Homebuyers are seeking larger, more luxurious living spaces as sustained economic growth boosts income levels.

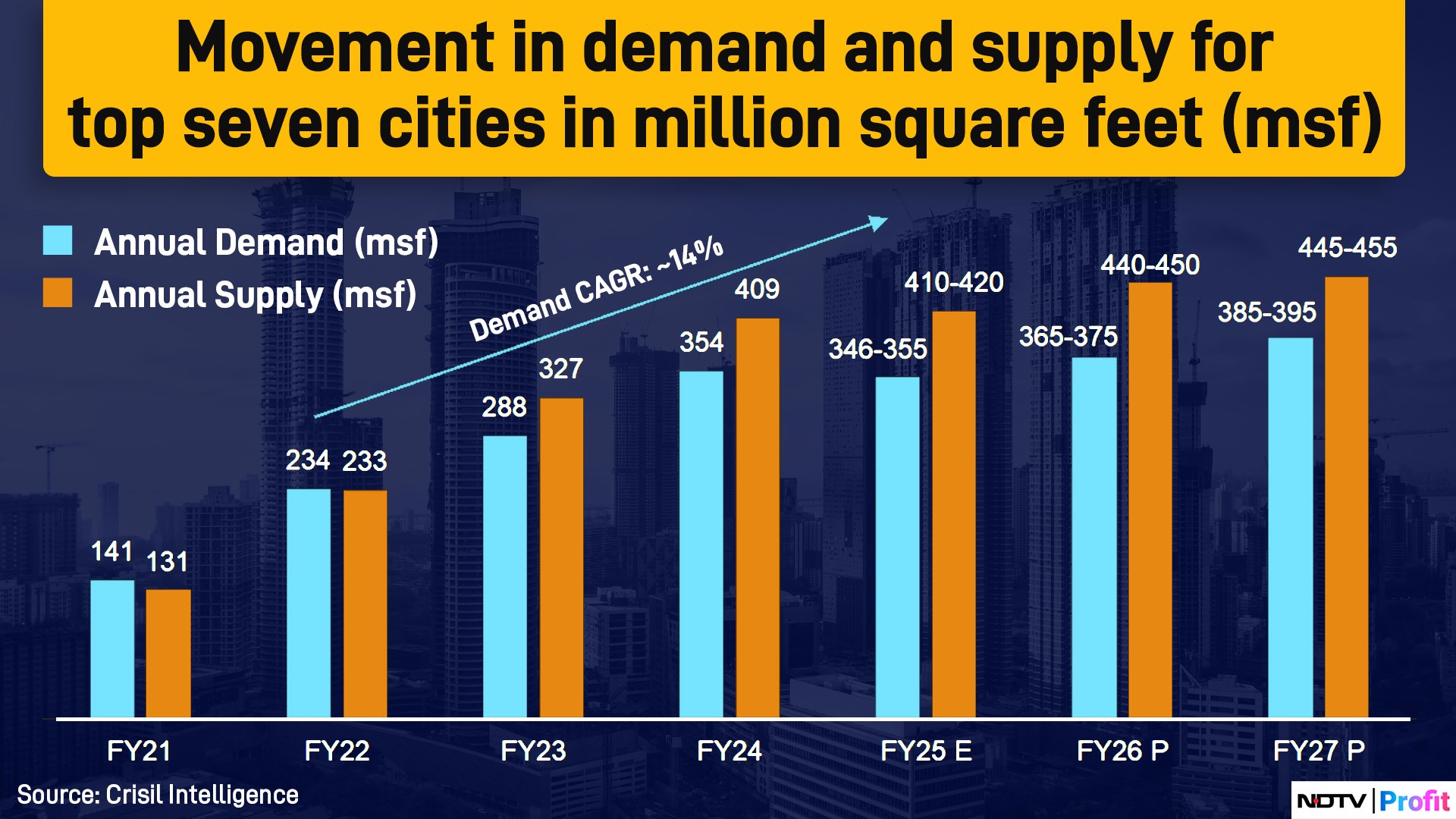

Residential property sales logged a compound annual growth rate of 26% over last three fiscals, riding on a CAGR of 14% in demand, with the balance being supported by an increase in realisations, led by a rise in capital values and increased share of premium and luxury segment in sales.

Building on the sharp post-pandemic recovery, residential real-estate sales in the top seven cities are expected to grow 10–12% this fiscal and the next, driven by demand (volume) growth of 5–7%, supported by sustained economic growth and improving affordability due to lower interest rates, and stabilised pricing growth of 4–6%.

