Idea Cellular Ltd. reported an 88 percent decline in its profit in the July to September quarter as finance costs soared.

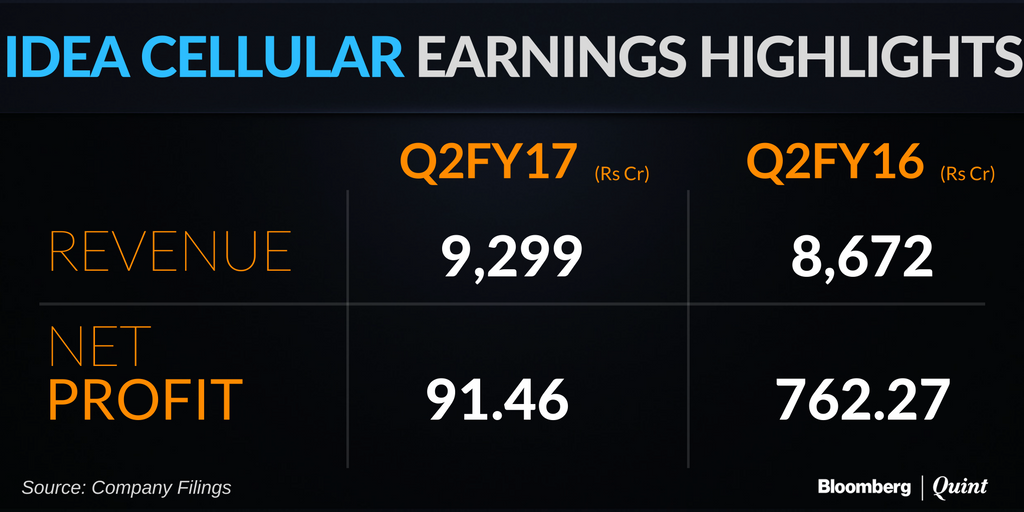

Net profit fell to Rs 91.5 crore from Rs 762.3 crore in the corresponding quarter of the previous financial year, according to the company's filing on the stock exchanges. The profit figure was 49 percent below the consensus estimate of analysts tracked by Blooomberg.

Himanshu Kapania, the managing director of Idea Cellular, blames seasonality for the dip in earnings. The second quarter is traditionally a weak quarter for telecom companies.

Revenue increased 7.2 percent year-on-year to Rs 9,298.9 crore but sequentially it was down 2 percent due to competitive pressure on voice minutes. Total voice minutes fell to 195.5 billion as compared to 199.3 billion in the June ended quarter.

Earnings before interest, taxes, depreciation and amortisation increased 1.8 percent to Rs 2,840.1 crore from Rs 2,790.4 crore year on year. EBITDA margin contracted by 160 basis points to 30.5 percent led by higher network expenses, and increased subscriber acquisition and servicing cost.

Finance costs for the company tripled to Rs 1,004.4 crore from Rs 313.1 crore in corresponding quarter last year.

The entry of Reliance Jio Infocomm Ltd. will make it difficult for Idea to turn around its operations in the medium term, Naveen Kulkarni, the co-head of research at PhillipCapital wrote in a note to clients.

It was a seasonally weak quarter in which the core operating performance has been weak and it is unlikely to improve in near to medium term because of Jio impact.Naveen Kulkarni, Co-Head of Research, PhillipCapital

.png)

In the second quarter, company's cash profit slumped due to higher operating cost. Cash profit slipped around 23.5 percent to Rs 1,940 crore when compared to September ended quarter last year.

Idea incurred a capital expenditure of Rs 2,000 crore in the second quarter and has revised its capital expenditure guidance for the financial year 2017 to Rs 7,500-8,000 crore, according to its press release.

Idea will be using the additional Rs 1,000 crore to expand its wireless broadband coverage using the spectrum it won in the October 2016 auction. Idea acquired 349.2 MHz of spectrum for Rs 12,800 crore in the recently concluded auction, which will help the company expand its spectrum portfolio by 64 percent.

Data realisation per megabyte decreased 11.4 percent to 18.7 paise while the voice realisation per minute fell 2 percent to 33.1 paise on quarter-on-quarter basis. Blended revenue per user fell 4 percent to Rs 173, while the data revenue per user fell 8.5 percent to Rs 130.

Idea's churn ratio, i.e., the percentage of subscribers who discontinue their subscriptions, increased to 5.4 percent in this quarter from 5.2 percent in the last quarter and 5.1 percent in last year.

