The adoption of electric vehicles in India is poised for a takeoff, subsidy or not.

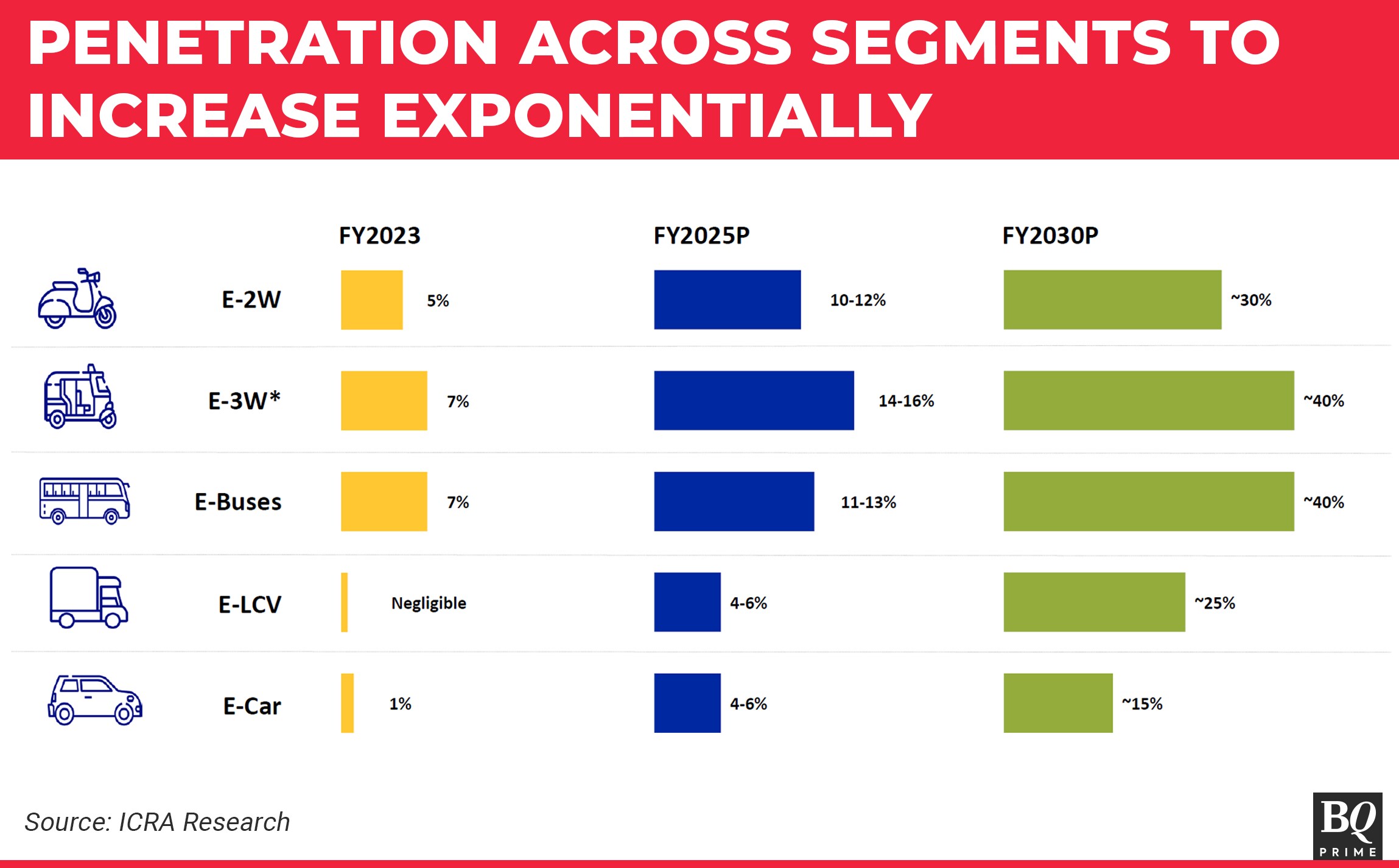

Nearly one in every three two-wheelers sold in India will be electric by 2030, ratings agency ICRA Ltd. said in a Oct. 31 report. Electric rickshaws will comprise 40% of the three-wheeler market by then, as will electric buses in the commercial vehicle space. Electric cars will make up only 15% of all passenger vehicles sold by the end of this decade.

