ICICI Prudential Life Insurance, India's largest private life insurer, hit the capital market today to raise around Rs 6,050 crore. This is the first initial public offer (IPO) by any life insurance company in India. It is also the biggest IPO since state-run Coal India raised over Rs 15,000 crore in 2010. The IPO will close on September 22. Last week, ICICI Prudential raised Rs 1,635 crore from anchor investors. As of 4 p.m. today, the issue was subscribed 14 per cent.

Here are 10 things to know about ICICI Prudential Life Insurance IPO:

1) Investors can buy a minimum of 44 shares in the price band of Rs 330-334. Out of the 18.13 crore shares on offer, 10 per cent is reserved for the shareholders of ICICI Bank.

2) ICICI Prudential, a joint venture between ICICI Bank (67.6 per cent) and UK's Prudential Corporation Holdings (26 per cent), started its operations in 2001. Wipro's billionaire founder Azim Premji and Singapore Government-owned Temasek Holdings hold 4 per cent and 2 per cent stake in the insurer.

3) The IPO is an offer for sale by ICICI Bank, which means that the private lender is offloading part of its shareholding in the insurer. Post the IPO, ICICI Bank's stake in ICICI Prudential will come down to around 55 per cent. ICICI Prudential's market capitalisation is likely to be Rs 48,000 crore if issue gets subscribed at the upper end of the price band.

4) India's life insurance industry continues to be underpenetrated, with a life insurance penetration of 2.7 per cent in FY15 compared to a global average of 3.5 per cent, according to Swiss Re. Life insurance companies have huge growth potential in India, considering faster economic growth and a relatively younger population.

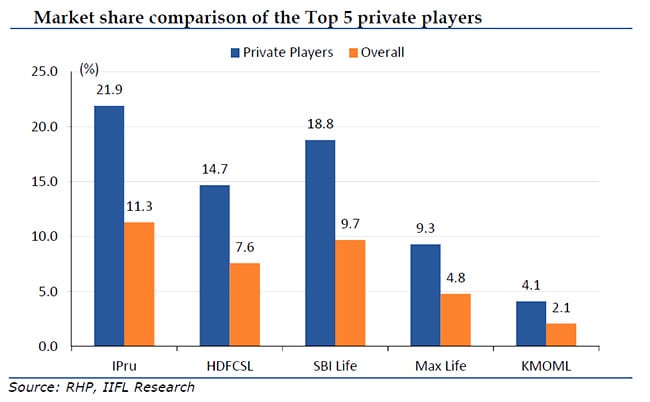

5) ICICI Prudential Life Insurance's market share has gone up from 5.9 per cent in FY12 to 11.3 per cent in FY16 on a retail weighted received premium (RWRP) basis. Among the 23 private sector life insurance companies in India, ICICI Prudential had 21.9 per cent market shares on RWRP basis.

6) ICICI Prudential has a multi-channel sales network, which enables the company to access different customer segments. As of June 30, 2016, the private life insurer had 1.24 lakh individual agents and 4,500 bank branches through which its policies were sold. In FY16, it got 58.6 per cent of its premium income through bancassurance channel.

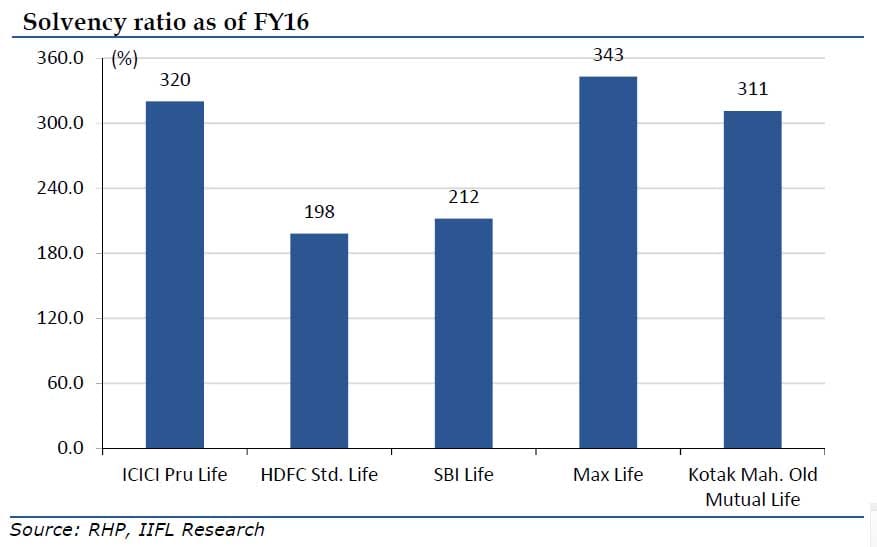

7) ICICI Prudential also has a strong capital position with a solvency ratio of 320.5 per cent as of June 30, 2016 (next only to Max Life's 343 per cent) compared to regulatory requirement of 150 per cent. According to Angel Broking, high solvency ratio indicates that the company can grow its business without raising further capital.

8) ICICI Prudential's persistency ratio - a valuation metrics which indicates increased scope of future income from existing policies - has been going up. ICICI Prudential's 13th month persistency ratio for FY16 stood at 82.4 per cent, which is highest among all private life insurers. Its 49th month persistency ratio stood at 62.2 per cent in FY16, next only to Kotak Mahindra Old Mutual Life's 71 per cent and HDFC Stadard Life's 63.4 per cent.

9) ICICI Prudential had reported a net profit of Rs 1,653 crore on total income of Rs 20,228 crore in FY16. At the upper end of the price band ICICI Pru's shares are valued at 28.9 times its FY2016 earnings per share of Rs 11.53. In the absence of any other listed life insurer in India, a PE comparison is not possible. Angel Broking has a "neutral" rating on the issue, saying the issue is "fully priced".

10) Unit linked insurance products (ULIPs) comprised 82.6 per cent of ICICI Prudential's retail annualized premium equivalent (APE) in FY16, which is the highest in the industry. Due to high contribution of ULIPs in the product portfolio, ICICI Pru's new business margin is lower compared to HDFC Life and Max Life. Nomura said higher concentration of ULIPs in its product mix could be a potential risk to the insurer's premium income and persistency as ULIP's as a product could be more cyclical.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.