.jpg?downsize=773:435)

Calmed by a dramatic turn in crude oil prices and stability in the Indian currency, the Monetary Policy Committee kept the benchmark policy rate unchanged for the second consecutive meeting.

The monetary policy stance also remains unchanged at 'calibrated tightening' even though a sharp cut in inflation projections may suggest a pause in interest rates for the foreseeable future.

Following the review, the repo rate remains unchanged at 6.5 percent. The reverse repo rate has been held at 6.25 percent. 48 of the 52 economists polled by Bloomberg had expected a status quo in rates. Despite calls for a cut in the cash reserve ratio to ease liquidity, the RBI choose to retain it at 4 percent. Instead, it reassured the market of an “elevated” level of bond purchases continuing via open market operation until March. The central bank also said that the Statutory Liquidity Ratio would be brought down by 25 basis points in January 2019, in line with its stated intention to reduce this reserve over time.

The MPC's decision to keep rates unchanged was unanimous, although committee member Ravindra Dholakia voted for a stance change back to 'neutral'.

"The decision of the MPC is consistent with the stance of calibrated tightening of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth," said the MPC's resolution.

In his comments after the MPC decision was announced RBI Governor Urjit Patel said space may open up for a change in future policy action. “If upside risks to inflation do not materialise, or stay muted, there is the possibility of space for commensurate action,” said Patel.

Given the judgement that growth will likely remain healthy for the rest of the year, the MPC retained its stance at calibrated tightening so as to buy time to pause, reflect and undertake future policy action with more robust inflation signals. If the upside risks we have flagged do not materialise, or are muted in their impact, as reflected in incoming data, there is a possibility of space opening up for commensurate policy action by the MPC.Urjit Patel, Governor, RBI

The December MPC meet came against the backdrop of continued tensions between the government and the RBI on matters ranging from the central bank's reserves, liquidity assistance to non banking finance companies and loan restructuring for small and medium enterprises.

Patel declined to answer any queries on the matter, choosing instead to remain focused on inflation, growth and monetary policy.

#RBIPolicy: RBI keeps rate unchaged. Here's what analysts make of the decision.

Read: https://t.co/rmcRyKec9T pic.twitter.com/QhNg3GoL8NInflation Forecast Cut; Growth Outlook Retained

The MPC has raised rates twice by 25 basis points each so far this financial year. At its October meeting, while keeping rates on hold, the MPC shifted its stance to ‘calibrated tightening', fearing that inflation will remain well above the mid-point of its target band of 4 (+/- 2) percent.

However, over the last two months, inflation has remained below forecast, oil prices have fallen and the rupee has stabilised.

In response to these developments, the MPC cut its inflation forecast significantly for the second half of the current year and the first half of next year.

- For H2 FY19, inflation is pegged at 2.7-3.2 percent compared to 3.9-4.5 percent earlier

- For H1 FY20, inflation is pegged at 3.8-4.2%

Still, the MPC maintained a cautious stance saying that “it is important to monitor their evolution closely and allow heightened short-term uncertainties to be resolved by incoming data.”

The dovish policy paves way for a neutral stance in the forthcoming policy, with inflation projections being significantly lowered, said Shubhada Rao, chief economist at Yes Bank, in an interview with BloombergQuint.

“The governor did sound ready to change stance to neutral in February and go beyond that as long as the data supported,” added Ananth Narayan, associate professor of finance at SPJIMR,

While cutting the inflation forecast significantly, the MPC retained the growth forecast at 7.4 percent for the current year. The optimism on growth stems from the expectation that lower oil prices will boost consumption and increased capacity utilisation will lead to strong private investments. Capacity utilisation is above the long run average at more than 76 percent, Governor Patel said.

Commentary focused on pick up in industrial activities and capacity utilisation should allay some of the market fears of low growth momentum for next few quarters. The Central Bank has kept its options for further rate actions open with downward revision of inflation projections and also retaining its stance of ‘calibrated tightening'.Rajni Thakur, Economist, RBL BankMarket Responds To Liquidity Comfort