The Jio Factor

Acknowledging Reliance Jio's entrance into the Indian telecom space, Kapania said there will be pressure on voice and data tariffs at least till the end of this calendar year.

The company plans to focus on expanding its 2G and 3G customer base, a segment which Kapania says Reliance Jio is not really keen to focus on.

“Currently we are focused on expanding our 2G and 3G services and we will have to wait for the new entrant to start monetizing before we react,” said Kapania.

The Path Ahead

Idea Cellular also plans to expand its pan-India wireless services. The 4G services will be ramped up to 20 circles from the present 11 circles and the 3G services will be expanded to 15 circles from its present coverage of 13 circles.

Idea will launch branded game services by the end of this quarter, followed by Idea Movies and Music service applications in quick succession, Kapania said.

“Our target is to achieve a billion users in the next three to four years and we have taken a step towards it,” Kapania said.

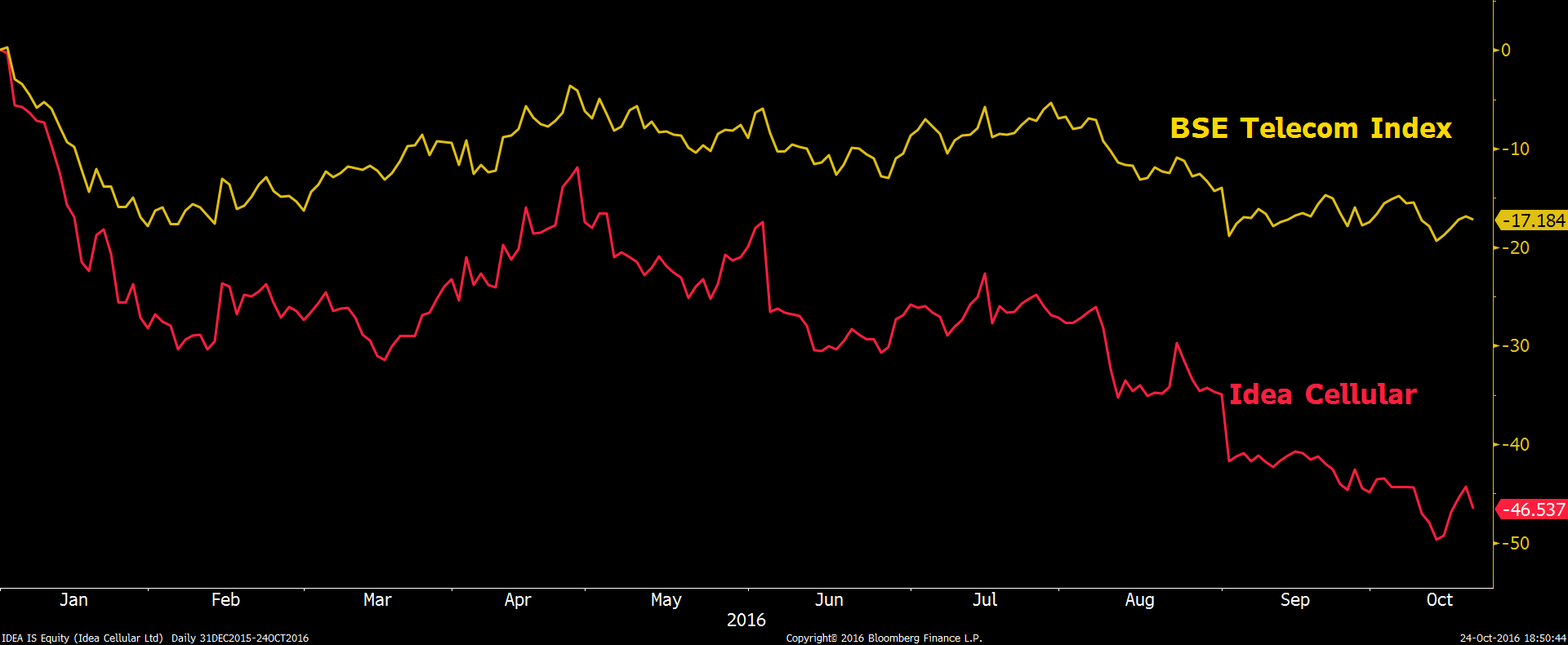

Idea Stock's Struggles

Idea Cellular's shares have already under performed the BSE Telecom index by wide margin. Year-to-date the stock prices fell 47 percent, while BSE telecom index slipped 17 percent.

Of the total 35 analyst tracked by Bloomberg, only 34 percent have a buy rating on this stock, down from 51 percent at start of the year.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.