IDBI Bank Ltd. reported a level of bad loans that were about a quarter lower than the Reserve Bank of India's (RBI) assessment, shows the lender's annual report released this week.

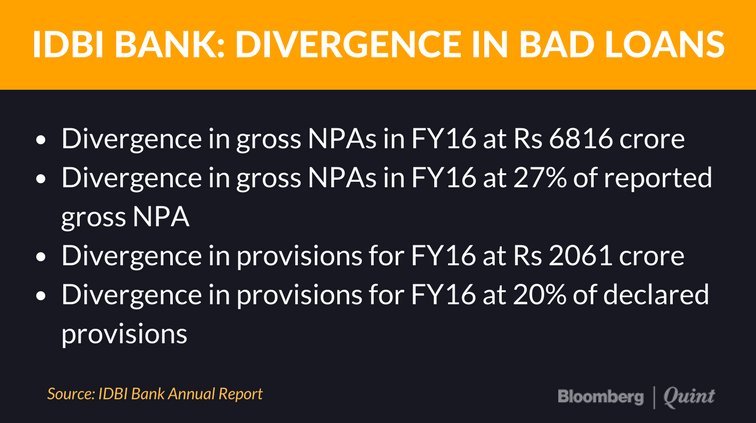

According to disclosures that are now mandatory, the bank said that it had reported gross non-performing assets (NPAs) of Rs 24,875 crore in the financial year 2015-16. This was lower than the RBI's assessment which pegged bad loans at Rs 31,691 crore.

In April, the RBI issued a notification saying that any material divergence in the estimation of bad loans between a bank and the regulator must be disclosed. In the case of gross NPAs, any divergence higher than 15 percent now needs to put in public domain.

In IDBI Bank's case, the divergence in assessment of gross NPAs stood at 27 percent.

There was also a resultant difference in the amount of provisions set aside by the bank in fiscal 2016. The lender set aside Rs 10,232 crore in provisions while the RBI pegged this at Rs 12,292 crore. The difference stood at 20 percent of declared provisions.

If the bank had accounted for bad loans and provisioned in line with the RBI's assessment, it would have reported a net loss of Rs 5,012 crore for the year compared to the net loss of Rs 3,665 crore that was declared, showed the annual report.

IDBI Bank is not alone in reporting a divergence in bad loan assessment. Banks like Yes Bank Ltd. and Axis Bank Ltd. have reported divergences too. In the case of Yes Bank, the lender disclosed gross NPAs of Rs 748.9 crore at the end of March 2016. The RBI, however, thought the true level of gross NPAs was six times higher at Rs 4,925.6 crore.

The RBI's directions to report the divergence followed an asset quality review (AQR) of bank balance sheets in 2015. The review found that banks were not fully or adequately disclosing and provisioning against bad loans.

The AQR's impact has been seen on bank earnings between the quarters ended September 2015 and March 2017. Gross NPAs of the 42 listed banks added up to about Rs 7.7 lakh crore at the end of March 2017 compared to Rs 3.4 lakh crore at the end of September 2015.

Also Read: ‘The Divergence Ratio' - What The Newest Banking Indicator In Town Tells You About Banks

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.