Corporate profitability likely shrunk for the third straight quarter, while revenue momentum sustained on price hikes in the quarter ended March, according to Crisil Research.

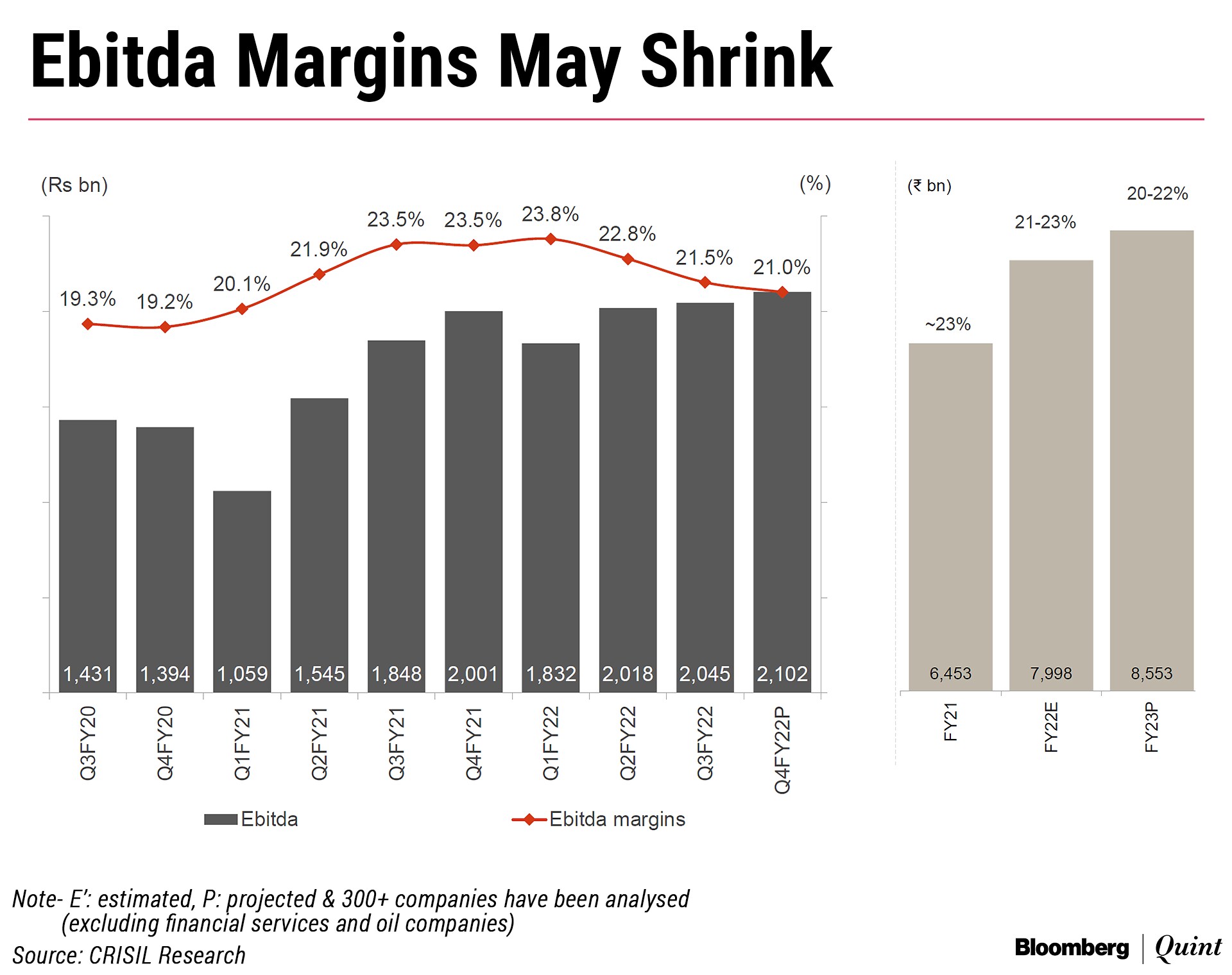

Average Ebitda (earnings before interest, taxes, depreciation and amortisation) margin likely declined 200-300 basis points year-on-year and 40-60 basis points sequentially in Q4 FY22, Crisil's analysis of more than 300 companies (excluding financial services, and oil and gas) indicated.