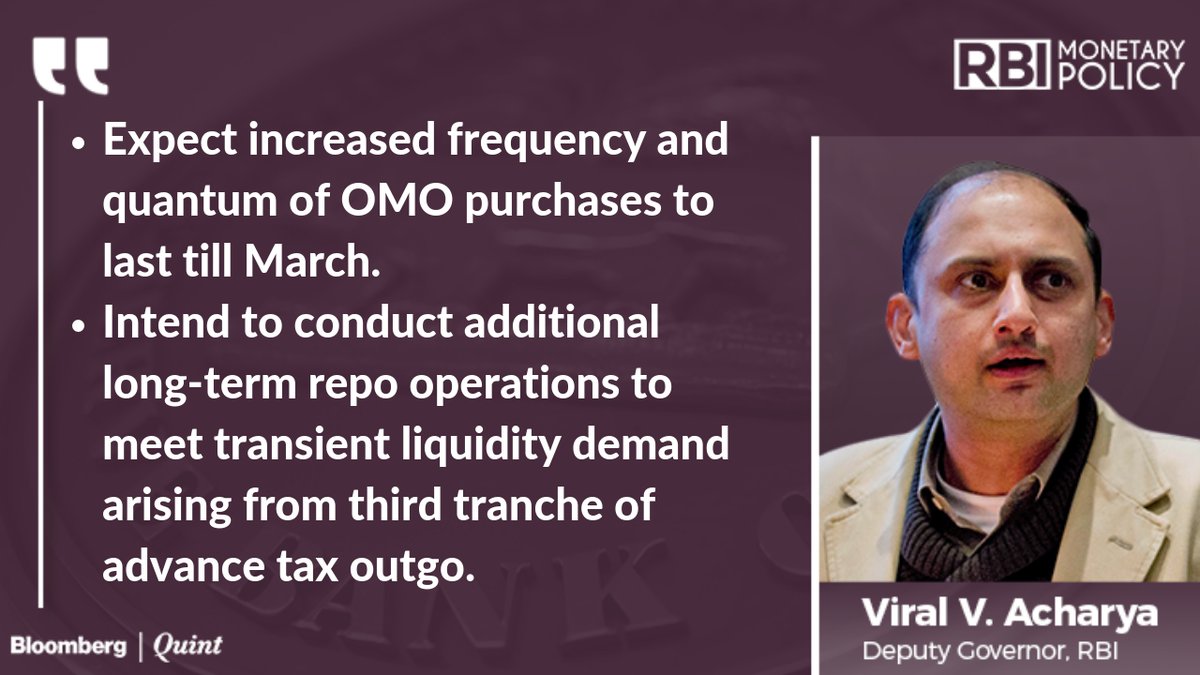

Post the MPC decision announcement the 10 year bond yield spiked and settled at 7.50 percent, a couple of basis points higher than it was pre-policy. But comments from deputy governor Viral Acharya, in the press conference thereafter, comforted the market and pulled the 10-year yield down to 7.44 percent.

Acharya assured that bond purchases via open market operations would continue and that long-term repo operations would be used alongside.

Viral Acharya's statements on liquidity are very comforting. Not only did he explain how much liquidity adjustment has happened through OMOs etc, but he also gave comfort that the RBI stands ready to do more OMOs and long-term repos as required. All of this has had an indirect impact on the bond markets.Ananth Narayan, Professor, SP Jain Institute of Management and ResearchAcharya also reassured that the RBI is watching the evolving market conditions for non banking financial companies (NBFCs) and housing finance companies (HFCs). “The RBI stands ready to be the lender of last resort provided that conditions warrant that kind of extreme measure,” said Acharya.

Other Decisions

A host of other decisions were outlined in the RBI's developmental and regulatory policies.

Benchmark Loan Pricing To External Benchmarks

- Starting April 1, 2019 all retail, SME loans with floating rates to be benchmarked to external benchmarks.

- External benchmarks can be repo rate, 91-day T-bill, 182-day T-bill or other approved benchmark

- Bank can determine spread over benchmark which remains constant unless rating of borrower changes.

Mandatory Loan Component in Working Capital Finance

- To stipulate a minimum level of 'loan component' in fund-based working capital finance for larger borrowers.

- Final guidelines which take effect from April 1, 2019 are being issued today.

Board of Management in Primary (Urban) Co-operative Banks (UCBs)

- To require UCBs to make a provision in their bye laws for setting up a BoM.

- Regulatory approvals such as expansion of area of operation and opening of new branches may be allowed only for such UCBs.

Access for Non-Residents to the Interest Rate Derivatives Market

- Was proposed that non-residents shall be given access to the Rupee Interest Rate Derivatives (IRD) market in India.

- Draft directions are being issued today for public feedback.

Measures to improve Liquidity Management by banks

- RBI will provide information on daily CRR balance of the banking system to market participants on the very next day.

- This will help banks forecast their liquidity requirements with a greater degree of precision.

Rationalisation of Borrowing and Lending Regulations under FEMA, 1999

- To consolidate regulations governing all types of borrowing and lending transactions between a person resident in India and a person resident outside India in both foreign currency and Rupee, in consultation with the Government.

- Consolidated regulation and guidelines will be issued by the end of December 2018.

Ombudsman scheme for digital transactions

- Covering services provided by entities falling under Reserve Bank's regulatory jurisdiction.

- Scheme will be notified by the end of January 2019.

Framework for limiting customer liability in respect of unauthorised electronic payment transactions involving prepaid payment instruments

- Guidelines will be issued by the end of December 2018

Expert committee on Micro, Small and Medium Enterprises

- To identify causes and propose long-term solutions for the economic and financial sustainability of the MSME sector.

Watch live coverage of the MPC decision here...

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.