Hindustan Unilever Ltd.'s new Chief Executive Officer Priya Nair is inheriting India's largest consumer goods maker that has seen stuttering growth in the last few years.

While the Indian unit of Unilever Plc posted a forecast-beating quarterly profit last week, Nair, who took over the CEO role on Aug. 1, has her task cut out in sustaining this momentum.

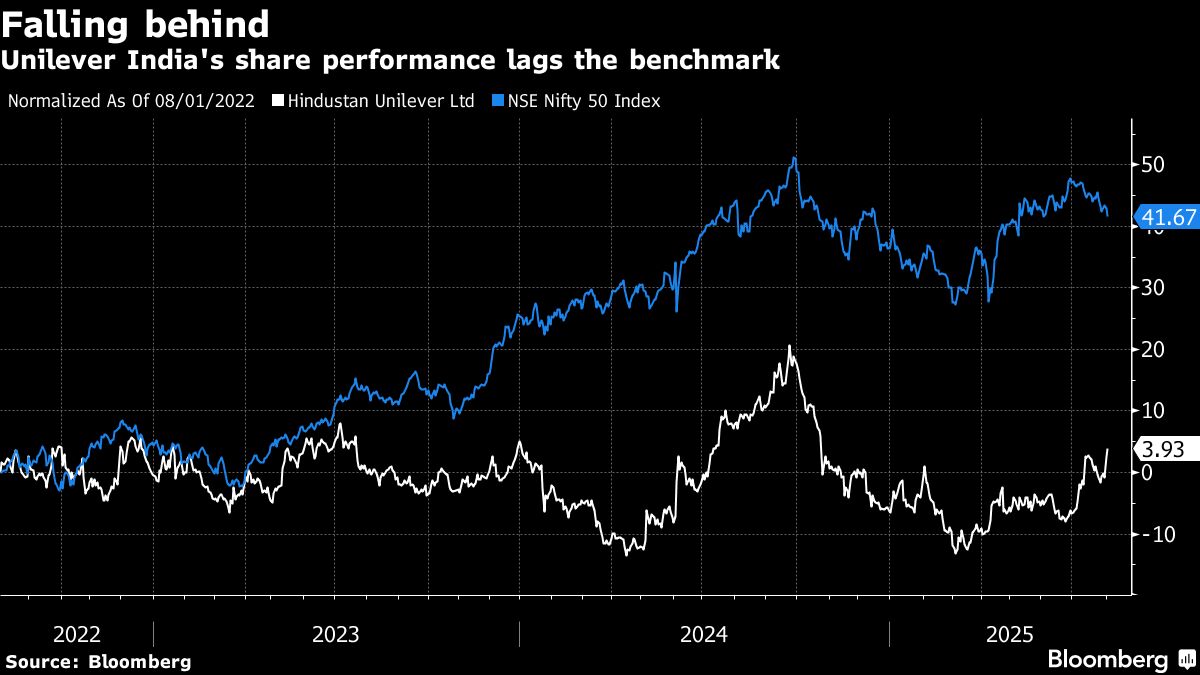

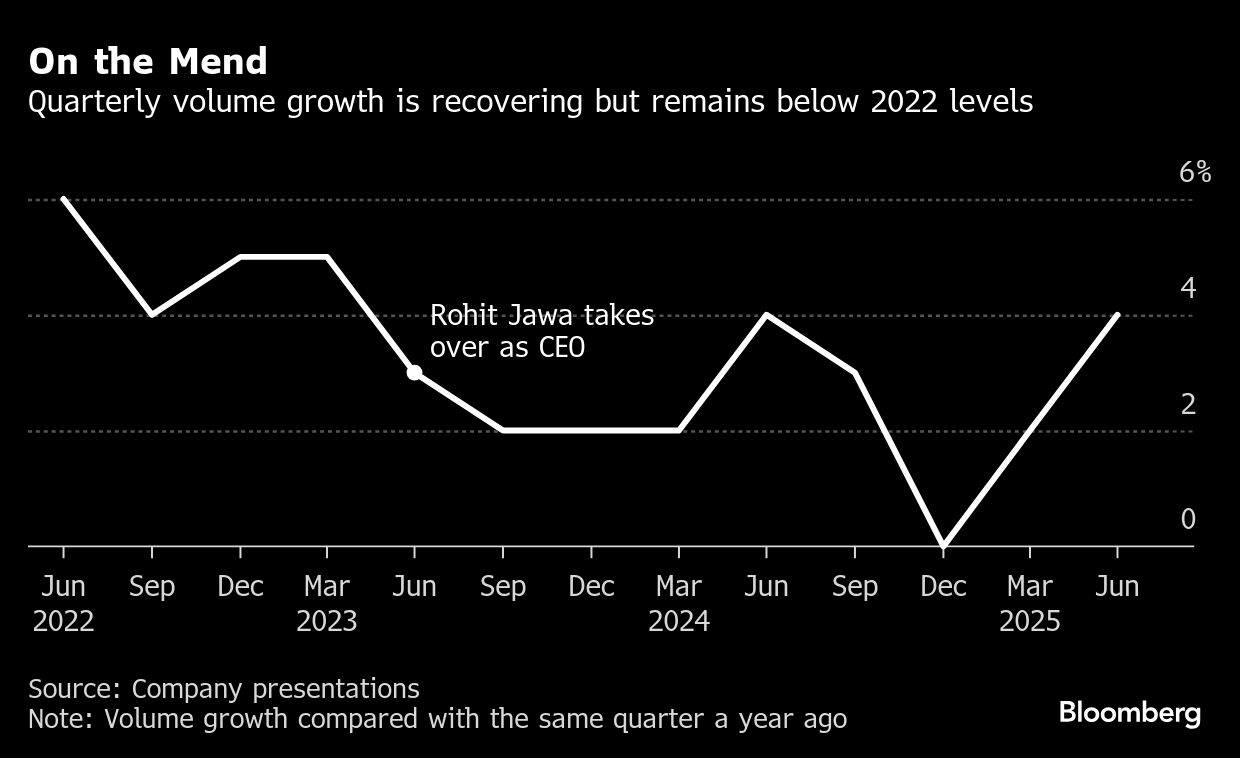

The company's stock has inched up about 4% in the last three years while the benchmark NSE Nifty 50 index surged almost 42%. Its volume growth has been sluggish. Sales expansion has been a fraction of the 2022 levels while disruptor local brands are eating into its market share across product categories.

Often seen as the bellwether of consumer sentiment in the world's most populous nation, Hindustan Unilever, or HUL, was also dragged down by a consumption slowdown in India over the past year.

So strong was investor disappointment that the sudden announcement about Rohit Jawa stepping down as the CEO halfway through his term to make way for Nair stoked a stock rally on July 11.

The first woman CEO for HUL was earlier serving as the president for the beauty unit and the Global Chief Marketing Officer at the London-based parent. Nair has led the Indian unit's home care, beauty and wellbeing businesses in the past.

Nuvama Wealth Management called Nair “a more aggressive leader” in a note soon after her appointment was announced.

Nair's “focus remains on delivering volume-led competitive growth that is profitable and sustainable,” a representative for Unilever's India unit said in an email. The company will “share more details at an appropriate time.”

Not Kept Pace

Hindustan Unilever “has had a problem for multiple years,” said Arvind Singhal, founder at retail consultancy Technopak Advisors. “India has been changing rapidly and they haven't been able to keep pace with India's changes.”

The seller of Bru coffee and Dove soaps was battling a consumer demand slowdown in the past few quarters as picky city buyers chose to spend less or switched to artisanal products. Hindustan Unilever gets about two-thirds of its sales from urban India, while rural areas contribute the rest.

“The firm will have to have a fresh distribution strategy and rejig margin structure,” Singhal said. It will also need to “develop new products,” and figure out the categories which can be rebuilt, he said.

Sales growth in the recent past has been tepid too, dragged down by global price volatility in raw materials like palm oil and coffee, though the June quarter saw the return of revenue expansion.

Nair will also be in the global spotlight. Unilever's new CEO Fernando Fernandez told analysts last week after its quarterly earnings that it would be investing a “disproportionate” amount in the US and India, adding that “momentum is building in India.”

India is Unilever's second-largest market by revenue after the US and the largest by volume.

Fernandez praised Nair's “deep understanding of our home and personal care business in India that she successfully ran for many years.” She also has the international markets knowledge to keep the company's portfolio in turn with consumer needs, he said.