"Government efforts to enhance EV adoption through policy support were instrumental in helping the electrification drive over the past few years," Rohan Kanwar Gupta, sector head-corporate ratings at ICRA, told BQ Prime over email. "A confluence of factors—such as improving product portfolio, charging infrastructure and financing availability—would accelerate EV penetration over the medium term."

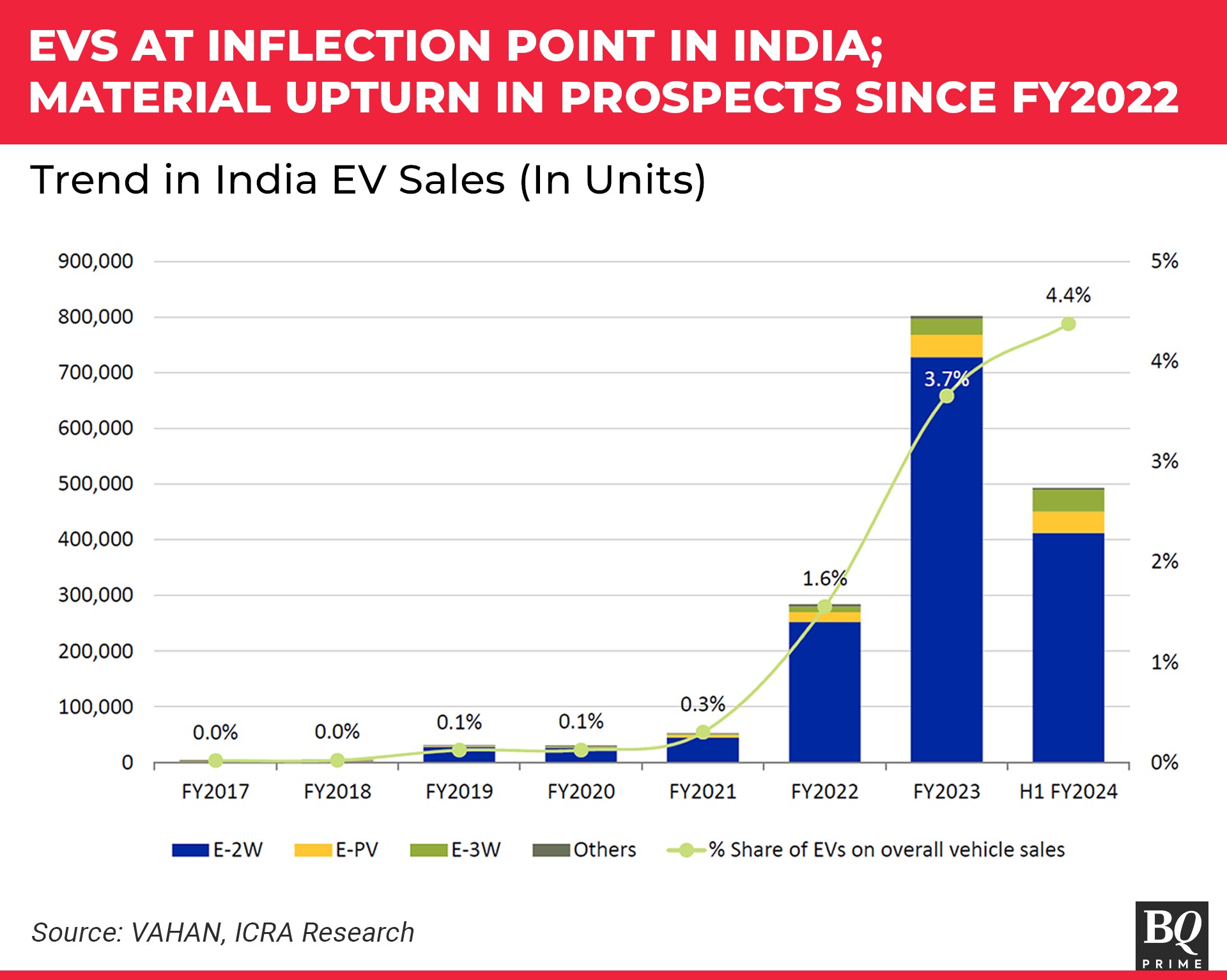

At nearly 5,00,000 units, EVs made up 4.4% of overall vehicle sales in the first half of the fiscal ending March 2024, the ICRA data showed.

