As HSBC Holdings Plc prepares to move into a new London headquarters as early as next year, executives are grappling with how to handle a more severe desk shortage than they previously anticipated in the new, smaller building.

Senior managers have informed executives that under one relocation scenario being explored, the new Square Mile headquarters building would face a shortfall of 7,700 desks for staffers, according to people familiar with the matter. That's an even more acute shortage than earlier in-house projections of less than 5,000, the people said, asking not to be identified discussing internal deliberations.

A combination of the firm's return-to-office mandates and a larger-than-expected London-based workforce led to the revised estimates, the people said.

“HSBC will be vacating 8 Canada Square and moving to our new headquarters in St Paul's in 2027,” a spokesperson for the bank said in an emailed statement, referring to the current office in Canary Wharf and the new location in the City of London.

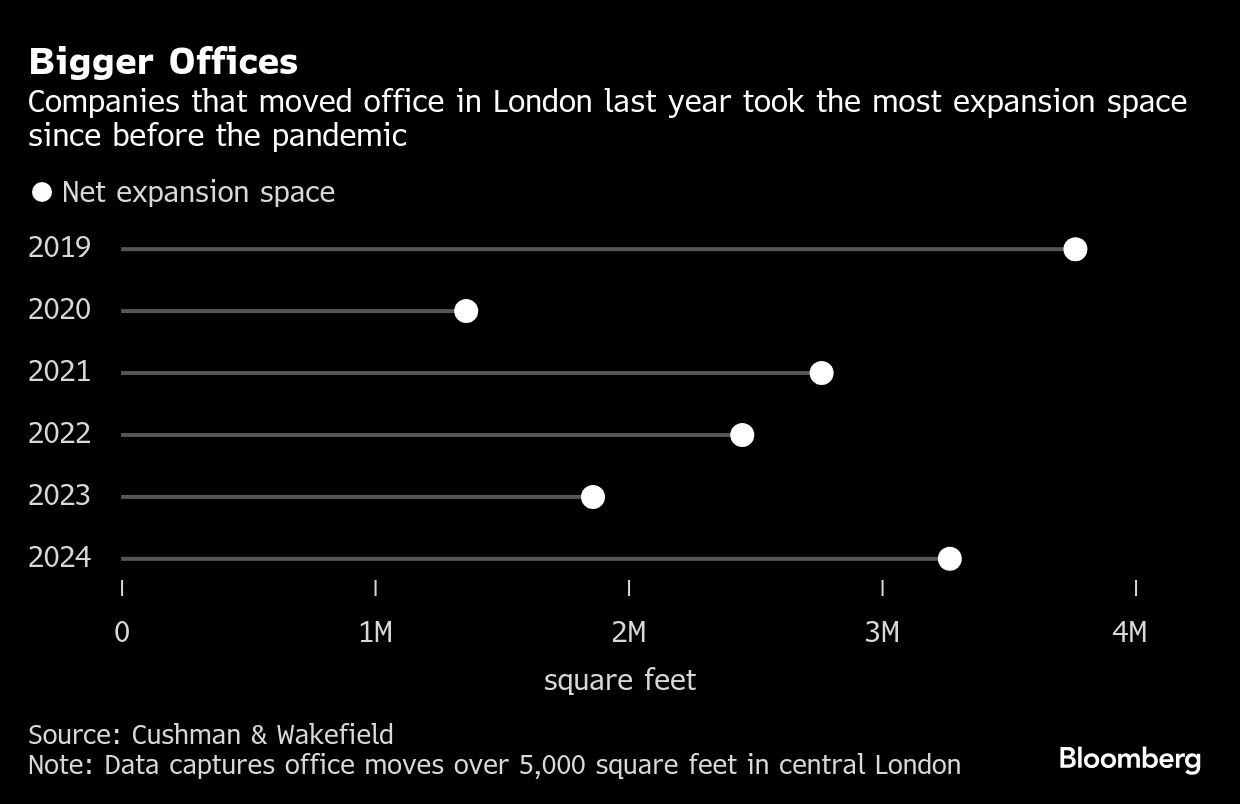

The British lender is one of several major companies that decided on office relocations in the aftermath of the pandemic and are now discovering that those plans no longer fully accommodate their needs due to shifting work patterns. Estimates made at a time when most staff were spending a significant portion of time working from home have been upended both by the gradual return-to-office-based working and a trend for more amenities that have increased the overall amount of space needed.

Law firms Clifford Chance, Latham & Watkins and Kirkland & Ellis have all taken on additional space after agreeing on their initial moves. Jane Street has increased the size of its planned London office move, while Deutsche Bank AG has ruled out vacating space it occupies in Canary Wharf after filling its new headquarters in the City of London.

As plans stand at present, HSBC is scheduled to begin moving from Canary Wharf next year to the new 592,000 square feet (55,000 square meters) building on Newgate Street in the City — known as Panorama St Paul's — where Orion Capital Managers is overhauling the former headquarters of BT Group Plc. Bloomberg News separately reported in November that the bank has already been weighing a proposal to take additional space due to concerns the new building is not big enough.

The British Council for Offices 2023 guidelines recommend 12.5 square meters for each employee but companies are increasingly taking space that equates to 15 to 20 square meters for each worker, according to a submission to the draft City of London plan by developer British Land Co. That's because they are adding more areas for collaborative working or socializing and employee wellbeing.

Banks typically occupy their buildings more densely than companies in other sectors, with trading floors often having a ratio of 1 person to every eight square meters or less.

Still, at this density at St Paul's, HSBC would manage to accommodate only fewer than half of the total desks required, with room for about 6,875 workers at peak capacity, according to Bloomberg calculations. Were the bank to occupy the building at the BCO's 2023 benchmark level, it would hold just 4,400 workers, increasing the scale of the shortfall further.

Deutsche Bank's new City headquarters at 21 Moorfields, which is roughly the same size as the new HSBC building, has about 5,000 desks, according to a planning filing. London's Gherkin skyscraper has room for about 4,000 desks, according to its contractor, meaning HSBC's shortfall equates to roughly two of the iconic towers.

The shortage confronting HSBC also underscores the paucity of options for major corporates seeking large new London offices after years of uncertainty wrought by Brexit, the pandemic and higher interest rates deterred developers from committing to major projects. In an interview with the Times newspaper in London last week, BlackRock Inc. Chief Executive Officer Larry Fink complained of a lack of London options to accommodate its recent expansion.

After scouting the market for several years, Morgan Stanley eventually decided to recommit to its existing London headquarters, while Bank of America is in the early stages of considering options for a potential move. JPMorgan Chase & Co. has leased additional office space in London after it ordered employees to start coming into the office five days a week earlier this year.

That could all mean HSBC has very limited options for additional space it can secure before its lease expires in Canary Wharf. The Qatar Investment Authority, which owns 8 Canada Square, could offer to extend the bank's existing leases, people familiar with the options said. It also jointly owns Canary Wharf Group, which controls most of the east London financial district, and it could offer a handful of alternatives across the estate, they added.

Representatives for QIA and Canary Wharf Group declined to comment.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.