CLSA upgraded Hindustan Unilever Ltd. to 'buy' citing reasonable valuations, easing price pressure and competition and an expected pick-up in rural demand.

The company's valuation is well below its five-year median, beyond which it has not fallen, apart from periods during black-swan events like Covid-19 and palm oil spike, according to its note.

CLSA also increased the target price from Rs 2,925 to Rs 3,135, implying an upside return potential of 27% given the positive commentary around festive season.

Worst Behind For Rural Demand

Rural demand has been subdued over the past couple of years, and below-normal rains in August have delayed recovery. However, CLSA expects the worst pressure on rural demand to be behind as companies are now seeing some green shoots.

"Spending in 2HFY24 could be better as consumers are able to get the benefits of price cuts. Postponement of trade stocking to 3Q and a decent rabi crop due to good rains in the north should help," it said in an Oct. 2 note.

There is usually a time lag between staple companies taking price cuts and consumers getting the benefit of the same, as trade channels usually sell higher-priced inventory first, CLSA said. "This also may have delayed the recovery in rural sales".

About 40% of HUL's revenue comes from rural areas, according to CLSA estimates.

Current Pain Points To Ease

Hindustan Unilever's market share loss in skincare and the absence of growth in health food drinks have been key issues, the note said. "We expect reduced competition from D2C players to benefit HUL in skincare."

Palm oil prices should be stable with higher production and a comfortable inventory. Efforts in market development for health food drinks should also start showing results over the next two to three years, according to CLSA.

Reasonable Valuations

HUL's past-five-year median valuations are a good indicator of fair value, as the trajectory of earning per share growth expected over the next three years (FY23-26) is not very different from the past five-year earning per share CAGR it has delivered, the brokerage said.

"We do not see a case for it to de-rate significantly below its five-year median," CLSA said.

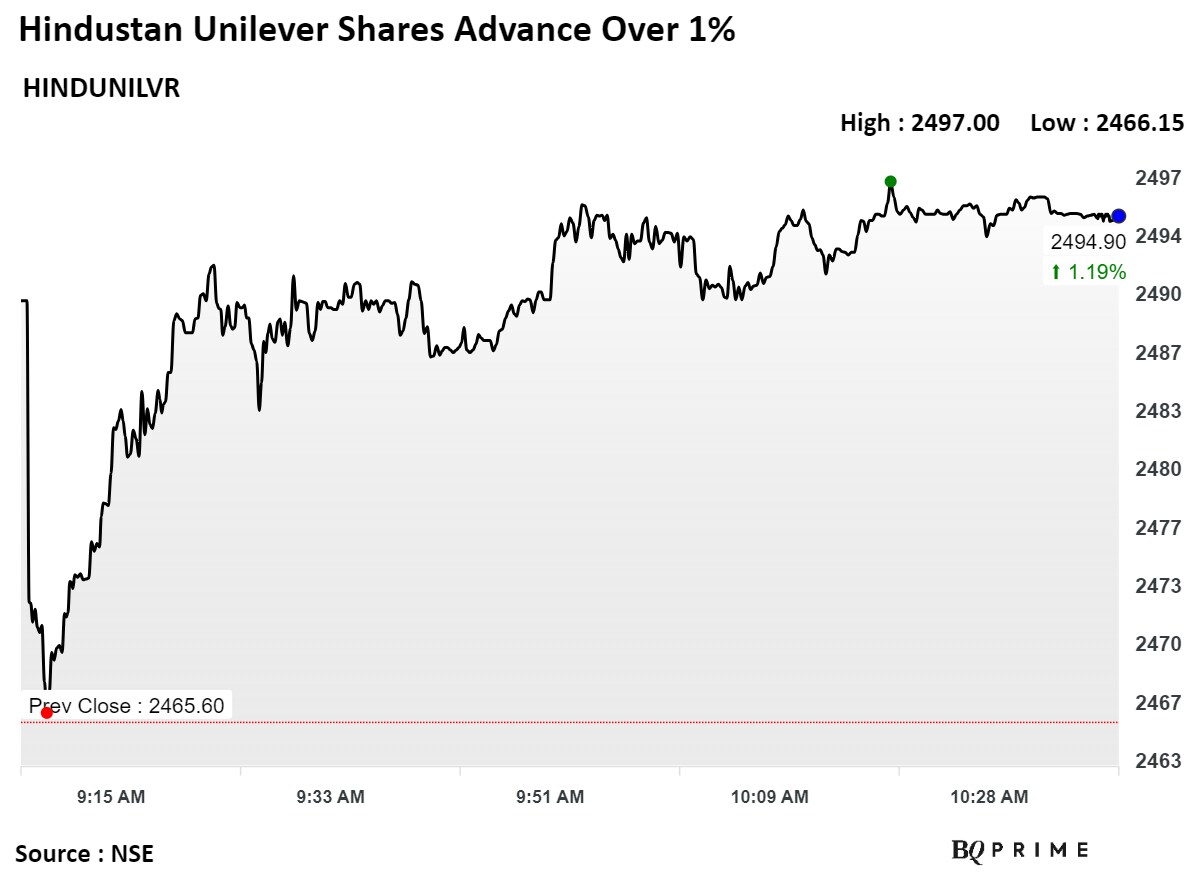

Shares of Hindustan Unilever were trading 1.18% higher compared to a 0.7% decline in the benchmark NSE Nifty 50 as of 10:49 a.m.

Of the 43 analysts tracking the company, 27 maintain a 'buy', 13 recommend a 'hold,' and three suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 15.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.