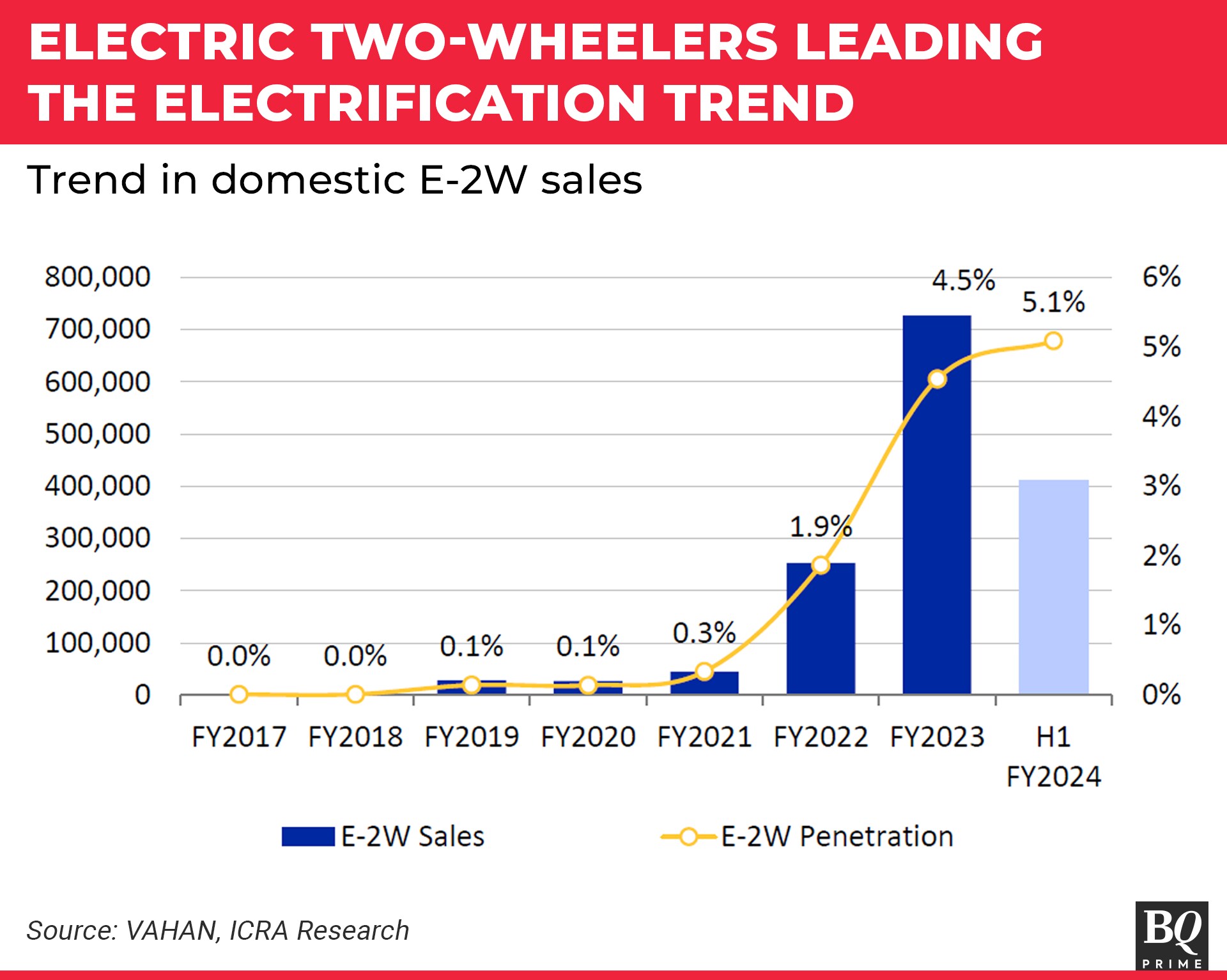

In fiscal 2023, that figure stood at 3.7% or nearly 8,00,000 units. Electric scooters accounted for nearly 90% of the EV sales, but only about 5% of the overall two-wheeler market. That's likely to grow to 10-12% by FY25.

The removal of the FAME-II subsidy, however, was a dampener—the pace of adoption has slowed over the past few months as without a subsidy, a buyer will be able to recover the cost of her purchase in five years as against three earlier.