A decline in Ebitda margin will mark the third straight quarterly contraction as input costs continue to rise. First because of pandemic-inducted disruption in supply chains. And now aggravated by Russia's invasion of Ukraine.

Profitability of as many as 32 of the 47 sectors tracked by Crisil Research is estimated to have shrunk year-on-year in the fourth quarter, it said in an April 11 report.

In Q4, margin in construction-linked sectors are likely to have fallen the most at 500-600 basis points year-on-year.

That's followed by exports-linked and industrial commodities sectors, where margin eroded about 400 basis points over the year earlier.

Within the construction-linked sectors, steel products saw a margin contraction of over 900 basis points year-on-year as input cost escalation (for both coking coal and iron ore) was higher than the rise in steel prices.

In contrast, margin of consumer discretionary services and consumer staples services and investment-linked segments expanded, albeit moderately.

Margin expansion in consumer discretionary services was largely supported by telecom services, which is estimated to see year-on-year improvement of over 250 basis points following tariff hikes.

Margin of consumer staples services are estimated to have been driven by a rise in profitability in the hospital sector.

“For the fiscal, overall Ebitda margin likely shrank 20-40 basis points year-on-year to 21-23%,” Hetal Gandhi, director at Crisil Research, was quoted as saying in the report. “Companies were unable to fully pass on the soaring input cost, especially prices of key metals and energy.”

