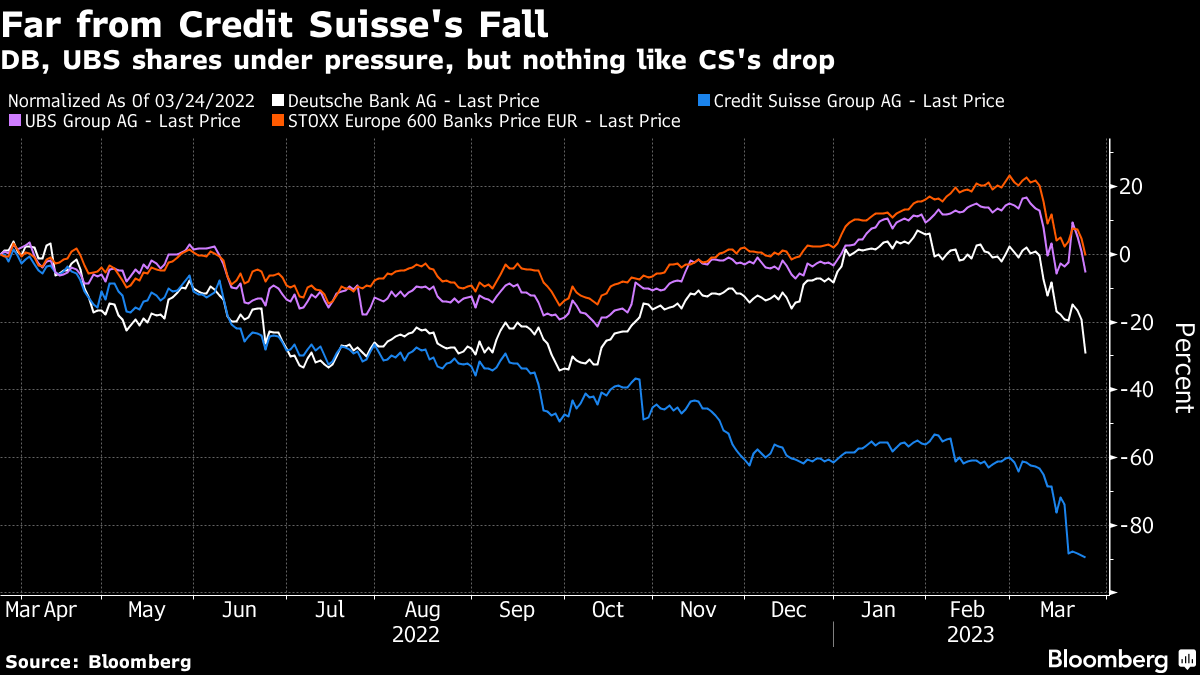

(Bloomberg) -- Deutsche Bank AG shares fell and the cost of insuring its debt against default rose in sudden moves that some attributed to hedge funds seeking to profit from the broader turmoil roiling the financial industry.

The German bank's shares fell as much as 15% before paring losses to end the day down 8.5% in Frankfurt.

There was no clear trigger for the declines Friday. But hedge funds have turned their attention to Deutsche Bank in the wake of the collapse of Credit Suisse Group and three regional US banks. They've been ratcheting up their bets against the bank in the stock and credit-default swaps markets, said investors familiar with the matter, who weren't authorized to speak publicly.

The sell-off prompted German Chancellor Olaf Scholz to publicly back the lender, which strengthened its balance sheet after some costly missteps years ago. Speaking at a news conference in Brussels, Scholz called it a “very profitable bank” and said banking oversight in Europe is “robust and stable.” A spokesman for Deutsche Bank declined to comment.

“It is a clear case of the market selling first and asking questions later,” said Paul de la Baume, senior market strategist at FlowBank SA.

Varde to Reap More Than $50 Million From Credit Suisse Trades

Banking stocks have been hammered since Silicon Valley Bank failed two weeks ago after sustaining a rush of depositor outflows. The stock losses continued this week even after Treasury Secretary Janet Yellen said regulators would be prepared for further steps to protect deposits if needed.

The head of Germany's banking regulator BaFin said on Wednesday that while there was no direct risk to Europe's banking markets from the recent turmoil, there was the danger of a “contagion via psychology of markets.”