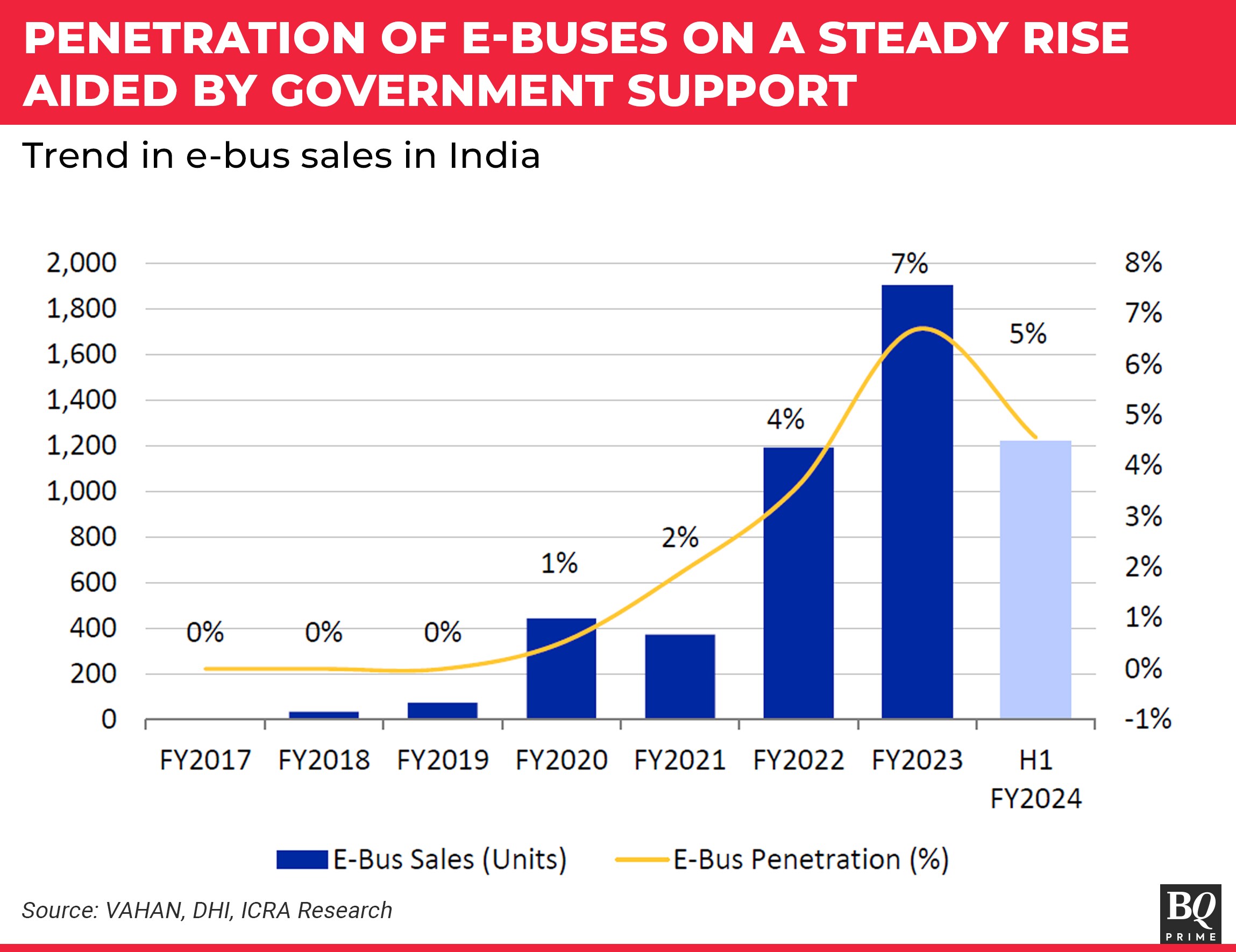

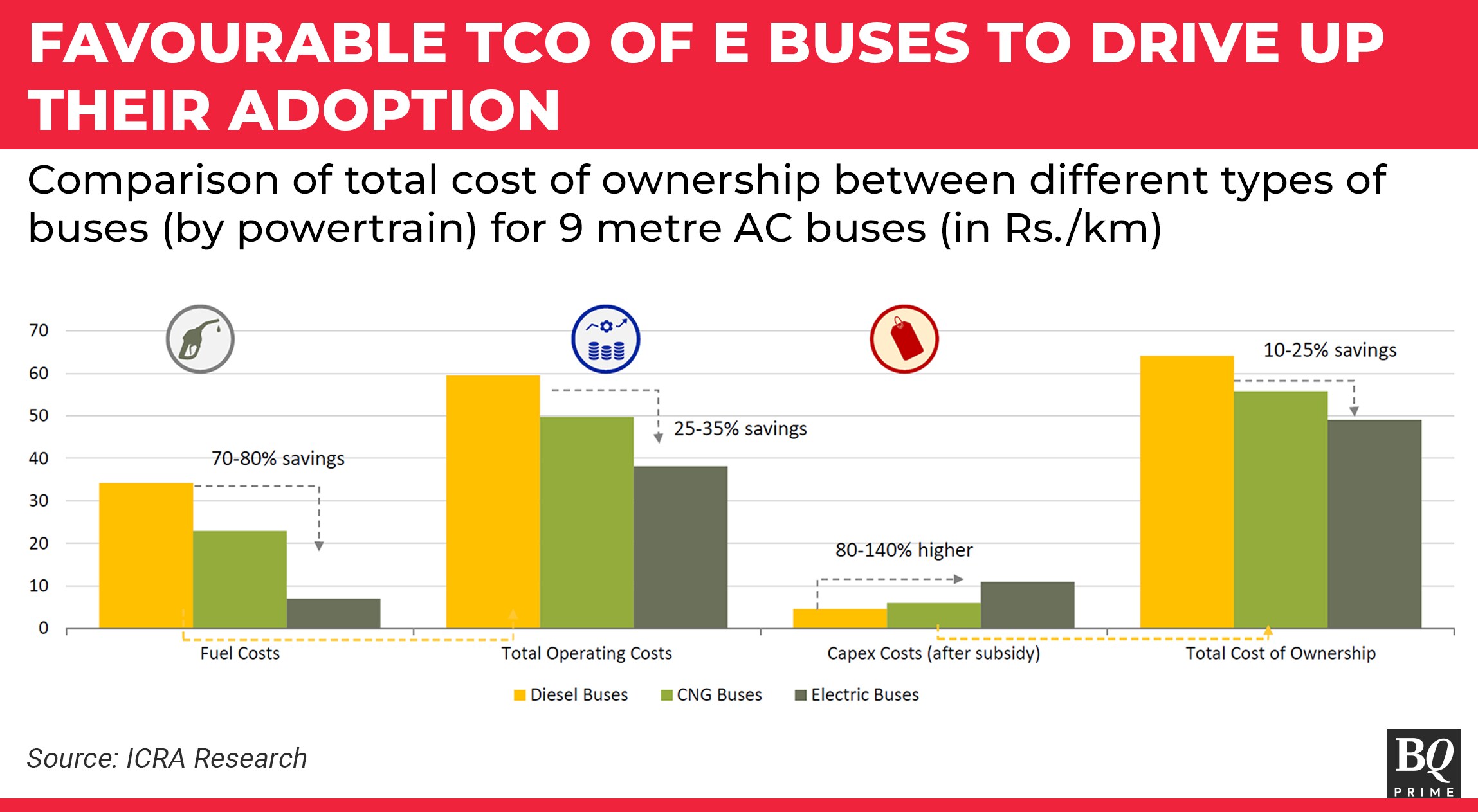

Government support, meanwhile, has propped up sales of electric buses—at nearly 1,900 units in FY23, they had 7% market share in the CV space. A favourable total cost of ownership also plays to their advantage.

“While fuel costs are the lowest for electric buses, other operating costs such as battery replacement and on-site support requirements increase operating costs,” ICRA said in the report. “(But) despite higher capital costs, even post the subsidies on offer, lower operating costs result in lower TCO for electric buses, thus driving up their adoption.”

