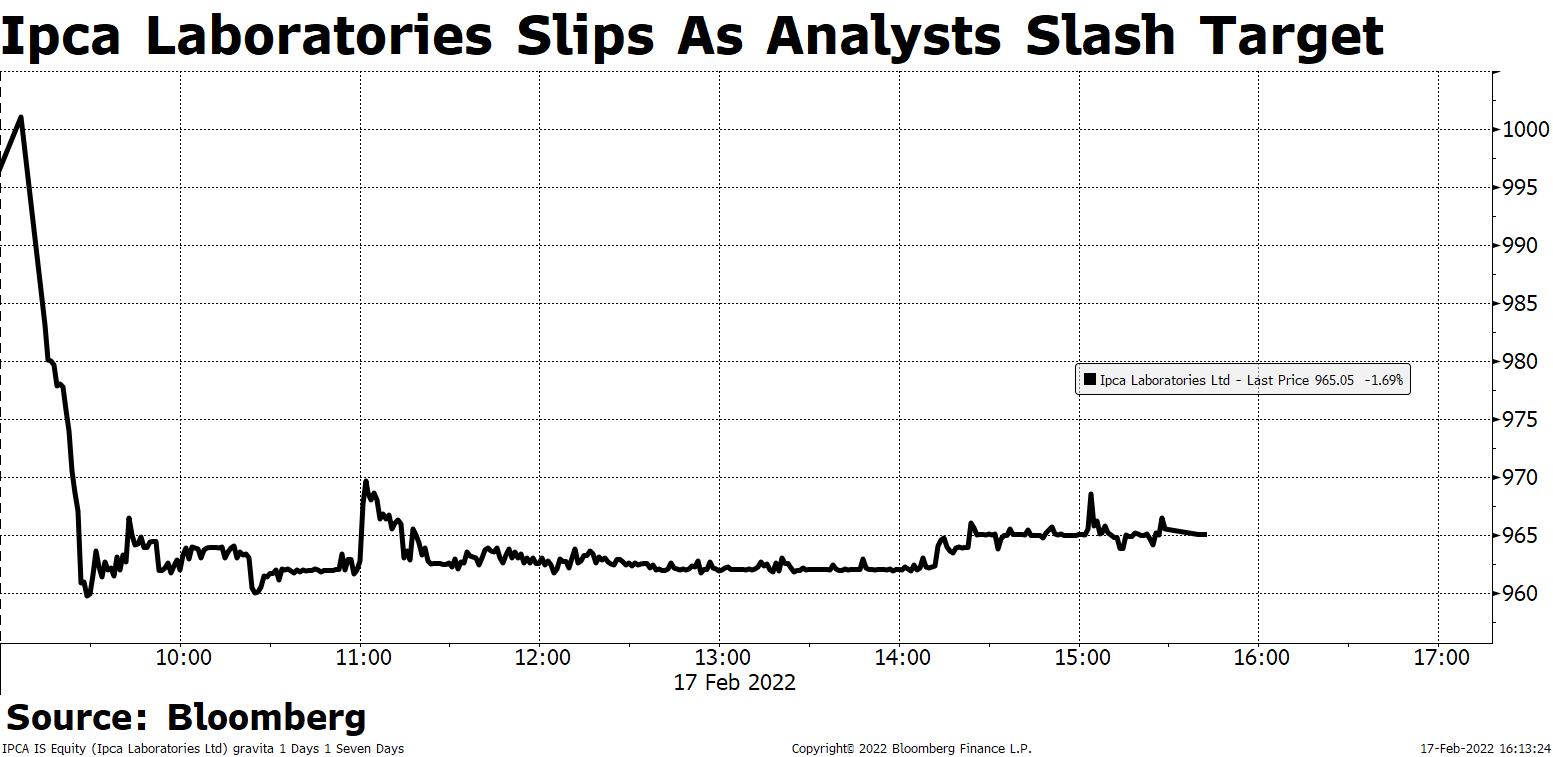

Shares of Ipca fell as much as 2.7% intraday, and closed 1.69% down at Rs 965.05 on Thursday. Of the 25 analysts tracking the drugmaker, 21 recommend a 'buy' and four suggest a 'hold', according to Bloomberg data. The 12-month consensus price target implies an upside of 23.7%.

Here's what brokerages made of Ipca Labs' Q3 FY22 results...

Nomura

Upgrades to 'buy' from 'neutral' on favourable valuation, but slashes target from Rs 2,375 to Rs 1,194—still implying a 21.63% upside.

Improved product mix supported gross margin in Q3, while domestic formulation and API sales exceeded expectations.

Domestic sales are materially higher than pre-Covid growth trends and the company is gaining significant market share in key molecules.

The company could leverage its brand strength and physician connect to expand its portfolio and reduce concentration risk over time.

Domestic price increases and easing of inflationary pressure could likely led to improvement in Ebitda margin.

Not yet factored in the impact from the acquisition of Lyka Labs.

Key Risks: Slower-than-estimated growth in India and higher-than-estimated cost pressures.

Jefferies

Reiterates 'buy' but cuts target price to Rs 1,151.38 from Rs 1,256.99—still an implied return of 16.41%.

High opex and lower sales weighed on margins in Q3.

Growth primarily led by domestic businesses, especially formulations and API segments.

Sartan issue that expectedly hit the API export could persist, with normalisation expected only from Q1 FY23.

The company continues to show strength in domestic franchise led by its pain segment.

The company trades cheap at 18.5x FY24 EPS versus the sector at 21.5x.

Motilal Oswal

Retains 'buy' but lowers target price to Rs 1,190 from Rs 1,325—an implied return of 20.32%.

Domestic formulation segment remains an outperformer.

Reduced business in Sartan and muted business in the U.K. offset the robust performance in domestic formulation segment.

Cuts EPS estimates by 11%, 10% and 10% for FY22, FY23 and FY24, respectively, to account for the recovery in Losartan offtake, delay in approvals in the U.K., high raw material costs and increased logistics costs.

The company continues to outperform in domestic formulations segment with steady market share gains in key therapies.

Emkay

Retains 'hold' with the price target cut to Rs 1,060 from Rs 1,120; an implied return of 7.17%.

Awaits more clarity on input cost trends and revenue growth trajectory.

Lowers FY22E EPS by 5% to reflect the Q3 miss.

Trims FY23E/FY24E EPS by 4%/3%.

Q3 miss was driven by lower-than-expected revenues and higher raw material costs, along with higher power, fuel and logistics costs.

Lingering uncertainty on RM cost pressures, demand softness in Europe and sartan-relates issues are some of the key challenges while more clarity is awaited on U.S. FDA inspection timeline.

Edelweiss

Reiterates 'buy' with the target slashed to Rs 1,220 from Rs 1,265; an implied return of 23.35%.

Near-term challenges like slow recovery in UK, shrinking API margins, higher raw material, power and freight cost are making long-term growth prospects aided by API leadership, domestic strength, cost optimisation.

Expects domestic outperformance to ease gross margin pressure.

Reduces FY23 EPS by 6% to factor in elevated opex and salesforce expansion.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.