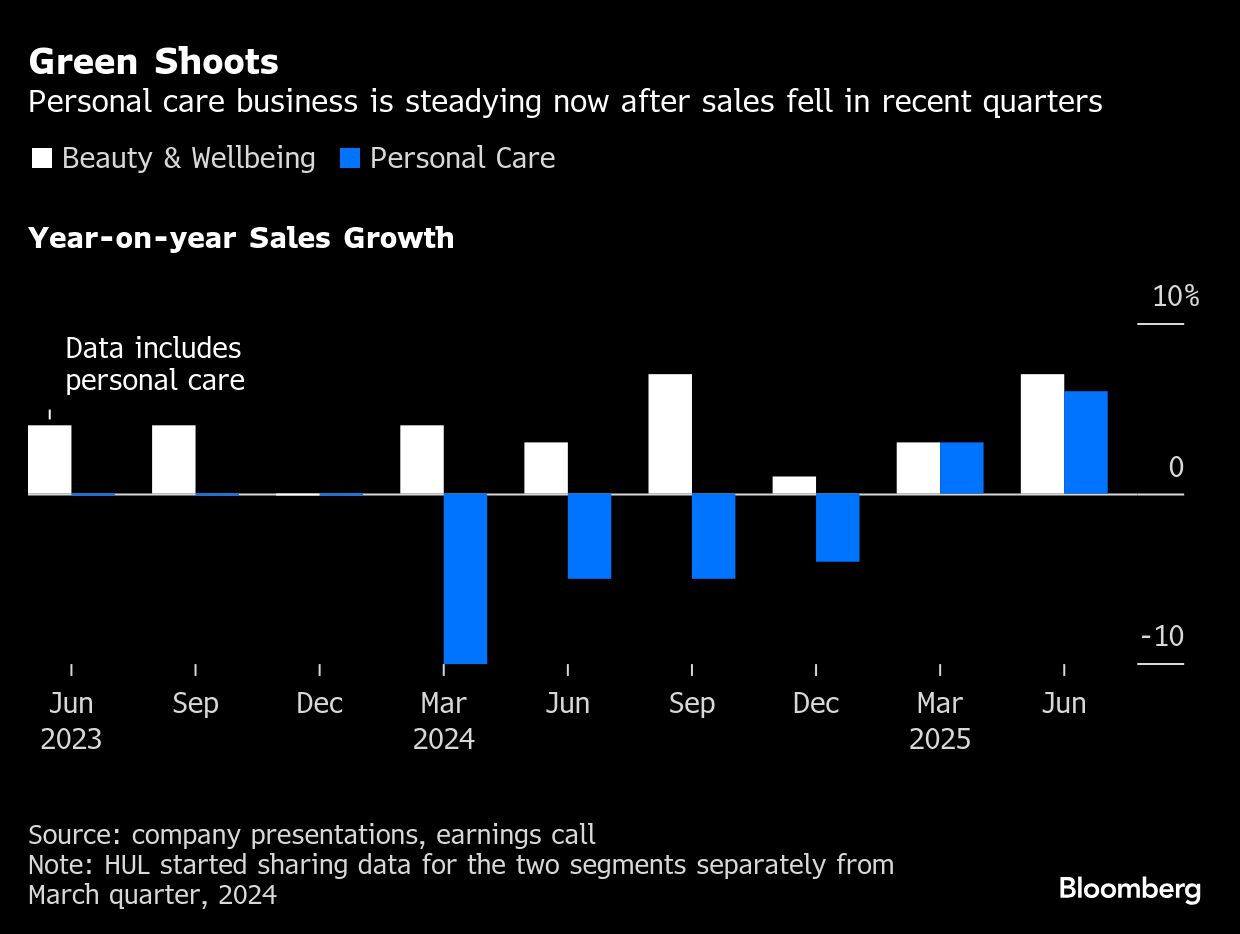

HUL's beauty and personal care segments — they contribute over a third of HUL's sales — have been hit by rising competition from local startups like Honasa Consumer Ltd., with its Mamaearth brand, and global rivals like L'Oreal SA pushing hard into India.

Jawa, Nair's predecessor, tried to double down on premiumization through the firm's ‘ASPIRE' strategy by upgrading its legacy brands, adding new brands and spending on digital push.

In January, HUL acquired skincare upstart Minimalist for 26.7 billion rupees ($305 million), in one of the biggest local deals for a cosmetics startup.

Ratings Upgrade

At least three brokerages including Goldman Sachs upgraded their ratings outlook on HUL on Friday and at least 17 analysts, including Jefferies and Citi, raised their price target for the stock, signaling that Nair has the wind at her back.

“We look forward to an update on the strategy” as the new CEO takes over, Jefferies analysts including Vivek Maheshwari wrote in a note Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.