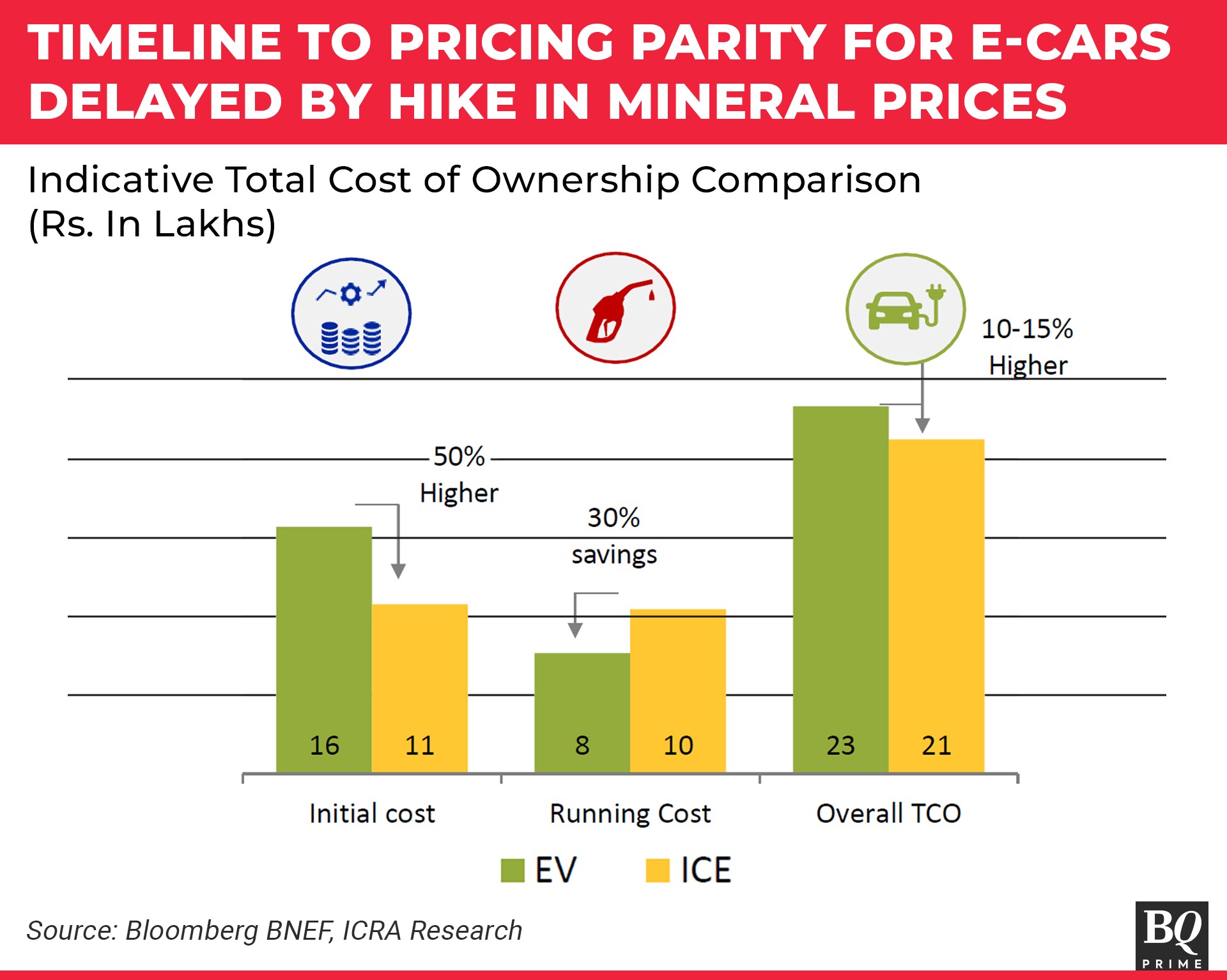

Adoption of electric cars, however, is lagging the rest of the EV ecosystem. Only 1% of all cars sold in India are electric at present—that figure will improve to 4-6% by FY25 and 15% by FY30, according to ICRA's estimates.

A pick-up in demand isn't likely until there is parity in pricing with fossil-fuelled cars. Prices of lithium-ion battery packs, which still make up 35-40% of the cost of an electric car, are trending higher for the past couple of years due to supply shortages.

“Battery costs need to reduce by 25-30% from current levels to achieve pricing parity for the PV segment,” ICRA said in its report. “Hybrids are viewed as an intermediate step towards acceptance of EVs, mitigating range anxiety and offering superior mileage.”

A first-mover advantage, then, can potentially realign the pecking order in India's auto sector.

Hero MotoCorp, the country's biggest two-wheeler maker, has been late to the EV party. Honda Motorcycle and Scooter India Pvt. is yet to launch an electric variant of its best-selling Activa scooter. An electric car by India's biggest carmaker, Maruti Suzuki India Ltd., is at least two years away.

That has allowed Ola Electric Pvt., Ather Energy and Tata Motors Ltd. to steal a march over incumbents, at least in the nascent stage.

"Even as multiple new companies have emerged, the legacy OEMs (original equipment manufacturers) are also aggressively ramping up product development to improve their EV portfolio," Gupta said. "The legacy OEMs stand to benefit from having an established brand and distribution network."

As such, the impact of enhanced EV adoption across segments on the competitive position of OEMs remains to be seen, according to Gupta.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.