Lack of proper storage facilities can prevent renewables from becoming an alternative power source as India speeds towards an energy deficit, according to Priyankar Biswas of Nomura.

It is unlikely that the power scarcity can be made up from alternative sources, Biswas, vice president of equity research at Nomura, told BQ Prime's Niraj Shah.

According to him, India doesn't have the right kind of storage for peak power saving. “While we are adding renewables quite significantly, we do have storage issues."

India needs to speed up thermal power production to stay afloat, given the scarcity that may disrupt the nation two years down the line, Biswas said.

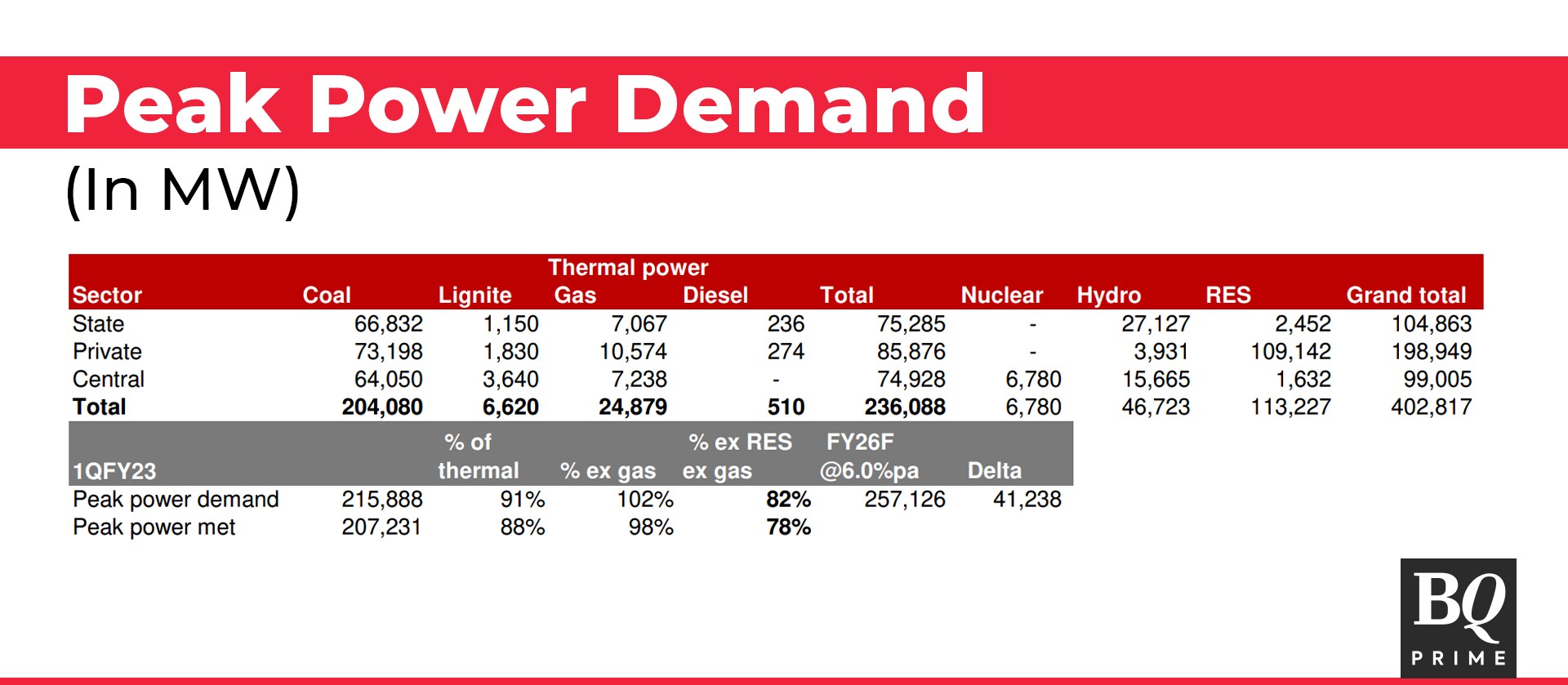

Current thermal power plants of about 27.6 gigawatt—that are under construction—may not suffice to keep the deficit in check over the next two to three years, Nomura said in a Sept.1 report. “We are using at the peak power demand level. We are already using up 82% of the base load power," Biswas said.

Considering thermal power on a standalone basis, India is already close to 100%, he said. If the current levels of demand growth continues—which is 5.5% to 6% on average—then India will face a power deficit after one or two years.

If optimal power conditions are maintained, the country can power through fiscal 2024. Additional incremental tendering, between 15 GW to 20 GW in the next three to four years, is required, Biswas said. In the near term—one to two years—at least 9 GW of tenders could be possible.

While it may not address peak power demand, it can prevent the power crisis from lasting longer, he said.

Source: Nomura

Towards Fuel Flexibility

With a discount of almost 12% on the cost, companies are shifting towards fuel flexibility so that they can use both natural gas as well as propane and LPG.

Biswas said liquefied petroleum gas and propane prices are "a lot more" cheaper than natural gas.

"Spot prices of LNG are quite high. Even the contracted LNG prices have moved up. In most of the cases, it is not really viable to run operations with natural gas."

In the recent quarterly results, Aegis Logistics Ltd.—which operates as an oil, gas and chemical logistics company—reported an unusually high distribution volume due to the shift towards fuel flexibility, Biswas said.

According to him, it could see unusually high distribution volumes, not just in this fiscal but in the next fiscal as well.

Biswas suggested a price target of Rs 400 for the company, implying an upside potential of 42.6% from its current price of Rs 280.35.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.