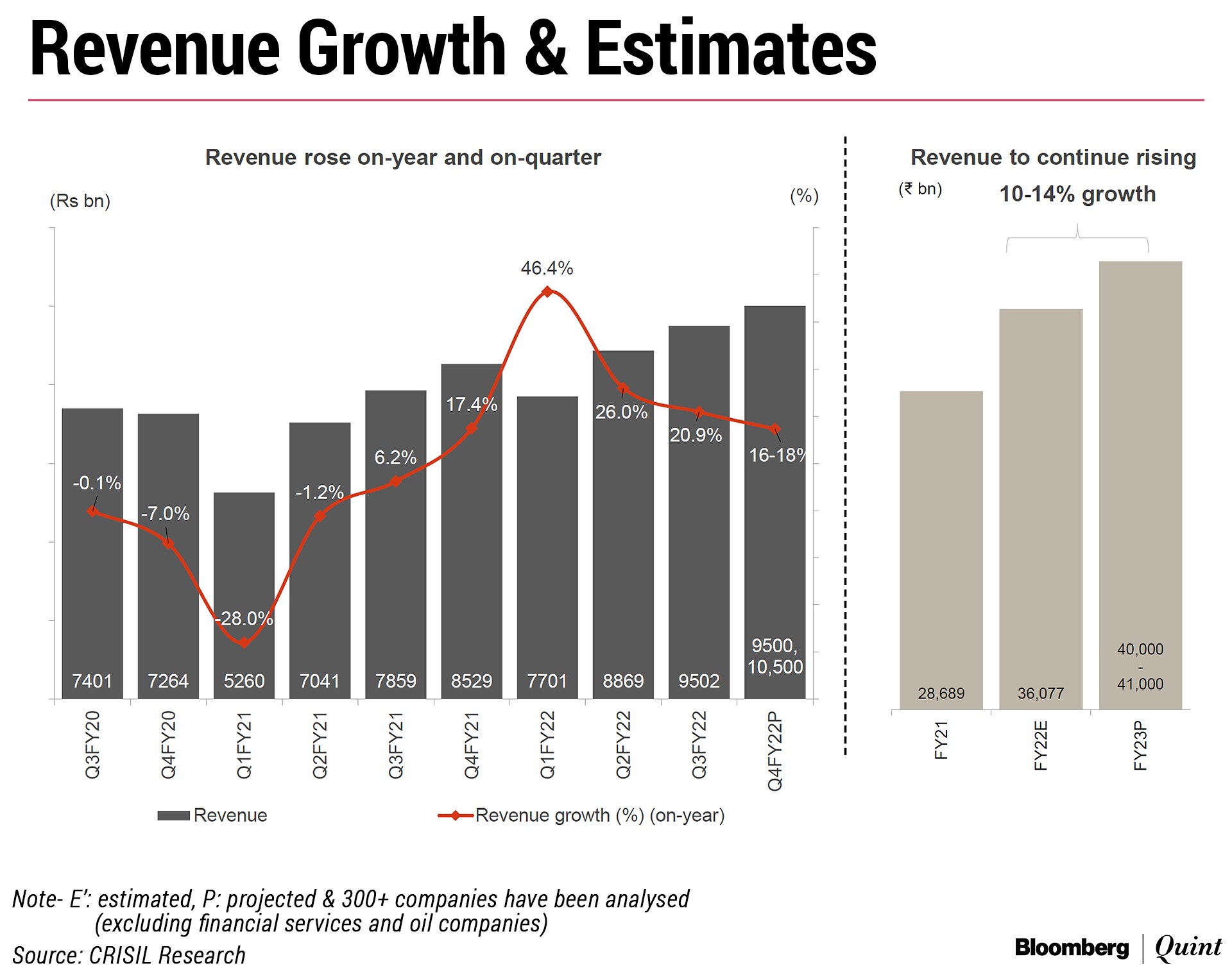

Corporate revenue, according to Crisil Research, is estimated to have grown 16-18% over the year earlier in the fourth quarter. Revenue grew across sectors, led by a moderate rise in volume and firm commodity prices. Volume gains were largely attributed to a pick-up in economic activity. Sequentially, corporate revenue is estimated to have grown around 5%.

For the quarter, automobiles revenue is estimated to have risen by 0-5% year-on-year, as a 12-17% fall in volumes partially offset the impact of an 18-23% increase in realisations (along with premiumisation). Supply chain and weak rural demand led to volume uncertainty.

Cement sector revenue also remained a drag with meagre growth, as dwindling volumes upset the impact of higher realisations.

Sectors like IT services, up 20-22% year-on-year, also propelled overall revenue growth, aided by continued demand for digital services and cloud.

Revenue of the steel sector is estimated to have grown 30-35% year-on-year on the back of an increase in average realisations, while that of aluminium jumped 50-55% on a ramp-up in production.

According to Sehul Bhatt, associate director at Crisil Research, “in absolute terms, revenue of most sectors and segments rose above their pre-pandemic levels last fiscal”.

For the fiscal, overall revenue is expected to have grown about 26% year-on-year, the report said.

Fiscal 2022, according to the report, also saw value growth in revenue outpacing volume growth, on the back of partially passing on rising input costs for most of the companies. Sectors such as automobile, steel, and aluminium witnessed the highest rise in value compared with volume growth. Some sectors opted for calibrated price hikes to prevent a potential drop in volumes.

“Of the total year-on-year incremental revenue in fiscal 2022, nearly 45% was contributed by just three sectors. About 23% was contributed by steel products, around 13% by IT services, and around 9% by automobiles,” Jignesh Surti, manager, Crisil Research, was quoted as saying in the report. “Of the total year-on-year incremental absolute Ebitda profit in fiscal 2022, the steel sector accounted for nearly 36%, while aluminium and telecom services accounted for around 12% and 9%, respectively.”

FY23 Outlook

“In the current fiscal, Ebitda margin could contract another around 100 basis points year-on-year to 20-22%, largely due to elevated energy and metal prices," Gandhi said. "The Ukraine-Russia conflict has sent crude and natural gas prices soaring. Trade across metals such as steel may also experience uncertainty amid the crisis, which will lead to elevated prices of commodities and hence continued pressure on profitability.”

Crisil Research also expects revenue to grow 10-14% year-on-year in the current fiscal, following continued recovery in volume and higher realisations. “Consumer discretionary segments such as airline services and hotels will steer performance amid a strong demand recovery.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.