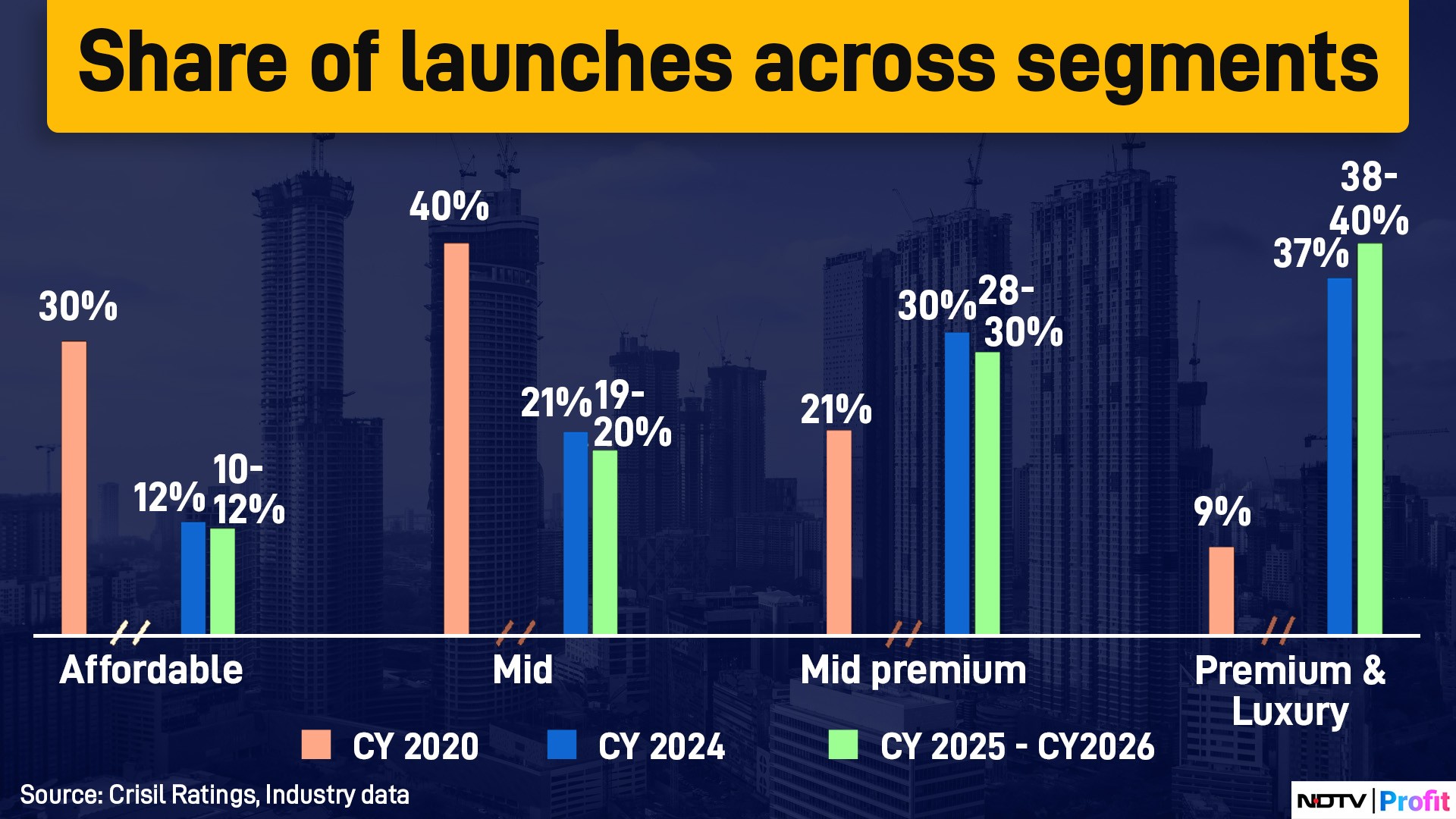

Anticipating continued demand for premium and luxury housing in the top seven cities, developers have recalibrated their launch pipelines. Resultantly, premium and luxury segment's share in total launches increased from 9% in calendar year 2020 to 37% in calendar year 2024 and is expected to rise further to 38-40% in calendar years 2025 and 2026.

In contrast, the affordable and mid-segments are likely to account for only 10-12% and 19-20%, respectively. This represents a steep decline from 30% and 40%, respectively, in calendar year 2020. Rising land and raw material costs have rendered these segments less viable for developers, leading to a shift in focus towards the more lucrative premium and luxury segment.

That said, the government's push for affordable housing through initiatives such as Pradhan Mantri Awas Yojana is expected to continue and will support the affordable segment over the medium term.

Residential real estate segment has also witnessed strong equity inflows, as reflected in the surge in qualified-institutional-placement volume for the Crisil Ratings-rated sample of 75 realty companies.

Notably, their QIP proceeds as a percentage of outstanding debt jumped to 24% last fiscal from 13-16% in the preceding three fiscals. Higher equity inflows, along with robust collections over last three fiscals, have helped developers significantly deleverage their balance sheets.

Accordingly, debt to cash flow from operations for the sample improved considerably to 1.2-1.4 times last fiscal from 5.6 times in fiscal 2020 and will improve further to 1.1-1.3 times over this and next fiscal.

To reiterate, demand for the premium and luxury housing will continue to grow, albeit moderately on an already high base.

The real estate industry's strong post-pandemic performance has put it on a firmer footing, as developers' prudent management of leverage has enhanced the sector's overall stability.

That said, the ability of developers to maintain moderate leverage in the face of their substantial launch pipeline will bear watching.

Gautam Shahi is a director of Crisil Ratings.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.