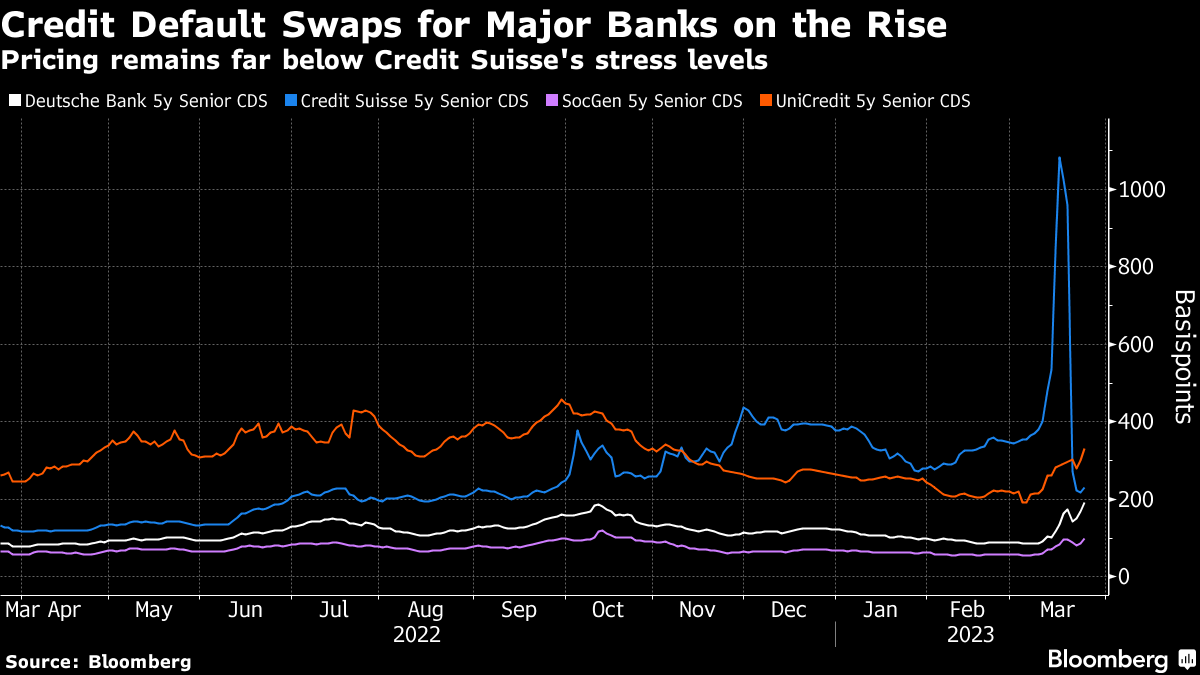

Credit default swaps on the five-year senior bonds were quoted at around 200 basis points on Friday afternoon, according to ICE Data Services, down from around 220 basis points earlier in the day.

The volume of Deutsche Bank's CDS quotes sent to market participants this week has increased by 30% compared to the start of the month, according to ICE CDS Data. That indicates a spike in demand for purchasing the protection, which has been driven particularly by hedge funds, according to a person with knowledge of the matter.

“We view this as an irrational market,” Citigroup Inc. analysts including Andrew Coombs wrote in a note. “The risk is if there is a knock on impact from various media headlines on depositors psychologically, regardless of whether the initial reasoning behind this was correct or not.”

Short interest in Deutsche Bank reached the highest level since May on Tuesday, according to data compiled by IHS Markit. It stood at 2.6% of shares outstanding on Thursday, up from less than 1% in early February.

“Deutsche Bank's recent CDS widening is in our view related to one way trades of de-risking across all market participants,” wrote analysts at JPMorgan Chase & Co. including Kian Abouhossein. “We don't see this and the associated share price decline as a reflection of the fundamentals.”

With markets in a state of heightened anxiety, displays of strength fell flat as investors looked at them as signs of weakness instead. Deutsche Bank's announcement Friday to repurchase a subordinated bond came on the very first day that the lender had the right to announce it. But instead of shoring up confidence, its credit default swaps jumped.

The bank recently emerged from a four-year turnaround plan that included thousands of job cuts and an exit from large parts of the investment bank. CEO Christian Sewing, who took over in 2018, even explored a deal with German rival Commerzbank in 2019 at the urging of the government, before deciding against it.

Investors were concerned about its exposure to US commercial real estate and its large derivatives book, according to Stuart Graham, an analyst at Autonomous Research. Yet both are “well known” and “just not very scary,” he added in a note.

“We have no concerns about Deutsche's viability or asset marks,” Graham wrote. “To be crystal clear - Deutsche is NOT the next Credit Suisse.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.