HDFC Bank Ltd. has been the worst performer among peers over the past week but most analysts suggest a ‘buy'.

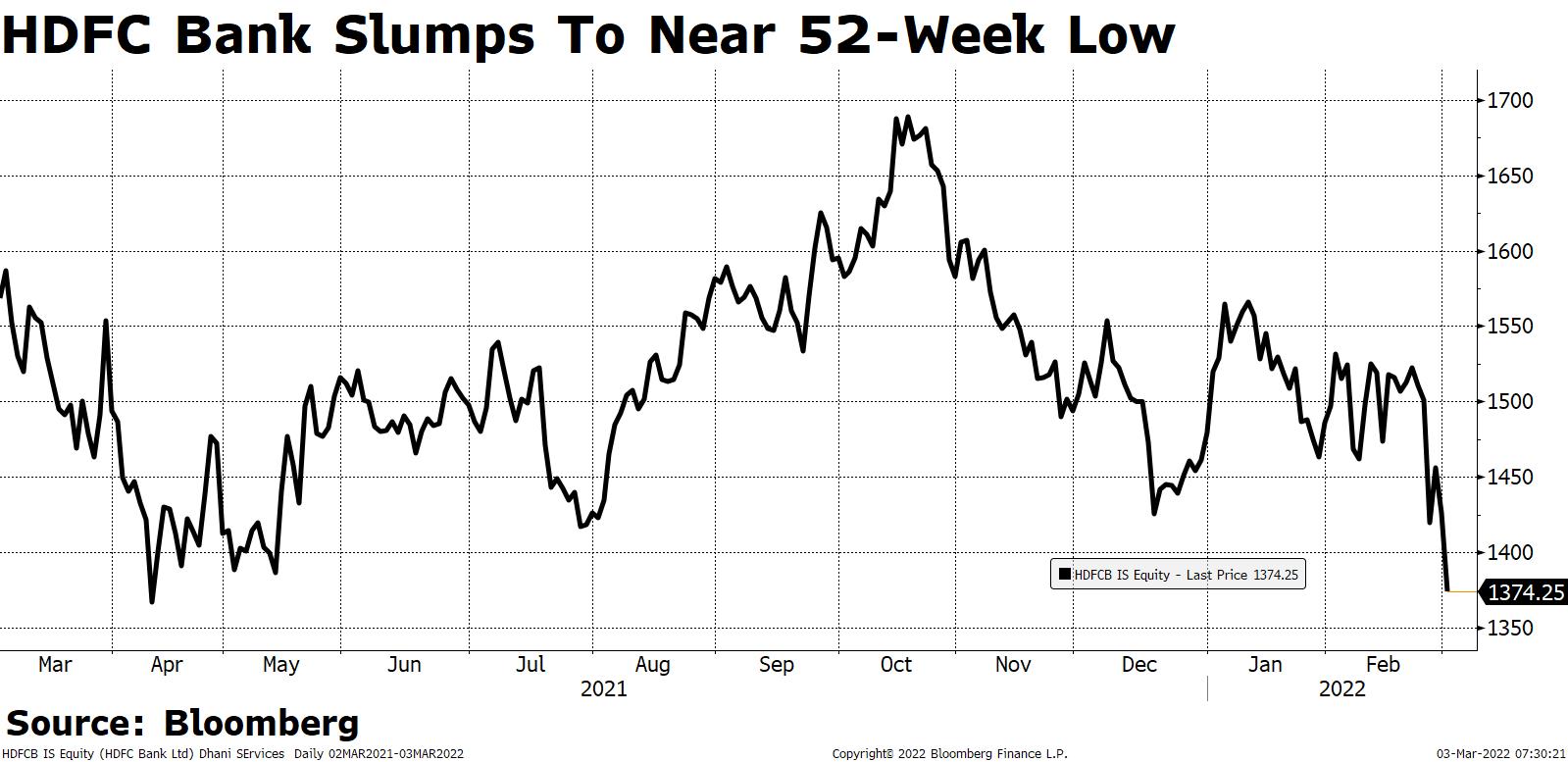

Shares of India's largest private lender fell more than 5% intraday on Wednesday to near 52-week low of Rs 1,354.4 apiece. The stock has declined more than 20% since hitting a record Rs 1,725 on Oct. 18.

HDFC Bank is the worst performer on the Nifty Bank Index after IDFC First Bank so far this year.

Since Feb. 24, HDFC Bank has been leading the losses among peers. That coincides with Russia's launch of a military operation on Ukraine.

HDFC Bank is also the fourth-worst performer on the Nifty 50 over the past week.

The Reserve Bank of India's embargo on HDFC Bank's fresh issuance of credit cards disrupted the private ender, which at 25.15% still maintains the highest market share in credit cards transaction value and spends, Systematix Institutional Equities said in a Feb. 2 note. But it has lost 112-basis-point share since October.

Prabhudas Lilladher, in its post-earnings review of the stock in January, said the challenges in maintaining loan growth momentum contributed to slow net interest income growth. But the brokerage continues to regard HDFC Bank as one of the best placed in the industry with higher earnings visibility leading to superior return on equity of 17-18% over FY23-FY24E.

Of the 49 analysts tracking the lender, 45 maintain a ‘buy', three recommend a ‘hold' and one suggests a ‘sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 44%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.