The Housing And Urban Development Corp. Ltd. (HUDCO) signed two memorandum of understandings at India Maritime Week 2025 for port infrastructure projects with development costs of Rs 80,000 crore and Rs 3,000 crore respectively.

According to a press release from the firm on Wednesday, the company signed a non-binding MOU with Sagarmala Finance Corp. to partner and jointly finance "maritime and coastal infrastructure projects including ports, harbours, terminals, and associated connectivity infrastructure."

The companies will also work on development of inland water transport infrastructure and waterway vessels as well as renewable and green energy initiatives in maritime zones.

They will further support for shipbuilding and ship repair infrastructure including modernization of shipyards and dry docks; development of logistics and multi-modal infrastructure and more.

The firms plan to spend a total of Rs 80,000 on the projects they will collaborate on as per the MOU.

The firm also inked an MoU with Syama Prasad Mookerjee Port, Kolkata to partner on the development, modernization, and upgradation of port and allied infrastructure projects for the latter and organise joint conferences oe workshops for capacity and capability building of both companies.

HUDCO is set to provide Rs 3,000 crore in funding to SMPA for selecting the agencies to implement the project.

"HUDCO shall explore opportunities to collaborate with project implementing agencies selected by SMPA and provide funds up to Rs.3000 Crore towards meeting the funding requirements for both new projects and refinancing/ take-out of existing projects," exchange filing said.

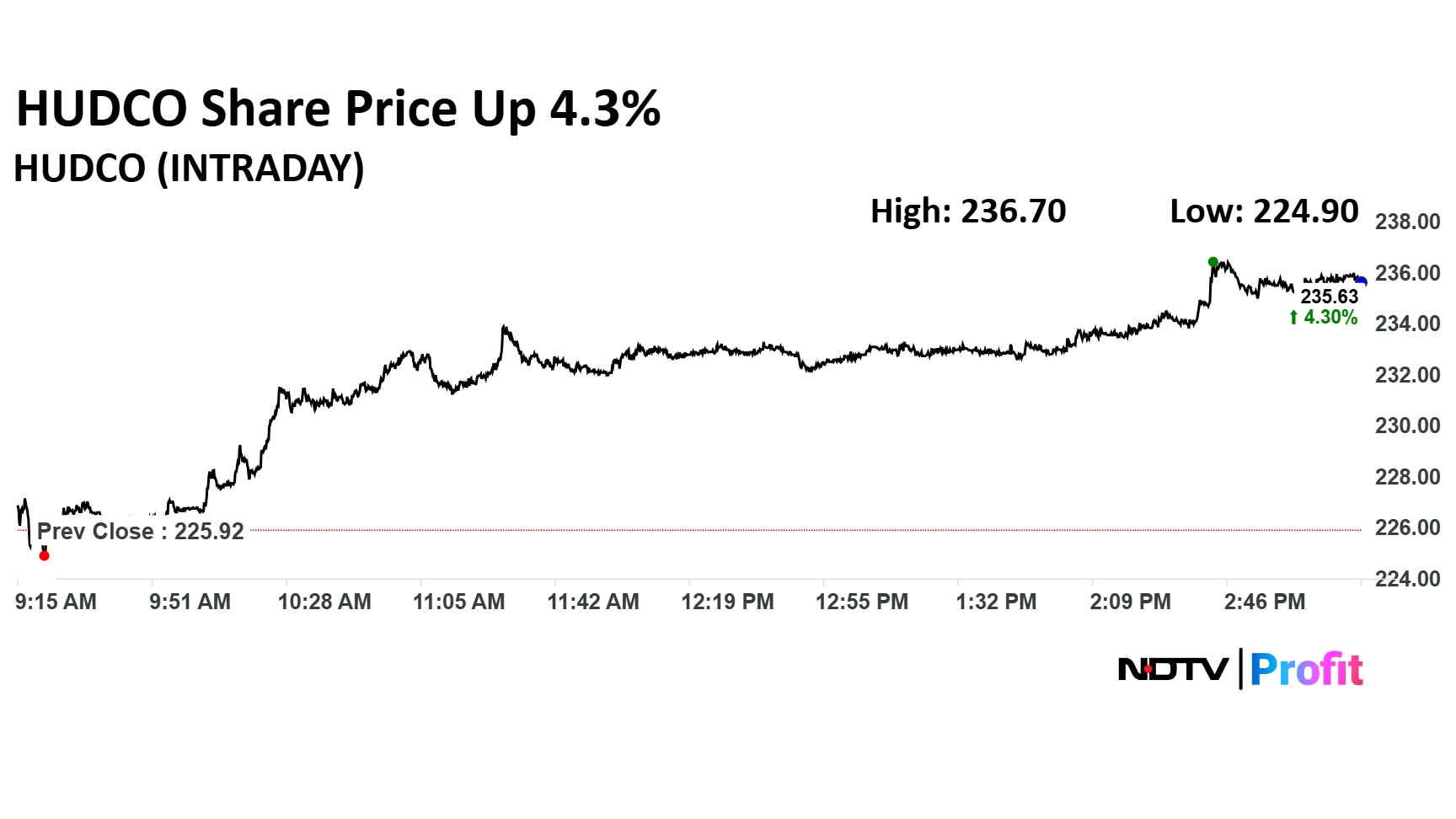

Shares of HUDCO were up 4.35% to Rs 235.75 at 3:23 p.m. compared to 0.43% uptick of the NSE Nifty 50.The stock had risen 8.89% in the last 12 months and 0.41% on a year-to-date basis.

Three analysts tracking the company, have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside/downside of 23.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.