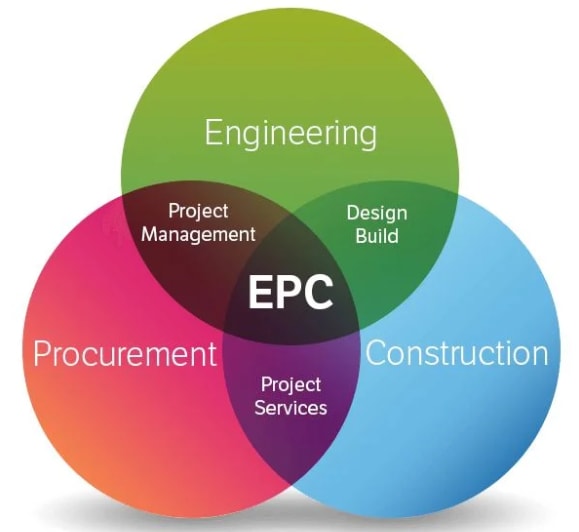

The Indian government has introduced a new rule for the engineering, procurement and construction (EPC) sector to make infrastructure projects stronger and more reliable. This rule changes how companies bid for projects like roads and bridges.

The Ministry of Road Transport Highways requires companies bidding much lower than the project's estimated cost to pay a higher additional performance security upfront. APS is extra money contractors must deposit to prove they can complete the project.

Earlier, APS was limited to 3% of the project cost, but that limit is gone. The goal is to ensure only serious and financially strong companies win bids, reducing poor-quality work.

Why Does This Matter?

Have you seen roads or bridges fall apart soon after they're built? Think of how many roads, bridges or infrastructure projects you have noticed disintegrate within a few months of their completion. Does it make you ponder about the poor quality, the extended deadlines and more importantly prompt you to question the right usage of taxpayer's money? Then this new rule could potentially bring a much needed change as it aims to fix this by ensuring companies don't cut corners to win bids.

EPC companies play a huge role in how India's infrastructure is being built in today's modern world. Right from the roads you use, to metro tracks, bus terminals, renewable energy parks, ports, electricity lines, the underground pipelines and a lot more, are all taken care of by many big and small EPC companies.

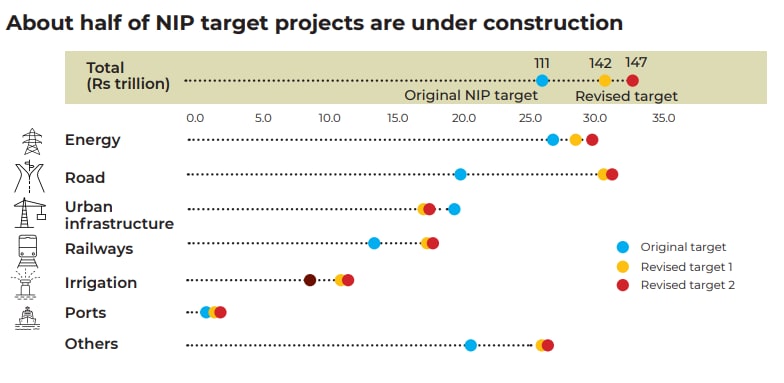

And just to add a layer of importance, the construction sector alone contributes about 8-9% to the total GDP of India. Plus, with the government increasing its focus on public infrastructure given the country's expanding population and formal economy, EPC is more than just a dry corner. In fact, according to a report by Edelweiss Alternatives, the government aims to channel substantial investments amounting to Rs 147 lakh crore into India's infrastructure over five years with EPC playing a pivotal part.

Source: Edelweiss Alternatives

How Does The EPC Model Work?

With India's fast-pace expansion, it is practically impossible for the government to micro-manage multiple projects and their complex processes all by themselves. Therefore, via the EPC route, the government signs contracts with private players that take care of projects, end-to-end, for a fixed amount and timeline and the cost of delays solely falls on the contractor.

Challenges For EPC Companies

(Source: C Dustin/ Unsplash)

Running an EPC company is no easy feat, with hurdles that test even the toughest players. The need for hefty upfront capital to cover materials, labour, and machinery before clients pay a dime puts immense pressure on cash flow.

Qualifying for tenders is a constant battle, as companies must secure a robust order book while facing fierce competition, where the lowest bidder often wins. This makes the industry cut-throat.

Delays from land acquisitions or navigating a maze of regulatory approvals can stall mega projects, adding to the strain. Smaller firms struggle even more, grappling with workforce management, geographical challenges, and supply chain disruptions. That's why giants like Larsen & Toubro dominate, leaving little space for smaller players.

To stay in the game, companies often slash their bids to razor-thin margins, especially when government tenders dry up, risking quality just to survive.

These challenges push companies to bid low to win contracts, sometimes leading to poor-quality work.

Why The New Rule Helps

The government changed the rule because low bids often lead to poor projects. By asking for higher APS, the ministry ensures companies are financially strong and committed. This could mean better roads, bridges, and other infrastructure, saving money and improving reliability in the long run.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.